There’s a trifecta cost challenge hitting U.S. household budgets in February 2022, highlighted in a poll from Morning Consult: inflationary spikes for housing, food, and energy, and the COVID-19 Omicron variant forcing health care costs up for some consumers driving medical debt up.

This further underscores the reality that medical spending in the U.S. is taking shape as a consumer service or good, competing with — potentially crowding out — other household line items like food and increasingly costly petrol to fill gas tanks.

This further underscores the reality that medical spending in the U.S. is taking shape as a consumer service or good, competing with — potentially crowding out — other household line items like food and increasingly costly petrol to fill gas tanks.

Or taken the other way, gas and food crowding out health care spending, leading to either medical debt or people self-rationing care — whether services for prevention, chronic condition management, or prescription drug filling.

This is not a new phenomenon, but is revisiting us in the convergence of the coronavirus pandemic, supply chain challenges and consumer price inflation, and the latest factor in the energy pricing market: Russia’s invasion of Ukraine, and subsequent impact on the energy market and downstream price effects, ever upward.

I started the Health Populi blog in September 2007 with a post titled “Health Care is the #1 Line Item in Our National Economy….and Taking More Out of Your Pocket,” displaying this sign from Tom’s Shell gas station comparing the price of gas to an “Arm, Leg, or your First Born” posted on their sign in 2007.

I started the Health Populi blog in September 2007 with a post titled “Health Care is the #1 Line Item in Our National Economy….and Taking More Out of Your Pocket,” displaying this sign from Tom’s Shell gas station comparing the price of gas to an “Arm, Leg, or your First Born” posted on their sign in 2007.

15 years later, AAA tells us that today (28 February 2022), people who fill cars with gas tanks are facing average per-gallon prices for regular at self-serve stations of $3.61 across the U.S.; more granularly, $4.83 in California, and $3.85 in Illinois, and a low of $3.23 in Arkansas.

U.S. consumer spending rose from December 2021 to January 2022 for education, telecom, auto leases and loans, health care, car insurance, gas, groceries, health insurance, and public transportation.

Spending fell a lot for apparel (14% drop), alcohol (falling 9%), airfare (a 9% decline), and personal care (9%).

The energy spike that moved steadily up and to the right between November 2021 and January 2022 is one of the key data points examined by Morning Consult. Average monthly spending on utilities versus the consumer price index rose every month over the year. Monthly spending on utilities rose from January 2021 to January 2022, with a couple of short-term dips then spike from November to December 2021, landing about $205 a month in January 2022 for the average U.S. household.

