It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated.

But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries.

How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans.

This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services.

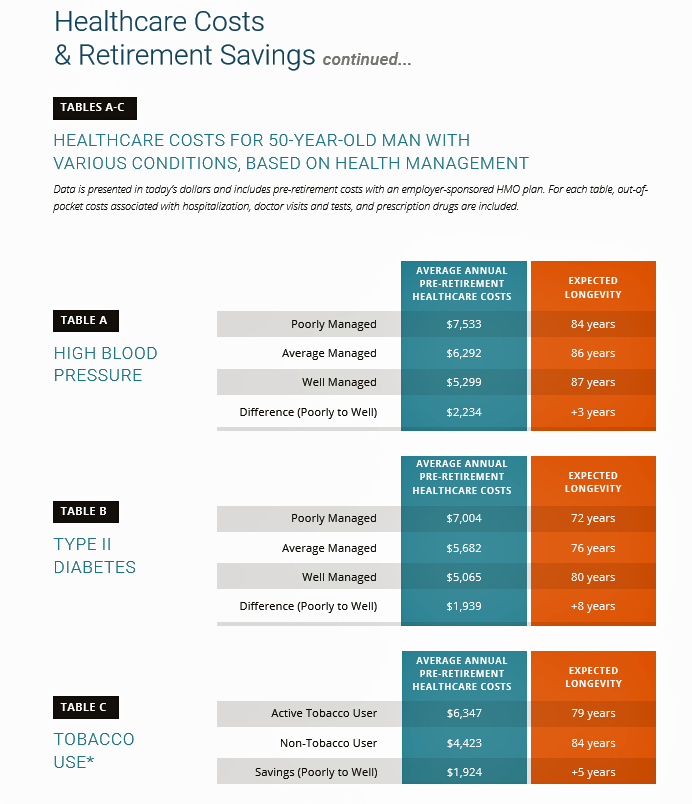

The chart illustrates three health-financial scenarios for a 50 year old man dealing with three conditions: high blood pressure, Type 2 diabetes, and tobacco smoking. If this patient engages in their health management to, say, lower blood pressure, he could save about $1,300 a year in pre-retirement health care costs if he manages his condition in an “average” way, or $2,234 if he moves from poor management to well-managed — also adding at least three years to his lifespan.

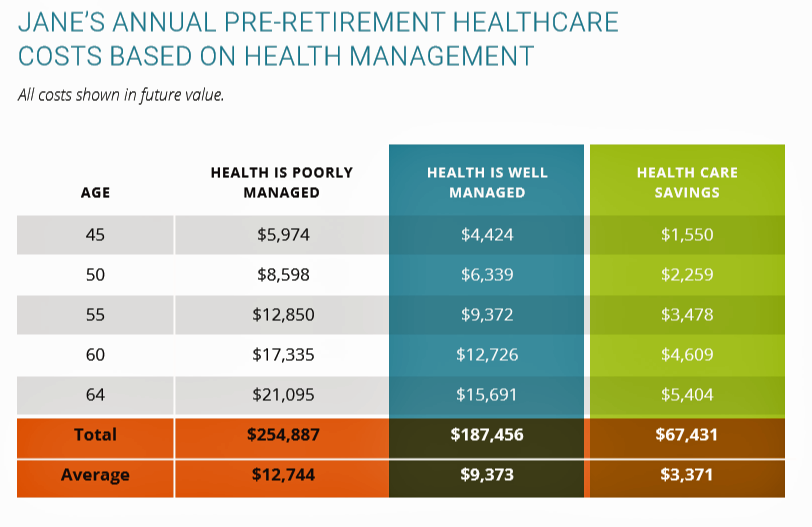

For a 45-year old woman “Jane” with Type 2 diabetes and high cholesterol, over the years pre-retirement age, she could add over $100,000 to her 401(k) retirement savings and eight additional years of life expectancy (from 76 to 84 years of age, based on this model) by moderating alcohol consumption and taking her meds as prescribed.

HealthyCapital develop a Health Management Retirement Index to calculate an individual’s percentage of retirement healthcare costs that can be funded by savings from improved health.

Health Populi’s Hot Points: In the U.S., we cannot separate the patient’s approach to self-managing a health condition with their access to a health insurance plan and the nature of that insurance.

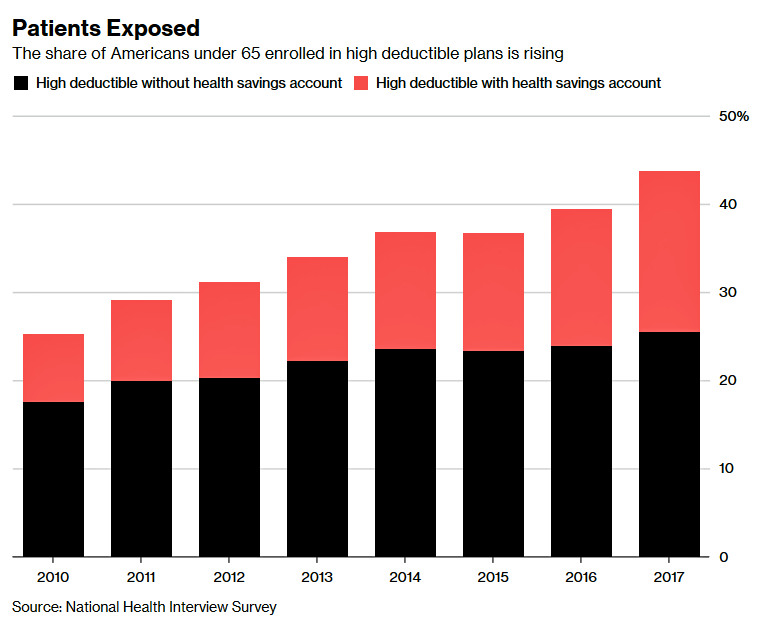

The proportion of Americans enrolled in high-deductible health plans continues to grow, in the face of growing evidence that many patients still don’t schedule healthcare services when they truly need them because they want to avoid spending “their” money for as long as they can. This can be due to people who are making tough spending decisions in family budgets between needed kitchen table spending, like food and rent/mortgage, along with other people who are postponing care. At that point, someone with an underlying undiagnosed health condition will face a more serious state of illness, and along with that, greater cost burden to deal with a chronic or acute disease.

I often write about the personal American arm-wrestle between the fiscal and the physical when it comes to self-rationing health care.

One trusted ally patients see for a conversation about health care costs is their physician, so a new survey report from the New England Journal of Medicine Catalyst series was of interest to me through my health-economic lens. The Cost of Care and Physician Responsibility asked U.S. healthcare executives, “How important is the cost of care (out-of-pocket) to patients?” 99% of the respondents said, indeed, OOP costs are important, with two-thirds of these execs saying the costs were “extremely important” (the top box in the poll).

All well-and-good, but healthcare providers largely lack the tools to help health consumers sort out their personal healthcare costs. 90% of the execs polled said that health care costs are confusing given the current payor mix they have to deal with, from Medicare and Medicaid to any number of commercial insurers, union plans, and other payors in the mix.

Furthermore, two-thirds of respondents said there isn’t enough time during clinic/exam hours to discuss the costs of treatments with patients.

Here’s a very-current example where “it takes a village,” of health plans, providers, patients and designers to share the data and develop the tools and information required to arm both doctors and their patients to address costs and care decisions. One of the five trends we’ll discuss in the 2018 Accenture Digital Health Tech Vision webinar on Wednesday 18th July is called “frictionless business.” This scenario is exactly what’s required to build a platform that effectively serves the multiple interests of payors, providers, and patients.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're