On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that,

“In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.”

Chopra further explained that medical debt on a consumer credit report was quite different than other kinds of debt like mortgages, auto loans, and credit cards, where consumers see more transparency when taking on those loans or transactions. He pointed to a visit to an emergency room, where “the debt is taken on unexpectedly and in a time of crisis,” as well as consumers dealing with “complexities with insurance” (consider: out of network providers, lack of up-front cost estimates, and trauma which prevents one from “shopping” for care).

The bottom line, he said, was the need to prevent bad actors from, “seiz(ing) on medical debts as a major moneymaking enterprise.”

‘

The CFPB’s call-to-action on medical debt and consumer credit reports comes at a time when Americans now feel health care costs crowding out other aspects of household spending.

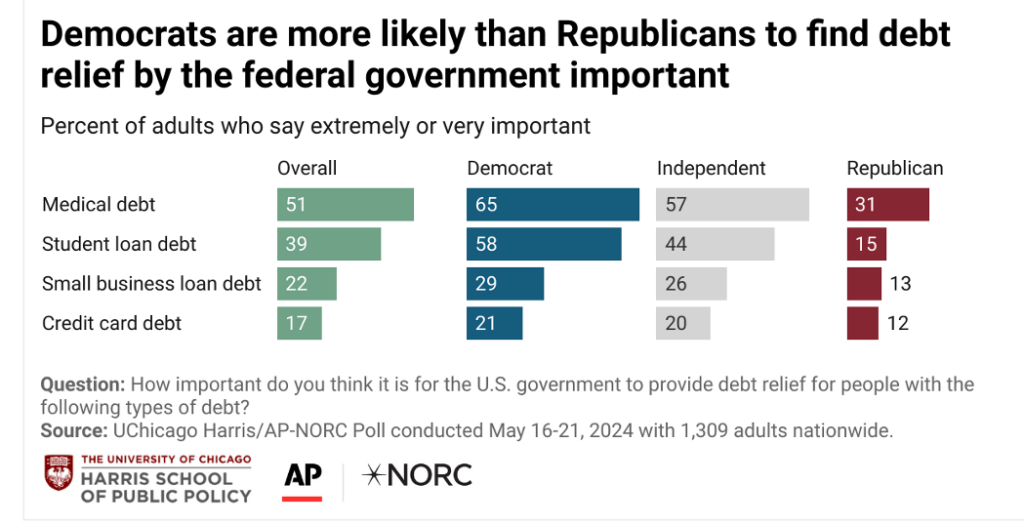

And most Americans believe it would be more important to forgive medical debt than student debt, found in this June 2024 poll from the University of Chicago and NORC.

Some recent signposts in research update our understanding of the patient-as-payer, such as the latest Aflac WorkForces Report 2023-24 on benefits and financial wellness in this 13th annual research study.

One-half of employed, insured Americans delayed some aspect of spending due to rising costs in the past year — including 30% of consumers who made a difficult health care decision due to the rising cost of consumer goods. That rivaled 31% of consumers who delayed going on vacation — an example of the inner-household rivalry between spending priorities.

For healthcare, those delays were either choosing between health care or paying another kind of bill, difficulty affording a prescription, or difficulty affording care recommended to seek by a doctor or specialist (say for a medical test or follow up specialty visit.

For this research, Kantar conducted online surveys among employers (1,201 companies) and employees (2,000 workers) in June 2023.

Looking ahead, Aflac learned that nearly one-half of employers increased employee deductibles and workers’ share of health insurance premiums to deal with the companies’ rising health care costs — thus increasing the financial burden (and financial health care risks) on patient-employees. The bar chart from Aflac’s report also shows that one-third of companies increased employee copays and reduced the number of plan options.

