The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute.

“What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will consume as much as 27% of household income.

[The Department of Commerce calculates that Americans spent $1 in $5 of household income on health care in 2015].

Adding to the discussion of concerns about health care consumers with more “skin in the game,” JAMA Internal Medicine published a letter the week of January 19, 2016, on cost-sharing obligations, high-deductibles, and shopping for health care. Researchers from Harvard and USC surveyed a nationa sample of U.S. adults via GfK’s Knowledge Panel, analyzing HDHP enrollees for attitudes on price shopping, out-of-pocket costs, and health care demand. Increaing a deductible (that is, increasing skin in the game) did not inevitably lead to consumers’ price shopping for health care. “If increasing price shopping is viewed as an important policy goal,” the team wrote, “there is a need for greater availability of price information and innovative approaches to enrollee engagement with this information.”

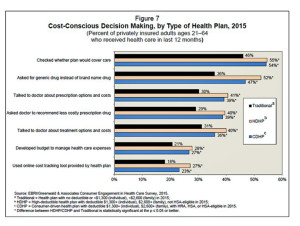

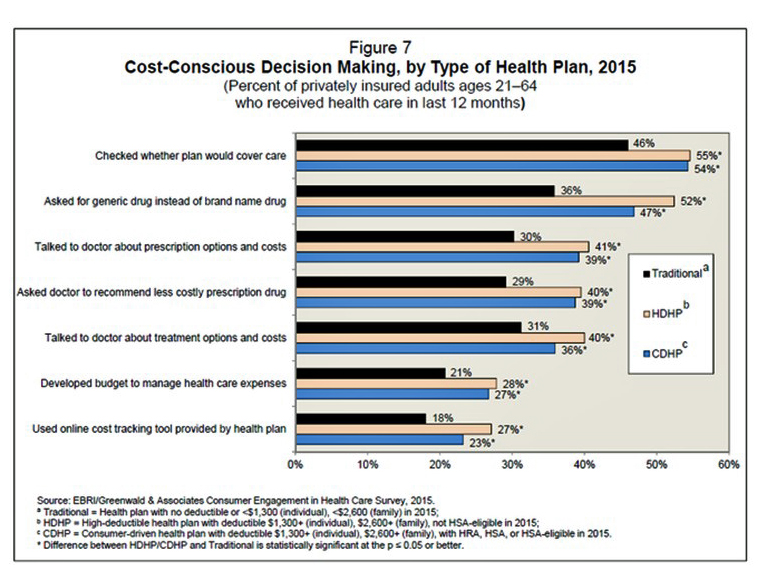

A third report, from EBRI (the Employee Benefit Research Institute), looked further into the hearts and minds of HDHP enrollees. Findings from the 2015 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey, published in December 2015, found evidence that HDHP members did exhibit more cost- conscious behaviors compared with traditional plan members such as checking whether the plan would cover care, asking for generic drugs versus brand name Rx’s, talking with doctors about treatment options and costs, and using online cost-tracking tools provided by health plans.

Health Populi’s Hot Points: Impacts of HDHPs are borne by a large and growing cohort of consumers, including both those who sign up for health insurance at work and shoppers on Federal and State-run health insurance marketplaces. According to an April 2014 Department of Health and Human Services (HHS) report, 65% of health plan enrollees chose silver plans; in these plans, 30% of health care costs were covered by the consumer, and the average deductible in these plans was $2,907 per person.

Health Populi’s Hot Points: Impacts of HDHPs are borne by a large and growing cohort of consumers, including both those who sign up for health insurance at work and shoppers on Federal and State-run health insurance marketplaces. According to an April 2014 Department of Health and Human Services (HHS) report, 65% of health plan enrollees chose silver plans; in these plans, 30% of health care costs were covered by the consumer, and the average deductible in these plans was $2,907 per person.

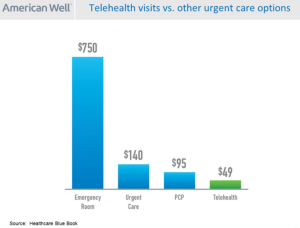

What consumers have begun to figure out is that cheaper, high quality care is increasingly available outside of hospitals, doctors offices, and emergency rooms in the form of telehealth and digital health channels. The second chart shows that a telehealth visit with, for example, American Well is half the cost of a visit to a primary care doctor, one-third the price of an urgent care visit, and about $700 cheaper than an ER admission.

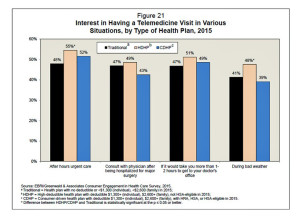

So it is unsurprising that EBRI’s survey found out, for the first time this question was polled in this annual survey, that some one-half of people enrolled in HDHPs are keen to have a telemedicine visit, shown in the third chart. Health consumers have begun to figure out how to use their HDHPs and HSAs, notwithstanding a lack of useful price and quality information. Word-of-mouth is a major driver of referrals in health consumers cottoning on to peer-to-peer healthcare in social networks, both offline and online.

So it is unsurprising that EBRI’s survey found out, for the first time this question was polled in this annual survey, that some one-half of people enrolled in HDHPs are keen to have a telemedicine visit, shown in the third chart. Health consumers have begun to figure out how to use their HDHPs and HSAs, notwithstanding a lack of useful price and quality information. Word-of-mouth is a major driver of referrals in health consumers cottoning on to peer-to-peer healthcare in social networks, both offline and online.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.