Healthcare Access and Cost Top Americans’ Concerns in Latest Gallup Poll

Healthcare — availability and affordability — is a more intense worry for Americans in March 2018 than crime and violence, Federal spending, guns, drug use, and hunger and homelessness. The Gallup Poll, fielded in the first week of March 2018, found that peoples’ overall economic and employment concerns are on the decline since 2010, at the height of the Great Recession which began in 2008. While 70% of Americans were worried about economic matters in 2010, only 34% of people in the U.S. were worried about the economy, and 23% about unemployment, in March 2018. Gallup has asked this “worry”

Sounds Like A John Denver Song: Virginia and Colorado Towns Rank High As Healthy Communities

If it’s true that “your ZIP code is more important than your genetic code,” you’d look for a job in 22046, buy a house there, and plant your roots. You’d find yourself in Falls Church, Virginia, named number one in the Healthiest Communities rankings of 500 U.S. towns. You can see a list of all of the communities here. The project is a collaboration between the Aetna Foundation and U.S. News & World Report, with help from the University of Missouri Center for Applied Research and Engagement Systems (CARES) and a team from the National Committee on Vital and Health

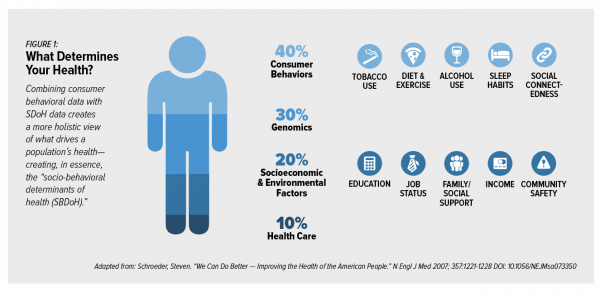

Add Behavioral Data to Social Determinants For Better Patient Understanding

“Health agencies will have to become at least as sophisticated as other consumer/retail industries in analyzing a variety of data that helps uncover root causes of human behavior,” Gartner recommended in 2017. That’s because “health” is not all pre-determined by our parent-given genetics. Health is determined by many factors in our own hands, and in forces around us: physical environment, built environment, and public policy. These are the social determinants of health, but knowing them even for the N of 1 patient isn’t quite enough to help the healthcare industry move the needle on outcomes and costs. We need to

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017. That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants. The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock

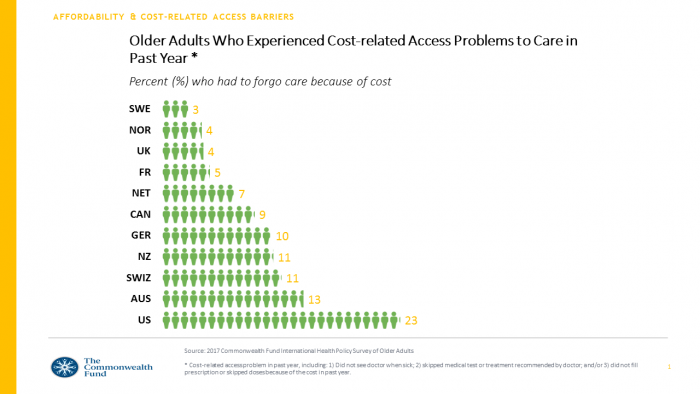

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

Healthcare EveryWhere: Philips and American Well Streamline Telehealth

Two mature companies in their respective healthcare spaces came together earlier this month to extend healthcare services where patients live and doctors work, via telehealth services. Philips, celebrating 127 years in business this year, has gone all-in on digital health across the continuum of care, from prevention and healthy living to the ICU and hospital emergency department. American Well is among the longest operating telehealth companies, founded in 2006. Together, these two established organizations will transcend physician offices and ERs and deliver virtual care in and beyond the U.S. I had the opportunity to sit down with Ido Schoenberg, MD,

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

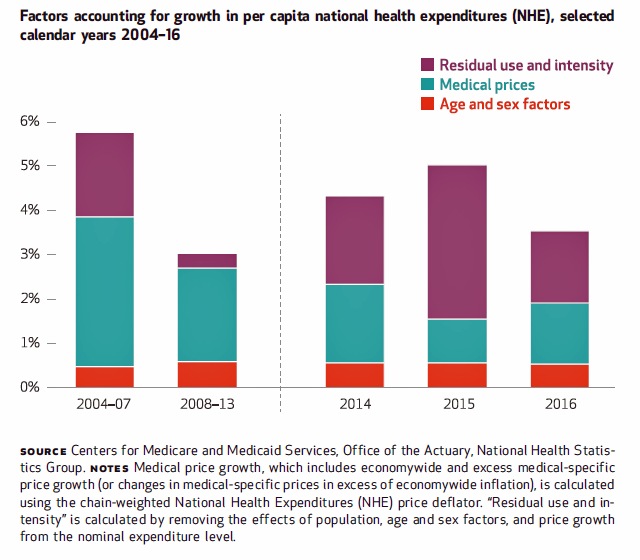

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

The State of Financial Wellness and Health in America – Suffering Across the Ages

