Spending on prescription drugs in America in 2015 hit nearly one-half trillion dollars, some 16.7% of national health spending. The latest report on Observations on Trends in Prescription Drug Spending was published this week by the U.S. Department of Health and Human Services’ Office of the Assistant Secretary for Planning and Evaluation (ASPE).

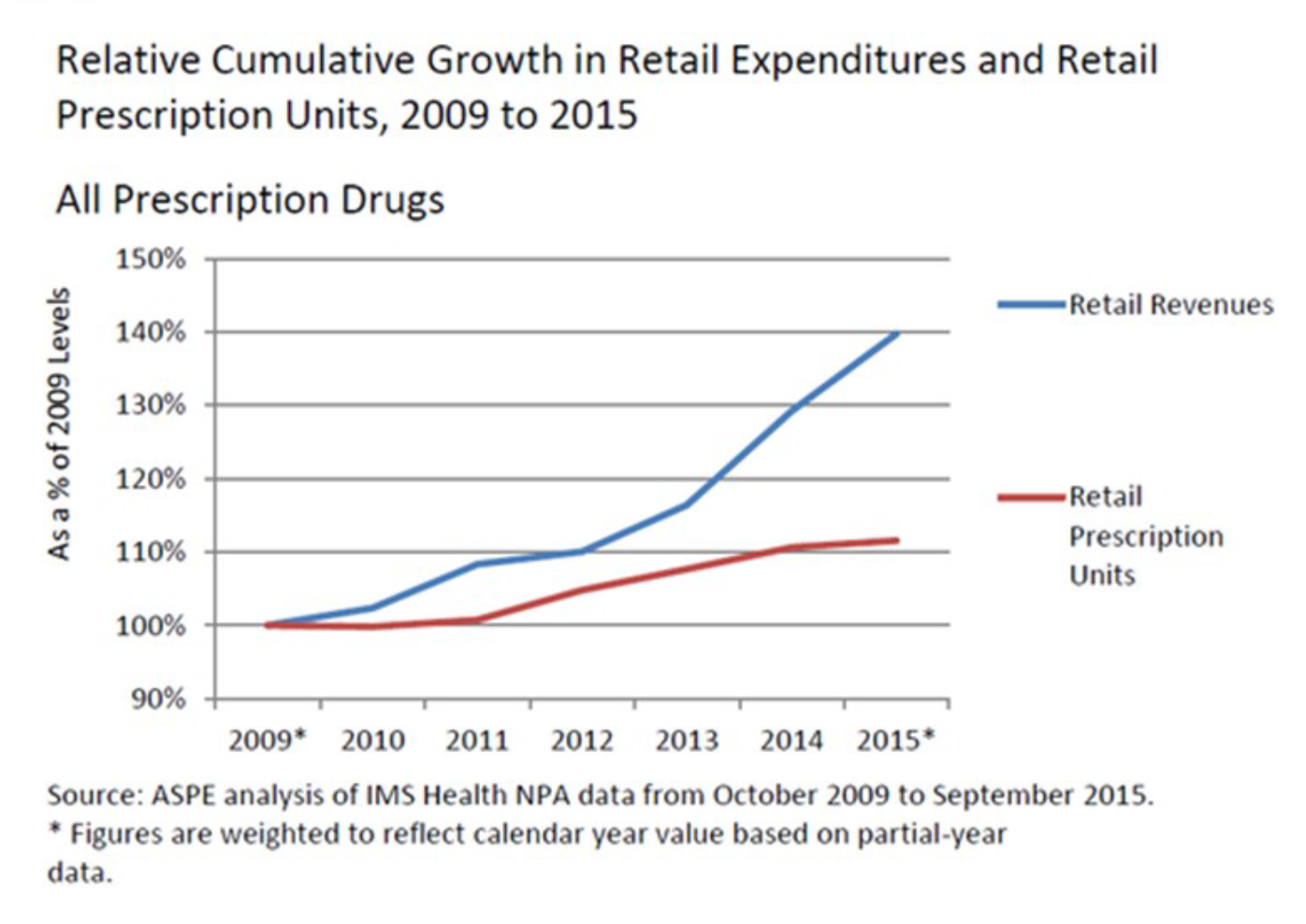

For over a decade in the U.S., the prescription drug component of national health spending was relatively flat, about 10% of overall health costs. In the past couple of years, the proportion of healthcare costs allocated to Rx medications is fast-increasing, as the line chart shows: while prescription units (volume) has increased in the past two years, the rate of price increase has grown much faster — seen by the steep slope of the blue curve which represents prescription drug revenues at retail.

ASPE points to the growth in prescription drug spending attributable to several factors:

- Population growth (accounting for 10% of the increase)

- Increase in prescriptions per capita (30% of the increase)

- Economy-wide inflation (30%)

- Higher-priced products with price increases greater than general inflation (30%).

The adoption of high-cost specialty drugs has risen faster than the use of general pharmaceutical products (non-specialty), driving up overall costs, ASPE found. The growth of specialty drug use has occurred along with greater prescribing of generics preferred instead of brand-name drugs where generics exist. The Generic Pharmaceutical Association estimated savings from generic drug prescribing hit $254 bn in 2014, and a 10-year savings of $1.68 trillion.

For this research, ASPE uses the National Health Expenditure Accounts (NHEA) which include retail prescription drug spending (via retail pharmacies that directly serve patients) and non-retail (spending by medical providers for drugs provided directly to patients). The components of spending by each of these sources was $458 bn on retail and $128 bn for non-retail drugs.

Health Populi’s Hot Points: There is no universally-accepted definition of “specialty drugs,” but most share several or all of the following characteristics: that the products are expensive (the most obvious criterion), manufactured in the living systems (biologics), difficult to administer, prescribed by specialists, used to treat serious conditions where there are few alternative therapies available, administered through specialized pharmacies, and requiring special handling.

ASPE asserts that “‘High cost’ is a common theme in almost all definitions of specialty drugs.”

This study demonstrates that the fast-growing nature of the top retail pharma spending is due to price, and most analysts agree that underlying that is the increasing adoption of specialty drugs.

For years, the pharma industry argued that the $1 in $10 spent on prescription drugs was a small proportion of total health costs to spend on Americans’ health. As the price tag component for Rx’s reaches $2 in $10, the pharmaceutical industry will feel greater pressure to prove an ROI based on health outcomes, cost-benefit analyses, and consumer preferences based on lifestyles and side effects.

I would point pharma researchers and developers to the instructive article in JAMA, Value-Based Payments Require Valuing What Matters to Patients. As patients and their families will be paying a growing proportion of their health costs through high-deductible health plans and health savings accounts, the patient is emerging as the payor. The industry may overlook this new, end-user payer at their peril.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're