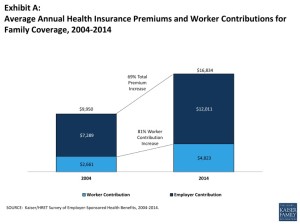

For employer-sponsored health care, trends continue for health premium costs to increase, high-deductible health plans to gain adoption, and cost-sharing to shift to workers in companies’ health plans.

For employer-sponsored health care, trends continue for health premium costs to increase, high-deductible health plans to gain adoption, and cost-sharing to shift to workers in companies’ health plans.

This is the top-line of the just-released Kaiser Family Foundation (KFF) 2014 Employer Health Benefits Survey, the annual go-to resource on company-sponsored health care trends and realities.

As the Kaiser Family Foundation team said during their teleconference to health writers this morning, employer-sponsored health care in America is moving “from comprehensive coverage to skin-in-the-game coverage.”

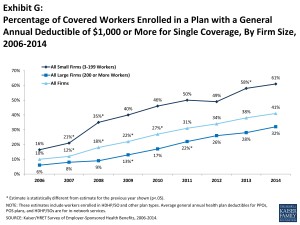

The extent of said skin-in-the-game varies from small to large firms: in small companies (defined in this survey as 3-199 workers), the average deductible in 2014 is nearly $1,800 for a single worker; for employees in larger companies, the deductible averages $971 this year.

The line chart illustrates the continued growth of insured people with single coverage who bear deductibles over $1,000 by size of firm, which also illustrates the variability between large and small companies. This year, 61% of health-covered workers in small firms bear an annual deductible of at least $1,000; 32% of workers in large firms have a $1,000 deductible or higher.

The line chart illustrates the continued growth of insured people with single coverage who bear deductibles over $1,000 by size of firm, which also illustrates the variability between large and small companies. This year, 61% of health-covered workers in small firms bear an annual deductible of at least $1,000; 32% of workers in large firms have a $1,000 deductible or higher.

Wellness programs are now mainstream offerings for employers, with biometric screening gaining adoption for firms beginning to gauge baseline health measures as a precursor to behavior change programs. 51% of large firms and 26% of small firms offer biometric screening programs. 8% of large firms incentivize employees to do biometric screening: either via carrots (rewards, such as discounts on health insurance premiums) or sticks (penalties).

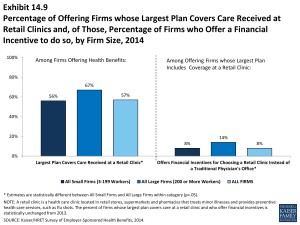

57% of employers cover health services delivered at retail clinics, a growing area of interest among companies sponsoring health insurance seeking lower-cost locales for health care. Among these companies, 8% provide a financial incentive to employees who seek care in retail clinics outside of a doctor’s office.

57% of employers cover health services delivered at retail clinics, a growing area of interest among companies sponsoring health insurance seeking lower-cost locales for health care. Among these companies, 8% provide a financial incentive to employees who seek care in retail clinics outside of a doctor’s office.

Health Populi’s Hot Points: As I discussed in yesterday’s Health Populi, the new patient engagement is (or should be) health cost engagement. People enrolled in health plans are, as KFF notes, exposed to more skin-in-the-game: that is, under high-deductible health plans and financial incentives for wellness, people are being asked to wear the hat of health care consumer.

While the noun and that hat may be unpalatable to some, it is, as they say, what it is. The new data point in this year’s KFF survey is the coverage for people receiving services in retail health clinics — and the 8% of employers incentivizing people financially to use lower-cost settings for health care delivered outside of their physician’s practice.

This is employers shaping the new retail health ecosystem, shifting people to cheaper — and more convenient — health care providers. It’s the incumbent providers – doctors and hospitals and ambulatory care clinics related to those higher-cost players – who should note this trend now, and adjust strategies to partner and extend care into the retail health milieu to be relevant to people/patients engaging in Health DIY.

In a future Health Populi post, I’ll parse out the survey’s findings on prescription and specialty drug benefits, which also show continued financial risk-shift to health plan members.

In a year where health policy will shake, rattle, and roll in the U.S., I'm grateful to be identified as writing one of the best blogs dealing with the topic this year.

In a year where health policy will shake, rattle, and roll in the U.S., I'm grateful to be identified as writing one of the best blogs dealing with the topic this year.  I am gratified and grateful for my Health Populi blog to be named #1 by Feedspot in the category of

I am gratified and grateful for my Health Populi blog to be named #1 by Feedspot in the category of  Jane will deliver the keynote address at the upcoming

Jane will deliver the keynote address at the upcoming