Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America?

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America?

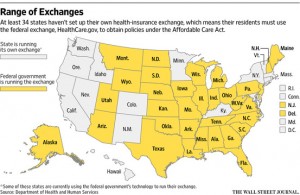

I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for health premium discounts. This means that people shopping for health insurance under the ACA are all-American, whatever state they live in. The yellow and the white states, when it comes to insurance subsidies, are all one color now.

This is good news for the insurance markets, which could have been dramatically disrupted on 25th June 2015. Instead, stock prices rose, and health consumers who are newly-covered under ACA-qualified health plans can keep their coverage, and whatever subsidies from which they benefit based on their income reported to the IRS.

Health Populi’s Hot Points: There are still tweaks and adjustments to be made to the law, and market supports that must deal with the ever-rising price of health care. While optimists report health care cost increases moderated to 6.5% in 2015, this growth rate is nonetheless many times greater than peoples’ wage increases (relatively stagnant for a decade) and the Consumer Price Index which in the previous year was actually negative (due to lower costs of petrol and other decreasing costs in the household budget). The one cost households can count on going up, up, up is….healthcare.

Health Populi’s Hot Points: There are still tweaks and adjustments to be made to the law, and market supports that must deal with the ever-rising price of health care. While optimists report health care cost increases moderated to 6.5% in 2015, this growth rate is nonetheless many times greater than peoples’ wage increases (relatively stagnant for a decade) and the Consumer Price Index which in the previous year was actually negative (due to lower costs of petrol and other decreasing costs in the household budget). The one cost households can count on going up, up, up is….healthcare.

And so with the growth of high-deductible health plans and health savings accounts, health consumers must become health care shoppers — that is, if people want to gain some control over their financial wellness.

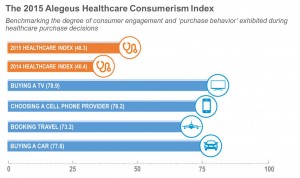

At this point, Alegeus, a consumer-directed health care company, calculated a new healthcare consumerism index, shown in the second chart. Alegeus learned that more U.S. adults spend time researching and shopping for TVs, phones, cars and travel planning than people do for health care — although the proportion of people behavior more like consumers grew by about 20% from 2014 to 2015.

At this point, Alegeus, a consumer-directed health care company, calculated a new healthcare consumerism index, shown in the second chart. Alegeus learned that more U.S. adults spend time researching and shopping for TVs, phones, cars and travel planning than people do for health care — although the proportion of people behavior more like consumers grew by about 20% from 2014 to 2015.

Bold transparency initiatives from the health care industry – hospitals, physicians, life science companies (pharma and biotech), and health insurance companies – are required on the supply side of this consumerism phenomenon. But people themselves need to get real about this new reality of health care costs and shopping on the demand side. The index is inching in the right direction, but too many people will spend too much money not-managing their health plan, service and HSA saving and spending in 2015, throwing away money unnecessarily, and some not spending when necessary.

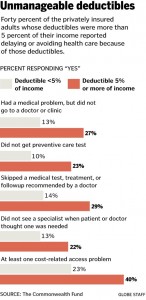

To that point, the third graph presents data quoted in a Boston Globe story published on the day of the ACA SCOTUS decision (June 25, 2015), illustrating how 40% of privately-insured Americans whose deductibles comprised at least 5% of family income delayed care due to health care costs….which can lead to greater healthcare costs in the longer term.

Learning to health/care shop has another side to its coin: bolstering personal financial health.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.