Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

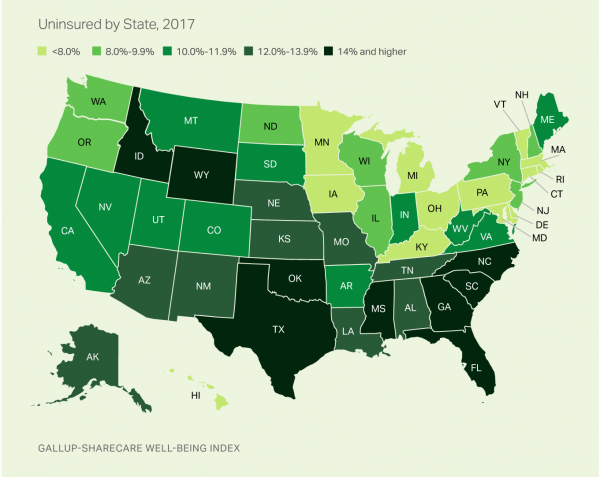

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

Universal Health Care and Financial Inclusion – Two Sides of the Wellness Coin

Two weeks in a row, The Economist, the news magazine headquartered in London, included two special reports stapled into the middle of the magazines. Universal health care was covered in a section on 28 April 2018, and coverage on financial inclusion was bundled into the 5th May edition. While The Economist’s editors may not have intended for these two reports to reinforce each other, my lens on health and healthcare immediately, and appreciatively, connected the dots between healthcare coverage and financial wellness. The Economist, not known for left-leaning political tendencies whatsoever, lays its bias down on the cover of the section here: universal healthcare

The Patient As Payor: From Rationing Visits Due to Co-Pays to Facing $370K for Healthcare in Retirement

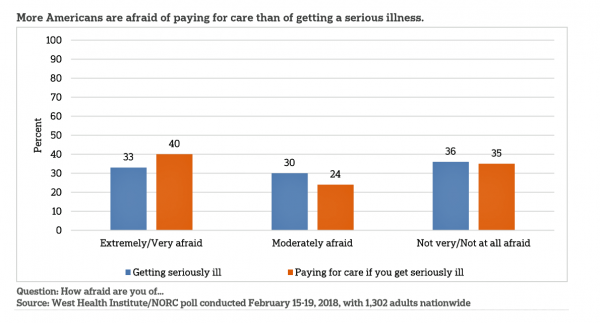

Health care in America is such a scary experience that more people are afraid of paying for care than the actually getting sick part of the scenario. The patient is the payor, and she is afraid…more afraid of the paying than of the illness, according to a survey conducted among U.S. health consumers from WestHealth Institute and NORC, Americans’ Views of Healthcare Costs, Coverage, and Policy from WestHealth and NORC. See the orange bar on the left: 40% of Americans are “extremely or very afraid” about paying for care if they get seriously ill, and 33% are that afraid

The New Financial Toxicity in Health Care: The Cost of Hospitalization

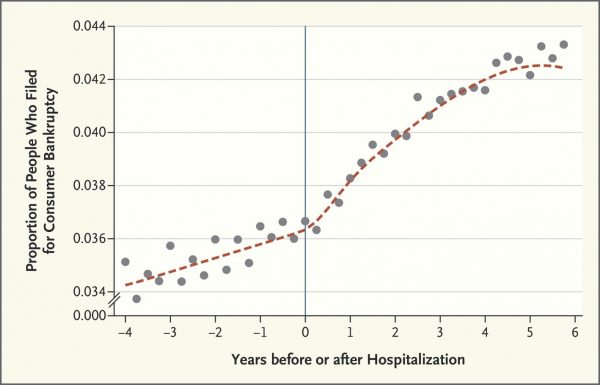

In healthcare, we use the word “toxicity” when it comes to taking a new medicine, especially a strong therapy to cure cancer. That prescription may be toxic as a harmful side effect on our journey to getting well. The concept of “financial toxicity” for cancer patients was raised by concerned clinicians at Sloane-Kettering Medical Center, who discussed the topic on 60 Minutes in 2014 and have published papers on the issue. Beyond strong medicines, a new financial toxicity has emerged for patients due to hospital inpatient admissions. A new article in the New England Journal of Medicine studies Myth and

Tweets at Lunch with Paul Krugman – Health IT Meets Economics

I greatly appreciated the opportunity today to attend a luncheon at the HX360 meeting which convened as part of the 2018 HIMSS Conference. The speaker at this event was Paul Krugman, who won the Nobel Prize for Economics 10 years ago and today is an iconic op-ed columnist at the New York Times And Distinguished Professor of Economics at the City University of New York (CUNY). I admit to being a bit of a groupie for Paul Krugman’s work. It tickles me to look at Rise Global’s list of the Top 100 Influential Economists:

