“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes.

Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts.

With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people is bound up in overall household spending and the umbrella of “home economics.” In this Health Populi post, I’m weaving together three just-published studies that together fill in a profile of the current state of health consumers in America — in particular, working-insured health citizens. We’ll discuss new papers from The Commonwealth Fund, The Consumer Financial Protection Bureau, and Glassdoor.

A report published November 21st from The Commonwealth Fund on The State of Health Insurance Coverage in the U.S. gives us a current snapshot of the healthcare financial stressors facing American families in light of what we know about consumers’ cost concerns across their lives and livelihoods.

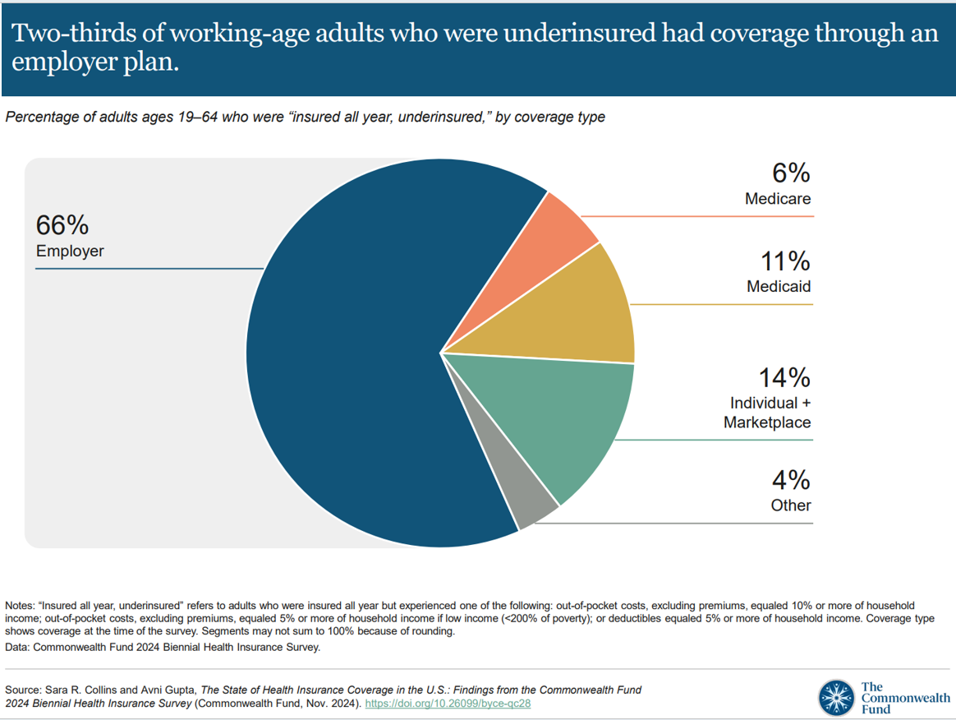

We’ll focus on people who are working and covered with health insurance through an employer. First, know that two-thirds of consumers in America who were underinsured had health insurance coverage through their workplace plan, shown in the first pie chart.

It is more likely for people who are underinsured to have cost-related problems getting medical care: 57% of Americans who were uninsured had at least one of four access problems due to cost, such as,

- Not filling a prescription (32%)

- Skipping a recommended test, treatment, or follow-up (43%)

- Having a medical problem but did not visit a clinic or doctor (42%), or,

- Not getting needed specialist care (37%).

Two in five people who delayed or skipped care or didn’t fill a prescription medicine due to cost said it worsened their health issues, varying by demographic factor as shown in the bar chart here.

This phenomenon of getting sicker when avoiding care due to cost — a form of self-rationing care — was riskier among those consumers who had poorer health status. That is, 45% of those who skipped care and were sicker resulted in worsening health status, not surprising but coupled with those with lower family income, a signal that demands attention be paid to the underlying drivers of health for these health citizens.

Complementing the Commonwealth Fund and CFPB data (discussed below) is another report out this week from Glassdoor addressing Worklife Trends 2025 published this week.

As employees were feeling “stuck” in their jobs and careers in 2024, they have also been struggling with prioritizing mental health. This has been more acute among younger workers 18 to 34, 64% of whom struggled to prioritize mental health, but nearly one-half of workers 35 to 54 also had difficulty prioritizing mental health, as well.

The blue-bar chart from Glassdoor’s 2025 trends report asserts that wellness and care benefit access has surged since 2019 as the pandemic was arriving on our workplace and home fronts — led first by working from home as a benefit accessed, followed closely by accessing mental health care among nearly one-half of workers in the Glassdoor survey. This number is not statistically representative of a national sample across all age groups and other demo’s, but we can still point to its direction and veracity in the context of a stressed-out workforce — mentally, financially, and socio-politically.

Health Populi’s Hot Points: Among U.S. consumers who had difficulty in making ends meet in home budgets, paying medical expenses were a challenge for 41% of people.

Paying for utility bills, food, housing (mortgage or rent), and car repairs were financially challenging for over 50% of people who had trouble paying for any expenses.

This profile comes from a November report from the Consumer Financial Protection Bureau called Making Ends Meet in 2024. published the day before the Commonwealth Fund’s report.

CFPB has assessed how Americans “make ends meet” year after year, this round finding that American consumers’ overall financial stability and well-being eroded from 2023 to 2024. In fact, those at the lower end of financial health fell even lower, with fewer households able to cover a month of expenses were they to lose a job.

Feeling stuck, fiscally stressed, and mentally anxious or burned out, there’s another aspect of workplace life employees are seeking in 2025: empathy, and empathetic leadership, we see in the last chart from Glassdoor’s study.

Far and away, it’s well-being people are seeking — holistically, across the many facets of our lives and livelihoods. And in the U.S., employers play (or have the opportunity to do so) a huge role in leading the way and lighting the path to well-being for the workforce and their families.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,