Nearly one-half of Americans are challenged by low financial well-being. Compared to emotional/mental, job/career, social, physical, and financial, it’s this last lens on personal health that gets the lowest ratings for the largest number of Americans. The second most worrying factor diminishing well-being is a tie between physical health and social health. Welcome to The uncomfortable reality of financial wellbeing, a report on the 2017 Financial Mindset Study Highlights from Alight Solutions, an HR services company. The first chart arrays the well-being rankings across the five factors, showing that just over one-half of Americans have more positive views on their emotional

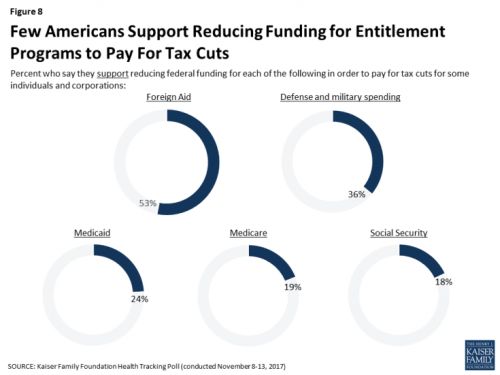

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

Movin’ Out(patient) – The Future of the Hospital is Virtual at UPMC

In 2016, most consultations between patients and Kaiser-Permanente Health Plan were virtual — that is, between consumers and clinicians who were not in the same room when the exam or conversation took place. Virtual healthcare may be the new black for healthcare providers. Mercy Health System in St. Louis launched a virtual hospital in 2016, covered here in the Health Populi post, “Love, Mercy, and Virtual Healthcare.” Intermountain Healthcare announced plans to build a virtual hospital in 2018. And, earlier this month, UPMC’s CEO, Jeffrey Romoff, made healthcare headlines saying, “UPMC desires to be the Amazon of healthcare.” UPMC, aka University of Pittsburgh

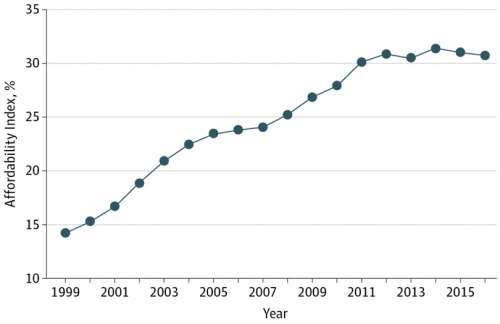

Health Care Is 2.5 More Expensive Than Food for the Average U.S. Family

The math is straightforward. Assume “A” equals $59.039, the median household income in 2016. Assume “B” is $18,142, the mean employer-sponsored family insurance premium last year. B divided by A equals 30.7%, which is the percent of the average U.S. family’s income represented by the premium cost of health insurance. Compare that to what American households spent on food: just over $7,000, including groceries and eating out (which is garnering a larger share of U.S. eating opportunities, a topic for another post). Thus, health care represents, via the home’s health insurance premium, represents 2.5 times more than food for the

