The supply side of telehealth has been readying itself for nearly a decade. The demand side appears to be aligning in 2014 for adoption to grow and sustain (some) solid business models.

On the demand side, Towers Watson’s 2014 survey of large employers forecasts growth among companies that will offer telemedicine in 2015. Towers found that 37% of employers planned to offer telemedicine to workers as a lower-cost site of care; 34% more employers were considering telemedicine in 2016 or 2017. The health benefits adviser calculates that employers could save over $6 billion if industry replaces virtual health consultations with face-to-face visits at doctors’ offices, emergency rooms, or urgent care centers.

The constraints on these savings are a shift in patient and physician expectations, health plans reimbursing virtual visits, and streamlined regulations that would enable cross-state provision of health care. The introduction in the U.S. House of Representatives of the TELEmedicine for MEDicare Act (aka the TELE-Med Act), H.R. 3077, seeks to address such licensure laws for expanding telehealth.

A bullish forecast for telehealth globally is offered by Deloitte in their predictions for eVisits: the 21st century housecall, part of the firm’s larger document on Technology, Media, and Telecommunications Predictions. Deloitte expects eVisit use to be greatest in North America, with an estimated 75 million virtual health visits in 2014 equal to 25% of the potential virtual visit market: this is calculated based on a possible 600 total annual visits to doctors in the U.S. and Canada, half of which could be addressed by an eVisit, Deloitte estimates.

Enabling the growt h of telehealth, Deloitte points to the “inflection point” in 2014, a convergence of changing technology and telecomms infrastructure, cost pressures in health care, pervasive PC deployment, older patients’ comfort with the Internet, and the mass adoption of mobile devices. Deloitte also notes that eVisits aren’t only those enabled through videoconferences, virtual face-to-face encounters, but also include the exchange of information through forms and images. The types of visits appropriate for this milieu could include basic diagnoses, prescription refills, and certain specialty encounters such as dermatology.

h of telehealth, Deloitte points to the “inflection point” in 2014, a convergence of changing technology and telecomms infrastructure, cost pressures in health care, pervasive PC deployment, older patients’ comfort with the Internet, and the mass adoption of mobile devices. Deloitte also notes that eVisits aren’t only those enabled through videoconferences, virtual face-to-face encounters, but also include the exchange of information through forms and images. The types of visits appropriate for this milieu could include basic diagnoses, prescription refills, and certain specialty encounters such as dermatology.

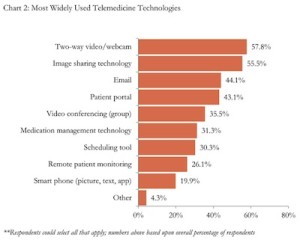

Currently, about 1 in 2 healthcare organizations use telemedicine tools, according to HIMSS Analytics 2014 Telemedicine Study released earlier this month. HIMSS surveyed 406 health providers and found that two-way video/webcam is the most prevalent telemedicine solution currently deployed in U.S. health care settings, closely followed by image sharing technology (like virtual PACS), email and patient portals.

On the supply/deal side, there has been more investment in telehealth in the first half of 2014 than in any previous year. CB Insights estimates that 29% of the entire $433mm invested in telehealth since 2007 was funded in 2014 year-to-date. Significant deals this year have been Doctor on Demand, MDLive, and Specialists on Call.

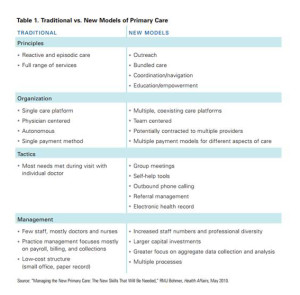

Health Populi’s Hot Points: The beauty of telehealth, from a health-economic standpoint, is that it scales from 1 to many. As we seek to conserve health costs in a resource-constrained health environment, telehealth can scale primary care — which is needed for bolstering the American primary care infrastructure. The fourth table, traditional vs. new models of primary care, comes out of my report, Primary Care, Everywhere, published by California HealthCare Foundation in 2011.

Health Populi’s Hot Points: The beauty of telehealth, from a health-economic standpoint, is that it scales from 1 to many. As we seek to conserve health costs in a resource-constrained health environment, telehealth can scale primary care — which is needed for bolstering the American primary care infrastructure. The fourth table, traditional vs. new models of primary care, comes out of my report, Primary Care, Everywhere, published by California HealthCare Foundation in 2011.

The report talks about the convergences Deloitte identifies in the eVisits prediction, cited above. In particular, the growing value-based health payment world — paying for outcomes, quality, patient experience — is today beginning to align incentives for the adoption of virtual visits and technology-scaled health care.

To ensure quality is driven through the telehealth value-chain, it is crucial for data to move from the virtual visit to the patient’s/person’s electronic health record. A one-and-one encounter is just that: an episode of care, but not one that drives a continuum of care that supports a person’s whole health. In the go-go financing world on the supply side of telehealth that CB Insights paints, let’s ensure the pull-through of data for data liquidity, continuity of care, and patients’ shared decision-making and health engagement doesn’t get lost in the telehealth transaction.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.