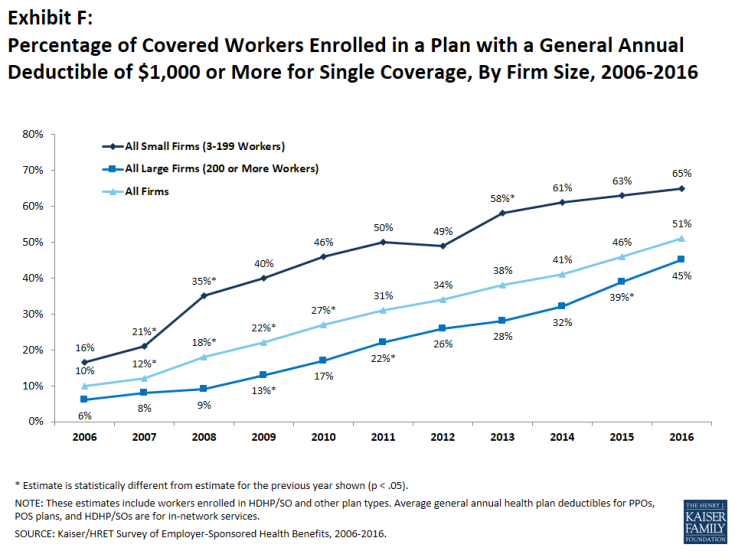

More Working Americans Enrolled in High-Deductible Health Plans in 2017

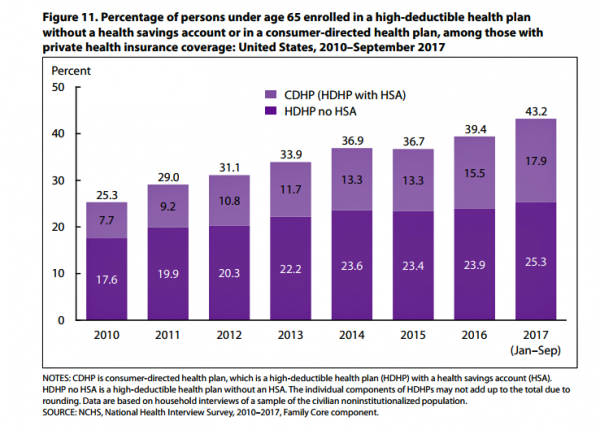

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

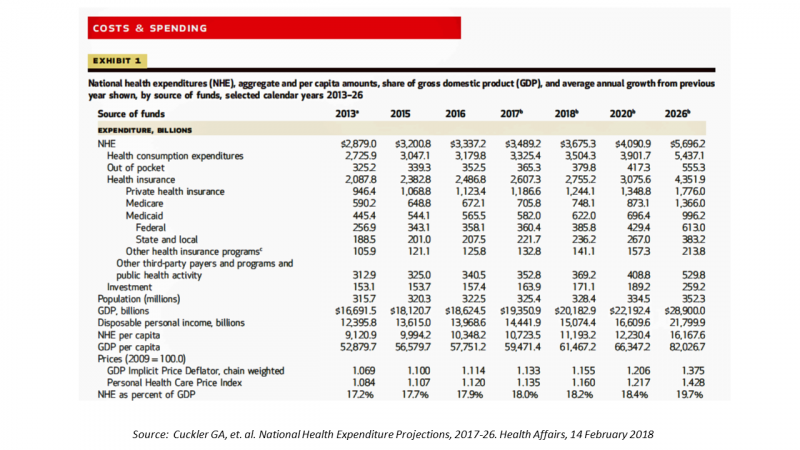

The $4 Trillion Health Economy of 2020

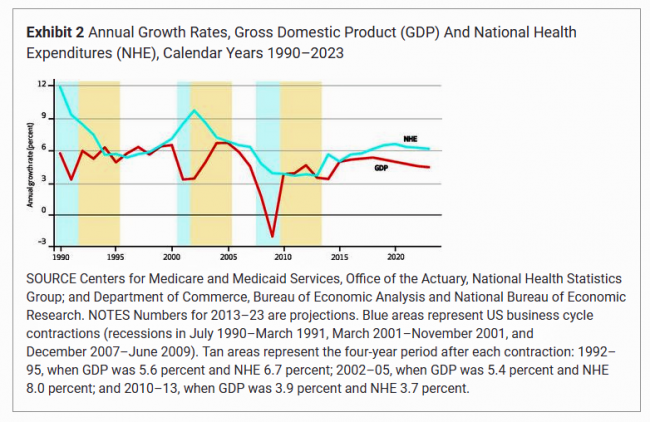

In 2020, national health expenditures (NHE) in the United States will exceed $4 trillion to cover 334.5 million Americans. That equates to 18.4% of the Gross Domestic Product (GDP) and $12,230.40 of health spending per person. I sat in on a press call today with researchers from the Office of the Actuary working in the Centers for Medicare and Medicaid Services (CMS) to review the annual forecast of the NHE, published in Health Affairs in a statistically-dense eleven page article titled, National Health Expenditure Projections, 2017-2026: Despite Uncertainty, Fundamentals Primarily Drive Spending Growth. What are those “fundamentals” pushing up healthcare spending?

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

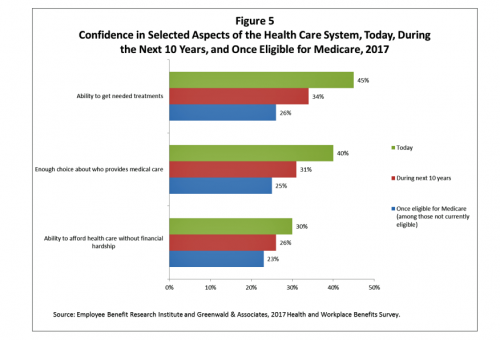

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017. That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants. The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

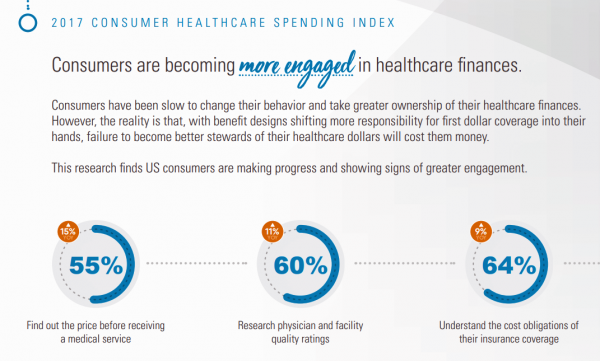

Patients Continue to Grow Healthcare Consumer Muscles, Alegeus’s 2017 Index Finds

Patients’ health consumer muscles continue to get a work out as more people enroll in high-deductible health plans and face sticker shock for health insurance premiums, prescription drug costs, and that thousand-dollar threshold. The 2017 Alegeus Healthcare Consumerism Index finds growth in patients’, now consumers’, interest and competence in becoming disciplined about planning, saving, and spending for healthcare. Overall, the healthcare spending index hit 60.1 in 2017, up from 54.4 in 2016. This is a macro benchmark that represents most consumers exhibiting greater healthcare spending engagement with eyes on cost as well as adopting purchasing behaviors for healthcare. Underneath that

