In the past couple of weeks, a grocery store launched a telemedicine pilot, a pharmacy chain expanded telehealth to patients in 25 states, and several new virtual healthcare entrants received $millions in investments.

On a parallel track, the AMA postponed dealing with medical ethics issues regarding telemedicine, the Texas Medical Association got stopped in its tracks in a case versus Teladoc, and the Centers for Medicare and Medicaid Services (CMS) issued a final rule for the Medicare Shared Savings Program that falls short of allowing Accountable Care Organizations (ACOs) to take full advantage of telehealth services.

These events beg the question: is retail telehealth moving ahead of legacy healthcare systems’ ability or willingness to adopt it?

Here are the details underneath my question:

Wegmans, the Rochester, NY-based family-owned grocery chain, is expanding a virtual health care visit program it has with Doctors on Demand, piloting the program in stores in DeWitt, NY, Niagara Falls, NY, Fairfax, VA, and Allentown, PA. This program will enable shopper-patients to visit the Wegmans store pharmacy for an online visit with a board-certified doctor or psychologist between 7 am and 11 pm, using their computer, smartphone or tablet, or the pharmacy’s kiosk. Wegmans is offering the first physician visit for free. The full story was covered in the Allentown Morning Call, the Syracuse Post-Standard and in the Buffalo Business Journal. (I’ve written extensively about Wegmans as a health destination here in Health Populi, and in the Huffington Post).

Wegmans, the Rochester, NY-based family-owned grocery chain, is expanding a virtual health care visit program it has with Doctors on Demand, piloting the program in stores in DeWitt, NY, Niagara Falls, NY, Fairfax, VA, and Allentown, PA. This program will enable shopper-patients to visit the Wegmans store pharmacy for an online visit with a board-certified doctor or psychologist between 7 am and 11 pm, using their computer, smartphone or tablet, or the pharmacy’s kiosk. Wegmans is offering the first physician visit for free. The full story was covered in the Allentown Morning Call, the Syracuse Post-Standard and in the Buffalo Business Journal. (I’ve written extensively about Wegmans as a health destination here in Health Populi, and in the Huffington Post).

Walgreens is in the process of expanding its telehealth program partnering with MDLIVE to 25 states. “Our society truly values anytime, anywhere convenience,” Adam Pellegrini, Walgreens’ divisional vice president of digital health, was quoted in the company’s press release. “With a growing need for access to affordable healthcare services, we believe telehealth solutions can play an important role in helping to improve patient outcomes and continues our mission to provide a seamless, omni-channel digital health experience.” This brings another flavor-meaning to Walgreens’ tagline, “at the corner of happy and healthy.”

Walgreens is in the process of expanding its telehealth program partnering with MDLIVE to 25 states. “Our society truly values anytime, anywhere convenience,” Adam Pellegrini, Walgreens’ divisional vice president of digital health, was quoted in the company’s press release. “With a growing need for access to affordable healthcare services, we believe telehealth solutions can play an important role in helping to improve patient outcomes and continues our mission to provide a seamless, omni-channel digital health experience.” This brings another flavor-meaning to Walgreens’ tagline, “at the corner of happy and healthy.”

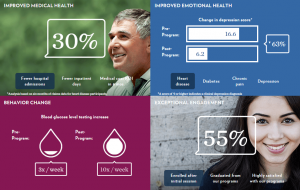

Another very recent milestone in telehealth is funding garnered by several new entrants into the market space. Carena attracted $13,3 million from Cambia Health Solutions, McKesson Ventures, Catholic Health Initiatives, and Martin Ventures for the telemedicine company to provide services to hospital systems. AbilTo (whose outcomes are featured in the third image) garnered $12 million in a Series C financing round from HLM Venture Partners, who joined with BlueCross BlueShield Venture Partners, .406 Ventures and Sandbox Industries. A third telemedicine financing deal that’s intriguing is Teva Pharmaceuticals’ multi-million dollar investment in AmericanWell, an innovative thought from a pharma company.

Another very recent milestone in telehealth is funding garnered by several new entrants into the market space. Carena attracted $13,3 million from Cambia Health Solutions, McKesson Ventures, Catholic Health Initiatives, and Martin Ventures for the telemedicine company to provide services to hospital systems. AbilTo (whose outcomes are featured in the third image) garnered $12 million in a Series C financing round from HLM Venture Partners, who joined with BlueCross BlueShield Venture Partners, .406 Ventures and Sandbox Industries. A third telemedicine financing deal that’s intriguing is Teva Pharmaceuticals’ multi-million dollar investment in AmericanWell, an innovative thought from a pharma company.

On the healthcare legacy side of my question, the AMA wrestled the topic of telemedicine ethics during its annual meeting earlier this week, postponing a consensus recommendation on telemedicine guidelines for the physicians’ association members. This (non)decision came in the wake of a Texas court decision in favor of Teladoc. The company sued the Texas Medical Board for what Teladoc considered restraining telemedicine trade in the state which required a face-to-face visit before virtual physicians would be permitted to prescribe medication to patients.

The CMS got into the telemedicine mix when releasing final rules for ACOs. On the upside, telemedicine coverage is extended in the so-called “Next Generation Accountable Care Organization” model to 80% of Medicare beneficiaries living in metropolitan areas, and lift on restrictions in rural areas. But the American Telemedicine Association has been asking for all restrictions to be lifted for telehealth coverage nationwide for all Medicare enrollees. CMS wants more time to evaluate the impact of such a decision.

Here’s iHealthBeat’s take on the ruling.

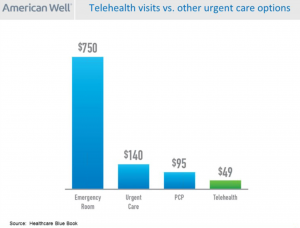

Health Populi’s Hot Points: Patients-cum-consumers are the end-user payor in health care, and telehealth in community settings will morph into a preferred setting for primary care and diagnostic encounters for people looking for convenience, access, a modern tech-edge, and most especially value.

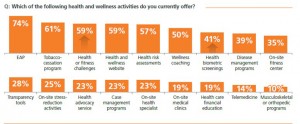

As the payor, a health consumer seeks transparency and trust, and retail settings can deliver on both. Furthermore, employers-as-payors are increasingly looking to telehealth to help bend the corporate cost curve, found in Optum’s latest wellness in the workplace study. The chart shows that 14% of employers currently offer telemedicine – these companies tend to be larger firms, representing many more workers and family members than smaller companies do. So the reach of employer-sponsored-telemedicine would cover more than 14% of employees and dependents.

As the payor, a health consumer seeks transparency and trust, and retail settings can deliver on both. Furthermore, employers-as-payors are increasingly looking to telehealth to help bend the corporate cost curve, found in Optum’s latest wellness in the workplace study. The chart shows that 14% of employers currently offer telemedicine – these companies tend to be larger firms, representing many more workers and family members than smaller companies do. So the reach of employer-sponsored-telemedicine would cover more than 14% of employees and dependents.

Today’s Wall Street Journal features an article on Surprises in Health-Law Bills, recognizing that out-of-network charges often aren’t flagged beforehand. Sticker-shock has come to health consumers, so transparency is key in shopping for health care services. Retail telehealth — delivered through grocery, pharmacy, Big Box store channels — will help to transform this new value-chain in health care.

Today’s Wall Street Journal features an article on Surprises in Health-Law Bills, recognizing that out-of-network charges often aren’t flagged beforehand. Sticker-shock has come to health consumers, so transparency is key in shopping for health care services. Retail telehealth — delivered through grocery, pharmacy, Big Box store channels — will help to transform this new value-chain in health care.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,