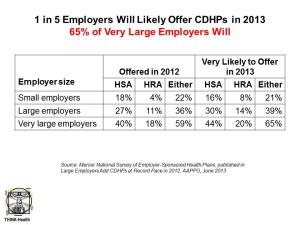

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years.

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years.

The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health care spending by improving worker health.

CDHPs typically include a deductible of at least $1,000, bundled with a medical account — a health reimbursement arrangement (HRA) or a health spending account (HSA), based on the definition from the Employee Benefit Research Institute (EBRI). HRAs are funded by employers only, and HSAs, by both employers and employees. As the table illustrates, HSAs are far more popular among employers.

Mercer is concerned that one-third of employers still don’t have a clear idea about the actual cost impact of the Affordable Care Act on their companies. Mercer believes that because the tax penalty for not obtaining insurance coverage will be “only” $95 per worker or 1% of household income (whichever is higher), some employees may choose to opt out of buying into coverage in 2014.

To slow down implementation costs of the ACA, Mercer notes that nearly one-third of employers will deduct more from workers’ wages for dependent coverage in 2014, and 13% will increase premium contributions for single coverage.

78% of companies told Mercer they are worried about the communication requirements in the ACA, “such as educating employees about their choices and supporting informed decision-making,” Mercer reports.

Health Populi’s Hot Points: Take note that the table illustrates greater popularity among employers for HSA — which workers fund through pre-tax wages. While both plan types are growing, more employees as a percent of total offered a CDHP are enrolled in HRAs than HSAs — probably because HRAs are funded only by employers.

Health Populi’s Hot Points: Take note that the table illustrates greater popularity among employers for HSA — which workers fund through pre-tax wages. While both plan types are growing, more employees as a percent of total offered a CDHP are enrolled in HRAs than HSAs — probably because HRAs are funded only by employers.

This trend reflects some health consumers’ lack of willingness to spend “my own money” on health care given decades of experience of first-dollar, and deeply discounted, health benefit coverage.

The U.S. is not a Saving Nation. The general savings rate in the U.S. was 2.6% in the first quarter of 2013. In the largest European countries, people save at least 10% each year: in 2011, the savings rate in France was 12.3%, in Germany, 10.5%, and in Sweden, 10%, based on OECD statistics shown in the graph.

How keen will Americans be on saving for account-based health plans? If past is prologue, it will be a painfully slow process to educate people on how “my” money is meant to benefit “my” and my family’s health. That most employers are shying away from educating employees will put the onus on health plans and financial service companies to do some of this heavy lifting.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.