Tonight, President Trump will present his fourth annual State of the Union address. This morning we don’t have a transcript of the speech ahead of the event, but one topic remains high on U.S. voters’ priorities, across political party – prescription drug prices.

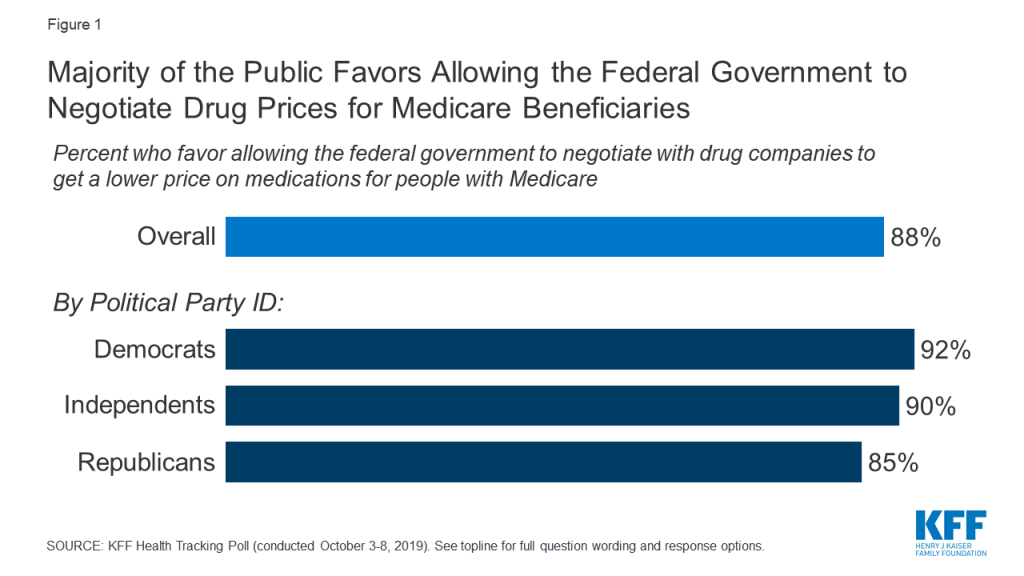

Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top strategy is via Medicare negotiation, above re-importation, reference pricing, and other tactics gauged in the survey.

Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top strategy is via Medicare negotiation, above re-importation, reference pricing, and other tactics gauged in the survey.

During a phone call in which I participated hosted by the U.S. Chamber of Commerce yesterday, Chamber leadership cited issues they expect to hear about (infrastructure, a national innovation plan) and those they hope not to hear. The first issue they cited in this “not-wanting-to-hear” category was regulating the price of prescription drugs, for fear of chilling future innovation and, instead, advocating for a free-market approach to drug pricing.