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

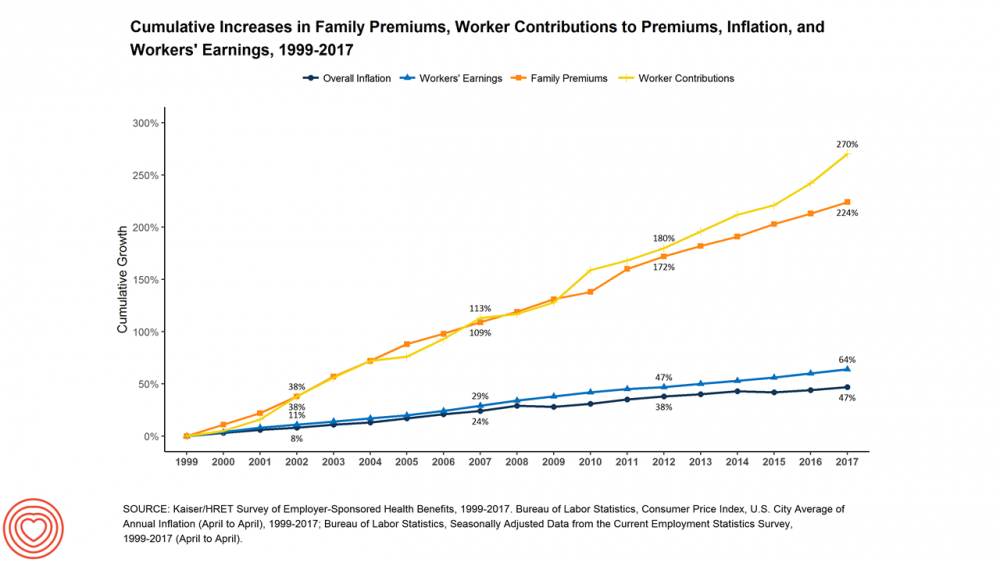

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

Celebrating 10 Years of Health Populi, 10 Healthcare Milestones and Learnings

Happy anniversary to me…well, to the Health Populi blog! It’s ten years this week since I launched this site, to share my (then) 20 years of experience advising health care stakeholders in the U.S. and Europe at the convergence of health, economics, technology, and people. To celebrate the decade’s worth of 1,791 posts here on Health Populi (all written by me in my independent voice), I’ll offer ten health/care milestones that represent key themes covered from early September 2007 through to today… 1. Healthcare is one-fifth of the national U.S. economy, and the top worrisome line item in the American

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

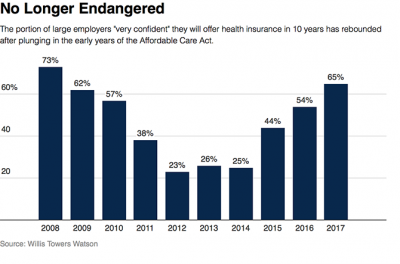

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

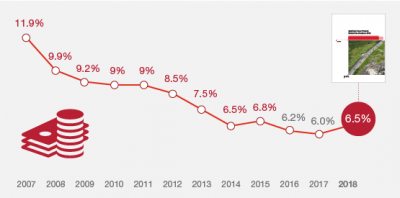

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

As High Deductible Health Plans Grow, So Does Health Consumers’ Cost-Consciousness

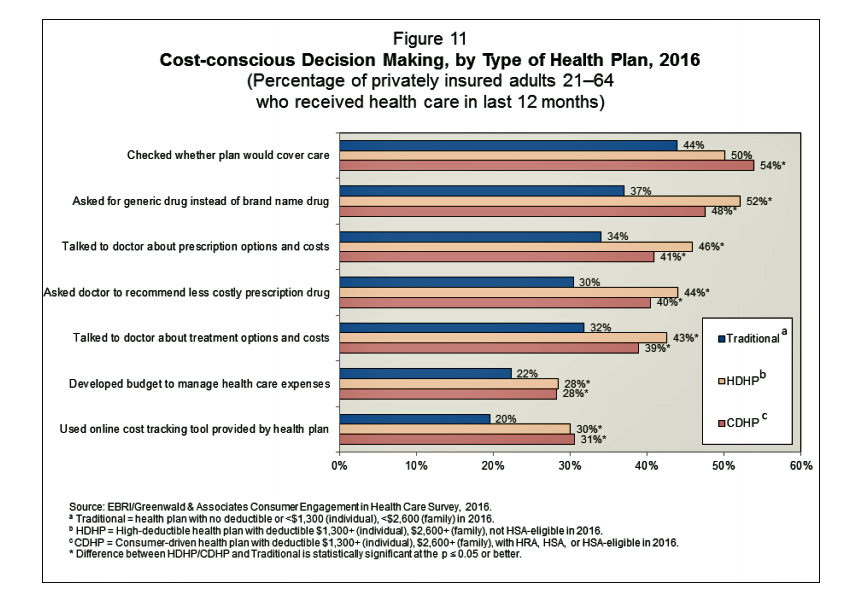

A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute. A high deductible is correlated with more engaged health plan members, EBRI believes based on the data. One example: more than one-half of people enrolled

