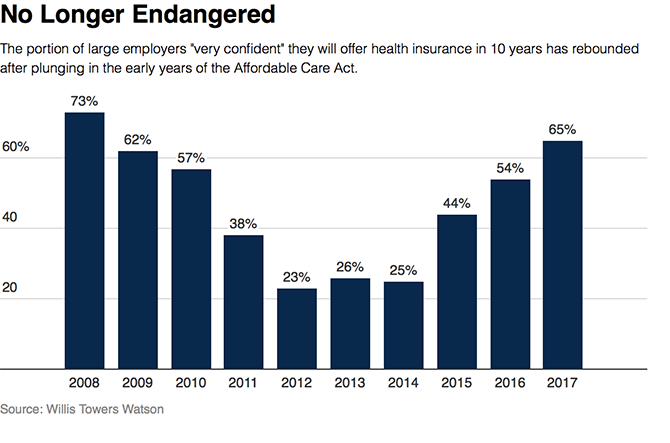

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing.

As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.”

First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer Survey found that, facing continued cost pressures, companies will focus on boosting health engagement, using analytics, and more tightly managing pharmacy costs. Look for further adoption of telemedicine and centers of excellence, population health approaches to diabetes and mental health, and partnerships to improve outcomes. Employers also expect to incorporate wearables and mobile apps into their benefit plans.

The WLTW survey was conducted in June and July 2017 among 678 U.S. employers; these companies represent 11.9 million employees across all major industry sectors.

The second report comes from the National Business Group on Health (NBGH), which conducts an annual survey into large employers and health insurance. Key findings in the study were that:

- Telehealth as a health benefit will be ubiquitous, and expand beyond physical health to behavioral health services

- Accountable care organization involvement and Centers of Excellence coupled with bundled payments will grow

- Over one-half of employers will offer onsite or “near-site” health centers, growing to two-thirds by 2020

- Value-based benefit design is gaining more traction, with nearly 40% of companies using some type of VBBD that includes reduced cost-sharing or premium reductions for employees who opt into managing chronic conditions

- Two-thirds of employers will offer medical decision support and second opinion services in 2018, up from 47% in 2017

- 9 in 10 companies will offer at least one consumer-directed health plan in 2018, and 40% will offer CDHPs as the only plan option – usually a high-deductible health plan coupled with a Health Savings Account.

- For the second year in a row, employers cite the top health care cost driver as specialty pharmacy costs. Seven in 10 employers will adopt more aggressive utilization management for pharmacy spending.

The NBGH survey was conducted in May and June 2017 among 148 large employers covering over 15 million workers and dependents.

Health Populi’s Hot Points: Employees who currently receive health benefits at the workplace can exhale, for the immediate future, when it comes to retaining their plans through their jobs. Workers can expect, as part of that health-social contract, to take on more responsibility for cost-sharing and greater engagement in their health care especially if they are diagnosed with a chronic condition — diabetes, behavioral health, and musculoskeletal issues (THINK: back pain) among them.

Health Populi’s Hot Points: Employees who currently receive health benefits at the workplace can exhale, for the immediate future, when it comes to retaining their plans through their jobs. Workers can expect, as part of that health-social contract, to take on more responsibility for cost-sharing and greater engagement in their health care especially if they are diagnosed with a chronic condition — diabetes, behavioral health, and musculoskeletal issues (THINK: back pain) among them.