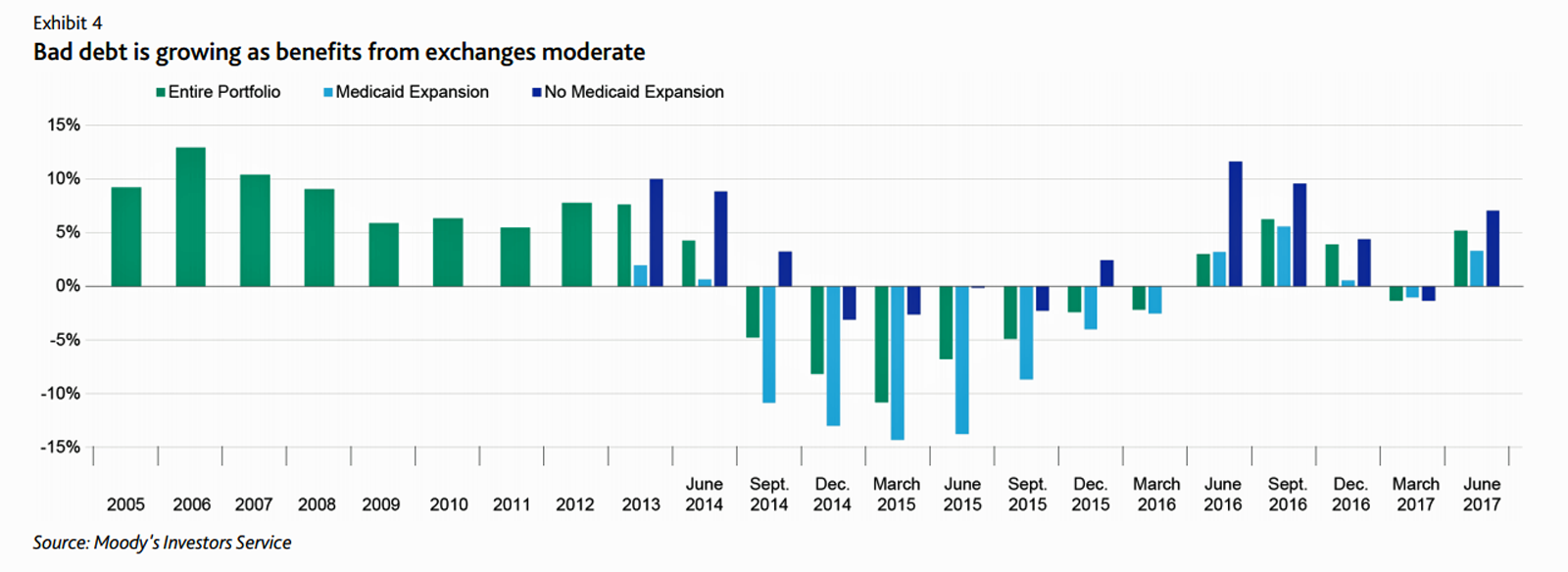

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

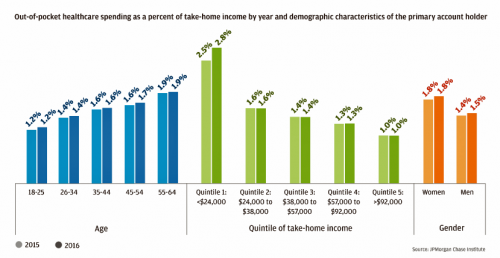

Out-Of-Pocket Healthcare Costs Grow in the Family Budget

For each dollar spent on healthcare in the United States, families paid 28 cents, according to the U.S. National Health Expenditure Accounts for 2015. Welcome to the new era of Americans and medical banking, with new insights provided by the largest of banks, JP Morgan Chase, in Paying Out-of-Pocket: The Healthcare Spending of 2 Million U.S. Families, from JP Morgan Chase. Chase is the largest bank in America based on its assets. They’ve mined 2.3 million de-identified records of Chase consumers in their banking network to learn about customers’ healthcare spending. These data represent spending between 2013 and 2016, detailed

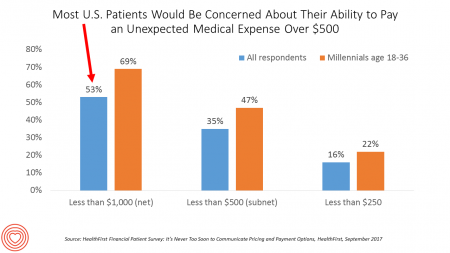

Patients Are Looking to Finance Healthcare Over Time

Most U.S. patients want healthcare providers to offer cost information before a procedure, and whether doctors offer financial options to help them extend payments over time. This is an automotive or home appliance procedure we’re talking about. It’s healthcare services, and American patients are now the third largest payors to providers in the nation. Thus, the title of a new report summarizing a consumer survey from HealthFirst notes, “It’s Never Too Soon to Communicate Pricing and Payment Options. The study found that two-thirds of U.S. consumers would like healthcare providers to discuss financing options; however, only 18 percent of providers have

