The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not.

Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.”

U.S. News & World Report published its first annual Health Care Index, looking at health care trends since 2000. The Index is built on several measures from public data sources, including the Centers for Medicare and Medicaid Services (CMS), the Department of Health and Human Services (DHHS), the National Center for Educational Statistics, the U.S. Bureau of Labor Statistics, and the World Health Organization. Thus, this Index looks at health care costs in the context of larger macroeconomic issues.

U.S. News & World Report published its first annual Health Care Index, looking at health care trends since 2000. The Index is built on several measures from public data sources, including the Centers for Medicare and Medicaid Services (CMS), the Department of Health and Human Services (DHHS), the National Center for Educational Statistics, the U.S. Bureau of Labor Statistics, and the World Health Organization. Thus, this Index looks at health care costs in the context of larger macroeconomic issues.

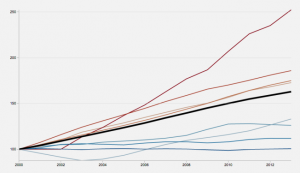

The graph includes the various dimensions included in the Index. The top red line in the chart represents health insurance deductibles, which clearly illustrates that consumers’ health care costs have dramatically increased (“massive” growth in the words of U.S. News). The next line down, the orange-red color, indicates health care spending by both public and private sources. Third, quite closely correlated, are the health insurance premium and health care consumer price index lines. The thick black line is the overall Index bundling all of the indicators.

Health Populi’s Hot Points: TIME magazine, which featured Steve Brill’s two stunning pieces on health cost transparency challenges in 2013 and 2014 (cover stories pictured here), recently published The Danger Lurking in Your Medical Bills. The chart recommends that consumers “don’t let doc bills ding your credit.”

Health Populi’s Hot Points: TIME magazine, which featured Steve Brill’s two stunning pieces on health cost transparency challenges in 2013 and 2014 (cover stories pictured here), recently published The Danger Lurking in Your Medical Bills. The chart recommends that consumers “don’t let doc bills ding your credit.”

On the upside, necessity is the mother, and health care at retail with consumers spending more out-of-pocket will drive new models for health care delivery. Health plans are nudging member-consumers into lower-cost sites for healthcare, such as increasing reimbursement for telehealth and visits retail clinics. UnitedHealth Group, for example, expanded its policy to pay for telehealth and virtual visits to physicians. And the Robert Wood Johnson Foundation published a new report on The Value Proposition of Retail Clinics as part of the group’s Building a Culture of Health program.

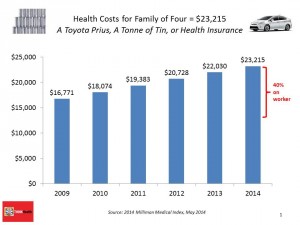

By the end of the month, Milliman will release its annual Milliman Medical Index, focusing on the cost of healthcare for a family of four in 2015. Health Populi will do our annual dive into this Index, which last year exceeded $23,000 for a family of four in a PPO – a fast-disappearing health insurance plan model. Last year, the family bore about 40% of that total, about $8,000-$9,000. Families spent 20% of family income, $1 in every $5, on health care. U.S. News’s tea leaves say the government will continue to grow as a health care payor, and consumers will continue to spend even more dollars with more skin in this uniquely American healthcare game.

By the end of the month, Milliman will release its annual Milliman Medical Index, focusing on the cost of healthcare for a family of four in 2015. Health Populi will do our annual dive into this Index, which last year exceeded $23,000 for a family of four in a PPO – a fast-disappearing health insurance plan model. Last year, the family bore about 40% of that total, about $8,000-$9,000. Families spent 20% of family income, $1 in every $5, on health care. U.S. News’s tea leaves say the government will continue to grow as a health care payor, and consumers will continue to spend even more dollars with more skin in this uniquely American healthcare game.

Stay tuned to the continuing saga of Americans in The New Health Economy – out-of-pocket in more ways than one.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.