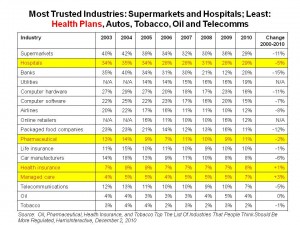

Americans trust their supermarkets and local hospitals more than other industries they deal with. while tobacco and oil companies remain at the bottom of the trust-list for U.S. consumers, health insurance and managed care aren’t much ahead of them. Pharmaceutical companies rank fairly low, with only 11% of U.S. adults seeing them as “honest and trustworthy.”

Americans trust their supermarkets and local hospitals more than other industries they deal with. while tobacco and oil companies remain at the bottom of the trust-list for U.S. consumers, health insurance and managed care aren’t much ahead of them. Pharmaceutical companies rank fairly low, with only 11% of U.S. adults seeing them as “honest and trustworthy.”

As a result, nearly one-half of Americans would like to see increased regulation on pharma. Over 1 in 3 Americans would like to see managed care and health insurance companies more regulated.

The latest Harris Poll has found that oil, pharmaceutical, health insurance and tobacco are the industries people think should be more regulated, discussed in the survey published December 2, 2010.

Hospitals have long topped the list of the most trusted health industry segment among consumers in the Harris Poll over the decade. However, even their reputation has eroded somewhat. Ironically, the only industry segments whose trust levels have improved between 2000 and 2010 among all polled by Harris were managed care (up 3 points from 4% to 7%) and health insurance (up 1 point from 7% to 8%). Still, these segments rank very low in the single digits on the consumer trust roster.

The Poll was conducted online in November 2010 among 2,151 adults age 18 and over.

Health Populi’s Hot Points: What is the return-on-investment in reputation for health stakeholders over the 10 year period, as U.S. consumers’ trust levels remained, at best, flat, or declined? Take the pharmaceutical industry, for which there is the most data on promotional spending. U.S. pharmaceutical promotional spending exceeded $8 billion in the first half of 2000 according to IMS Health. Pharma indus try spending on promotion hit $20.5 in 2008 according to the Congressional Budget Office. In 2004, the pharma industry spent twice as much money on drug promotion in the U.S. than on R&D, according to The Cost of Pushing Pills by Gagnon and Lexchin in their 2008 analysis of IMS and CAM data.

try spending on promotion hit $20.5 in 2008 according to the Congressional Budget Office. In 2004, the pharma industry spent twice as much money on drug promotion in the U.S. than on R&D, according to The Cost of Pushing Pills by Gagnon and Lexchin in their 2008 analysis of IMS and CAM data.

We can’t calculate an absolute ROI on reputation, but the data in the Harris Poll shows that drug companies, health insurance and managed care reputations continue to rank lower than most other consumer-facing categories like banks, computer suppliers, and energy utilities. The two top categories — supermarkets and hospitals — remain more beloved.

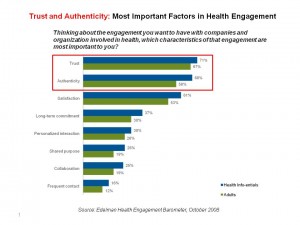

Trust and authenticity are the top two factors that underlie a consumer’s choice of who to engage in health, found by the Edelman Health Engagement Barometer in 2008. With hospitals topping with health industry ranks, they represent a trusted partner in their local communities that has been under-valued by the other health industry segments that reap lower trust-levels among health citizens. This is a missed opportunity among health marketers who can leverage social media in concert with health providers to gain attention and health engagement that promotes better health outcomes for individuals and the communities in which they live.

Thank you Feedspot for

Thank you Feedspot for  Jane was named as a member of

Jane was named as a member of  I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on