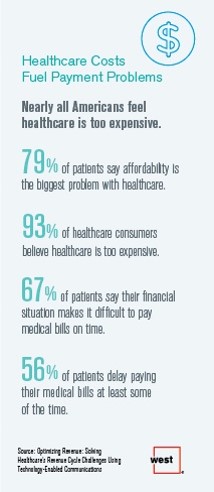

Patients’ Healthcare Payment Problems Are Providers’, Too

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

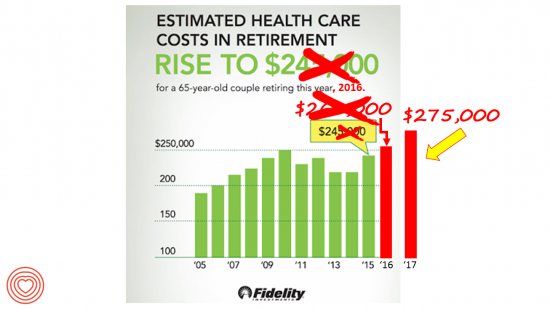

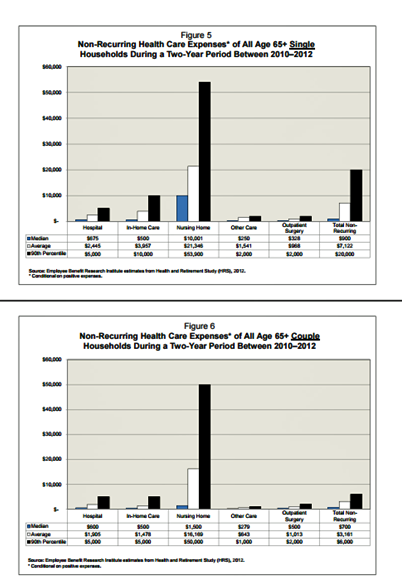

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

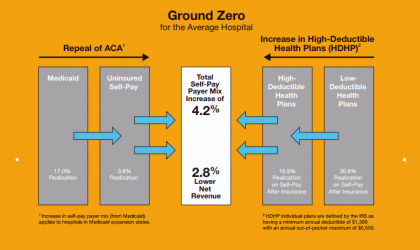

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

The Pursuit of Health Equity and the State of U.S. Health Care

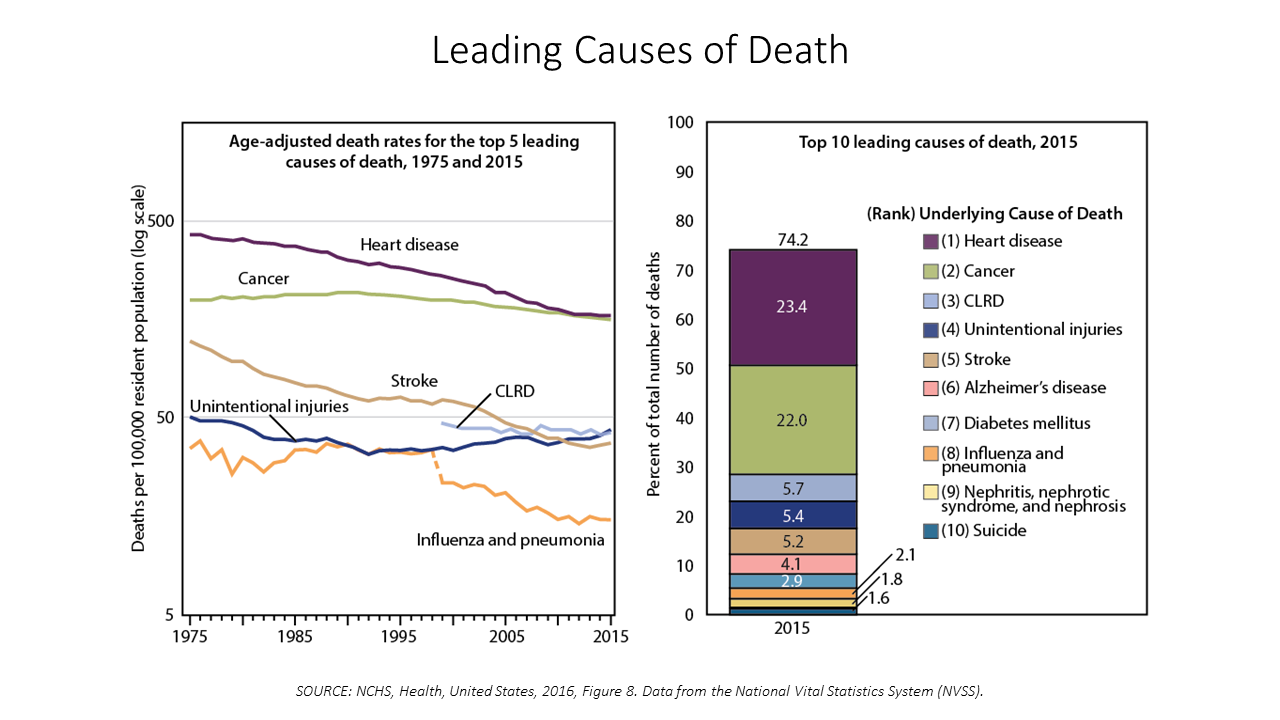

Between 2014 and 2015, death rates increased for eight of the ten leading causes; only death rates caused by cancer fell, and mortality rates for influenza and pneumonia stayed flat. The first chart paints this sobering portrait of Americans’ health outcomes, presented in the CDC’s data-rich 488-page primer, Health, United States, 2016. Think of this publication as America’s annual report on health. Every year, it is prepared and submitted to the President and Congress by the Secretary of the Department of Health and Human Services. This year’s report was delivered by DHHS Secretary Tom Price to President Trump and the

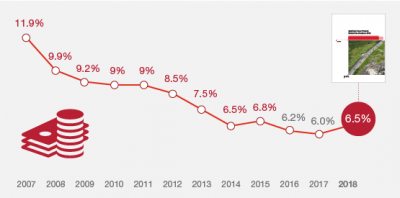

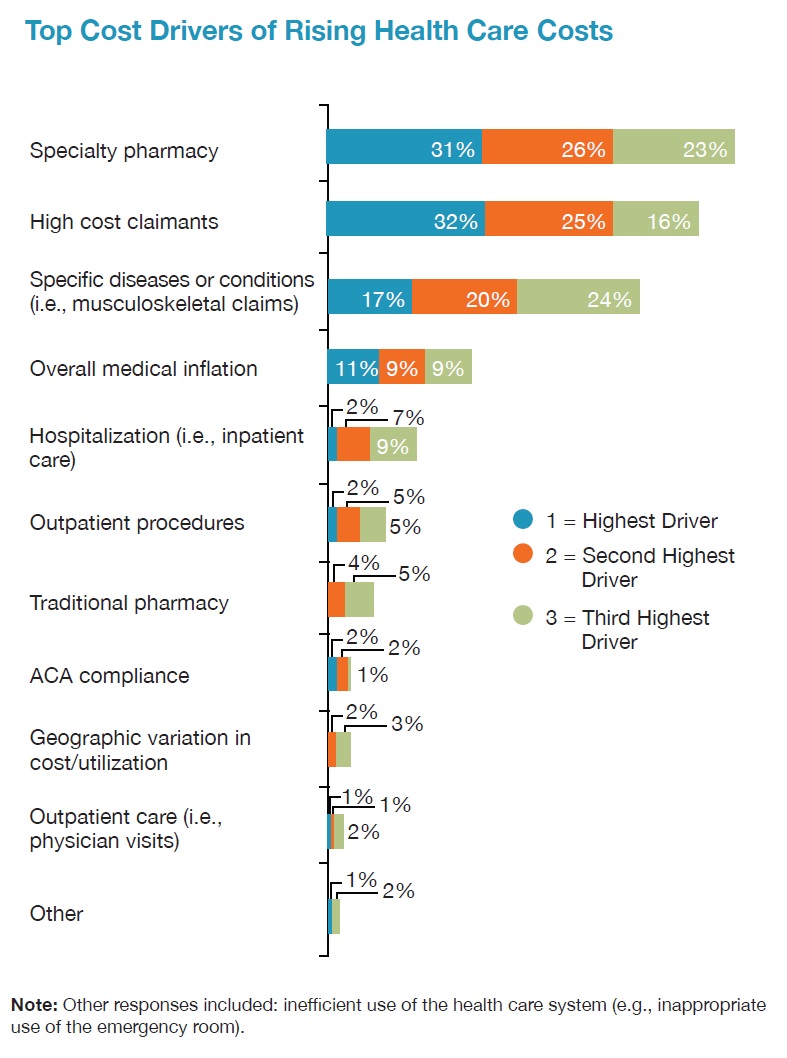

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

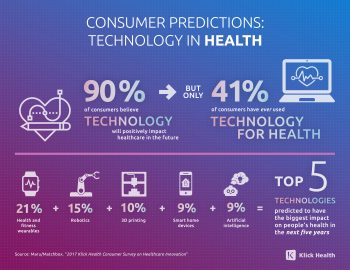

U.S. Consumers Expect, But Don’t See, Innovation From the Health & Wellness Industry

