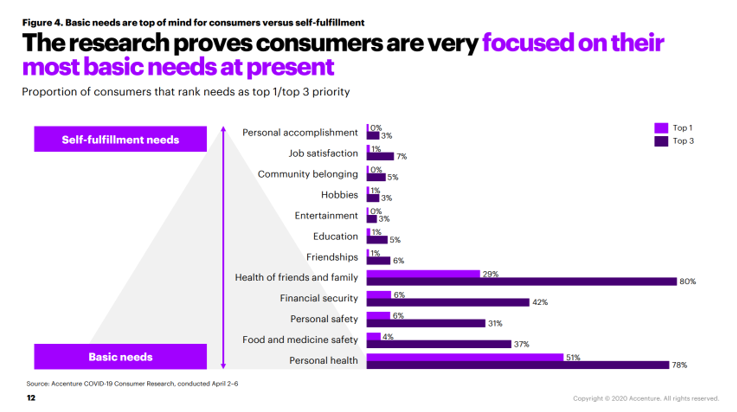

Personal health, food and medicine, safety and financial security are consumers’ top priorities as of April 2020, learned in consumer research analyzed in How COVID-19 will permanently change consumer behavior from Accenture.

Both health and economic concerns plague consumers around the world as people “strive to adapt to a new normal,” Accenture reports. “Fear is running high as individuals contemplate what this crisis means for them…for their families and friends, and the society at large,” the report sets the table on the evolving behaviors of consumers in the pandemic.

Both health and economic concerns plague consumers around the world as people “strive to adapt to a new normal,” Accenture reports. “Fear is running high as individuals contemplate what this crisis means for them…for their families and friends, and the society at large,” the report sets the table on the evolving behaviors of consumers in the pandemic.

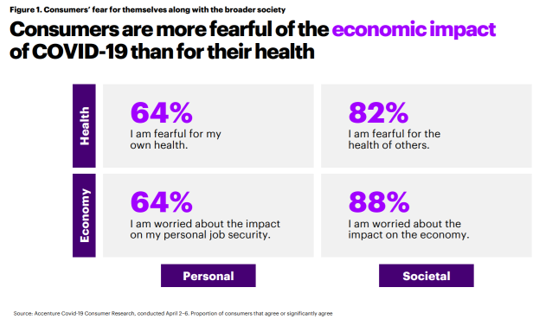

On an individual, personal level, two-thirds of people are fearful for their own health and worried about the impact of the pandemic on their personal job security.

At the same time, peoples’ societal worries seem even more concerning: 82% fear for the health of others, and 9 in 10 consumers are worried about the impact on the larger economy outside of their own kitchen table.

Accenture’s survey divined five consumer segments in the COVID-19 era organized by behaviors of “panic-buying” of staple and hygiene products.

The “panic index” shown here details the purchases of consumers from early April back the prior two weeks. The dark purple illustrates the increasing purchases versus the lighter purple where items decreased in sales.

The “panic index” shown here details the purchases of consumers from early April back the prior two weeks. The dark purple illustrates the increasing purchases versus the lighter purple where items decreased in sales.

Accenture developed five consumer personae based on the panic index details, including:

- The Worrier (21% of consumers)

- The Individualist (22%)

- The Rationalist (39%, the largest segment)

- The Activist (8%), and

- The Indifferent (11%).

By cohort, Accenture found that…

Worriers tend to be older, anxious and most concerned about health and stress; they also consume news relatively more than other people.

Individualists are self-oriented, stockpiling and trying to keep to their “normal” life. They are less socially connected and less likely to approve governments’ actions.

Individualists are self-oriented, stockpiling and trying to keep to their “normal” life. They are less socially connected and less likely to approve governments’ actions.

Rationalists are the “keep calm and carry on” folks, as Accenture points out, very news-aware and informed, and big purchasers of cleaning, hygiene and shelf-staple products for their pandemic pantries.

Activists, the smallest cohort, support others in their community. They are not product-hoarders and shop for people beyond their own households. They are big in social engagement.

Finally, the Indifferents, a small group of 1 in 10 consumers, live lives as “business as usual.” They tend to consume less news and information, and least likely comply with government advice. No surprise, then, that this group is the least-stressed of all five consumer segments, least likely to purchase hygiene and cleaning products.

The most important purchases across the five consumer segments Accenture identified were personal hygiene, cleaning products, tinned food, fresh food, frozen food, and online entertainment. Declining purchases at this time were fashion, home decor, beauty, alcohol, and consumer electronics.

Health Populi’s Hot Points: Teasing out the detailed purchasing behaviors in aggregate, Accenture identified three key trends:

Health Populi’s Hot Points: Teasing out the detailed purchasing behaviors in aggregate, Accenture identified three key trends:

- A growing focus on health,

- A rise in conscious consumption, with people more mindful about what they’re buying in terms of sustainability and value, and

- A growing love for “local,” for local business, provenance and sourcing, and community needs.

Hand hygiene has become a new normal as a personal, first-line workflow for people trying to “#FlattenTheCurve and keep the coronavirus at bay from oneself and those with whom one is sheltering in place in the #StayHome ethos.

As Accenture shows in the last chart, people are washing their hands many more times a day – a 90% increase – one impactful self-care behavior and mindful activity that’s bolstered the purchases of hand sanitizer, soap, antibacterial products, and home hygiene purchases.

Accenture also quantified that people are using virtual digital health tools more for both physical and mental well-being. Growing downloads and use of fitness and health apps, more workouts at home via fitness portals and online gym offerings, and mental health programs like Headspace and Calm have grown in the COVID-19 pandemic.

Accenture’s study also asked whether we will have a “home-working revolution?” As more consumers have set up home office spaces and digital capabilities to engage in Zoom meetings, et. al., our homes have been morphing into our workplaces and self-care places. The uptake of telehealth to the home and smartphone are bolstering greater self-care patterns for physical and mental health — and also bringing greater health literacy and self-efficacy/competency to health consumers. Expect people to hold onto these life-flows among those folks who perceive the hard benefits of mastering aspects of their well-being, from keeping healthy during the pandemic through mastering a yoga position, learning to cook healthy meals, and appreciating through basic needs fulfillment how small things during these blurring days can mean a lot.

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast