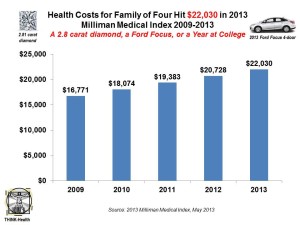

If you have $22,030 in your wallet, you can buy:

- A princess-cut diamond

- A Ford Focus 4-door

- A year’s tuition at James Madison University (in-state, 2013-14)

- A health plan for a family of four.

The 2013 Milliman Medical Index gauges the annual health care costs for a typical American family at $22,030, up $1,302 from 2012 — a 6.3% increase, nearly 6x the all-items increase of 1.1% for the U.S. Consumer Price Index from April 2012-April 2013. That 1.1% includes the costs of food and energy, along with cars, tobacco, shelter, and other consumer goods.

In 2013, the average family will cover $9,144 of that $22K total, representing over 40% of annual costs. And out-of-pocket health costs (co-pays, coinsurance and other cost-sharing) of $3,600, are roughly equivalent to gas costs for a year.

Milliman estimates that $9,144 is just over the annual cost of groceries for that same family of four. This is split between premium costs of $5,544 and out-of-pocket costs of $3,600.

The $22,030 is allocated across the following health care expenditure line items:

- $6,990, doctors and professional services = 32%

- $6,855, inpatient/hospitals = 31%

- $4,037, outpatient/ambulatory health care = 18%

- $3,296, pharmacy= 15%

- $851, other services = 4% (medical equipment, home health, ambulance).

Outpatient services grew the fastest of all 5 categories at 9.2% between 2012 and 2013. Watch this space as more care gets delivered outside of the inpatient hospital setting: costs in this category are fast-growing and for hospitals getting squeezed on inpatient rates, represent a revenue-generating opportunity for the emergency department, outpatient surgery, radiology (THINK: MRI and digital imaging), among other services.

Pharmacy costs grew 7.9% in the year, with specialty drug costs offsetting the switch to lower-cost generics. The average monthly cost of specialty Rx’s is $600 for a monthly supply according to the American Journal of Managed Care’s review on specialty drugs published in February 2013.

Health Populi’s Hot Points: Milliman’s bottom line, in Health Populi’s lens, is that, “While both employer and employee costs increased, a larger portion of the shared increase was borne by the employee, primarily through the payroll deduction.”

Milliman believes that employers are seeking to lower the costs of care rather than continuing to allocate more costs onto employees. To do this, price transparency of health services may come to the rescue, the actuaries write in the report’s conclusion. The Bitter Pill article in TIME magazine, lauded in this blog on the day of publication, raised the issue of the chargemaster and other arcane and opaque pricing policies in health care.

For transparency to work its magic, consumers must seek, review, understand and act on the information. This is a value chain of activity that needs the skills of artful designers who understand human behavior and how to communicate data in engaging ways via communication channels where people “are.” These skills will be in great demand in the coming months as health insurance exchanges launch and employers and plan sponsors try to usher new and confused health care consumers into the promise of the ACA and employers’ collective wish to bend that stubborn health cost curve.

Thanks and kudos to Milliman for providing yet another year of this important resource.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.