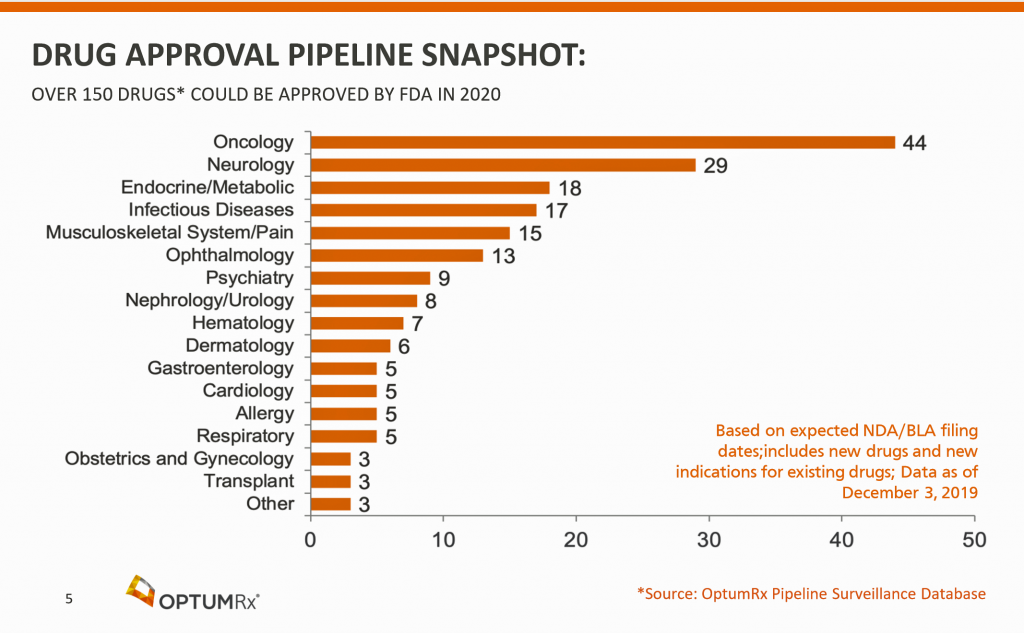

The Q1 2020 OptumRx Drug Pipeline Insights Report was released last week and it speaks to what we can expect from new-new medicines coming into the market this year.

The Q1 2020 OptumRx Drug Pipeline Insights Report was released last week and it speaks to what we can expect from new-new medicines coming into the market this year.

CMO Sumit Dutta introduces the report with the following proviso: “We look at several drugs expected to be approved by the FDA in the months ahead. We identified these drugs as significant because of the unique way they work and the high cost they will likely bring to the health care system.”

We can parse this sentence into two key themes: noting (1) “the unique way they work” and (2) “the high cost they will likely bring.”

This is the tension between innovation and breakthrough therapies that save and improve the lives of people we love, and second, the high cost of these products.

The three drugs OptumRx discusses address:

- A new class of drugs for high cholesterol, gauged at under $4,000 a year

- A new treatment for peanut allergy, estimated to cost at least $6,000 for the first six months “dosing-up” phase and at least $4,000 for a year of maintenance

- A new drug for the rare disease NASH, a liver condition that can lead to cancer or liver failure, that may be priced between $10,000 and $18,000 per year.

The OptumRx pipeline chart illustrates that most of the new drugs will be launched for oncology. Last year, IQVIA estimated a median price for new oncologics in 2019 was $149,000.

Switch your lens from oncology drugs to insulin. Tonight, Democrats have invited a group of insulin advocates to attend the State of the Union address, reported in STAT.

We’ll close this discussion looking back to a Wall Street Journal article published last May 2019 on A $2 Million Therapy About to Hit [the] Market, discussing a new gene therapy treatment that addresses spinal muscular atrophy (SMA). Without a treatment, patients with this condition can die before their second birthday, which gives SMA the sobering distinction of being the most common genetic cause of infant death. This is a rare disease, with between 400 and 500 babies born with the genetic defect each year in the U.S.

“A therapy is useless if no one can afford it,” asserted Cathryn Donaldson from AHIP, the health insurance advocacy group, is quoted in the WSJ story.

“A therapy is useless if no one can afford it,” asserted Cathryn Donaldson from AHIP, the health insurance advocacy group, is quoted in the WSJ story.

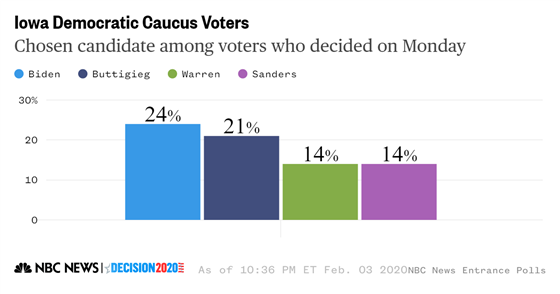

We’re at a moment when the U.S. public has identified health care as their top voting issue (confirmed in the entrance polls at last night’s Democratic Iowa Caucuses) — and the top line item priority under “healthcare policy” is the price of medicines. Whether or not the President cites this in tonight’s State of the Union, Americans seek a solution to balancing innovation for themselves and their loved ones’ health, while preserving their household financial health and avoiding the side effect of financial toxicity due to the price of medicines.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,