The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link?

The key elements of whole health, as people define them are:

– Absence of sickness, 37%

– Feeling of happiness, 32%

– Stable mental health, 32%

– Management of chronic disease, 15%

– Financial health, 14%

– Living my dreams, 9%.

1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above.

This holistic view of health is compelling consumers to seek solutions that impact health across these many dimensions from health insurance plans, providers, and other health industry stakeholders.

This holistic view of health is compelling consumers to seek solutions that impact health across these many dimensions from health insurance plans, providers, and other health industry stakeholders.

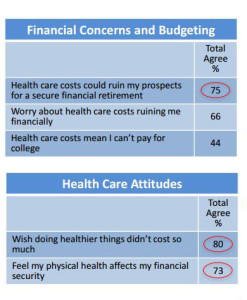

3 in 4 people say their physical health impacts their financial security. So while financial health falls below several other components, personal health finances are top-of-mind when people think about the future — especially prospects for a secure financial retirement, and the ability to pay for children’s college cost, shown in the first chart. The biggest health cost concerns are hospitalization and medication costs. And most people doubt that the current high-healthcare-cost situation will improve.

There’s also a general perception, shared by 4 in 5 people surveyed, that “doing healthier things” costs a lot of money.

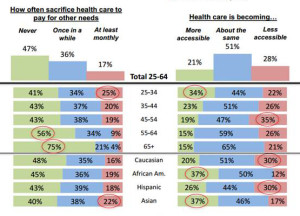

The second chart illustrates that some across the population surveyed, 17% sacrifice health care to pay for other needs at least once a month, and 36% do so “once in a while.” This varies by age: younger people under 44 sacrifice health care to pay for other needs, compared with only 4% of people 65 and over, and 9% of people 55-64.

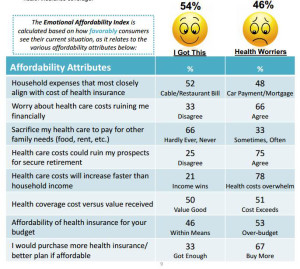

CIGNA gauged peoples’ “emotional affordability index,” based on how favorable people see their current situation vis-a-vis affordability issues: for example, people who don’t over-worry about health costs say the cost of health insurance aligns closely to the cost of their cable or a restaurant bill; however, people who are “health worriers” see their health insurance expenses akin to their car payment or mortgage.

Interestingly, even people in the highest income category measured in the survey — those with $100,000 a year and over — are worried about the affordability of health care. 33% of these most-wealthy surveyed consumers fall into the “health worrier” category when it comes to health care affordability.

Thus it’s no surprise that consumers look to health insurance plans to help them manage health care costs: 82% of people would value support and help to manage cost issues, 80% look for financial protection from high costs, 71% would like plans to lower medical costs by negotiating fixed prices for physicians, hospitals and tests, and 63% would seek help in navigating the health care system.

Most people look to themselves as health care consumers to use lower cost prescriptions drugs when they can, to plan ahead and budget for health insurance and medical expenses, and to shop for health care services that cost less. Very few people, however — 30% — say they would, themselves, negotiate health costs and expenses with doctors and other health providers.

CIGNA’s survey objectives were to gauge consumers’ health perspectives including how people defined health and wellness, how they chose insurance plans, what health challenges they face, and their expectations from health plans. CIGNA surveyed 1,847 U.S. adults, ages 25 to 74, in August 2014, sampling for people who were the health insurance decision makers in their homes.

Health Populi’s Hot Points: When it comes to the U.S. health care system, “follow the money” is a useful directive in several ways:

Health Populi’s Hot Points: When it comes to the U.S. health care system, “follow the money” is a useful directive in several ways:

- The “treasury function” in health, how money is allocated from, say, an insurance company or pharmacy benefits management plan, is important to track for understanding incentives for changing behavior – whether for clinical workflow (for physician decision making) or for patients (say, for quitting smoking or sticking to prescription medications).

- Understanding pharmaceutical and medical device companies’ payments to physicians, and how these inducements might motivation health care providers to decide in favor of using one product over another. This transparency has come out in the past month through the Open Payments database launched by the Centers for Medicare and Medicaid, which list every licensed physician in the U.S. and payments received by companies: how much, and for what purpose. Note that some purposes can be deemed quite appropriate (depending on your lens), such as doing research or taking time out of schedules to give a talk to other doctors on patient care topics. Others, like paying for the office’s lunch, might be deemed less constructive. And, of course….

- Look to health consumers themselves to make choices for health care based, primarily, on costs.

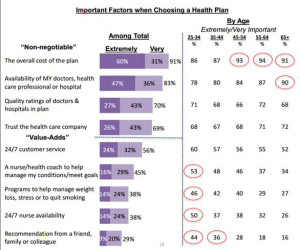

The final chart (with purple bars) illustrates “important factors when choosing a health plan” based on consumers input to the CIGNA survey. Far and away, “the overall cost of the plan” ranks #1, well ahead of the “choice” factor — that is, the availability of “my” doctors in the network. And quality ranks even lower than choice, albeit still important to consumers. Trust ranks equal to quality ratings — an important finding for health marketers to keep in mind.

CIGNA provides a video summarizing the survey results:

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,