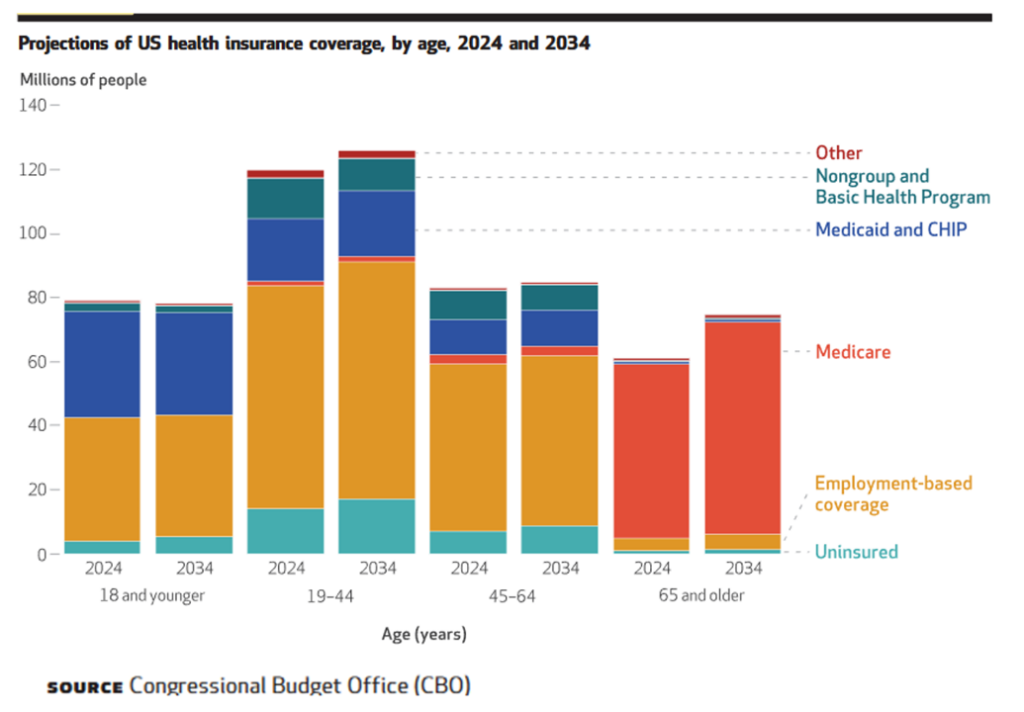

Looking forward even further out a decade to 2034, the U.S. Congressional Budget Office (CBO) forecasts that health insurance coverage will shift as more Boomers will age into Medicare and for those of working age, a rise in the uninsured population should be expect especially among people ages 19 to 44.

This has been coined as a kind of “unwinding” of Medicaid’s continuous eligibility provisions.

Health Populi’s Hot Points: In these Hot Points, I want to point out a new study published by the National Bureau of Economic Research titled, Who Pays for Rising Health Care Prices? Evidence from Hospital Mergers. The research found that consumers — in this case, American health citizens — pay in the form of lower payroll and employment (outside of the health care labor force), and an increase in deaths from suicide and overdoses. The math for the deaths of despair were found to be about 1 in 140 of the individuals who became fully separated from the labor market after health care prices increased, dying from a suicide or drug overdose.

I have previously written here in Health Populi about the relationship between unemployment and mortality in the U.S., most recently in 2020 in the midst of the COVID-19 pandemic.

So beyond the health care impacts of financial disruption for U.S. consumers, it’s also the American social fabric that rips and suffers due to various aspects of financial toxicity and stress in how health care is financed in America — especially the financial risk and medico-fiscal stress on patient-as-payers.

In the meantime, it behooves those of us keen to bolster that pesky, perennial social determinant of health of financial well-being and household sustainability to support the CFPB’s efforts on behalf of patients-as-payers. As Chopra’s announcement calculated,

“The 15 million Americans who would benefit from this change would see their credit scores rise by an average of 20 points. And for the lenders, when they pull a credit report to see whether someone can qualify for an auto loan, home mortgage, or credit card, they would see more predictive and accurate information, leading to improved underwriting. For mortgages alone, we estimate this would lead to approximately 22,000 additional home loans every year.”

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're