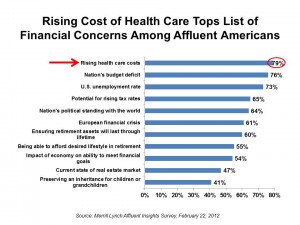

For the third year in a row, wealthy Americans cite increasing health costs as their top financial concern. Furthermore, 1 in 3 affluent Americans are more concerned about the financial stress that could accompany a health event than they are about how that condition could affect their quality of life.

For the third year in a row, wealthy Americans cite increasing health costs as their top financial concern. Furthermore, 1 in 3 affluent Americans are more concerned about the financial stress that could accompany a health event than they are about how that condition could affect their quality of life.

Merrill Lynch Wealth Management, part of Bank of America, conducted the firm’s annual poll among 1,000 Americans with investable assets of at least $250,000, in December 2011. The investment firm has looked at richer Americans’ views on financial concerns since 2009.

The chart shows rising health care costs to be in the #1 position of financial concerns, closely followed by the budget deficit and unemployment. The deficit is closely tied to the nation’s health care cost burden with life expectancy lengthening — the good news — which the burden of chronic disease for older people will, as a result, grow, putting even more pressure on the already-fiscally challenge Medicare system.

And it is life expectancy that has caused at least one-third of affluent Americans to reconsider their financial planning goals for that longer-term than expected:

- 39% of those polled said they’d continue to work at least part-time during retirement

- 37% said they’d re-evaluated their savings and investment strategies

- 32% said they’d pay more into their 401(k), IRA or other investment vehicle

- 29% would look into buying long-term care insurance.

To save more money for later years, affluents will make tradeoffs such as cutting day-to-day expenses (38%), purchasing fewer luxury items (35%), limit vacation budgets (32%), cut back on entertainment (31%), keep the same car longer (26%), and leave less of an inheritance to their kids (25%).

And, 19% of affluents said they’d clip more coupons.

Health Populi’s Hot Points: Sadly, there aren’t enough coupons to clip to manage the personal costs of health care in America. Two-thirds of affluents told Merrill Lynch they haven’t figured out what their health costs might be in retirement.

The Employee Benefits Research Institute has done some of those calculations, and the numbers are daunting even for the most affluent of American health citizen. In EBRI’s latest report on Funding Savings Needed for Health Expenses for Persons Eligible for Medicare, to supplement Medicare with Medigap and the Part D Rx drug benefit, a man with median drug expenditures would need $65,000 in savings and a woman, $93,000, if they want a 50% chance of having enough money to cover health expenses in retirement. For a 90% chance of have enough money for health care in retirement, a man would need $124K and a woman, $152K. A couple with median drug expenses would need $158K for a 50% chance of having sufficient health care funds, and $271K for a 90% chance of being flush with personal health funding.

The Employee Benefits Research Institute has done some of those calculations, and the numbers are daunting even for the most affluent of American health citizen. In EBRI’s latest report on Funding Savings Needed for Health Expenses for Persons Eligible for Medicare, to supplement Medicare with Medigap and the Part D Rx drug benefit, a man with median drug expenditures would need $65,000 in savings and a woman, $93,000, if they want a 50% chance of having enough money to cover health expenses in retirement. For a 90% chance of have enough money for health care in retirement, a man would need $124K and a woman, $152K. A couple with median drug expenses would need $158K for a 50% chance of having sufficient health care funds, and $271K for a 90% chance of being flush with personal health funding.

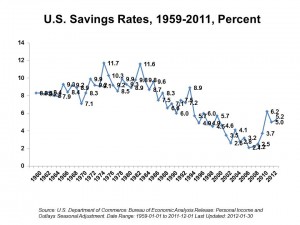

Given that the average personal U.S. savings rate plummeted from a high of 11.6% in the early 1980s to a low of 2.2% in 2007, it is slightly encouraging to see savings grown to about 5% in 2011. But it’s clear that not only affluent Americans must worry about health costs in retirement: they’re the ones with at least $250K worth of assets to invest. People with less have even more reason to be concerned about their future ability to fund health care.

All the more reason to re-imagine what the Medicare program should be, and what the new-normal picture of retirement will be.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.