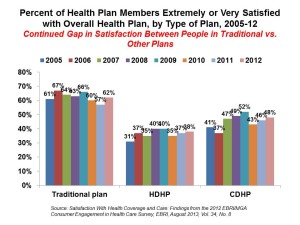

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund.

As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012. “Traditional plans” are defined in this study as health insurance plans with no deductible, or a deductible below $1,000 for a single and $2,000 for a family.

In contrast, 38% of enrollees in high-deductible health plans (those with a deductible over $1,000 for a single or $2,000 for a family) and 48% of those in CDHPs (plans with HDHP-level deductibles combined with a financial health account like an HSA) were satisfied with their plans.

The plan satisfaction numbers for HCHPs and CDHPs have ticked up by 7 percentage points each compared with the 2005 levels when 31% and 41% of plan enrollees said they were satisfied with these plans.

What could explain the health plan satisfaction chasm is out-of-pocket (OOP) costs. The reality is that no plan members are happy with out-of-pocket costs:

- 44% of traditional plan members were satisfied with OOP health care costs in 2012

- 18% of HDHP members were satisfied with OOP health care costs in 2012

- 27% of CDHP members were satisfied with OOP health care costs in 2012.

Health Populi’s Hot Points: Most consumers are satisfied with the quality of health care they receive under each type of health plan: 72% of members in traditional health plans, 72% of those in HDHPs, and 71% in CDHPs said they were satisfied (very or extremely) with their quality of health care.

Thus, consumers differentiate their perceptions of satisfaction between their experiences with health care vs. health insurance.

This is important for health plans to recognize as they begin to compete in health insurance exchanges, whether public or private, on January 1, 2014. As the HIXs begin to open up shopping portals for studying health plan options on October 1, 2013, insurance companies have the opportunity to begin branding the consumer experience online, via telephone, and in retail storefronts many health plans are opening as either “pop up” stores or full-time investments in bricks-and-mortar retail insurance shops.

The more health plans can adapt to the consumer retail mindset – engaging and accessible customer service, online and mobile platforms that are delightful and streamlined, and addressing concerns that are of value to real people — the more those health plan satisfaction numbers will rise.

Dissatisfaction with out-of-pocket costs is another matter. As more people enroll in HDHPs or CDHPs in the health insurance marketplaces, they will be dealing with more out-of-pocket spending in meeting deductibles. As the health plan enrollees stretch new muscles in newer forms of health plans, they need to understand how to spend their up-front health money rationally as part of being an effective consumer. One aspect of this is knowing when to spend the cash “now” for prevention, early detection and prescription drugs vs. “later” when downstream costs could be higher and health status more challenging to manage. A study published in the August 2013 issue of Medical Care found that men, especially may have foregone needed care following enrollment in a high-deductible health plan — in this case, seeking emergency treatment to avoid paying for the care.

Robert Laszewski, Washington DC health policy analyst and my go-to honesty (health insurance) broker in these situations talks about benefit shock when consumers go shopping on the Health Insurance Marketplaces: that is, confronting the combination of sticker-shock in plan prices vis-à-vis the health benefit package and deductibles involved in each health plan option (e.g., bronze, silver, gold, platinum). Bob’s concern, among other factors, is that benefit shock could keep people from buying into health plans.

Banks and financial services companies have experience in messaging to retail consumers on how to save and spend money. Here, messages of health=wealth, combined with social media and engaging tools, will help.

And perhaps the addition in the team-based multispecialty medical home of care providers or the hospital CFO’s office – a financial health educator?

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.