Most Americans follow some kind of eating regime, seeking energy, more protein, and healthy aging, according to the annual 2024 Food & Health Survey published this week by the International Food Information Council (IFIC). But a person’s household finances play a direct role in their ability to balance healthful food purchases and healthy eating, IFIC learned.

In this 19th annual fielding of this research, IFIC explored 3,000 U.S. consumers’ perspectives on diet and nutrition, trusted sources for food information, and new insights into peoples’ views on the GLP-1 weight-loss drugs and the growing sense of financial stress among American families (think: food inflation and the current economic “vibe-cession”). Consumers surveyed were ages 18 to 80 years, and the poll was fielded in March 2024.

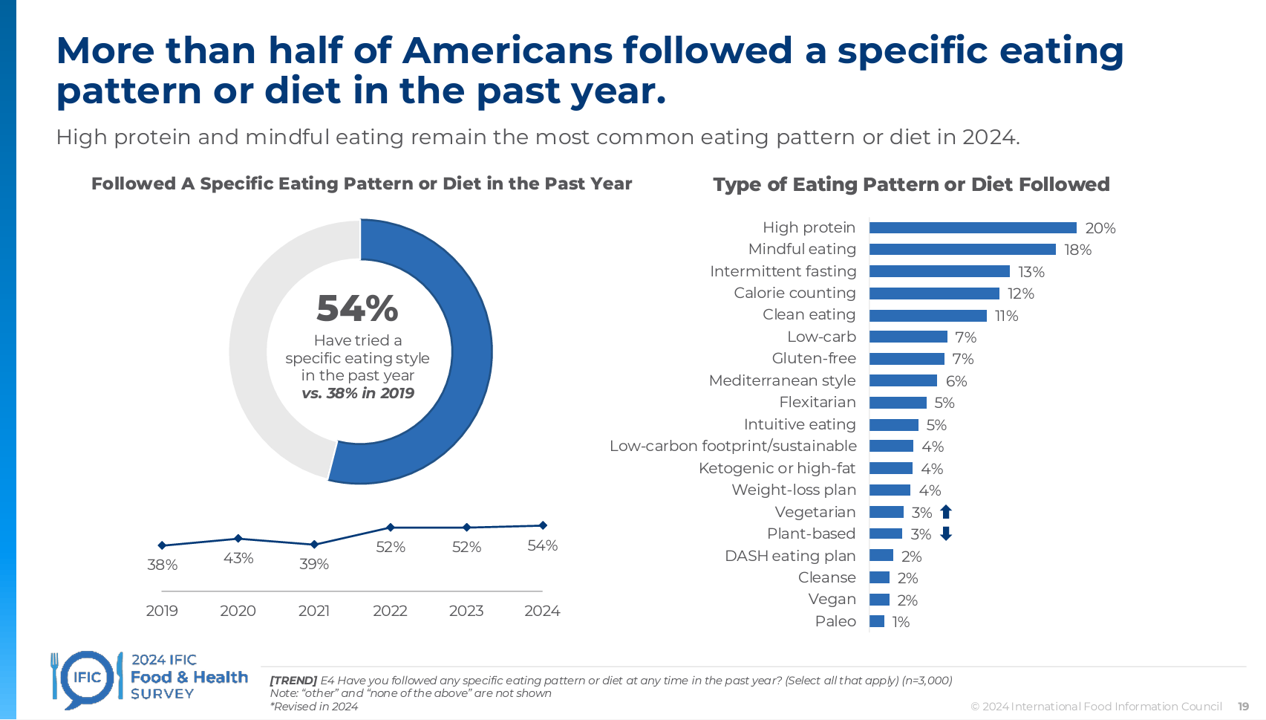

A few of the top-line findings are that:

- Money and income in the household drive consumers’ sense of “healthfulness” and ability to prioritize spending on healthy foods

- This underpins inequality in consumer well-being, and cycles through food and diet choices

- Bolstering protein consumption is key in U.S. consumers’ food choices, growing from 59% in 2022 to 71% in 2024

- Home economics, looking at income and wealth, have a direct impact on peoples’ ability to incorporate nutritious food choices into their daily lives, and,

- Technology — mobile apps and digital tools along with the use of AI — are becoming mainstream tools for consumers seeing food for health and well-being.

Underlying consumers’ food choices and spending are motivations and expected benefits: top among motivations are wanting to feel better and have more energy, and wanting to lose weight, followed by improving physical appearance and protecting long-term/future health status, all for over 40% of U.S. consumers.

Energy is the top benefit sought from food (for 43% of U.S. consumers), followed by healthy aging (40%), weight loss or management (37%), digestive/gut health (for 36%), and heart and cardiovascular health promotion (among 30%). These benefit values vary by generation: for example, most Boomers seek healthy aging through food choices, while for Gen Z, Millennials, and Gen X consumers, it’s all about energy boosting and fatigue avoidance (though 43% of Boomers also seek the energy/fatigue benefit, too).

