This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending.

The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal care spending (on toothpaste and health and beauty categories) is also up 19% compared with a year ago.

At the same time, 38% of people are spending less on travel and dining out (with a net decrease of 12% spending), and 31% are spending less on consumer electronics (down 11% in net spending).

While more people in the U.S. have plans to travel this summer, they will be doing more “staycation” type trips, being close to home and the vast majority traveling by car. All travelers expect their vacation costs will be higher.

Gallup points out a Morgan Stanley study that expects health insurance premiums will increase at the highest rate the company has ever seen, based on a poll of 148 health insurance brokers.

Health Populi’s Hot Points: The title of Gallup’s press release on this survey is “Consumers Spending More, Just Not On Things They Want.” Food, gas and healthcare are now the staples of a family budget – the “must-spends,” not the “nice-to-spend” discretionary items that people like.

Specifically, people are increasing out-of-pocket spending on health insurance and health care: on premiums, and to meet out-of-pocket deductibles.

We’ve found on the HealthcareDIY website (which launched one week after the opening of the Health Insurance Exchanges in October 2013) that people engaged in health care are much, much more keen to talk about food-in-health than they are about purchasing or understanding health insurance. This has been a light-bulb moment for our team, and we are carefully listening to health consumers to tweak both our content and the tools on our website. As a result, we’re adding “on-ramps” and links to sites we believe people want to access to help them project-manage and hack their health through food, digital tracking, living well and, if they are interested, accessing health insurance plans. But we anticipate greater traction on the non-health insurance sites because it’s just not a subject people “like.”

On a more positive note, it’s important to call out that 18% of people are allocating more into retirement investments now vs. last year, which is a very good thing. Net spending on long term investments is up on 1%, but the fact that more people are investing for retirement is (for the moment) good news on the financial wellness front. While few people like to think about saving or talking about money, more people investing for the long-term is a positive development for overall health and stress management. And, as such, HealthcareDIY also has a financial wellness on-ramp for people who want to hack their financial health, as well.

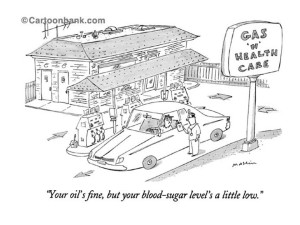

The New Yorker cartoon featured here is one I’ve used for over a decade. Gas ‘N Health Care back in the day received a lot of laughs. Today, in the retail health era, the juxtaposition is not so funny anymore.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.