Today, the White House is convening a Conference on Hunger, Nutrition and Health. So it’s a propitious time to weave together some of the latest research and insights into food-as-medicine and a key determinant of health and well-being. This is the first White House conference focused on nutrition and food in over 50 years.

The National Strategy was released today, and covers a range of programs that bake health and nutrition into Federal policies going beyond “food” itself: we see various determinants of health embedded into the Strategy, such as supporting physical activity, addressing the cost of food, ensuring access, investing more in nutrition education, bolstering regulation (say, with food labeling) and to be sure, enhancing food security.

In the wake of the COVID-19 pandemic and current economic stress facing U.S. families and households, the Biden-Harris Administration is bringing together experts and advocates addressing hunger, food and health including Chef José Andrés (who must be cloning himself these days dealing with all the world’s emergencies and feeding the people impacted in those geographies, globally via the World Central Kitchen) along with relevant Cabinet Secretaries for Agriculture and Health, and others. The agenda topics cover ensuring affordable food for all children and families, food-as-medicine, looking locally to grow food closer to homes, creating communities baked with activity-opportunity for health citizens, and forging public-private partnerships.

Speaking of public-private partnerships, the private sector has been growing strategies, products and services to “feed,” if you will, this crucial challenge which sub-optimizes public and individual health around the world — and notably in the U.S. That’s on the supply side; but on the demand side, it’s consumers across all demographics that are more keen than ever on the role of food in their lives and their health.

It is now mainstream that consumers are embracing food for health as a health-economic strategy at home. New research from Deloitte calls out the phenomenon of Fresh food as medicine for the heartburn of high prices.

For the study, Deloitte surveyed 2,025 U.S. adults influencing household fresh food purchases, ages 18 to 70 years, in July 2022.

Consumers have become more stressed when shopping: one-half of shoppers are concerned over rising food prices, and others concerned more generally about a change in their financial situation, spreading/catching COVID-19.

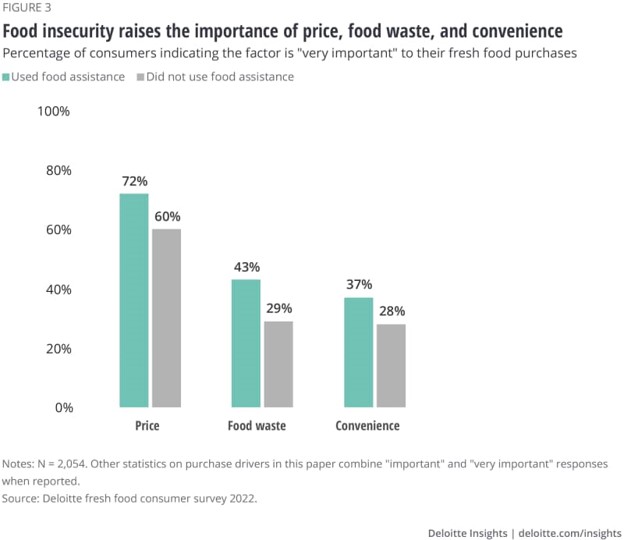

Over 38 million people in the U.S. live in a food-insecure household. Some 15% of U.S. consumers use food assistance such as sourcing form a food pantry, using Supplemental Nutrition Assistance Program (SNAP), Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), or other assistive programs.

Note from the first chart that grocery shoppers using food assistance are more likely to say that price is a very important factor in purchasing fresh food — 72% compared with 60% of people who do not use food assistance.

Importantly, food waste is of much greater import to consumers using food benefits, where the margin on “convenience” when shopping fresh has a smaller margin — though still greater for people using food assistance.

The White House Conference will have a tight focus on health equity, and food insecurity is directly related to adverse health outcomes in the U.S. Food deserts — local communities that lack supply of fresh food for residents — continue to jeopardize millions of peoples’ health even as more folks understand the direct connection between nutrition and family health.

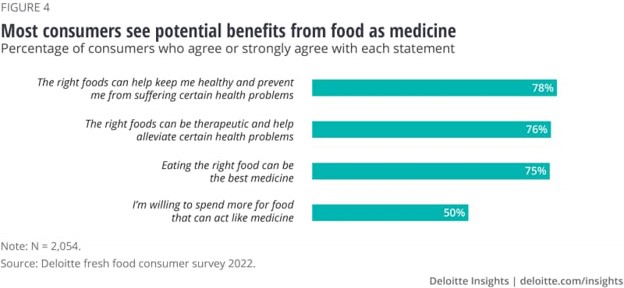

Figure 4 here from the Deloitte study shows us that a large majority of consumers agree that the right foods can keep them healthy and also address certain health problems == and that, “Eating the right food can be the best medicine,” channeling Hippocrates’ maxim.

Specifically, consumers seek preventive and therapeutic benefits from fresh food. Deloitte found that,

- 52% of consumers see benefits from food to help them “feel good”

- 45% look to improve overall energy

- 43% for weight management

- 39% to prevent disease and preserve health

- 35% for building immunity

- 34% for mental and emotional health, and

- 32% to manage existing health conditions.