U.S. consumers consider Consumer Electronics to be the most innovative industry they know. But people believe that Health & Wellness should be the most innovative sector in the economy. Welcome to the 2017 Klick Health Consumer Survey, which focuses on health innovation in the context of peoples’ hopes for technology to improve health and healthcare. 1 in 2 people say that technology has had a positive impact on their health and wellness, skewing slightly more toward younger people (although 45% of people 55 years of age and older agree that tech positively contributes to health. 41% of consumers say they’ve

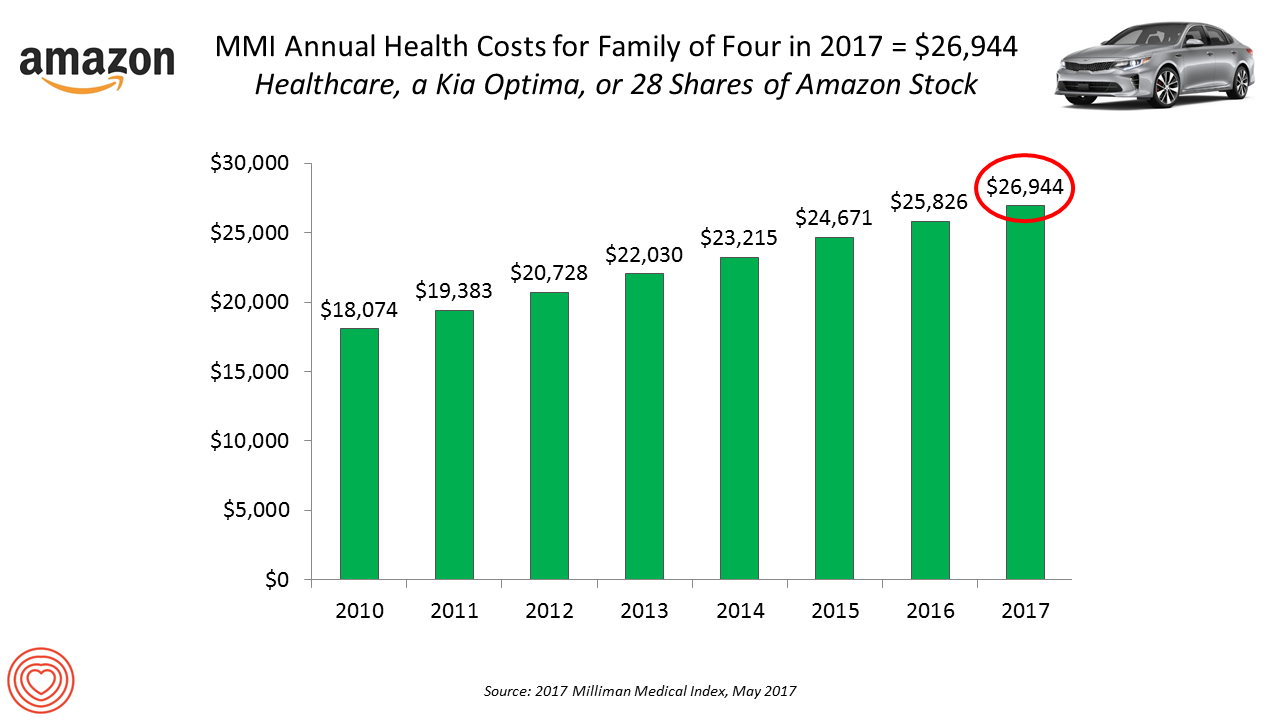

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

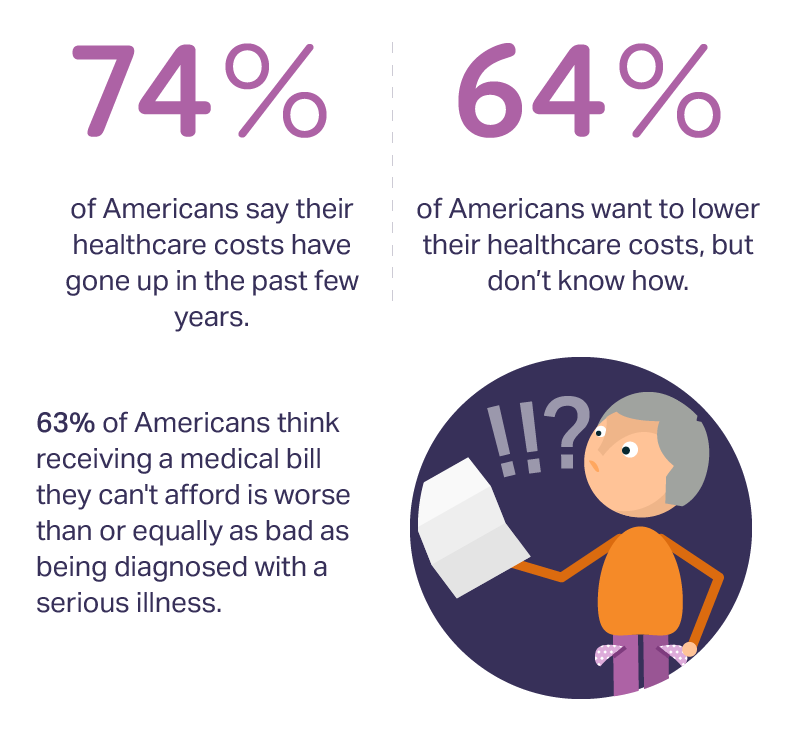

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

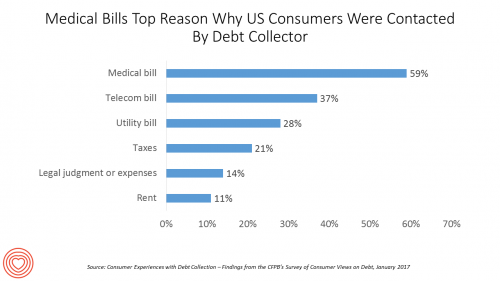

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

Health Care For All — Only Better, US Consumers Tell Consumer Reports

Availability of quality healthcare, followed by affordable care, are the top two issues concerning U.S. consumers surveyed just prior to Donald Trump’s inauguration as the 45th U.S. President. Welcome to Consumer Reports profile of Consumer Voices, As Trump Takes Office, What’s Top of Consumers’ Minds? “Healthcare for All, Only Better,” Consumer Reports summarizes as the top-line finding of the research. 64% of people are confident of having access to good healthcare, but 55% aren’t sure they can afford healthcare insurance to be able to access those services. Costs are too high, and choices in local markets can be spotty or non-existent.

