“In an extreme example of angst over expensive medical bills, an elderly Washington couple who lived near the U.S.-Canadian border died in a murder-suicide this week after leaving notes that detailed concerns about paying for medical care,” USA Today reported on August 10, 2019.

Five years ago, financial toxicity as a side-effect was noted by two Sloan Kettering Medical Center in a landmark report on 60 Minutes in October 2014. Epidemiologist Peter Bach and oncologist Leonard Saltz told CBS’s Lesley Stahl, “A cancer diagnosis is one of the leading causes of personal bankruptcy…We need to take into account the financial consequences of the decisions that we make for our patients,” observing that new cancer therapies launching on the market were costing more than previous products — costs that were borne increasingly by patients.

A timely report from Optum Bank (a unit of UnitedHealth Group) asks, “is financially preparing for a chronic condition possible?”

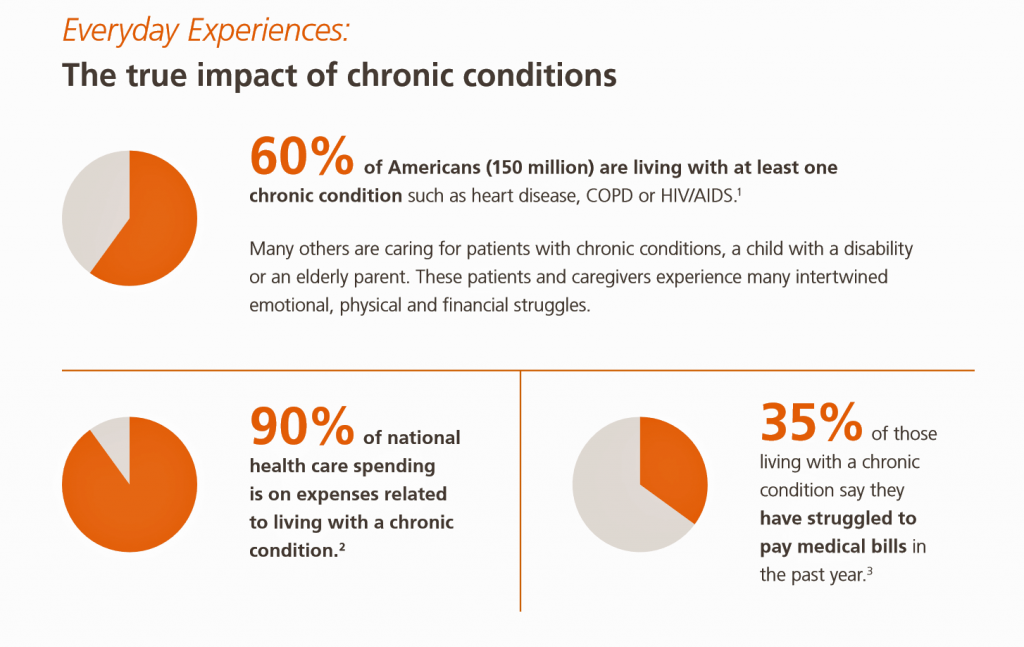

The report aggregates data on the state of Americans’ general finances then focuses in on health care costs. One-third of Americans with chronic conditions say they have struggled to pay medical bills in the past year, noted in the pie chart from the Optum report.

The report aggregates data on the state of Americans’ general finances then focuses in on health care costs. One-third of Americans with chronic conditions say they have struggled to pay medical bills in the past year, noted in the pie chart from the Optum report.

The numbers of people that represents can be calculated by the first statistic, that 60% of Americans live with at least one chronic condition. That’s about 150 million people.

Now consider the stress that health care costs can cause someone living with, and paying for, a chronic condition.

The text excerpted here from the Optum report summarizes that emotional impact. “At some point they (patients with chronic conditions) began to feel stress caused by symptoms and fear of the unknown….their world was turned upside down as they struggled to understand the impact of their diagnosis and understand options for insurance, doctors and their work situation. In some cases, this stress led to anxiety depression and even substance abuse.”

Moreover, “many patients are now preoccupied with managing logistical details like transportation, insurance claims and finances.”

Ultimately, “Most patients feel guilty about the financial toll their condition has on their family and caregivers,” Optum soberly observed.

Health and finances are highly intertwined, Optum concludes, explaining how health savings accounts and proactive planning can help risk-manage the stresses of chronic medical expenses.

Health Populi’s Hot Points: In 2014, Dr. Bach and Dr. Saltz were referring to innovative therapeutics like Gleevec and Zaltrap, each priced then at over $10,000 a month.

In 2019, today, we see CAR-T therapy can cost $1.5 million all-in. The treatment was approved last week for payment by Medicare for some patients.