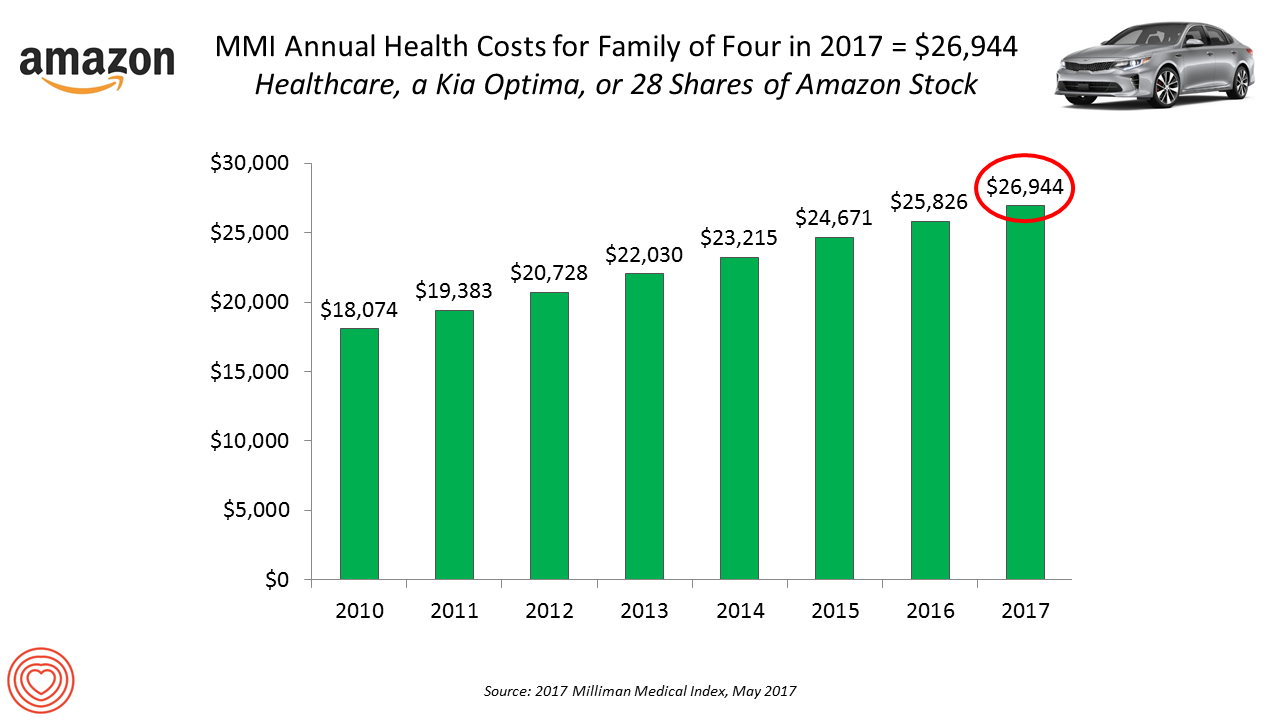

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

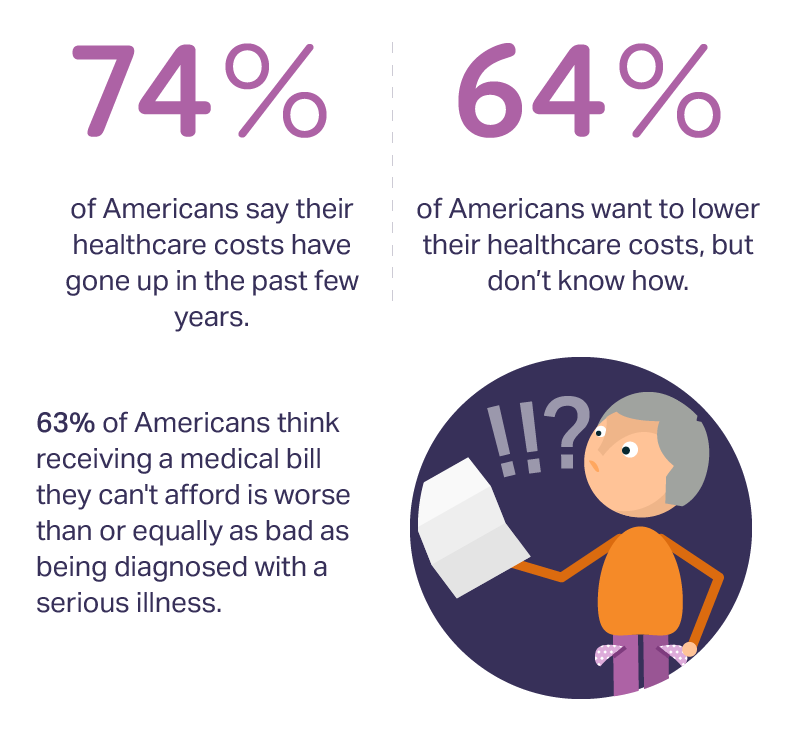

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

Retail Trumps Healthcare in 2017: the Health Populi Forecast for the New Year

Health citizens in America will need to be even more mindful, critical, and engaged healthcare consumers in 2017 based on several factors shaping the market; among these driving forces, the election of Donald Trump for U.S. president, the uncertain future of the Affordable Care Act and health insurance, emerging technologies, and peoples’ growing demand for convenience and self-service in daily life. The patient is increasingly the payor in healthcare. Bearing more first-dollar costs through high-deductible health plans and growing out-of-pocket spending for prescription drugs and other patient-facing goods and services, we’re seeking greater transparency regarding availability, cost and quality of

