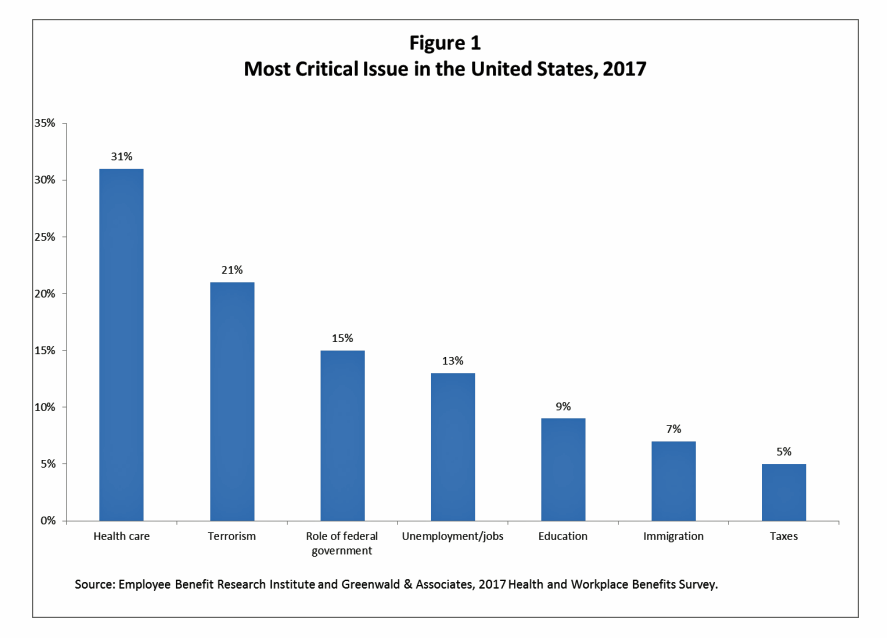

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes.

Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey.

Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied with the costs of healthcare services not covered by that insurance.

