Trading down is the spending ethos among American consumers in 2010: will shoppers’ frugality persist? That’s the question explored by Strategy& (formerly Booz and Company) in their survey, which begs, Forever Frugal? 2010 U.S. Consumer Survey Confirms Persistent Frugality.

Trading down is the spending ethos among American consumers in 2010: will shoppers’ frugality persist? That’s the question explored by Strategy& (formerly Booz and Company) in their survey, which begs, Forever Frugal? 2010 U.S. Consumer Survey Confirms Persistent Frugality.

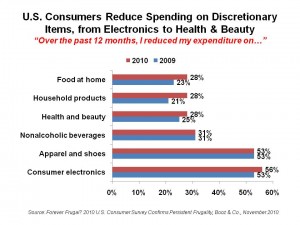

The firm points out that while the recession officially ‘ended’ in September 2009, most consumers don’t behave bullish in shopping matters 14 months later. In the post-recession shopping ethos, more consumers have traded down to store brands and generic labels, buying through the value-maximizing lens. “On average, consumers continue to economize everywhere — they are buying fewer discretionary items,” as detailed in the chart. Branded consumer electronics, apparel, and household products have taken hits. So have products in the health and beauty aisles.

There are differences, no surprise, in these shopping behaviors depending on income strata: less-wealthy consumers with less than $100K household income per year have been more likely to trade down: for household products, 41% of less-wealthy people trade down brands, while 30% of affluent customers go for the store/generic products.

1 in 2 lower income people (defined by Strategy& as household will less than $100,000 a year) are worse off in 2010, based on the poll. 1 in 3 affluent people said they were worse off in 2010.

For the health and beauty category, looking to 2011 expectations, 77% of consumers expect to spend the same amount of money; 12% expect to spend less. Thus, consumers won’t spend more — they’ll remain cautious in spending. It is this flatline in spending that underpins the forecast that frugality is here to stay, at least for the foreseeable future.

Booz & Co. conducted this online survey among 2,000 U.S. consumers in August 2010.

Health Populi’s Hot Points: An important coping mechanism for increasingly-frugal consumers is researching for products and shopping online. There’s a big increase in consumers going onto to research and buy, from 16% of U.S. consumers in 2009 to 32% in 2010. This segment is called Shopper 2.0. In addition, “online window shoppers” doubled between 2009 and 2010, from 11% of consumers to 23% — now the second-largest consumer shopper segment. These are people who tend to do research online before purchasing at bricks-and-mortar stores, but are not yet buying online.

This week, in a study among Harvard Pilgrim Health Plan enrollees, researchers found that lower-income plan members could not afford to get treatment due to the high up-front deductibles associated with the plan. The study, published in the Archives of Internal Medicine, unveiled the “darker side of high-deductible health plans,” according to the researchers. Less well-off people were two times more likely to ask their doctor the need for a $100 blood test or a $1,000 colonoscopy.

‘Tis the season to give thanks, and anyone with a job and health insurance in 2010 has much for which to be appreciative. If you’re not dealing with high deductibles in this frugal era, all the more reason to give thanks.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.