Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods.

A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

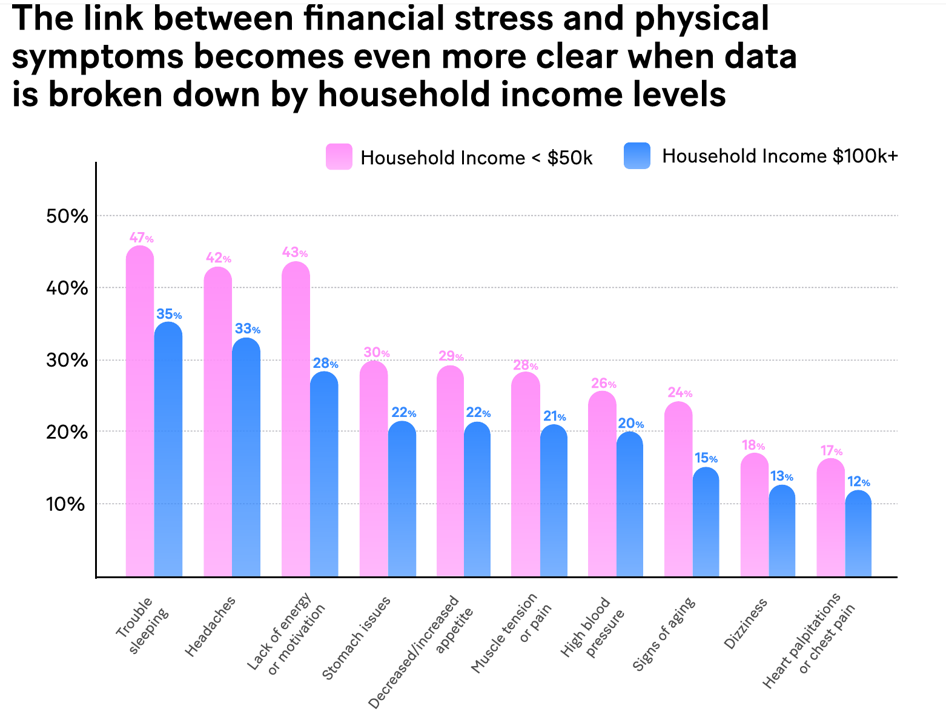

The report’s subtitle points to “The Hidden Link Between Finances & Physical Well-Being,” which is illustrated by the first vertical bar chart.

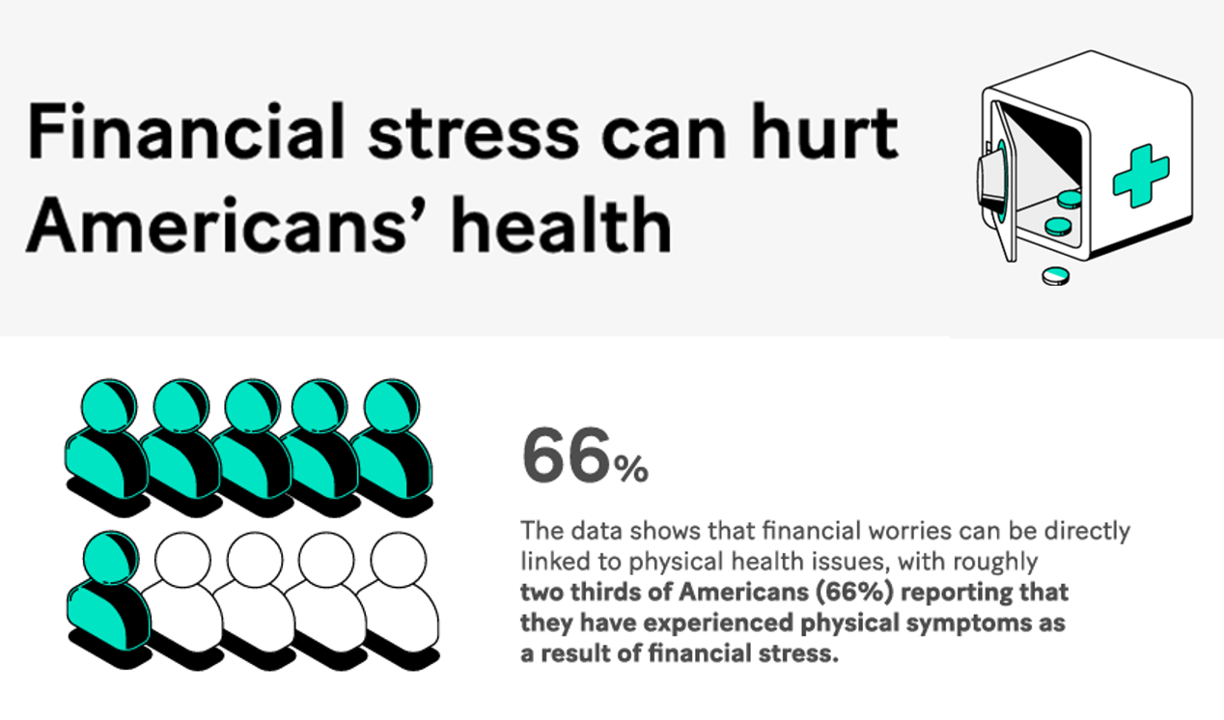

Financial stress can hurt Americans’ health in many ways, most prominently negatively impacting sleep, headaches, energy and motivation, stomach/gut issues, approaches to eating, pain and muscle tension, and blood pressure, among other issues shown in the chart.