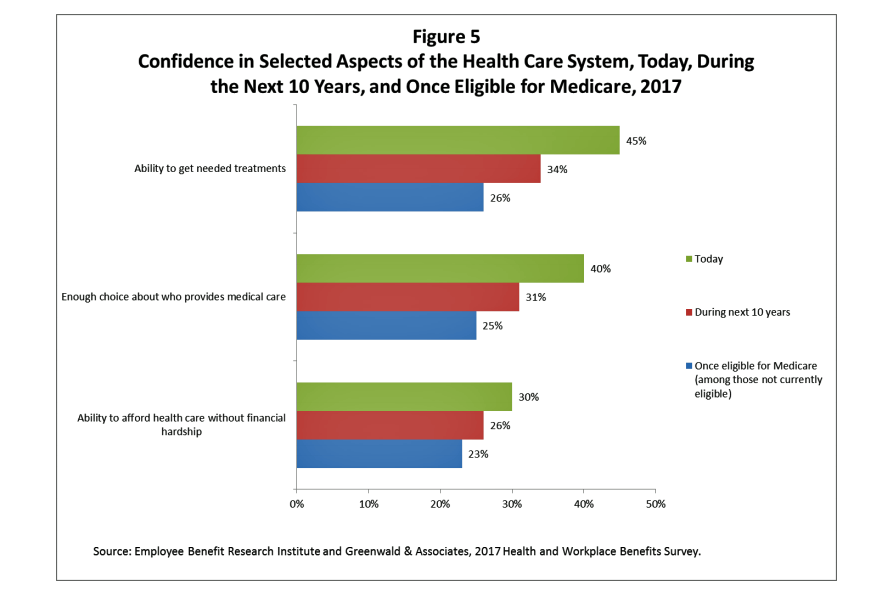

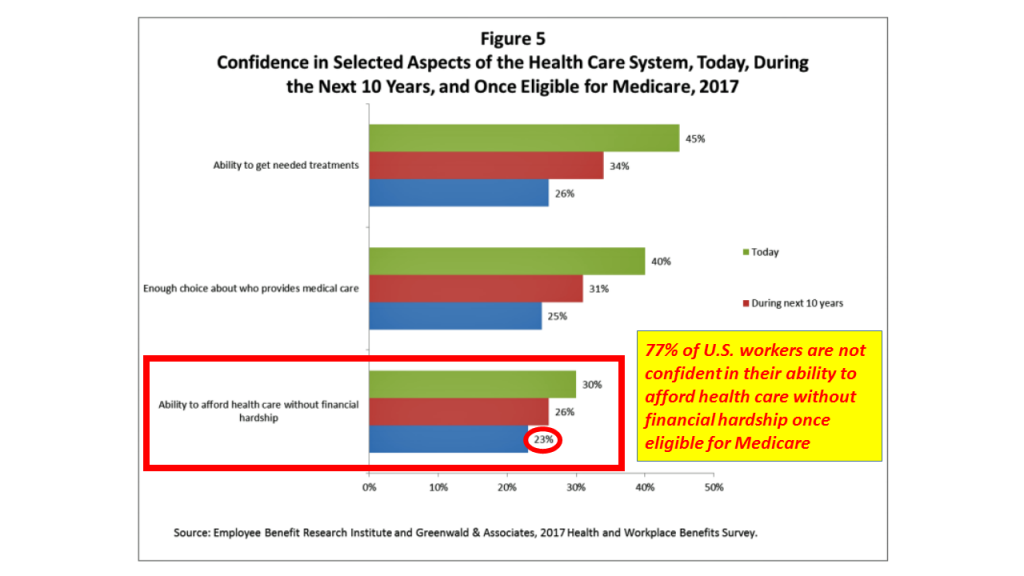

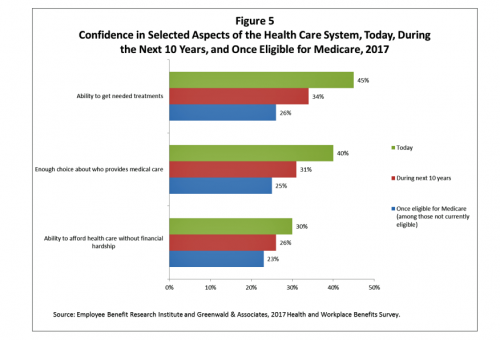

Today, fewer than 1 in 2 people are confident in their ability to get needed treatments; this falls to one-third of people in the next decade, and only 1 in 4 people once eligible for Medicare.

Today, fewer than 1 in 2 people are confident in their ability to get needed treatments; this falls to one-third of people in the next decade, and only 1 in 4 people once eligible for Medicare.

When it comes to affording health care without financial hardship, the percentage of people confident about affordability now, in 10 years, or when Medicare-age are even lower, shown in the second chart.

One-third of the workers polled said they had used up all or most of their savings or increased credit card debt, 22% had borrowed money, and 15% had taken a loan or withdrawn from their retirement plan, which connects the dots between health consumers’ health care spending and household financial wellness.

In 2017, most workers adapted their use of health care services based on cost increases. Most commonly, 68% of workers tried to take better care of themselves as a result of cost increases, 63% chose generic drugs more often as well as went to the doctor only for more serious symptoms, 56% talked to the doctor more carefully about treatment options and costs, and 55% delayed going the doctor due to costs.

About 1 in 3 workers obtained coupons or discount cards for brand-named medicines, switched to over-the-counter drugs, looked for less expensive health care providers, skipped doses or didn’t fill and Rx, or looked for cheaper health insurance.

The survey was conducted in June 2017 among 1,518 U.S. workers between 21 and 64 years of age.

Health Populi’s Hot Points: What’s most notable about this list of priorities, based on the EBRI/Greenwald & Associates Health and Workplace Benefits Survey, is that the 115th U.S. Congress passed tax reform during President Trump’s first year in the White House, but provisions to the Affordable Care Act eroded during the first twelve months of his tenure.

