The Consumer Electronics Association (CEA) has formed a new Health and Fitness Technology Division, signalling the growing-up and mainstreaming of digital health in everyday life.

The Consumer Electronics Association (CEA) has formed a new Health and Fitness Technology Division, signalling the growing-up and mainstreaming of digital health in everyday life.

The CEA represents companies that design, manufacture and market goods for people who pay for stuff that plugs into electric sockets and operate on batteries — like TVs, phones, music playing and listening, kitchen appliances, electronic games, and quite prominent at the 2014 Consumer Electronics Show, e-cigarettes (rebranding “safe smoking” as “vaping” technology).

In its press release announcing this news, CEA President and CEO Gary Shapiro says, “Technology innovations now offer unprecedented opportunities for consumers to take control of their health and engage in their personal fitness. Under CEA’s leadership, the Health and Fitness Division brings together a group of proven leaders in the space to further raise awareness that these products can help us change our lives for the better.”

Board members of the Division come from a host of digital health and technology companies, such as AT&T, Fitbit, Fitbug, Google, GreatCall, Humetrix, Ingram Micro, Jawbone, LG, Linear LLC, MC10, Misfit Wearables, Neurosky, Qualcomm Life, Samsung, Sony, Under Armour, Valencell, and Verizon. These companies span both niche mobile and digital health, and broader telecomms and technology segments.

The CEA has over 2,000 corporate members who are part of the $208 billion consumer electronics market.

Health Populi’s Hot Points: Increasingly, “consumer electronics” also embodies “connected life” environments, like automobiles, homes, and of course, health and health care. I pointed out in my review of the 2014 Consumer Electronics Show how there was health and health care, everywhere.

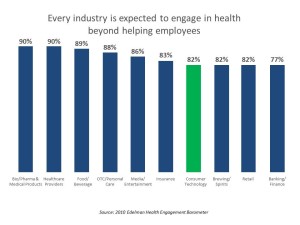

I learned several years ago that people want to engage with many industries for their health, well beyond hospitals, pharma and life sciences companies, and pharmacies. The bar chart, derived from data from the 2010 Edelman Health Engagement Barometer survey, shows that most consumers look to virtually every industry segment to engage in health, including food and brewing/spirits to financial services and, yes, electronics companies (shown in green).

Will this be a case of “if consumer electronics companies build it (digital health devices), will they (consumers) come?” We saw dramatic growth in the vendor quantity showing at 2014 CES in Las Vegas, especially marked by more wristbands than can be worn by a healthy octopus. There’s the supply side of wearable digital health – which is fast-growing, and at the top of the Gartner Hype Cycle. Then there’s the demand side, of what consumers will pay for. In reality, fewer than 10% of U.S. adults wear digital tech on their sleeve or bra. Susannah Fox’s sage research at the Pew Research Project found that only 6% of U.S. adults track health digitally – and most people still track “in their heads.” What will nudge, push, urge, motivate consumers up the slope of the digital health adoption curve to the proverbial Tipping Point?

There are several converging forces that the industry/supply side is banking on:

- The growth of consumers DIY’ing health and buying more at retail in pharmacies, grocery stores, Big Box and consumer electronics stores like Best Buy. Note Amazon’s expansion of their digital health storefront earlier this month.

- The expansion of high-deductible health plans for people enrolled in commercial plans through the workplace, and in the Health Insurance Exchanges in the first wave of the Affordable Care Act (Obamacare). These plans force first-dollar coverage paid by consumers themselves, creating a new consciousness about what health care costs when it’s spent out-of-pocket until the deductible is met. That skin-in-game is, theoretically, going to forge consumerism among people/patients.

- More employer-based health plans are coupled high-deductibles with wellness programs, targeting carrots and sticks to move employees’ collective BMI and blood pressure.

- Growing awareness of the impact of personal lifestyle choices and behaviors on health, and particularly so-called non-communicable diseases – diabetes, obesity, heart and cardiovascular conditions, asthma, and some cancers.

The CEA means to fan the flames of demand among consumers, and support their members who are making the bet that these forces will create a steep slope of consumer adoption. Along with the recent launch of HIMSS’s and Continua’s Personal Connected Health Alliance, it’s clear the supply side is ready for business.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.