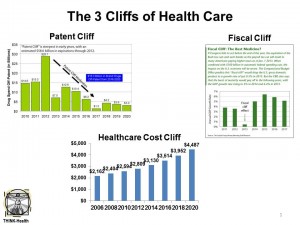

As I prepare remarks to present a talk about health reform and the pharmaceutical market landscape for tomorrow, Election Day, it struck me that the health industry is now facing 3 Cliffs: the patent cliff, the health care cost cliff, and the Fiscal Cliff.

The patent cliff represents about $290 billion worth of sales losses to the pharmaceutical industry between 2012 and 2018. The first chart illustrates that dramatic slope downward, with this year, 2012, being the height of patent losses for the industry. EvaluatePharma, a UK consultancy, says that falling revenue for a pharma is usually a precursor to a falling stock price, eventually.

In 2013, the top brands with expiring patents include Cymbalta from Lilly (with about $5 bn annual sales), OxyContin from Purdue Pharma (with about $2.4 bn in annual sales), Novartis’s Reclast, with about $612 million a year, among others.

According to George Van Antwerp of Silverlink, an Rx brand loses 90% of its volume once it patent expires, with sales moving to the generic alternative. That’s why pharma companies work hard to lengthen patent protection as long as possible.

The second cliff we face in health care is the cost cliff, with the cost-curve ever-increasing. A new book, The Cost Disease from William Baumol, one of my economic gurus for many years, argues that the U.S. can continue to afford such health spending (this will be the subject of a future Health Populi post). But for now, 20% of GDP allocated to health care isn’t a politically popular percentage — which is the proportion that health costs will comprise of the GDP by 2020.

The third cliff is the one that’s getting the most attention in the media today: the Fiscal Cliff. A phrase coined by Ben Bernanke, Chairman of the U.S. Federal Reserve, in Feburary 2012, the Fiscal Cliff commences at midnight on December 31, 2012 (Happy New Year, indeed!), when tax hikes, spending cuts, and funding the Affordable Care Act, all converge. Over 1,000 government programs, including Social Security, Medicare and Defense, would be hit with big, automatic cuts. This could hurl the U.S. economy into another recession without a New Deal coming together.

Together, these three cliffs will complicate the financing, delivery and innovation in health care for the next decade.

Health Populi’s Hot Points: There’s a fourth cliff to keep in mind: the personal health cost cliff. In 2012, nearly 19% of Americans under 65 years of age had high out-of-pocket costs,, according to a new analysis from The Commonwealth Fund — that is, spending more than 10% of personal income on health care, by definition. This cost burden stayed the same even during the recession, as the chart shows. These are fiscally sobering times, especially in the wake of Hurricane Sandy and the economic ravages she leaves behind for the northeastern U.S. which will trickle through the larger macroeconomy for the nation. What impacts New York City impacts the nation and the world. In addition to London and Hong Kong, New York is a hub for financial markets, fashion, entertainment, advertising and communications, and other industry segments around the globe.

We know that in the past decade, out of pocket costs for health care are increasing on workers while wages have stayed flat or declined. Health care costs take an increasing share out of families’ take-home pay. Interestingly, relative to the patent cliff, high health costs were largely unchanged because spending on prescription drugs shifted from more expensive brands on-patent to off-patent generic drugs.

Without improvement in family incomes, and jobs that come with health benefits, the personal medical cost burden – the fourth health cliff – will grow in prominence. This would then be a further burden on taxpayers — and further exacerbate the Fiscal Cliff.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're