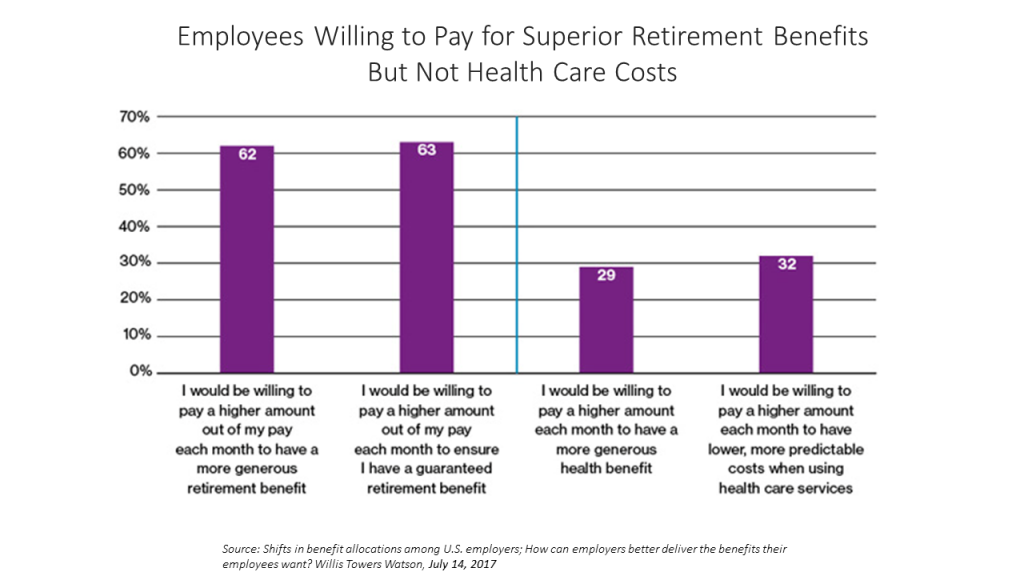

Workers have begun to understand the wage-health benefit trade-off they’ve made over the past decade, facing flat wages with fast-rising health care costs. This is now translating into employees’ financial wellness mindsets, a previous WLTW survey learned in July 2017. Note in the second chart that more employees are willing to pay more money out of a paycheck on a monthly basis to fund a more generous retirement. Fewer people would be willing to spend more each month for more generous health benefits.

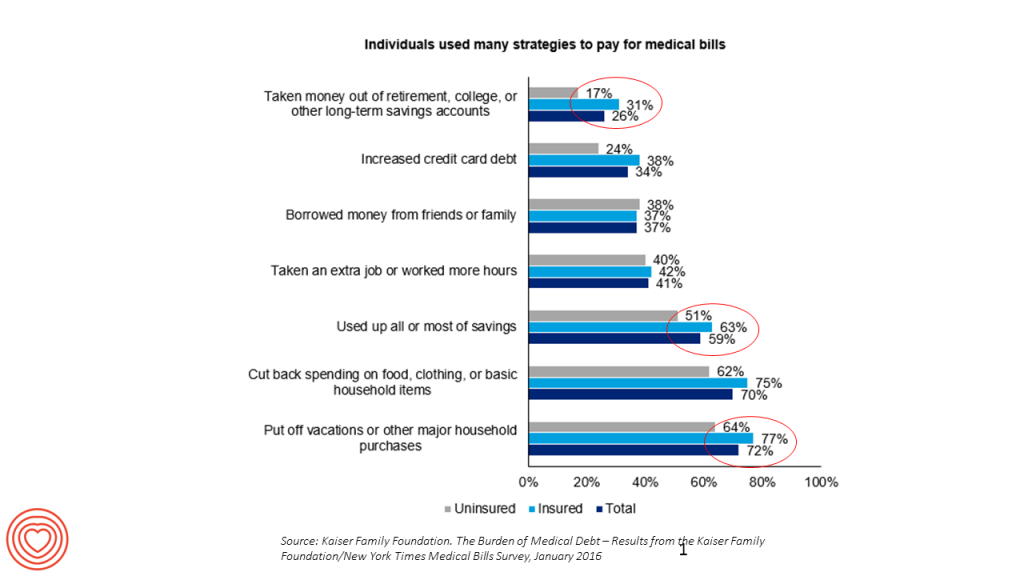

This mind-shift, worrying more about retirement saving, is due to a shift in personal spending habits I discovered mining data from a Kaiser Family Foundation study into medical debt. See the top circled line-item: 31% of consumers took money out of retirement, college, or other long-term savings accounts to pay for current medical bills in 2015.

This mind-shift, worrying more about retirement saving, is due to a shift in personal spending habits I discovered mining data from a Kaiser Family Foundation study into medical debt. See the top circled line-item: 31% of consumers took money out of retirement, college, or other long-term savings accounts to pay for current medical bills in 2015.

This illustrates the financial bind American families now face when allocating budgets to current spending for food, housing, utilities, and health care, versus saving for future living in retirement.

Beyond the health benefit, then, employers are looking to furnish a new one: focusing on workers’ financial health to deal with the stress too many employees feel financially.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,