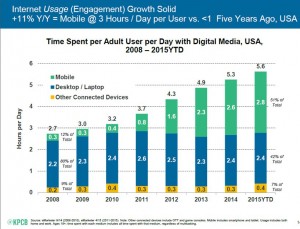

People in the U.S. spend over five-and-a-half hours a day with digital media in 2015, with time on mobile devices exceeding use of laptop and desktop computers. The growth of mobile means people are using and seeking more just-in-time services in daily living, and this has big implications for health/care, based on the annual mega-report on Internet Trends from Mary Meeker, KPCB’s internet analyst.

“People” in health/care are patients, consumers and caregivers; people in health/care are also health plan administrators, employer benefits managers, doctors, nurses, allied health professionals, financial managers in hospitals, pharmacists, and the entire range of humans who work in the health/care ecosystem.

Digital tech, a nd increasingly mobile platforms, can enable people to self-care, clinicians to help people manage care outside of the doctor’s office, streamline health care payments, anticipate adverse events that can be prevented (say, to avert hospital inpatient admissions), and triage and nudge patients toward lower-cost, quality health care settings. All of these streams of activity can help bend the healthcare cost curve.

nd increasingly mobile platforms, can enable people to self-care, clinicians to help people manage care outside of the doctor’s office, streamline health care payments, anticipate adverse events that can be prevented (say, to avert hospital inpatient admissions), and triage and nudge patients toward lower-cost, quality health care settings. All of these streams of activity can help bend the healthcare cost curve.

Meeker’s exhibit calls out four conditions – cardiovascular, diabetes, obesity and cancer — all of which can leverage digital and mobile tech to improve care and lower costs.

I’ve previously dug into Mary’s reports here in Health Populi – you can read these posts via these links:

2014 – Health care at an inflection point – digital trends via Mary Meeker

2013 – The role of internet technologies in reducing health care costs – Meeker inspirations

2011 – Meeker & Murphy on mobile – through the lens of health

Health Populi’s Hot Points: The New Digital Divide was recently defined by Deloitte as the gap between consumers’ digital behaviors and expectations vis-à-vis retailers’ ability to deliver the desired experiences. This rift is particularly wide in health/care compared with other industries like financial services, travel, food/grocery, and entertainment.

Health Populi’s Hot Points: The New Digital Divide was recently defined by Deloitte as the gap between consumers’ digital behaviors and expectations vis-à-vis retailers’ ability to deliver the desired experiences. This rift is particularly wide in health/care compared with other industries like financial services, travel, food/grocery, and entertainment.

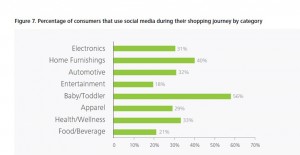

Deloitte’s work in digital tech and retail finds that 1 in 3 U.S. consumers used social media when shopping for health and wellness products in late 2014/early 2015. This is roughly equal to the 31% of people who use social media when shopping for electronics, as the bar chart shows.

As U.S. patients continue to morph in to health consumers in shopping for health insurance, hospital and physician services, and prescription drugs, managing high-deductible health plans, people become increasingly price and quality aware. Meeker’s Internet report points out that U.S. household health spending grew 11% between 2013-2014 (per the Consumer Expenditure Survey of the U.S. Bureau of Labor Statistics) compared with flat to declining spending across all other household categories.

Deloitte makes the point in its conclusion on how retailers can evolve by noting “there should be no such thing as a digital strategy.” This is as true for health/care as it is for retailing electronics, furniture, cars, and clothing.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're