My post, Even Rich Girls Worry About Being Bag Ladies, was published in the Huffington Post this week. In the analysis, I weave the results of several seminal surveys on women, money, and health that have been conducted in the past few months. The bottom-line: even the most affluent women are financially stressed, and that stress is leading women to re-define what it means to be personally successful.

My post, Even Rich Girls Worry About Being Bag Ladies, was published in the Huffington Post this week. In the analysis, I weave the results of several seminal surveys on women, money, and health that have been conducted in the past few months. The bottom-line: even the most affluent women are financially stressed, and that stress is leading women to re-define what it means to be personally successful.

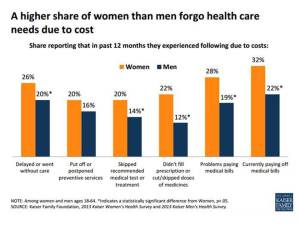

When it comes to personal health, financial wellness is part of overall well-being, as defined by women who place being healthy above having money. Avoiding debt is the nuance here, not amassing piles of cash; it’s about security, not riches.

At the same time, women are becoming the CFOs of their households, beyond their already-top role as “CHO x 2”- that is, Chief Health Officer and overall Chief Home Officer. While women are keen to step up to the financial management plate, though, they admit to lacking sufficient skills to do so as effectively as they would like to.

Thus, connecting the dots between financial wellness, health, and financial/health literacy is key for the health industry — and in particular, stakeholders in the health ecosystem looking to get payments and patronage from women.

Read the piece in HuffPo, and think through the implications for your organization and business in health care. Women will make or break your efforts.

Health Populi’s Hot Points: Since publishing the post in the past 36 hours, I have come across yet another important study into women and financial issues. Financial Experience & Behaviors Among Women is the 2014-15 Prudential Research Study, the eighth biennial study from the financial services company.

44% of women are the primary breadwinners in their families, Prudential found, and one-half of women say they do not have sufficient disposable income to take control of financial and retirement planning.

Prudential calls this “a troubling picture of long-term financial preparedness.”

Behind that troubling picture is a short-term picture of lack of cash, shortage of time, financial illiteracy, and a sense of not knowing what to do to improve their financial position.

Two-thirds of women told Prudential they’re concerned with not being able to keep pace with rising health care costs.

The health industry must help women connect these dots, from the hospital CFO’s office to the primary care doctor asking the question in the exam room: Mrs. Jones, what’s your financial temperature. Both that hospital exec and doctor will be immediately impacted by a woman’s lack of financial access; and in the long-term, her health and well-being will be better served by incorporating financial discussions into the health care dialogue.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,