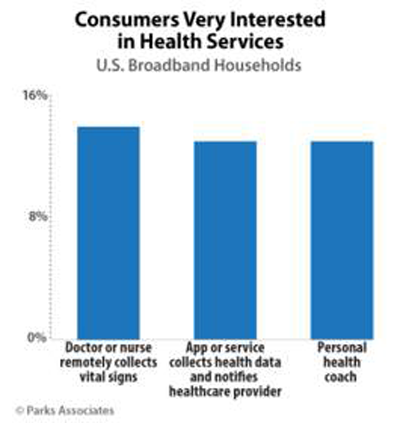

People living in only 1 in 10 homes with broadband are “very interested” in connected health services, like a personal health coach, a remote health monitoring app that connects to and notifies a healthcare provider, or a clinician collecting vital signs virtually. This finding comes out of a survey from Parks Associates.

People living in only 1 in 10 homes with broadband are “very interested” in connected health services, like a personal health coach, a remote health monitoring app that connects to and notifies a healthcare provider, or a clinician collecting vital signs virtually. This finding comes out of a survey from Parks Associates.

This is a relatively low consumer demand statistic for digital health, compared with many other surveys we’ve mined here on Health Populi. While these are not apples-to-apples comparisons — note that Parks Associates focus on broadband households — a recent study to consider is Accenture’s consumer research published in March 2016, which found that the number of consumers using mobile health apps grew to 33% in 2016, and those using health wearables, 21%.

Parks Associates gauges that only 13 to 14% of U.S. broadband holds “show interest” in remote health monitoring, personal health coaching, or wearable health tracking that connects back to clinicians.

The company recommends that free trial periods with the products and services, and a pay-as-you-go approach (without requiring long term contracts) would help grow adoption of connected health services.

Health Populi’s Hot Points: The recently-launched wearables database from Vandrico found at least 434 wearable health devices on the market that are worn, literally, from head to toe (well, ankle). That’s a rich and crowded supply side, mostly aimed direct-to-consumer. And speaking of consumer, we expect to see even more product launches for health-focused wearables at the 2017 CES (the Consumer Electronics Show) in Las Vegas in January 2017. Many of these will be smartwatches with embedded health apps and sensors.

The growth of adoption of connected health programs and technologies will be largely driven through the healthcare system “prescribing,” or recommending, the devices for use in chronic care management. Underlying this trend would be the migration from volume-based reimbursement to value-based payment and other incentive-based financial nudges for both providers and patients. Also, look to corporate wellness programs to be an engine for inducing demand for connected health, which will move Parks’ relatively low demand number up toward a tipping point by 2018.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,