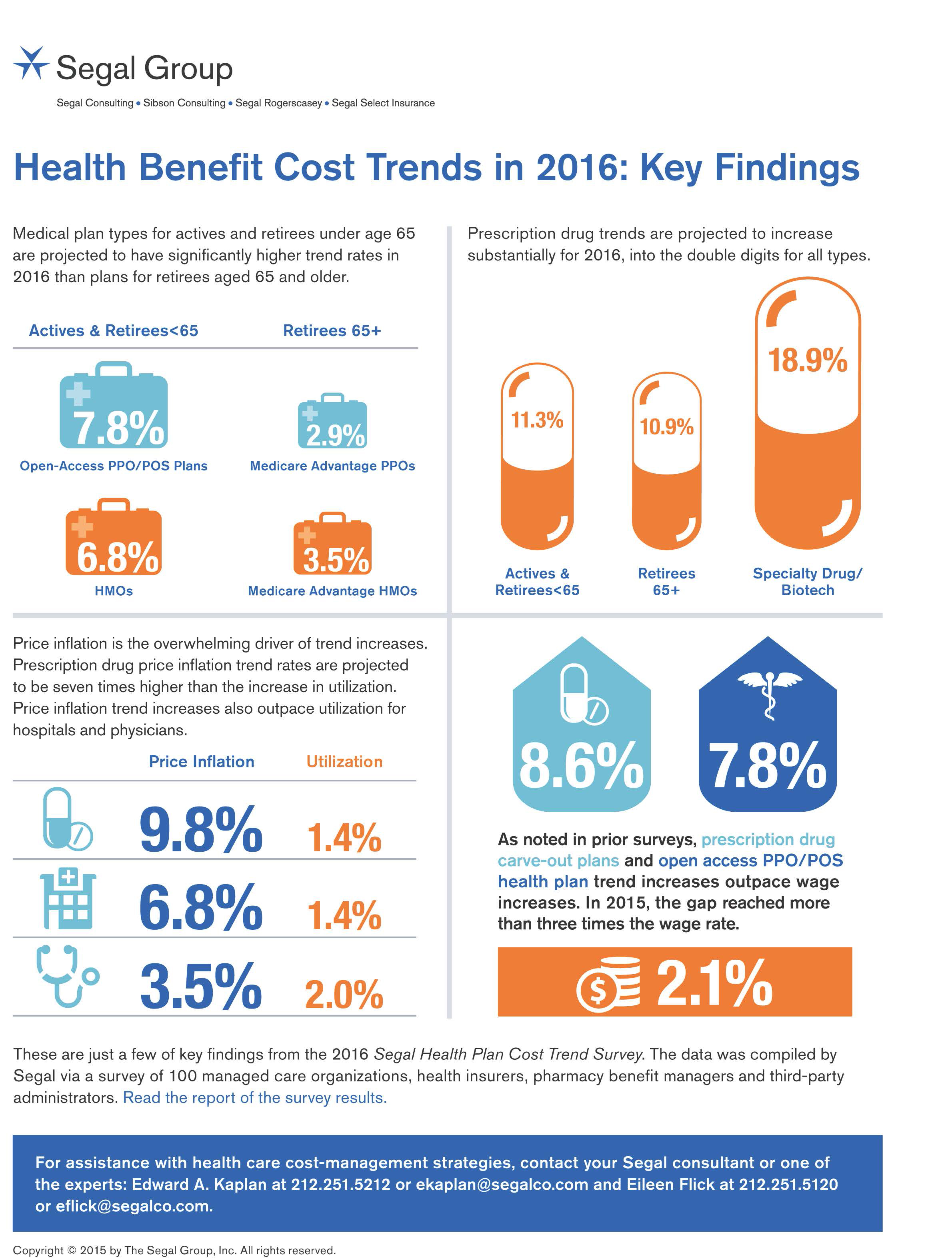

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015.

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015.

By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies.

Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in 2016, versus 11.3% for Rx carve-out benefits for active employees and 10.9% for retirees age 65 and over.

The prescription drug trend is an increase from 10% in 2015 to 11.2% in 2016. Segal calculates that prescription drug price inflation is nearly double-digits, over 10x the rate of the Consumer Price Index.

To manage rising prescription drug costs, Segal’s survey of health plans found that employers used a combination of cost containment strategies in 2015, including:

- Using specialty pharmacy management

- Expanding prior authorization

- Intensifying pharmacy management programs

- Adding Part D Employer Group Waiver Plans for Medicare-eligible people

- Expanding step-therapy programs.

Segal surveyed dozens of health plans for this annual study, including Aetna, Anthem, Cigna, UnitedHealthcare, Humana, Blues plans, and other major regional plans. Segal also spoke with pharmacy benefits firms including CVS Caremark, Express Scripts and Prime Therapeutics, among others managing prescription drugs, as well as many dental plans.

Health Populi’s Hot Points: Health cost growth has been many times greater than the increase of workers’ wages in the past decade, which I discussed in Health Populi’s coverage of the 2015 Employer-Sponsored Benefits survey. Segal notes payors’ growing attention to cost management, and expects greater use of data mining and analytics and focus on condition management; narrowing networks of providers to target efficiency and population health outcomes; more value-based benefit design; the growth of telemedicine and remote health care services; and, to be sure, tighter management of specialty drugs.

Segal’s survey bolsters our view that the payor is seeking proof of value for high-cost products, whether health plan deductible and premium, specialty drug or health service. That payor is the employer and plan sponsor, to be sure; and in that high-deductible plan world the consumer with greater financial skin in the game.

I'm once again pretty gobsmackingly happy to have been named a judge for

I'm once again pretty gobsmackingly happy to have been named a judge for  Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during

Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during  Jane collaborated on

Jane collaborated on