Finances in general — not just health care costs — can motivate people in a negative way to delay health care, which is a form of self-rationing health care. We’ve seen this in other studies that focus on medical bills and healthcare spending as a negative influence on seeking health care.

But MoneyLion also goes into other aspects of self-care and well-being — namely the impact of general financial health on making healthier food choices, or joining fitness clubs or classes.

Here, we see that overall, 3 in 5 U.S. consumers have skipped health or wellness services due to personal finances — with 31% avoiding dentists, 25% avoiding doctor’s visits, 18% skipped mental health care, and 16% of folks not filling a prescription for a medicine.

Furthermore, on the wellness front, nearly one-fourth of people say their finances negatively impact them making healthier food choices, and 17% not joining a gym or fitness classes.

It would be no surprise or “a-ha!” moment for me to call out what is represented in the third graphic from MoneyLion’s report: that people who have lower household incomes (under $50,000/yr) report more physical symptoms due to financial stress — in particular, sleeping, headaches, and lack of energy.

The study also revealed that more women report higher levels of physical impacts due to financial stress than men: specifically, the Harris pollsters asked women if they felt increased stress and anxiety, as well as delaying or skipping mental health care, due to inflation.

The results were that,

- Increased stress was felt by 40% of women versus 35% of men;

- Increased anxiety was felt by 38% of women and 33% of men; and,

- 17% of women delayed or skipped mental health care compared with 13% of men, due to inflation.

Parents and caregivers were also found to be more likely than non-parents to report the strains of inflation impacting physical health by a factor of 84% for parents compared with 59% for non-parents.

Health Populi’s Hot Points: The immediate impact of “Liberation Day,” when on April 2nd President Trump announced mass tariffs on over 50 countries around the world, were shocks to the entire U.S. economy as well as the economies of nations around the world.

In the days since, we’ve seen early indications that the health care ecosystem has already begun to feel impacts, including the medical device industry as well as hospitals and other brick-and-mortar providers, with AdvaMed representing the former in this response and the American Hospital Association even before the tariffs were announced in this letter from early February 2025.

From the consumer’s self-care and well-being point of view, we have to also note the impact that personal finances have on peoples’ choices for healthy eating — a very real focus among a growing proportion of health consumers who seek health benefits from the food they buy at the grocery and Big Box store

This last chart comes from the 2024 Food & Health Survey led by IFIC last year, bolstering the data point that U.S. families’ stress was driven first by personal finances followed by the overall national economy — further exacerbated by health and medical issues faced by their families.

With our knowledge that people living in households with lower annual incomes, as well as women and women-led households, have more trouble making healthier food selections due to fiscal constraints, the scenario impacts to consider are that,

- Households could buy less-healthy foodstuffs if further household financial erosion happens due to tariff impacts (whether general price inflation or supply-chain constraints kick-in where demand can exceed supply, resulting in higher prices)

- Householders and families have less opportunity to go the gym or fitness classes where they benefit from exercise and the social aspects of fitness-together

- Consumers delay physical and mental health services due to worsening personal finances in general — avoiding doctor visits, diagnostic tests (where folks might be enrolled in high-deductible health plans),

and other impacts occasioned by tariff effects. Together, these three drivers together would be risk factors for worsening individual, family, and community health. And these are considerations only in the context of potential tariff impacts, and not taking into account scenarios for cutting back on Medicaid, Medicare, or Social Security which continue to be uncertainties in the current political climate.

Since the tariffs were announced, there have been pronouncements from the White House that the rationale for the tactic was to “Make America Wealthy Again,” and to bring manufacturing jobs back to the United States.

In coverage in Bloomberg (behind a paywall, apologies), Anthony Pompliano, Founder and CEO of Professional Capital Management was quoted saying, “They’ve said (that is, The White House) that they don’t care about the stock market right now, they believe that wealthy investors are going to be just fine, and they’re very focused on getting the 10-year Treasury yield down, which is exactly what they’ve been able to do.”

I added emphasis to this quote because, while it is true that millions of Americans do not have investments in the “stock market,” people do buy groceries, need to fix their cars, want to upgrade their refrigerators, were keen to buy the next Nintendo Switch (now put on hold as the gaming device was priced at $450 and could reach $900 in a tariffed scenario), or perhaps even buy a house in 2025 as they waited for a post-pandemic soft-landed national economy.

We’re not talking about buying a new iPhone for over $2,300 — we’re talking about basic human needs in running a household and holding down a job. If tariffs cause overall economic growth to fall, then many people would be at risk of losing jobs — further exacerbating financial stress and, indeed, delayed health care and well-being spending.

We’ll be tracking all of these factors in the coming days and weeks….and their impacts on peoples’ health across physical, fiscal, and mental/emotional planes.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a