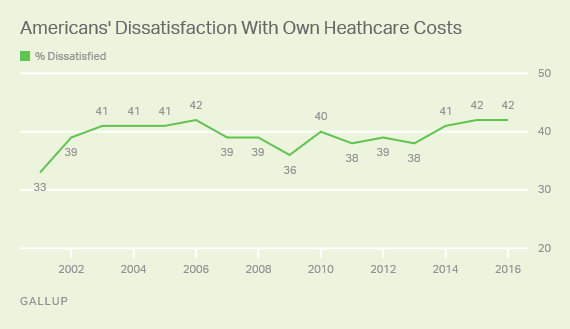

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

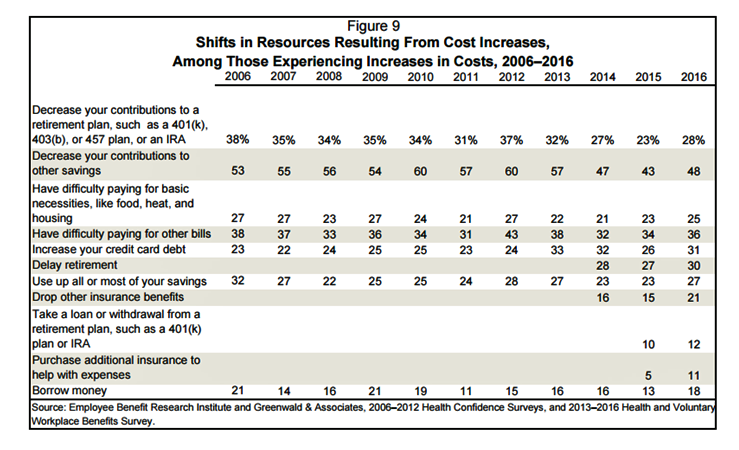

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

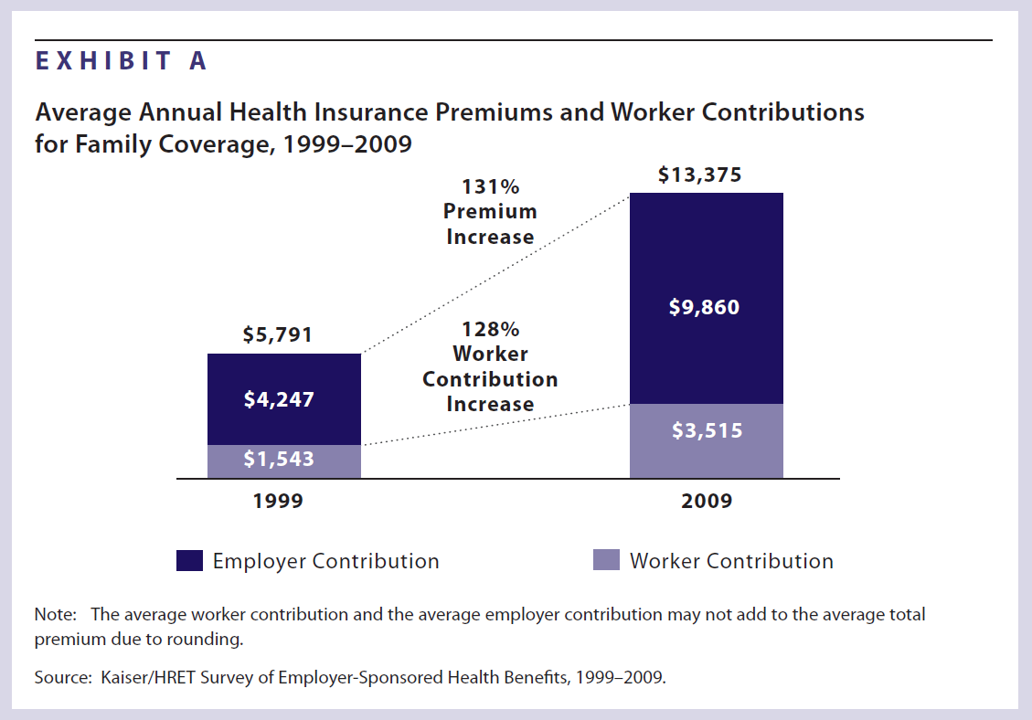

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,