The health care landscape in 2030 will feature an expanded consumer health industry that will become,

“an established branch of the health ecosystem focused on promoting health, preventing, disease, treating symptoms and extending healthy longevity,”

according to a report published by Deloitte in September 2024, Accelerating the future: The rise of a dynamic consumer health market.

While this report hit the virtual bookshelf about six months ago, I am revisiting it on this first day of the second quarter of 2025 because of its salience in this moment of uncertainties across our professional and personal lives — particularly related to health politics, global economics and trade, and the erosion of trust in institutions.

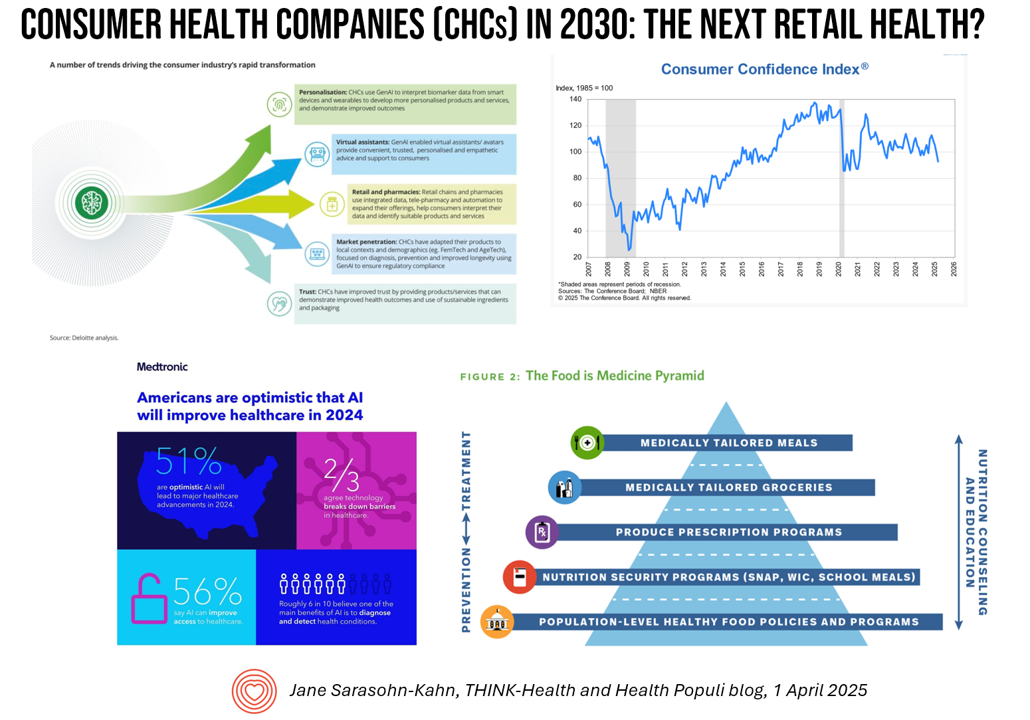

The report is set in the world in 2030, where Deloitte’s unified-field thesis is that Consumer Health Companies (CHCs) are embedded into the larger health/care ecosystem offering AI-enabled personalized services to consumers across a range of clinical areas and larger thematic portfolios focused on specific health citizen populations. This is retail health’s next major iteration.

In the report, Deloitte identifies five drivers that, together, will shape CHCs in 2030:

1. Trust central to the relationship of a consumer and the CHCs with which people connect

2. Technology and digital transformation underpinning personalization which will bolster the next iteration of retail pharmacies

3. Nutrition companies “putting health first,” in Deloitte’s words

4. Virtual assistants embedded with GenAI that will support consumers’ journeys, and,

5. Segment focuses that are informed by individuals’ data along with local contexts and regulatory compliance — Deloitte points to AgeTech and FemTech as examples of specific market penetration opportunities.

To get to the 2030 health care world, Deloitte identifies “conquered constraints,” some key challenges that are sorted out in the transition between 2025 and five years from now: these include,

- Skills and talent, where human capital can scale across digital platforms and deploy evidence-based programs, services, and products (think: wellness coaches, tech designers, and pharmacists in collaboration, for example)

- Funding and business models, with new funding and innovative financial approaches combined with insurance models

- Regulation, in place to reduce or stop the spread of mis-information or exaggerated claims as well as bolstering compliance and quality assurance, and,

- Digitalisation (sp) and data, where consumers’ levels of trust are such that health citizens willingly share personal data with CHCs in exchange for valued products and services, This invokes high levels of security and privacy-by-design.

In revisiting the report “six months later” in the current environment of public health and health care in the U.S. and more global political-economic currents, that Deloitte’s attention to trust, writ large, and 2030’s commitment to ESG are deeply woven into the future retail health narrative.

Health Populi’s Hot Points: Deloitte published this report in late 2024, and it was prescient: today, we can point to several factors that have reshaped consumers in 2025 that may persist in 2026, building health-consumer behaviors that will meet the CHCs Deloitte envisions in 2030:

- Trust in institutions and health care eroding

- Embrace of GenAI for life- and work-flows, with concerns baked in

- Growing interest in food for health, medicine, and longevity, and,

- Personal financial wellbeing eroding across all income cohorts, with different impacts but still a collective fiscal “ennui” among U.S. consumers.

These converge into an over-arching trend of self-reliance across the health care continuum, among younger and older people, working folks and retirees. Some uncertainties and critical aspects in this transition are many, but in my own work-lens, I’m focusing on,

- The continuity of personal information, with the question of whether a person’s electronic medical record (say, via Epic MyChart) will be capturing our retail health/CHC encounters along with personally generated data….and then “who” is responsible for informing us with actionable information based on data that gets mashed up and analyzed through that system, or other systems to which our data flow?

- What will be the “elasticity of demand” for consumers spending on health versus medical conditions versus longevity and other personal health-values? We are beginning to understanding different demographic and psychographic segment cuts at this, but to build the services and devices that health consumers want, we need to know more. and,

- What builders of omnichannel health services will be trusted in our journeys to more personalized self-care and care for the people we love (whether we are caregiving for aging parents or growing children)?

On the supply side of health care and especially public-sector health care services and public health systems and information, I publish this post on a day when major cuts to the CDC, the FDA, and other health agencies are announced. This begs one question of many, “where will American health citizens turn for trusted information on health issues, such as vaccines, pandemics and viruses, women’s health, HIV/AIDS, support for rare diseases and clinical trials?” and so on. I expect more public-private collaborations to launch to address various gaps; these won’t be panaceas to a larger fraying public health infrastructure, but hopefully useful ventures that benefit people who need access to services, information, and supplies for self-care.

With these uncertainties and challenges in mind, my Spidey-senses and forecasting chops do point to the sort of 2030 vision the Deloitte team paints in this report, accounting for trends and innovations and socio-political winds in this second quarter of 2025.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a