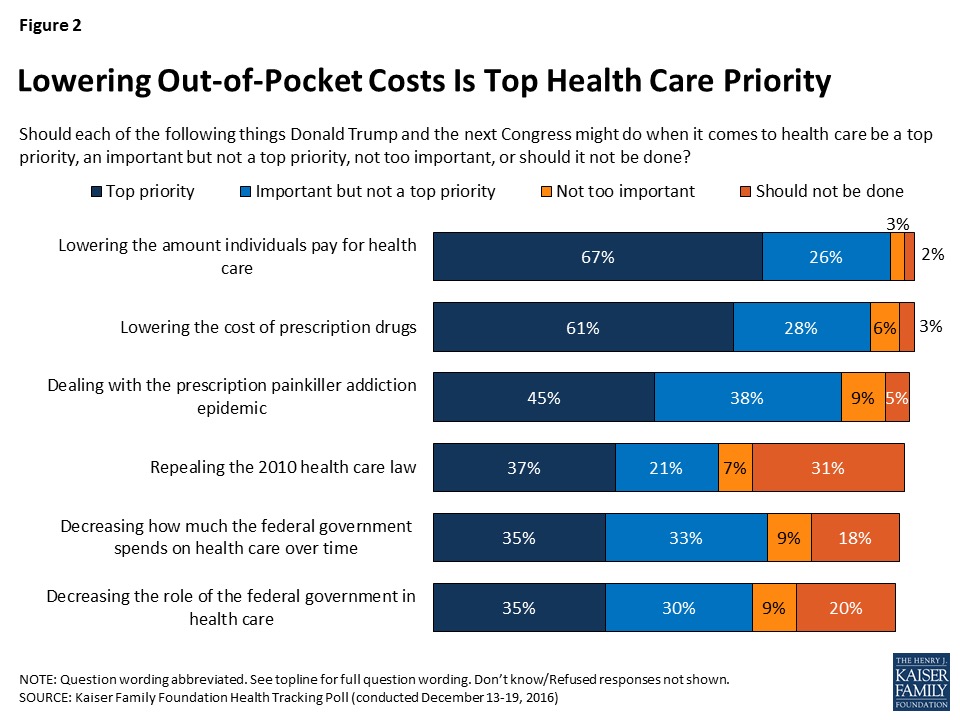

Health Care Costs, Not the ACA, Rank #1 in Americans’ Minds As President Trump Assumes the Presidency

More Americans are worried about their out-of-pocket health care costs than they are about repealing the Affordable Care Act (ACA), according to the Kaiser Family Foundation (KFF) Health Tracking Poll published 6th January 2017, the first KFF poll for the new year. Cost worries fall into two buckets of concerns: the cost of health care, and the cost of prescription drugs. Managing the opioid epidemic falls in third place after health care costs. Repealing the Affordable Care Act? It’s #4 on Americans’ health care priorities as of mid-December 2016, followed by shrinking the Federal’s government’s role in and spending on

Self-Care Is the Best Healthcare Reform

The greater a person’s level of health engagement, the better their health outcome will be. Evidence is growing on the return-on-investment for peoples’ health activation and how healthy they are. That ROI is both in survival (mortality) and quality of life (morbidity), as well as hard-dollar savings — personally bending-the-healthcare-cost-curve. But people are more likely to engage in “health” than “healthcare.” We’d rather ingest food-as-medicine than a prescription drug, use walking in a lovely park for exercise, and laugh while we’re learning about how to manage our health insurance benefits. Thus, Campbell’s Soup Company and Hormel are expanding healthy offerings,

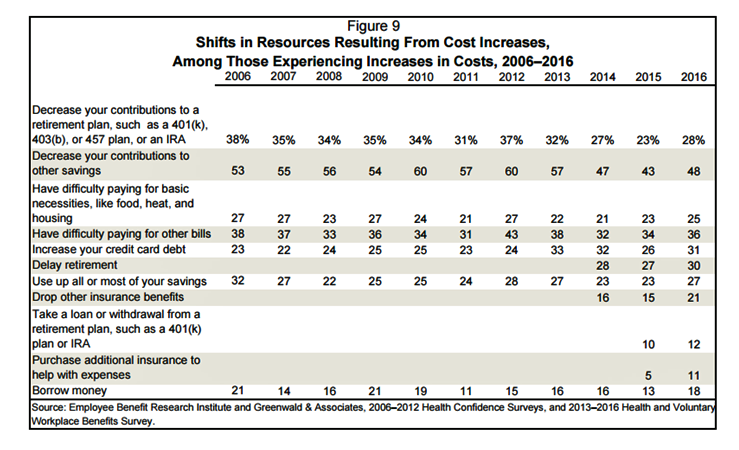

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

43% of Americans Worry About How They’ll Pay for Health Care

4 in 10 Americans are worried about how they’ll pay for health care, according to Americans’ Views on Current Trade and Health Policies, a poll conducted jointly between the Harvard T.H. Chan School of Public Health and Politico. There are no significant party differences between Democrats and Republicans regarding peoples’ worrying about their ability to pay medical costs in the next year. But there are differences in geography, with 53% of people in the South significantly more worried about health care costs compared with other regions of the U.S. Who’s to blame for the high costs of health care that

Let’s Go Healthcare Shopping!

