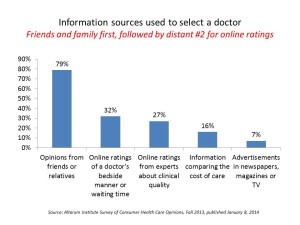

More than twice as many people value the opinions of friends and family for health care provider choices than turn to online ratings for doctors’ bedside manner, waiting times, or clinical quality, according to the Altarum Institute Survey of Consumer Health Care Opinions, Fall 2013, released on January 8, 2014. 1 in 3 consumers also looks into the cost and quality of services recommended by nurses, doctors, labs and hospitals before choosing a provider.

However, most people (4 in 5) say they are comfortable asking their doctor about how much treatment will cost: 43% are “very comfortable,” and 38% somewhat comfortable, About one-half of consumers have asked about cost before a health visit, a percentage that has stayed relatively flat since the Fall 2011. More younger people under 54 tend to ask about health care cost and quality than people over 55: About one-third of people under 55 look into cost and quality, compared to 23% of people 55 and over.

While most people say they’re comfortable looking into health care costs, two-thirds aren’t confident they can reduce their cost for health care by shopping for better prices.

While most people say they’re comfortable looking into health care costs, two-thirds aren’t confident they can reduce their cost for health care by shopping for better prices.

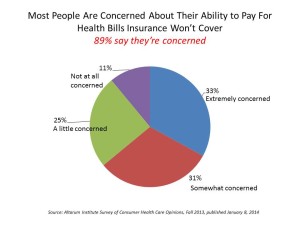

This lack of confidence extends to peoples’ perspectives on their ability to pay medical bills, shown in the second pie chart. Only 1 in 10 people say they’re not at all concerned about paying for health care if they develop a serious health problem.

This concern has impacted Americans’ seeking care: overall, 44% of people said they sometimes avoid getting care because it is too expensive. This behavior declines with age, with:

- 54% of people 25-34 years old skipping care due to expense

- 49% of people 35-44 skipping care

- 40% of people 45-54 avoiding care

- 36% of people 55-64 years of age avoiding care due to expense.

The proportion of people who have their current job for the primary reason of getting health insurance is fairly similar across all age groups: 27% overall go to work for the health insurance, with 27% of people 25-34 years of age doing so and 26% of people 55-64 working for the health insurance (this peaks at 35-44 years of age with 32% of people believing this).

There’s a high lack of confidence when it comes to people thinking they’ve saved enough money to pay for health care in retirement. When asked whether they’ll have $220,000 saved specifically for health care expenses if retiring at 65, only 16% of people said “yes,” they would have saved enough. 65% of people said, “probably not.”

There’s a high lack of confidence when it comes to people thinking they’ve saved enough money to pay for health care in retirement. When asked whether they’ll have $220,000 saved specifically for health care expenses if retiring at 65, only 16% of people said “yes,” they would have saved enough. 65% of people said, “probably not.”

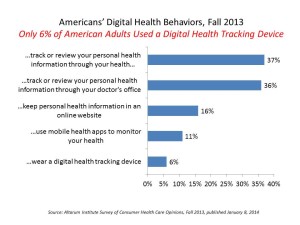

Altarum also included questions regarding consumers’ use of technology for health care and health information seeking. About 1 in 5 people have access their personal health information online to share with family or a doctor, with 55% not doing so. About 17% of people have securely messaged their physician (e.g., via encrypted email).

Only 6% of people track health information via a digital health device, and 11% of people use a mobile health app to monitor their health, Altarum found. Among people who self-track, the most common metrics are physical activity (73%) and food (65%), followed by medical conditions (28%), women’s health (21%), mood (16%) and children’s health (8%).

Health Populi’s Hot Points: The growing supply of shiny new digital health devices (such as those just unveiled at the 2014 Consumer Electronics Show) won’t do much to stem peoples’ lack of confidence in their ability, at least in the short term, to impact health care costs or pay for them in retirement.

In 2014, Americans aren’t yet connecting the dots between self-care and their personal health economics.

I had a sobering, as well as practical and informative, conversation just before leaving Las Vegas and the 2014 CES. The brainstorm was organized by Dr. Wen Dombroski (@healthcarewen on Twitter), who is a leader and connector in digital health. She convened her colleague Dr. Steve Landers, head of the VNA Health Group in New Jersey together with Gary Kaye, long-time journalist and expert in aging and technology who leads In the Boombox and advises the AARP among other influencers, and me.

We focused our conversation on the aging demographic in the US, and the hard fact that Boomers haven’t saved the money they’ll need for living and health care as they age into their 70s and 80s. This was Altarum’s point about $220K savings, which comes out of the work of the Employee Benefits Research Institute’s Health Confidence Survey.

We talked about how technology could help people age well at home — from the highest-tech hardware exoskeletons seen at CES to mobile tools based on evidence-based software algorithms that help you manage your mood and stress, like Heartmath. We agreed that national planning is essential, along with peoples’ individual efforts, and remain pessimistic about America’s commitment to dealing honestly and aggressively with what could become an increasingly isolated, impoverished, depressed elder segment. THINK: the elderly and ice floes.

Altarum’s survey paints a picture of consumers at-risk for self-rationing health care when it’s needed, and stressed out about personal finances for health. One of the few health tools unveiled at CES that can help to begin to address this challenge – the health/wealth connection – was MyEasyBook from UnitedHealthcare. This online portal helps consumers find doctors, book appointments, and pay their share of the cost (co-payment, via health savings account, etc.). Furthermore, the site shows the consumer how much the service will cost, the person’s out-of-pocket costs for the service, and then does the math on the personal health plan showing how much they’ve spent out of their HSA and how much of their high-deductible they’ve met. This helps people with ongoing financial management of their family’s health care spending, making it very easy to track with no personal intervention of pen, pencil or Excel spreadsheet. MyEasyBook also enables physicians to open their appointment schedule and offer discounted prices for services, allowing providers to fill in open spots and maximize revenues and efficiency in the practice. This service will roll out in 3 U.S. markets in 2014 – Phoenix, where the service has already been piloted, as well as Dallas and Denver.

Financial wellness impacts peoples’ use of the health system, health literacy and health plan literacy. Organizations that sponsor wellness programs would do well to bundle in a financial wellness pillar to bolster whole health – beyond tracking steps and calories.

Gil Bashe, Chair Global Health and Purpose with FINN Partners,

Gil Bashe, Chair Global Health and Purpose with FINN Partners,  Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast