Based on a TIME magazine interview conducted today with President-Elect Donald Trump, the pharmaceutical and life science industries may expect to find coal in their Christmas stocking, and tougher pricing constraints in 2017.

Based on a TIME magazine interview conducted today with President-Elect Donald Trump, the pharmaceutical and life science industries may expect to find coal in their Christmas stocking, and tougher pricing constraints in 2017.

“I’m going to bring down drug prices,” Mr. Trump said, quoted on the TIME website naming him Person of the Year. “I don’t like what’s happened with drug prices.”

As CNN put it, “Trump put the entire drug industry on notice on Wednesday in an interview with Time.”

In fact, Donald Trump’s campaign website talked about drug importation as one potential tactic consumers could potentially use to bring down their household prescription drug costs.

Media coverage of the interview’s pharma content appeared in many business and trade publications, among them:

- Bloomberg, Trump’s Vow to Control Drug Costs Alerts Another Industry, which titled their short video, “Trump: Bad Medicine for Pharma?”

- Money magazine quoted Trump saying, “I will bring down drug prices.”

- The UK Daily Mail wrote, “Trump vows to bring down drug prices, doesn’t say how.”

- Barron’s acknowledged that, “Trump Comments on Drug Prices Sink Biotech.” Among stocks that took price hits on 7 December following the TIME comments were Incyte, Celgene, both down 5%; Vertex, Illumina, Mylan, and Regeneron, down 4%. The SPDR S&P Pharmaceutical ETF fell 3.4%, and iShares NASDAQ Bioetch ETF was down 4.2% at one point on the day.

- Seeking Alpha‘s DoctoRx (a Health Populi favorite commentator), coined, “Et tu, Donald? Drugs Dive: What’s Going On, And What’s Next. DoctoRx reminded us that, “This should be no surprise to anyone. Mr. Trump’s campaign website was rudimentary for quite a long time, but one of the points it specified early was that he would work to equalize drug prices between the US and other developed countries.”

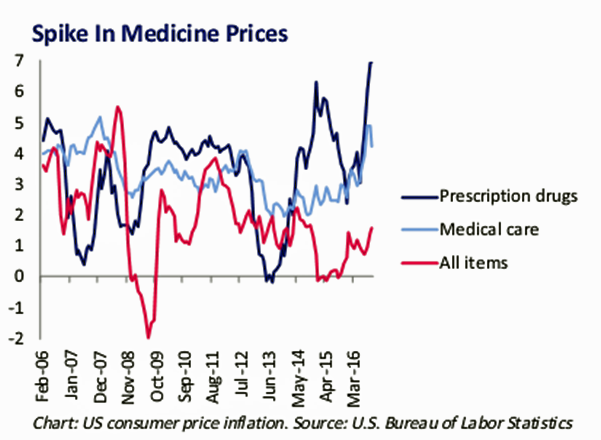

Health Populi’s Hot Points: Check out the link graph, which illustrates prescription drug price inflation fluctuations compared with medical care and general consumer price inflation (sourced from the U.S. Bureau of Labor Statistics).

Health Populi’s Hot Points: Check out the link graph, which illustrates prescription drug price inflation fluctuations compared with medical care and general consumer price inflation (sourced from the U.S. Bureau of Labor Statistics).

Note the dark blue line, which for the past two years has generally been above (and sometimes, well above) health care inflation and always above general market basket issues over the two years since May 2014.

The issue of drug pricing hit popular culture status in 2016 based on the EpiPen pricing story, on top of the past two years’ stories of Gilead’s Hepatitis C drug pricing (for Harvoni and Sovaldi), and the demonization of Martin Shkreli of Turing Ph armaceuticals, called, “The Bad Boy of Pharma” by the New York Times one year ago.

armaceuticals, called, “The Bad Boy of Pharma” by the New York Times one year ago.

Note the September 12, 2016, People magazine coverage (pictured in “Passages” image) of the EpiPen, which I noted inside the issue featuring Rob Kardashian’s impending fatherhood.

From an investment standpoint, DoctoRx of Seeking Alpha recommends investors take a long view looking at industry fundamentals and the fact that it’s hard to cut health benefits. But in this new-new era of President Trump, what’s past is not prologue. I’m expecting public support of more stringent drug pricing regimes moving closer to European nations’ constraints and value-based evaluations using health economics outcomes research (HEOR).

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,