Healthcare is going direct-to-consumer for a lot more than over-the-counter medicines and retail clinic visits to deal with little Johnny’s sore throat on a Sunday afternoon. Entrepreneurs recognize the growing opportunity to support patients, now consumers, in going shopping for health care products and services. Those health consumers are in search of specific offerings, in accessible locations and channels, and — perhaps top-of-mind — at value-based prices as defined by the consumer herself. (Remember: value-based healthcare means valuing what matters to patients, as a recent JAMA article attested). At this week’s tenth annual Health 2.0 Conference, I’m in the zeitgeist

Older Couples Have Lower Out-of-Pocket Healthcare Costs Than Older Singles

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households. In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse. But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found. The average per-person out-of-pocket spending for

PhRMA vs. Employers: Healthcare Costs In the Eye of the Beholder

In the past week, the Pharmaceutical Research and Manufacturers of America (PhRMA), the advocacy organization for the branded prescription drug industry, published Medicines: Costs in Context,” the group’s lens on the value of prescription drugs in the larger healthcare economy. Their view: that prescription drug costs comprise a relatively low share of health care spending in America, and a high-value one at that. PhRMA contends that 10% of the health care dollar was allocated to prescription drugs in 2015, the same proportion as in 1960. “Even with new treatments for hepatitis C, high cholesterol and cancer, spending on retail prescription

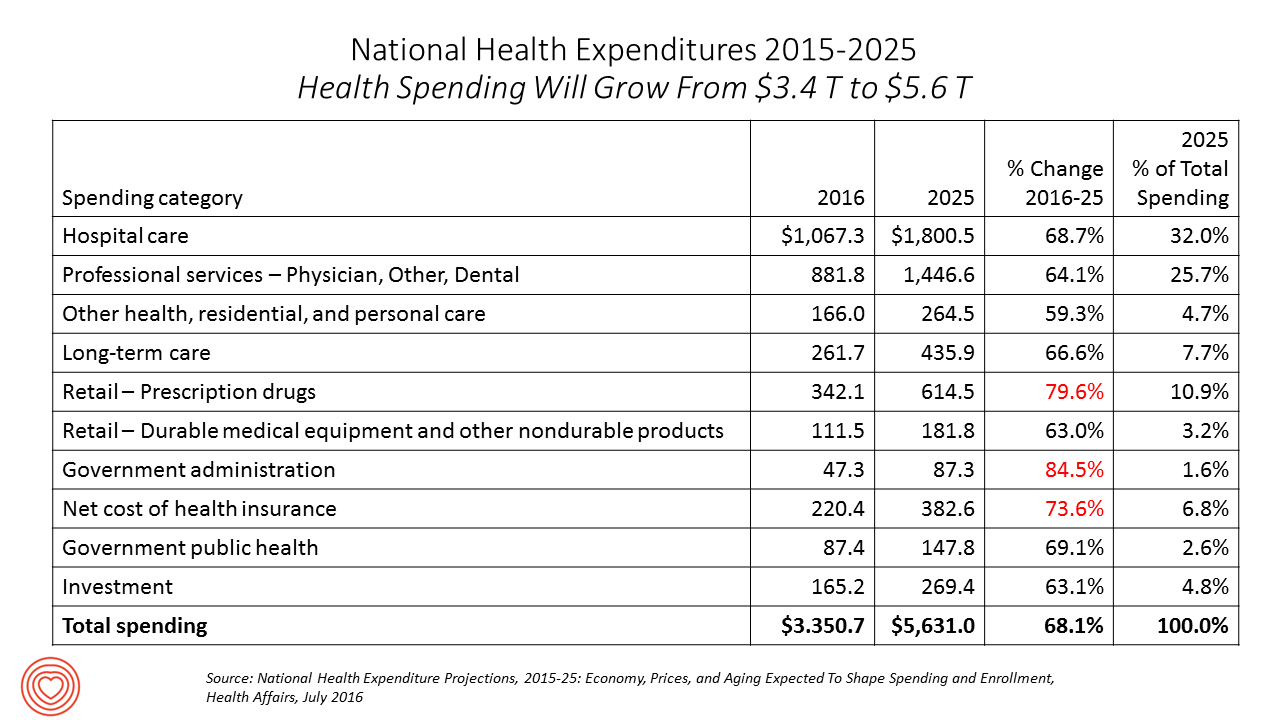

U.S. Health Spending Will Comprise 20% of GDP in 2025

Spending on health care in America will comprise $1 in every $5 of gross domestic product in 2025, according to National Health Expenditure Projections, 2015-25: Economy, Prices, And Aging Expected to Shape Spending and Enrollment, featured in the Health Affairs July 2016 issue. Details on national health spending are shown by line item in the table, excerpted from the article. Health spending will grow by 5.8% per year, on average, between 2015 and 2025, based on the calculations by the actuarial team from the Centers for Medicare and Medicaid Services (CMS), authors of the study. The team noted that the Affordable Care

