Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system.

Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers.

Key findings are that:

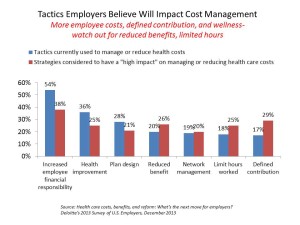

- Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees

- They will expand other tactics they believe will help address cost increases, such as defined contribution plans and potentially cutting benefits

- Some employers are looking to more employee health engagement through behavior change that can lower health risks. Even with that, most employers still don’t know the ROI on wellness programs nor doing claims analysis to learn more on that score.

Among the major influences on health care costs, employers point to hospitals first (noted by 75%), followed by prescription drug costs tied with waste and inefficiencies across all processes (clinical, administrative and billing, both Rx and waste cited by 67% of employers), defensive medicine (62%), unhealthy consumer lifestyles (58%), government regulation and fraud in the system (each with 56% of employers citing this factor), and overuse of tests and procedures (among 53% of companies).

Only 1 in 3 employers says their human resource departments are prepared to navigate this environment.

Health Populi’s Hot Points: Health benefit designs will continue to morph toward define contribution, coupled with growth in wellness programs – even when most employers don’t have much of a clue what their investments in wellness are yielding either clinically or economically. Deloitte found that one-fourth of companies will invest in rewards and penalties, technologies and coaching in 2014. 1 in 3 companies will include dependents to encourage families to socialize health and wellness (my read on that statistic). Larger companies will be more likely to try out incentives and “sticks” (like premium discounts for improvements, and hikes for lack of behavior changes like smoking cessation or reducing BMIs).

Health Populi’s Hot Points: Health benefit designs will continue to morph toward define contribution, coupled with growth in wellness programs – even when most employers don’t have much of a clue what their investments in wellness are yielding either clinically or economically. Deloitte found that one-fourth of companies will invest in rewards and penalties, technologies and coaching in 2014. 1 in 3 companies will include dependents to encourage families to socialize health and wellness (my read on that statistic). Larger companies will be more likely to try out incentives and “sticks” (like premium discounts for improvements, and hikes for lack of behavior changes like smoking cessation or reducing BMIs).

Consumers must gird themselves for an immediate future of higher health care costs and greater responsibilities for decision making and financial management when it comes to health care. The new world of high-deductible health plans will require much more from activation by employees to understand (1) the amount of deductible, (2) how to manage that spending up to the limit, and (3) when to use what services to optimize that spending. This won’t be easy – most U.S. families don’t manage within a family budget, and here we are talking about a health-budget. Can a Mint.com for health come soon enough?

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.