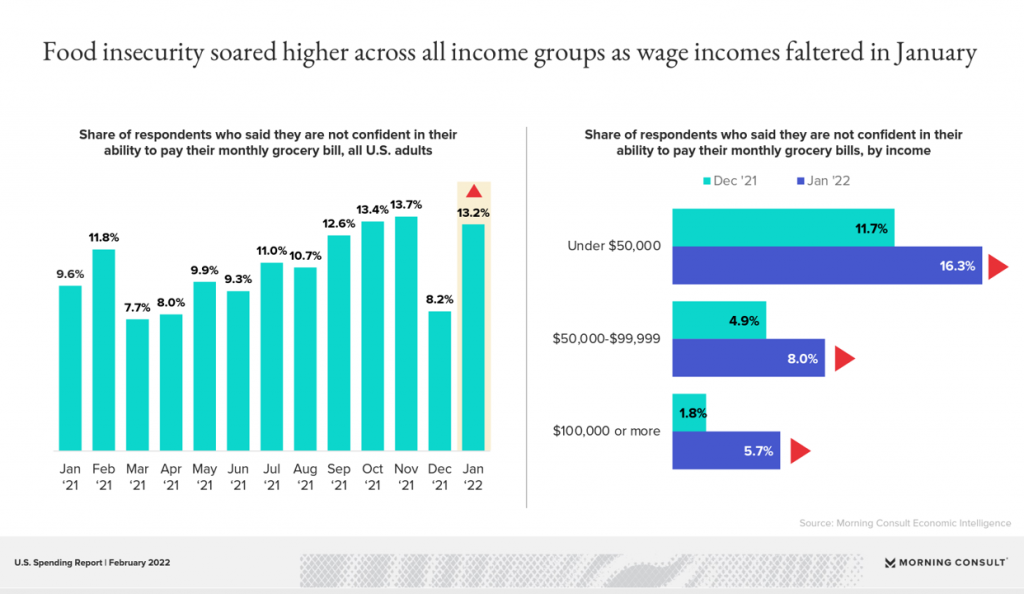

Food security challenged U.S. families during the first year of the pandemic. During the late Delta into Omicron phase, food insecurity has “soared higher” across all income groups especially as wage growth was not keeping up with food price inflation in the new year.

Food security challenged U.S. families during the first year of the pandemic. During the late Delta into Omicron phase, food insecurity has “soared higher” across all income groups especially as wage growth was not keeping up with food price inflation in the new year.

The vertical bar chart illustrates that by January 2022, over 13% of people were not confident they could pay their monthly grocery bill, one of the highest rates of food insecurity rates since January 2021.

Note that food security challenges were felt by over 16% of families earning under $50,000 a year as of January 2022, up from under 12% in December 2021.

The rate of people lacking confidence in their ability to pay monthly grocery bills more than tripled from 1.8% in December 2021 to 5.7% in January 2022.

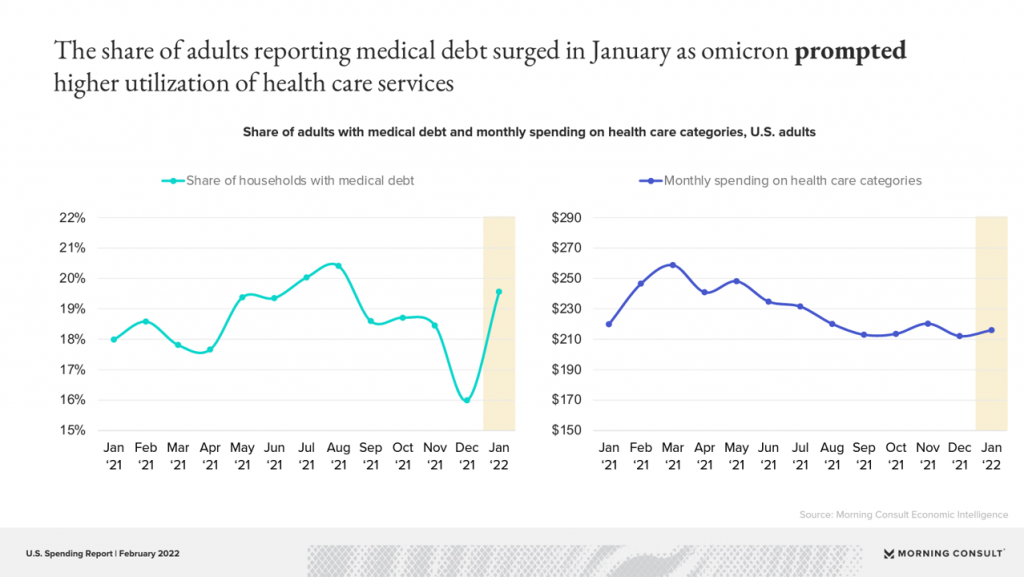

After pondering energy and gas prices and grocery bills, now consider health care spending.

After pondering energy and gas prices and grocery bills, now consider health care spending.

The share of U.S. adults reporting medical debt spiked up in January 2022, from a low point of 16% of households with medical debt to nearly 20% — one in five families — reporting medical debt, appearing on the left side of the graphic.

