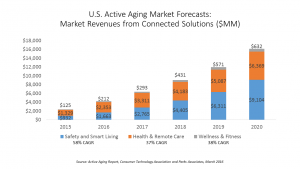

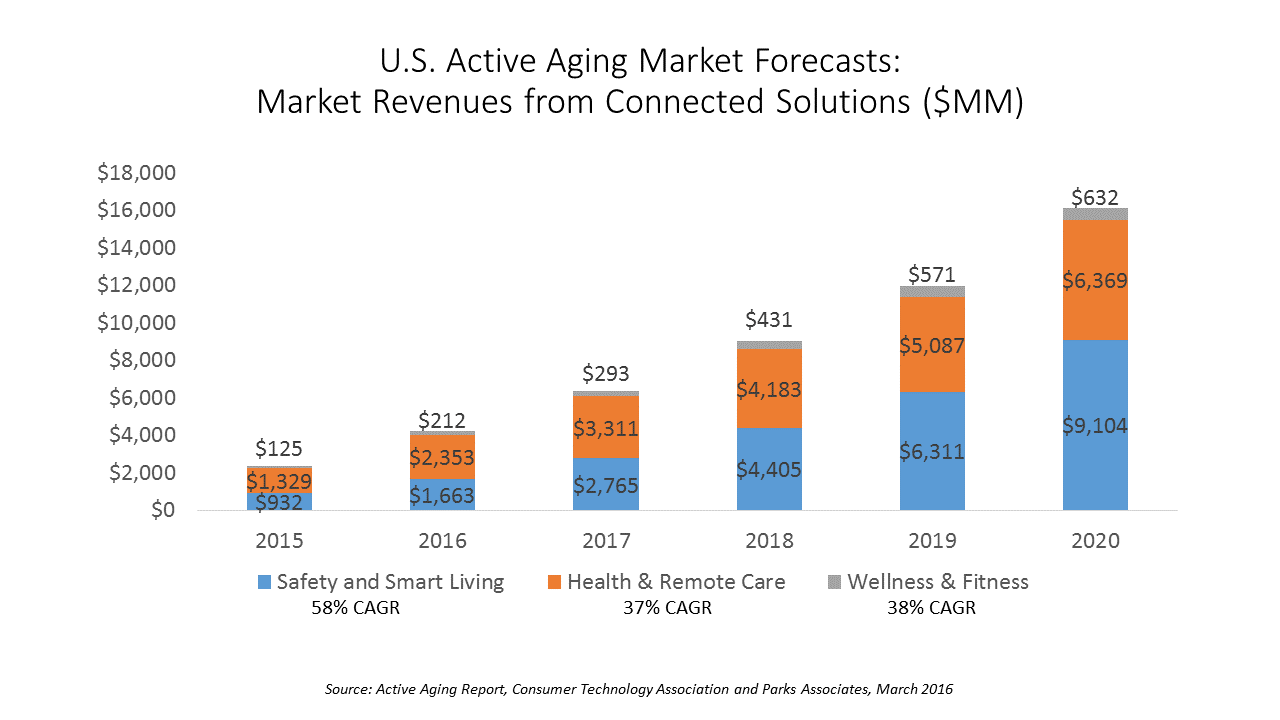

There are 85 million people getting older in America, all mindfully working to not go gentle into their good nights — that is, working hard to stay young and well for as long as they can. This is the market for “active aging” technology products, which will be worth nearly $43 billion in 2020, according to a report from the Consumer Technology Association (CTA), the Active Aging Study.

There are 85 million people getting older in America, all mindfully working to not go gentle into their good nights — that is, working hard to stay young and well for as long as they can. This is the market for “active aging” technology products, which will be worth nearly $43 billion in 2020, according to a report from the Consumer Technology Association (CTA), the Active Aging Study.

CTA and Parks Associates define the active aging technology market in three segments with several categories under each:

- Safety and smart living, which includes safety monitoring, emergency response (PERS), smart living, and home living support

- Health and remote care, covering personal health devices, remote diagnosis and monitoring, and virtual consultation

- Wellness and fitness, for fitness tracking devices, diet/weight loss tools, and wellness monitoring devices and apps.

What’s behind the growth of active aging are Boomers and the Silent Generation living longer than previous generations; an institutional long-term care market with constrained reimbursement, driving up economic incentives for aging at home; and the emergence of practical, cost-efficient and well-designed smart home and Internet of Things technology options for people and caregivers. Finally, the FDA’s recent guidance on Medical Device Data Services and Medical Mobile Apps clarify the Agency’s review process and increases market certainty for developers.

On the technology trends front, important underlying drivers are emerging standards and networking technologies that underpin home-delivered tech, including Wireless Personal Area Network (WPAN), Local Area Network (LAN), Wide Area Network (WAN), and smart home standards such as ZigBee, Threat, and Insteon. CTA observes: “Technology openness has gained significant mindshare in recent years” as consumers do not appreciate fragmented, hard-to-implement solutions.

Most importantly, it’s aging consumers’ collective attitudes rejecting traditional assisted living, a resiliently stubborn wish to age comfortably at home, and the economic realities of the cost of aging and healthcare that underpin the active aging market. Caregivers are also a key consumer segment here, where over 40 million people perform caregiving duties ongoing in the U.S., further driving market demand for technology-based aging-at-home solutions.

CTA offers the following recommendations for serving the active aging market:

- Market smartly

- Leverage best distribution channels

- Be agile and adaptive

- Use broad channel partnerships with strategic market segmentation

- Address seniors by needs and wants, and not just by “needs”

- Simplify the experience — fragmentation is the enemy

- Ensure affordability.

CTA worked with Parks Associates on the data analyses, which go into great detail on the three market segments and example vendors within each.

Health Populi’s Hot Points: The World Health Organization (WHO) has long been involved in supporting communities’ policies for active aging, and devotes a portal to the topic here. WHO defines active aging as,

Health Populi’s Hot Points: The World Health Organization (WHO) has long been involved in supporting communities’ policies for active aging, and devotes a portal to the topic here. WHO defines active aging as,

The process of optimizing opportunities for health, participation and security in order to enhance quality of life as people age…Active aging allows people to realize their potential for physical, social, and mental well-being throughout the life course and to participate in society, while providing them with adequate protection, security and care when they need.

As WHO’s bubble chart illustrates, active aging has several determinants — THINK: Social Determinants of Health which touch on physical, social (as in community/networks), economic, behavioral/mental health, and personal factors — along with health and social services.

With all of the promising technologies being developing for active aging described in this report, we should be mindful of the distinction between what is necessary and what is sufficient. Many of the technologies discussed in the CTA report will be necessary assistants to enable people to age well in their homes, avoiding institutional care. But we must be mindful that it’s the digital plus the analog of the social determinants of health that will address the complete and quality of life-cycle of aging people.

As a proud Big Ten alum, I'm thrilled to be invited to

As a proud Big Ten alum, I'm thrilled to be invited to  I was so grateful and joy-ful to join my long-time brother mischief-maker Matthew Holt and three other old health care leader friends on the Health Care Blog Gang webcast, #Election2024 (and Halloween!) edition. We covered a lot of ground as Matthew always does, with a special brainstorm about the very momentous election just a few days before November 5, 2024.

I was so grateful and joy-ful to join my long-time brother mischief-maker Matthew Holt and three other old health care leader friends on the Health Care Blog Gang webcast, #Election2024 (and Halloween!) edition. We covered a lot of ground as Matthew always does, with a special brainstorm about the very momentous election just a few days before November 5, 2024. I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!

I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!