The current role of health insurance at work is that it’s the “benefits” part of “compensation and benefits.” Soon, benefits will simply be integrated into “compensation and compensation.” That is, employers will be transferring risk to employees for health care. This will translate into growing defined contribution and cost-shifting to employees.

Health care sponsorship by employers is changing quite quickly, according to the 2013 Aon Hewitt Health Care Survey published in October 2013. Aon found that companies are shifting to individualized consumer-focused approaches that emphasize wellness and “health ownership” by workers to bolster behavior change and, ultimately, outcomes. The most popular health improvement programs will be biometric screenings (offered by 71% in 2013), physical activity challenges (53%), telephonic health improvement coaching (52%), nutrition programs (37%), and stress reduction initiatives (35%).

7 in 10 employers use some kind of incentive to inspire that behavior change, particularly for smoking cessation. Managing blood pressure to 140/90, lowering BMI under 30, and achieving fasting glucose between 70 and 110 mg/dl are 3 common health metrics employers are adopting.

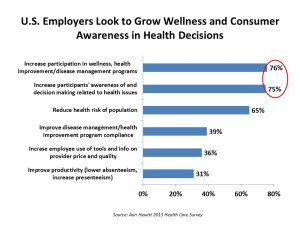

The graph illustrates this ethos: that 3 in 4 employers want to grow workers’ participation in wellness and health improvement programs, as well as increase participants’ awareness of and decision making related to health.

For most employers, focusing on wellness is a higher priority than dealing with the Affordable Care Act. Motivating behavior change and health engagement is Job #1 for employers sponsoring health insurance. In addition, most companies also target the issue of health risk management.

Consumer-driven health plans (including a financial health account) are now de rigueur for most employers. While PPOs remain the most common health plan offered, high-deductible health plans (HDHPs) coupled with health savings accounts are now offered by 41% of employers in this survey.

On the health care supply side, employers are focused on provider payment models that deliver outcomes and promote primary care and prevention, such as patient-centered medical homes.

Health Populi’s Hot Points: The writing’s not only on the wall: it’s a neon sign that reads, “Consumers: you’re on the hook for health care. Get over it and on with it.” As the ACA is getting implemented, employers are migrating their risk from their CFOs’ problem to workers’ and their dependents’ wallets. We’re now in a consumer health risk management mode.

How to enable people to grow these new muscles? “Engagement” is a broad and overused term and not very specific. People – consumers, patients, caregivers – are going to face decisions we’ve avoided for the past few years. Taking Health Savings Accounts more seriously, understanding our personal fiscal risk levels for bearing the up-front cost of deductibles analyzed against our personal health risks (e.g., whether we have a pre-existing condition, expect to undergo a surgical procedure next year, or have had a mysterious lump under our skin we’ve avoided dealing with) — people will have to get real about these health/financial issues or get buried by them. Banks and financial services companies, tax advisors and financial planners, and the hospital’s and doctor’s financial offices must staff-up – an opportunity for sure, but a threat for some if health plan and financial literacy gets put on the back burner.

Check out HealthcareDIY‘s section on Shopping Smart for health care to get wiser about how to pick insurance, set your HSA amount, fill your Rx with a generic or brand, find a doctor. These are now Health Consumer 101 must-dos.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.