Omicron prompted higher utilization of health care services in January 2022, driving up medical debt according to Morning Consult’s read of their data. “Going forward,” the report’s writers expect, “households paying off medical debt will have an added cost burden on top of rising inflation, potentially restricting spending.”

And, while the share of uninsured U.S. adults fell in 2021, inequalities persist across demographic groups — mostly adults in households earning less than $50,000 a year, people with greater unemployment with some of those losing health care coverage they had received through their employer-sponsored insurance.

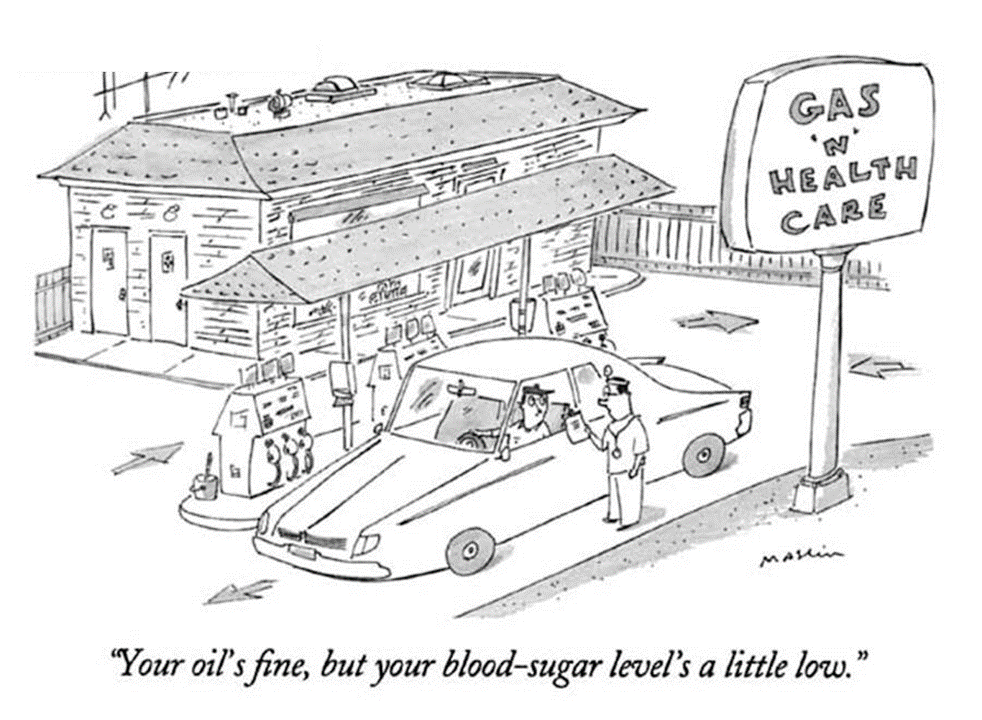

Health Populi’s Hot Points: Michael Maslin created this cartoon for the New Yorker in September 1994….forecasting the emergence of retail health at the convenience store (C-store) and gas station.

Health Populi’s Hot Points: Michael Maslin created this cartoon for the New Yorker in September 1994….forecasting the emergence of retail health at the convenience store (C-store) and gas station.

THINK: Wawa meets CVS Health meets Teladoc.

Back in 1994, this was incredibly prescient….and a scenario that is now playing out, with health care spending playing a center stage spending role along with gas, food, and housing.

The Morning Consult poll findings for February 2022 set the table for continued retail health ecosystem expansion, as we see primary care next-generation being funded and implemented in various models and locales via pharmacy chains (CVS Health, Walgreens), companies focused on primary care (from concierge style to Medicaid and Medicare Advantage focused modes), and virtual-first health plans featuring on-ramps of health consumer triage before face-to-face care encounters.

And indeed….C-stores like the Dollar Store providing testing sites and exploring health care strategies during this latest pandemic era.

Value-based care is already on the minds and in the pocketbooks of patients as they continue to pump their health consumer muscles.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're