Rosie the Riveter reminds us to Honor Labor. In that vein, with the Labor Day holiday upon us, this post assembles data to paint the latest picture of health insurance and the American worker in 2009…

Rosie the Riveter reminds us to Honor Labor. In that vein, with the Labor Day holiday upon us, this post assembles data to paint the latest picture of health insurance and the American worker in 2009…

Workscape’s Annual Benefits Study for 2009 found that employees have a heightened appreciation of benefits. The declining economy clearly has increased awareness and appreciation of workplace benefits.

Trends In Underinsurance And The Affordability Of Employer Coverage, 2004-2007, in Health Affairs online, found eroding health insurance coverage among employers who continued to provide insurance, and further moves for employees to have more financial “skin in the game.” That is, greater copayments for services and a higher level of premium-sharing.

The analysis concluded, “If you are sick and earn a modest income, then you are probably underinsured–even if you have employer-based health coverage.” Underinsurance increased between 2004 and 2007, while the value of employer-based health insurance slightly fell.

Middle-class Americans – those with incomes from $44,000 to $88,000 — face mounting out-of-pocket costs that are eroding household disposable income available for food, shelter, and energy line items. While most of the uninsured are from lower-income families, 11 million of the uninsured live in middle class working families. Most of the growth of the uninsured between 2004 and 2007 — 70% — is in the middle class.

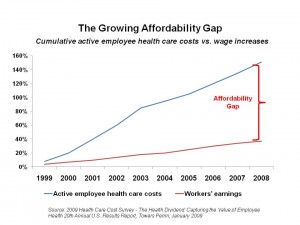

The chart tells the tale: the gap between health premium increases and workers’ wages continues to widen, making health insurance unaffordable for more working families.

The chart tells the tale: the gap between health premium increases and workers’ wages continues to widen, making health insurance unaffordable for more working families.

Health Care and the Middle Class: More Costs and Less Coverage, a report from the Kaiser Family Foundation published in July 2009, points out that, “workers have to spend more of their income each year on health care in order to maintain their current level of coverage.”

Put in context of household health spending, the average annual family contribution for employer-sponsored coverage rose to $3,354 in 2008, shown in the chart. KFF calculates that this equates to 7% of a household’s pre-tax income. In the real world of disposable income, this might roughly equal 10% of income after tax – or $1 in every $10 of “take home pay.” This is in addition to out-of-pocket costs for deductibles, office and ER visits, and prescription drugs.

Looking forward to 2010, health care costs for employers who cover health insurance for workers will increase 9%, according to PricewaterhouseCoopers’ Behind the numbers: Medical cost trends for 2010. Segal predicts over 10% growth for managed care plans; other consultancies predict double-digit cost growth, as well.

Health Populi’s Hot Points: As the gap widens between health costs and take-home pay, health care insecurity is growing. A New York Times story on page A-1 on July 27, 2009, was titled, “Reach of subsidies is critical issue for health plan.” In this recession, health reform isn’t just about access-for-all; it’s about affordability-for-all.

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,  Thank you, Feedspot, for

Thank you, Feedspot, for