Consumers seeking food for well-being and health care management have specific ideas of what “fresh” and “good sources of protein” mean, informed by various sources of information on nutrition and food “healthfulness.” It’s concerning that trust in information from government agencies about what foods to eat and avoid dramatically fell since 2022: Millennials, high-income household consumers, and men experienced double-digit falls in the trust of food information from government agencies.

Who is trusted? The bar chart tells us two kinds of people in the health/care ecosystem are much more trusted than other consumers’ touchpoints for the information: these are personal healthcare professionals (say, “my” doctor or nurse practitioner or pharmacist) and registered dietitians or nutritionists. At the bottom end of trusted sources are social media influencers and bloggers, and the food companies and manufacturers themselves who lack credibility in the eyes of food consumers.

IFIC covered two very current aspects of health consumers’ lives and perspectives in this year’s study: the role of financial health in overall health and home economics (impacting food choices), and opinions about the GLP-1 drugs for weight loss.

First, those GLP-1s: at the time of the study’s fielding in March 2024, one in 10 Americans were found to have used a prescription medication to lose weight in the past year. When it comes to weight-loss drugs, one-half of Americans see the drugs as “effective,” but only one-third see them as “safe.”

Based on this, it makes sense that most Americans favor making a change in lifestyle to deal with a health condition versus taking a medication: that’s 70% of consumers in the U.S. favoring lifestyle change for health (NET strongly disagree at 43% and somewhat disagree at 27%) compared with 27% of Americans favorite medication vs. lifestyle change for health (19% somewhat agreeing and only 8% strongly agreeing).

Now consider finance and food: two-thirds of U.S. adults reported feeling stressed as of March 2024, compared with 60% in 2023 — most likely to feel stressed are women, people in lower income households, and Hispanic people. Among all stress factors, personal finances are the biggest stressor, followed by the macro-economy, health and medical issues, and personal relationships (the latter two being the combination of physical health and mental/social health).

It’s important to note a direct relationship IFIC found in peoples’ happiness, stress. and health status based on income. The line chart clearly tells this story: wealth can translate into health and happiness, accompanied by lower stress.

This then translates into most Americans believing their food and beverage choices impact their mental/emotional well-being — with 76% of consumers saying food and bev consumption has a significant or moderate impact on their health and well-being, and 65% of consumers believe food and bev impacts their mental and emotional well-being.

If you work on the intersection of health and food, I recommend your reviewing the entire 100+ page data deck of this report. You will find a treasure trove of consumer health insights invaluable to understanding how people increasingly view food as central to their health, healthcare, and well-being.

Health Populi’s Hot Points: It’s clear that mainstream Americans are viewing food-as-medicine for health conditions (especially for gut and heart), energy boosting, mindfulness, and for healthy aging and brain function.

Two-thirds of consumers overall see that online tools and mobile apps can help with diet and physical activity — ranging from a low (though majority) of 54% of Boomers to over 70% of Millennials and Gen Z consumers. Furthermore, nearly 3 in 5 consumers with less than $35,000/yr believe digital health tools can help with diet and activity, an opportunity to engage people say on Medicaid to adopt digital therapeutics and wearable tech for mindful management of activity and medication adherence, as examples.

Furthermore, 51% of consumers would be interested in using AI to make safe and nutritious food choices — fewer Boomers (though a healthy 36% of a plurality) and most consumers under Boomer age. I note a woman vs. male gap in trusting AI for health in this part of the research, which I’ve talked about before in Health Populi here.

Even if people living in households earning under $35K a year adopt the best evidence-based digital tools and AI for informing food decisions and bolstering health and nutrition literacy, lacking sufficient income to buy healthy foods constrains the consumer’s and her family’s ability to afford the food she would like to put on her grocery list to bolster the health of the family.

Research from the USDA (the U.S. Department of Agriculture) which is responsible for the SNAP nutrition assistance program in the U.S. published this month on spending by program for FY 2023. The accounting found that SNAP comprised $2 in $3 of spending on nutrition security in America.

American taxpayers should look at this spending as an investment in public health and the health of, especially, children — for whom nutrition is a key early social determinant of health and well-being, helping not only health per se but a child’s ability to pay attention and learn in school — with education being an adjacent SDoH.

Given IFIC’s finding that annual income is a direct relationship with happiness and health, and stress alleviation, this U.S. budget line item is a risk-management tactic for alleviating food insecurity and bolstering access and affordability to healthy eating. See more on this in my post on the White House Conference on Hunger, Nutrition, & Health.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future... Looking forward to speaking at

Looking forward to speaking at