U.S. workers aren’t just changing their healthcare utilization choices based on increasing costs. Among workers who have seen their health care costs rise in 2017, 43% have decreased contributions to non-retirement savings, and 26% have decreased contributions to retirement plans like 401(k)’s.

Consumers’ finances have also been negatively impacted by rising healthcare costs in the following ways:

Consumers’ finances have also been negatively impacted by rising healthcare costs in the following ways:

- 36% have had difficulty paying for other (non-healthcare) bills

- 34% have increased credit card debt

- 30% have used up all of their savings

- 28% have difficulty paying for basic necessities like food, heat and housing

- 22% of workers borrowed money.

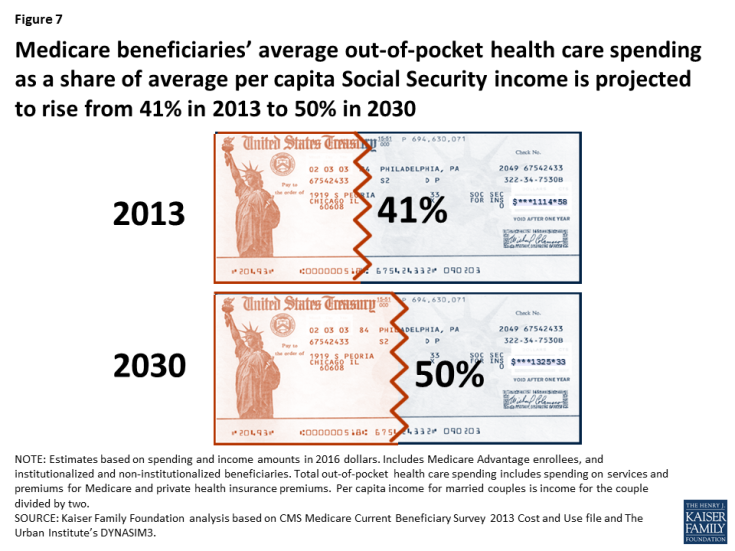

This is “today,” but looking to the future, health consumers will be faced with even more cost challenges. New research from Kaiser Family Foundation on Medicare beneficiaries’ out-of-pocket health care spending as a share of income in the future serves up a financial sobering picture of aging in America.

The last chart illustrates the percentage of Social Security income the average Medicare member would spend out-of-pocket on healthcare expenses in 2030. That’s $1 in every $2 of Social Security payments.

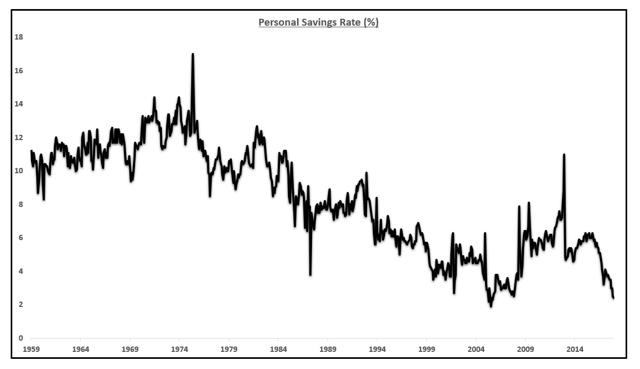

Note that personal savings rates in America are in decline, shown in the last chart. At the same time, the “third rail” of public policy — entitlements in the form of Social Security and Medicare — make up larger shares of household spending. Today’s workers expect Social Security and Medicare to be part of their retirement future income portfolios.

Never say Americans aren’t in touch with their own financial wellness. Eight in 10 workers are well aware of the personal financial risks that health care costs represent when they’re looking to retire with Medicare and Social Security as social safety/financial nets.

Never say Americans aren’t in touch with their own financial wellness. Eight in 10 workers are well aware of the personal financial risks that health care costs represent when they’re looking to retire with Medicare and Social Security as social safety/financial nets.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,