Employee benefits make up one-third of employers’ investments in workers, and companies are looking for positive ROI on that spend. Health benefits are the largest component of that spending, and are a major cost-management focus. In 2012 and beyond, wellness is taking center stage as part of employers’ total benefits strategies.

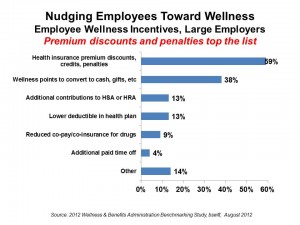

In the 2012 Wellness & Benefits Administration Benchmarking study, a new report from bswift, a benefits administration company, the vast majority of large employers (defined as those with over 500 workers) are sponsoring wellness programs, extending them to dependents as well as active workers. Increasingly, sticks accompany carrots for nudging employees to do the right thing by their health — that is, to make good lifestyle decisions on behalf of personal wellness. The most popular strategies are using health risk assessments (HRAs), which are used by 3 in 4 large companies, followed by smoking cessation programs, adopted by 56% of big employers. Two-thirds of employers are also using biometric tests to measure health indicators such as BMI, cholesterol and blood pressure. To motivate employees to undergo biometric tests, 40% of companies are providing incentives for workers to engage.

The most common wellness initiatives among large employers are:

- Providing flu shots, 86%

- Offering free or first-dollar cover for annual wellness exams, 79%

- Providing online health content, 75%

- Assessing HRAs, 70%

- Offering gym memberships, discounts, and onsite facilities, 64%

- Performing biometric tests, 60%

- Staging health fairs, 58%

- Health phone coaching, 52%

- Challenges or incentives for healthy activities, 49%

- Emailing and internet coaching, 48%

- Weight Watchers, 46%

- Weight loss challenges, 40%

- Onsite clinics, 20%

- Discounts on healthy food, 15%.

Health Populi’s Hot Points: bSwift’s survey bolsters Health Populi’s 2012 forecast that employers are welcoming in a new era of wellness in the post-recession economy, trying to bend corporate health cost curves and employee productivity and morale through strategic investments in whole health — not simply illness-care.

In a related report this week, Colonial Life Insurance Company published Well on the Way: Engaging Employees in Workplace Wellness, covering the Holy Grail of health engagement. As bswift’s poll recognized, sticks and carrots are being used to nudge workers to participate in wellness programs. Without effective nudging, employees won’t engage in these programs, resulting in a Field of Dreams effect (you’ll build the program, and workers won’t adopt it), and wasting precious health benefits resources.

Colonial Life suggests that employees don’t understand their benefits plans very well — a phenomenon I refer to as health plan illiteracy. Colonial Life’s own survey found that over half of employees whose employers offer wellness programs are only somewhat or not at all knowledgeable about the programs.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.