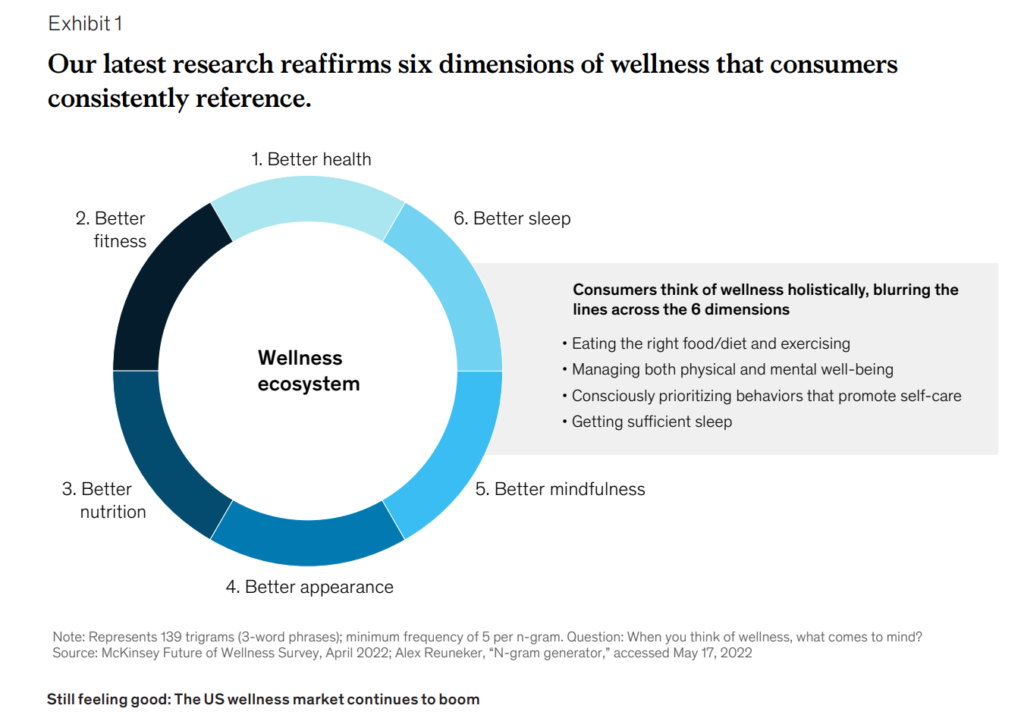

Complementing these Deloitte insights, a new report from McKinsey offers an updated look at health consumers’ views on well-being’s many facets in Still feeling good: The US wellness market continues to boom.

Food and nutrition are one of six life-flows people integrate for their overall well-being, McKinsey found in their study. These address,

- Better health (including OTC medicines, vitamins, and hygiene)

- Better sleep (supplements, apps, for example)

- Better mindfulness (therapy off-line and on-, apps)

- Better appearance (especially skin care, dermo-cosmetics, and hair)

- Better fitness (connected, clubs in the post-pandemic environment, and wearable tech); and, to be sure,

- Better nutrition — with a focus on diet programs, subscription food services, and nutrition apps.

With their growing keenness for and knowledge of wellness, health consumers are seeking greater personalization and alone with choice and, nor surprisingly, value-for-money.

Health Populi’s Hot Points: Speaking of value-for-money, consider another signal shaping the nutrition and health space this week: Dollar General’s launch of a line of private label vitamins and supplements called ‘Oh Good!’

For the past eighteen months, I’ve been telling you about Dollar General’s turbocharged focus on health for its shoppers: last year, when the company identified a Chief Medical Officer, and in July 2022 when this dollar store leader appointed a health care advisory panel for the business.

McKinsey’s pillar on health-for-wellness embeds vitamins/minerals/supplements along with other complementary life-flows and consumer purchases meant to bolster wellness. McKinsey also noted in their research that consumer preferences for private-label brands increased for more mature product categories. Here, vitamins like Oh Good!’s product line range fit that bill — literally, with their value-pricing and selections covering energy and sleep, probiotics and apple cider, and even prenatal vitamins which can reach Dollar General’s consumers who may be cash-strapped to buy higher-priced brands in other retail channels.

There remain categories in wellness that are under-served, along with groups of health citizens who are under-served. McKinsey asserts that Black consumers in the U.S. exhibit the greatest unmet need in the wellness product/service world, with 55% of Black people saying they needed more wellness products and services to meet their needs — a much greater proportion of consumers than seen in the Asian and White cohorts in the survey.

Collaboration is crucial in forging health/care that is relevant and valued by people as their grow their health consumer muscles and empowerment.

And to deliver personalization, especially to under-served consumers, trust will be a key ingredient for engagement and purchase decisions.

Deloitte’s report tells us that about one-half of consumers are open to sharing their data for healthy food guidance. This data point focused on peoples’ trust with grocers: 56% of people trusted grocers to provide them with data about safety, origin, and nutritional properties of fresh food, and 54% of consumers trusted grocers to properly use and protect personal data.

The last point on this chart shows that 42% of consumers would be willing to share some health/medical data with their grocer for better personalized food recommendations.

This quote from McKinsey’s report summarizes health citizens’ expectations from the health/care supply side people expect to serve them:

Consumers increasingly value and seek out products and services that can address needs across several wellness dimensions.

This calls for collaboration between the legacy health system, grocery stores and other food channels, including dollar stores — who are becoming many consumers’ favored health/care destinations, for vaccinations, prescription drugs and food-as-medicine.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,