To Optum’s point about creative financing for health care, Bluebird Therapeutics has designed a payment-on-installment-plan-by-outcomes for Zynteglo, which I discussed here on Health Populi. Bluebird set the price of Zynteglo at about $1.8 million.

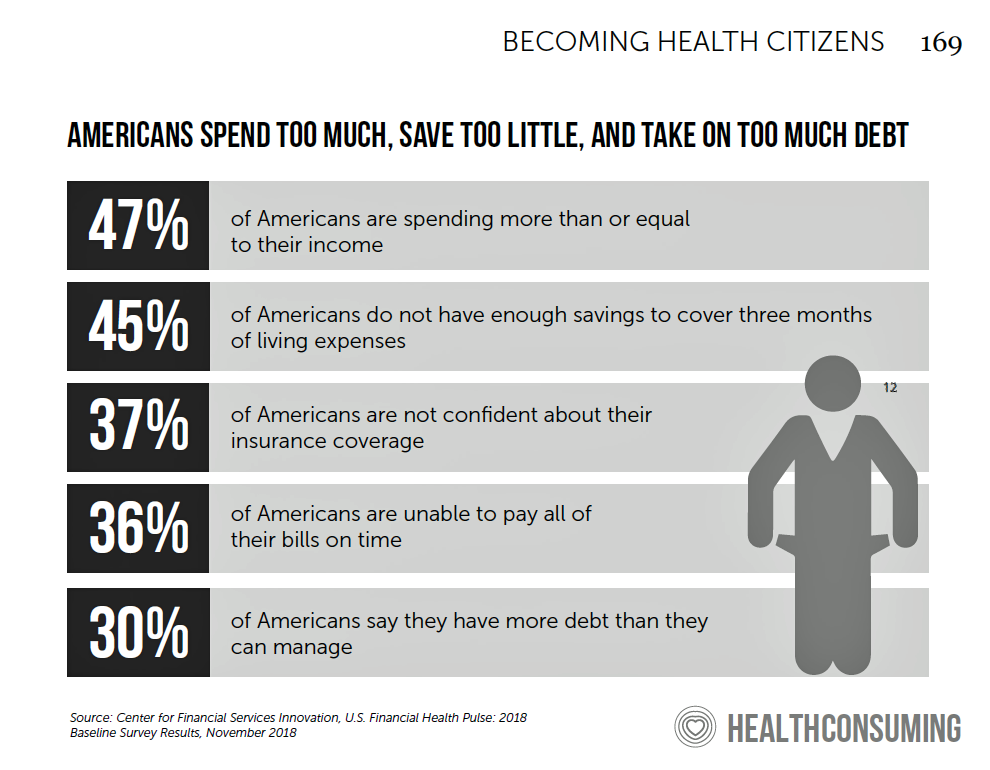

I describe this uniquely-American phenomenon in my book, HealthConsuming, in the chapter titled, “The Patient Is the Payor.” Americans don’t have a great savings habit compared with other health citizens around the world. The range of what U.S. adults have saved in a bank range from about $400 to about $1,000, depending on the source. That savings wouldn’t cover the cost of a month’s worth of insulin for many managing diabetes.

In that context, you don’t have to look at a seven-figure specialty drug price to find financial toxicity as a mainstream issue for patients in America. The cost of insulin has driven some patients to ration or abandon the prescription, to tragic outcomes like the death of Josh Wilkerson in June Josh’s death was not a one-off statistic: he represents other patients with diabetes who have made the choice to ration the life-saving drug. “It’s the Prices, Stupid,” as our friend Uwe Reinhardt and colleagues reminded us, over and over.

In that context, you don’t have to look at a seven-figure specialty drug price to find financial toxicity as a mainstream issue for patients in America. The cost of insulin has driven some patients to ration or abandon the prescription, to tragic outcomes like the death of Josh Wilkerson in June Josh’s death was not a one-off statistic: he represents other patients with diabetes who have made the choice to ration the life-saving drug. “It’s the Prices, Stupid,” as our friend Uwe Reinhardt and colleagues reminded us, over and over.

I heard the historian Jon Meacham, author of the book The Soul of America, say the other day in the wake of the El Paso and Dayton shootings, that America’s “work-flow” (my phrase) tends to be very last-minute. Throughout history, U.S. leaders haven’t been effective at or valued planning ahead the way I might engage my clients in scenario planning for the future. No doubt there are strategic “war rooms” dotted throughout U.S. administrations through 200+ years, but Meacham’s research on the soul of America has revealed that American leadership has tended to do things only when faced with that bull in the ring, close-up and facing death squarely in the eye, in the last moment of truth.

This is how the Jones’ must have felt, in that bull ring, between rock and the hard place of health care costs they couldn’t afford. Will we learn from their tragic choice?

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast