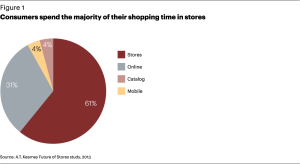

When it comes to retail shopping, most people spend most of their time shopping in brick-and-mortar stores – not online. 92% of spending happens in stores.

When it comes to retail shopping, most people spend most of their time shopping in brick-and-mortar stores – not online. 92% of spending happens in stores.

3 in 10 people spend most their shopping time online.

Brick-and-mortar is far from dead, concludes the report Recasting the Retail Store in Today’s Omnichannel World from AT Kearney. This study looked into the shopping behaviors for consumers in the US and the UK in February 2013.

What is true is that the growth of online retail has taught consumers how to shop on the basis of more transparent pricing and supply. This then drives the suppliers (retailers and their supply chain partners) to be lean and drive inefficiencies out of the system.

Welcome to the “omnichannel experience,” as AT Kearney coins it: consumers shopping and buying at different kinds of “stores” and retail networks.

The physical store is the channel of choice for consumers of all ages, including Millenials, and across all income groups – from under $25K to affluent people over $100K.

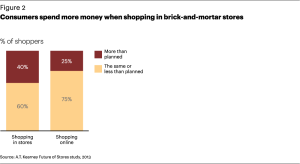

The brick-and-mortar store also garners more spur-of-the-moment spending, where 40% of people spend more than they planned before they walked into the store. Only 20% of people shopping online do that, as shown in the bar chart.

People shop in stages, AT Kearney found:

- Research, discovering new products and reviewing options, accessing 3rd party reviews online via social media

- Test or try on, making preliminary selections and verifying a good choice, trying on in store after finding it online

- Purchase, obtaining and paying for the product, purchasing in store and shipping it home or to a store

- Pickup or delivery, acquiring products (picking up in store or delivery to home), or ordering product online and picking up in store on same day

- After-sales experience, getting post-purchase support such as returns, or returning online-purchased items to store.

The future of stores, AT Kearney says, is for discovery (for trial, “the hunt,” and education), entertainment (for engagement and social experience), relationships (for personalized service which drives brand loyalty and increasing spending), and transactions (for “sealing the deal” and boosting profits through up-selling or extending warranties).

Grocery and pharmacy items were seen in the study to have high and significant brick-and-mortar store roles across all five of these dimensions.

Health Populi’s Hot Points: The health industry implications for the new retail – offline and online – are many. AT Kearney learned that grocery and pharmacy items resonate with people more online than off across dimensions of research/trial, buying, acquisition, and after-sales support. This isn’t to say that the online, within that, mobile channel, aren’t relevant. Far from it: shopping for health is done across all platforms, and the dimensions of learning and, especially, getting high quality, accessible and transparent information on price, quality, and the supply options for goods and services are best done online for many people.

The trick is to leverage these different channels and platforms to engage with health consumers where they can best be leveraged for the health good/service, and at the right phase of retail shopping (from research to after-sales and points between).

Consider the current hot-topic of shopping for and buying health insurance: the initial phase of Health Insurance Exchange online shopping has been frustrating, dismal, or a flop, depending whether you’ve kicked the tires of Healthcare.gov, read a newspaper, or listened to a cable news channel. Word, overall: hasn’t been good.

Now, think about a health insurance company which operates a brick-and-mortar storefront in a shopping mall – a growing retail health phenomenon. The frustrated consumer who kept getting shut out from Healthcare.gov could drive to the mall and consulted with an empathetic sales person, knowledgeable about their plan’s options, to provide the front-end research, education and trial phases of shopping for a health plan. While the final sale wouldn’t be sealed in that format, the consumer comes away with some satisfaction, empowerment and knowledge, and brand appreciation (equity and goodwill for the health plan). And, the health plan has contact information to follow up on with a live prospect to add to their insurance rolls.

Being where the puck is will be increasingly important in the growing retail health environment for health shopping, everywhere – online and off, via mobile and desktop computer. AT Kearney knows that brick-and-mortar stores are still alive, and in health care, they’ll be important places to shop for health – in groceries, pharmacies and drug stores, Big Box retail, hospitals and shopping malls.

For more on health shopping, everywhere, see: http://healthcarediy.com/healthcare-essentials/health-care-outside-doctors-office/

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.