“We definitely do see a slight change compared to the total population, we do see a slight pullback in overall basket,” the CEO of Walmart US is quoted in Bloomberg. “Just less units, slightly less calories.”

With patients’ use GLP-1 drugs such as Ozempic, Wegovy, and Mounjaro fast-rising in the pharmacy market, so are the concerns of companies that stock the-middle-of-the-grocery-store aisles for processed foods like sweet and salty snacks.

As the prospects for the drug companies who manufacture prescription drugs made for patients managing diabetes and obesity are on the uptick, the likes of the makers of Pringles and Oreos are in the throes of re-thinking and -making snack foods and other products that some consumers aren’t filling their baskets with.

Several Big Food companies have gone public with this realization:

- Kellanova, the recent spin-off from Kellogg’s, which owns the snack brands Cheez-It, Pringles, and Pop-Tarts

- Campbell, which markets Cape Cod potato chips and Goldfish crackers

- Mondelez, maker of Oreos and Chips Ahoy cookies,

- Smuckers, which recently bought Hostess (maker of Twinkies, Ho-Hos, and other sweet treats),

among other food companies in the news relating to the GLP-1 threat to the snacking business.

As CNBC described this moment, “Big Food vs. Big Pharma: Companies bet on snacking just as weight loss drugs boom.”

As for grocers that operate retail pharmacies and Big Box retailers like Walmart with a substantial business through pharmacy and health care services, this scenario re-sets the retail health marketspace.

This speaks to the influence of a segment of patients, acting as health consumers, DIY’ing health from home to the grocery and retail pharmacy. That DIY is not done without collaboration with health care providers’ influence and support because the GLP-1’s require prescriptions to be written.

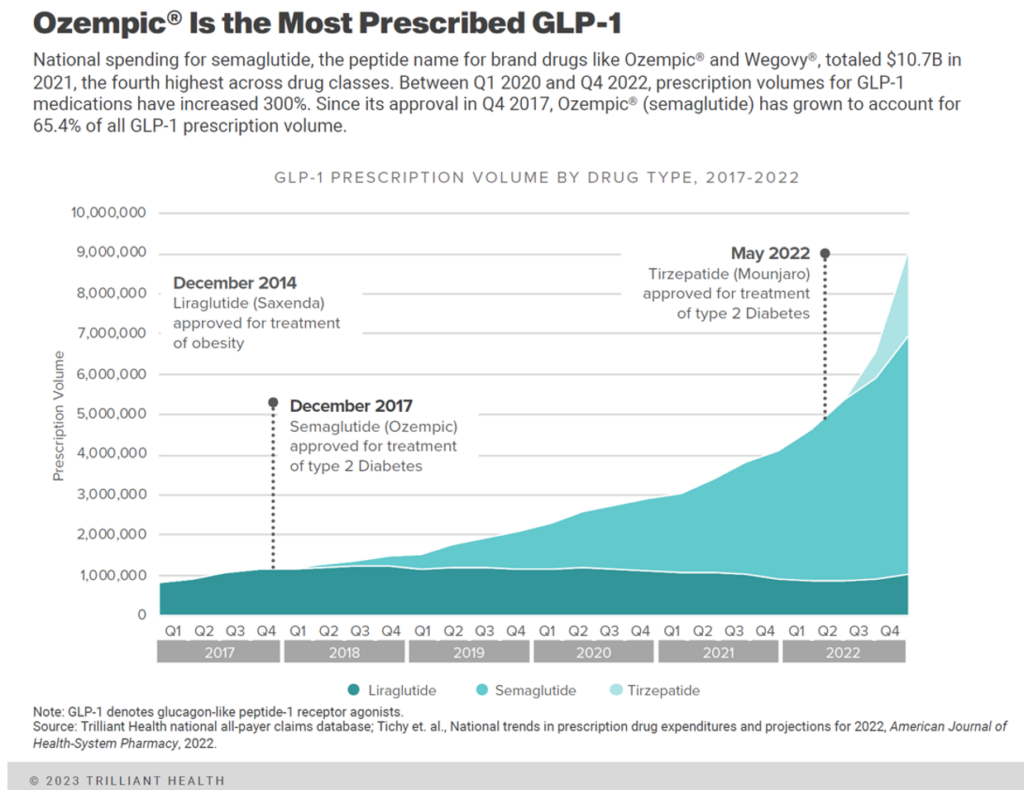

That market grew 300% from the start of 2020 to the end of 2022, according to Trilliant Health’s recent trends report.

The category is heavily-promoted via DTC ads. boosting consumers’ collective asks for the Rx’s. Nearly one-half billion dollars was spent on ads for these drugs in 2023 according to MediaRadar — mostly on four drugs, three from Novo-Nordisk (namely Ozempic, Rybelsus and Wegovy) and Jardiance from Boehringer Ingelheim.

Note, too, that some of the most popular diet apps and plans people use, such as WW (Weight Watchers) and Noom, now offer an on-ramp to accessing these medicines.

The composition of consumers’ grocery baskets varies from person to person depending on their family composition (married or not, with kids or not), age and gender, lifestyles, values and to be sure, value-orientation in light of food inflation that is still stubbornly high in several categories.

One of the lifestyle factors is a consumer’s “taste” or inclination for health and well-being, by which people “vote” with their wallets and how they allocate spending on stuff in the basket.

This is a yang to the yin I discussed earlier this week on trends in Food-As-Medicine — very much consumer-driven for that segment of patients opting in to the GLP-1 phenomenon.

Health Populi’s Hot Points: Alexia Howard, an analyst for the food industry with Bernstein, said that the GLP-1 drugs “have the potential to have a bigger impact on food consumption … than, arguably, anything that we’ve seen before.”

Clearly, Walmart has noticed the early days of this consumer reaction by analyzing changes in the company’s shoppers’ sales patterns. The Bloomberg story pointed out that Walmart has the capability of tracking purchasing statistics for (anonymized) shoppers who fill the GLP-1 medicines vis-a-vis their grocery store shopping patterns.

The potential to mash up data from daily lives has the promise of helping us better understand our individual behaviors, and health trends in populations that can benefit public and communities’ health.

We know that health, overall, is made where we live, work, play, pray, learn…and shop.

Walmart knows that too, and no doubt will be tracking the impact of what happens in the center of the store combined with what happens in the pharmacy and health service operations.

On the consumer-demand side, patients will increasingly look to do what they can — when shoppable, affordable, and price-transparent — for their health and well-being. This won’t be all people — and we must remain mindful and attentive to the uses of consumer data baking privacy- and equity-by-design into the AI workflows — along with equity when it comes to accessing modern, evidence-based health care services, procedures, and products.

In the short-immediate term, the grocery store and retail pharmacy will continue to gain traction if they can build trustworthy bridges with health-motivated consumers. Local/regional hospitals and health systems have the opportunity to collaborate in their communities. This is more likely to be an attractive and realistic proposition as value-based payment grows.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,