More Patients Morph Into Financially Burdened Health Consumers

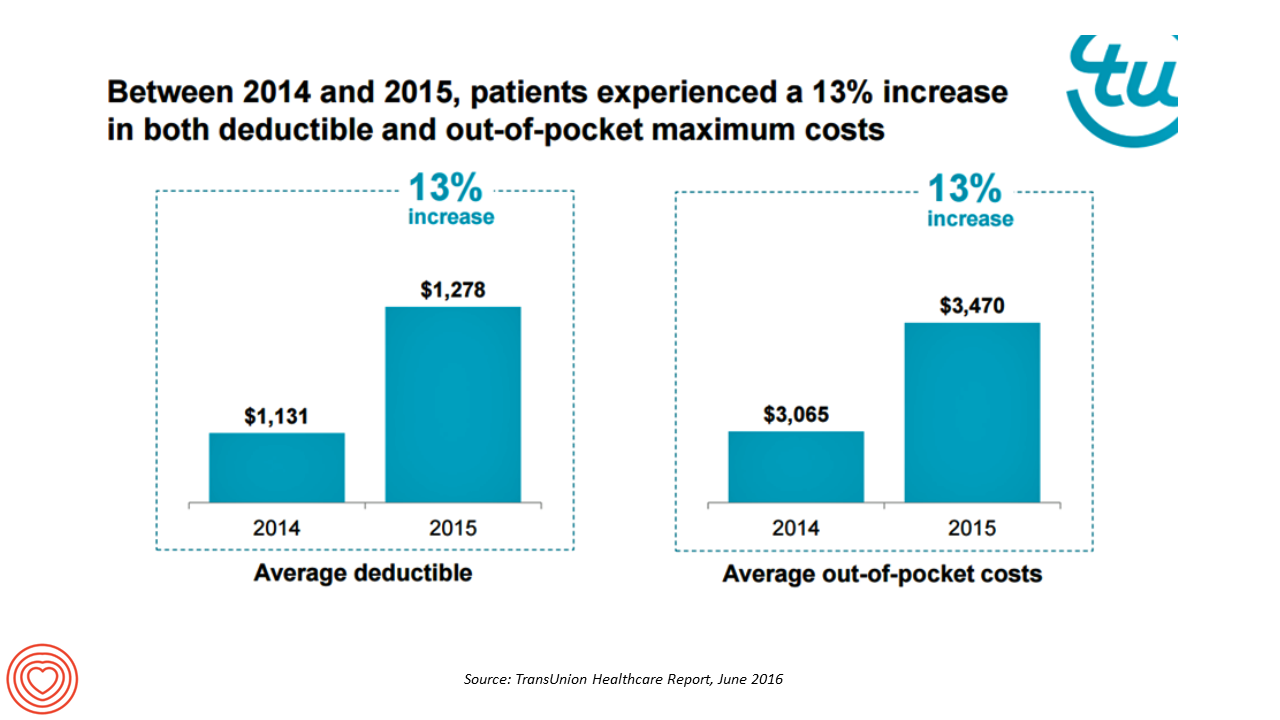

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016. Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015. In

What Financial Health Means to Me: It’s Baked Into Wellness

Today is Financial Wellness Day. Do you know how financially well you are? Let me take a crack at that answer, even though I haven’t seen your bank account (which you may not even have as over 20% of people in the US are, as financial services companies would call you “un-banked” or “under-banked”.) You have some level of fiscal stress, ranging from a little to a lot. You aren’t taking all of your summer vacation your employer extends to you. You’re spending around $1 in every $5 of your household budget on health care. And your sleep isn’t as

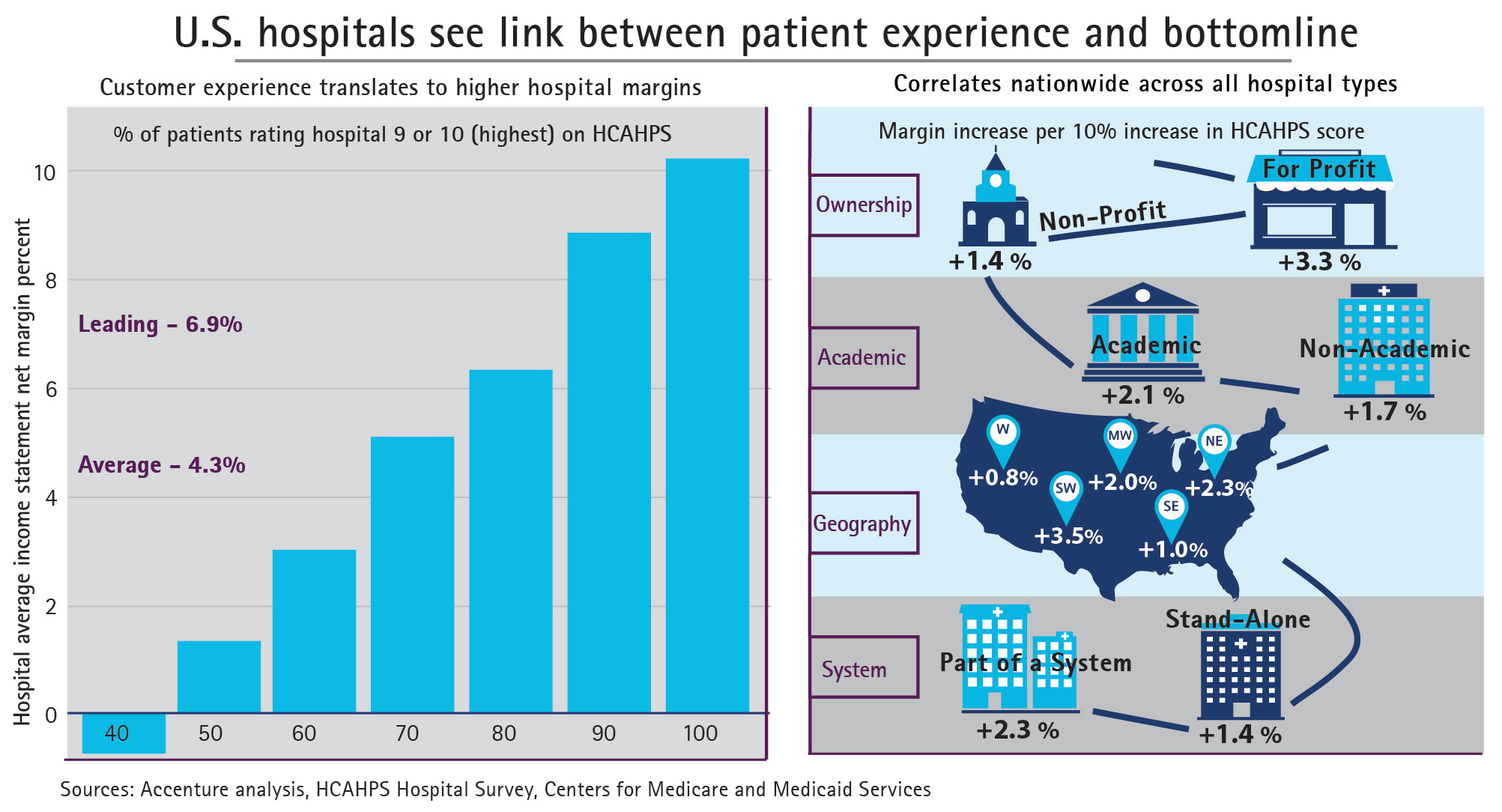

Happy Patients, Healthy Margins – the Hard ROI for Patient-Centered Care

Hospital margins can increase 50% if health providers offer patients a better customer experience, Accenture calculates in the paper, Insight Driven Health – Hospitals see link between patient experience and bottom line. Specifically, hospitals with HCAHPS scores of 9 or 10, the highest recommendations a patient can give in the survey, more likely enjoy higher margins (upwards of 8%). The Hospital Computer Assessment of Healthcare Providers and Systems (HCAHPS) survey is administered by the Centers for Medicare and Medicaid Services (CMS) and measures patients’ exeperiences in hospital post-discharge. The correlation, simply put, is “Happy Patients, Healthy Margins,” Accenture coined in

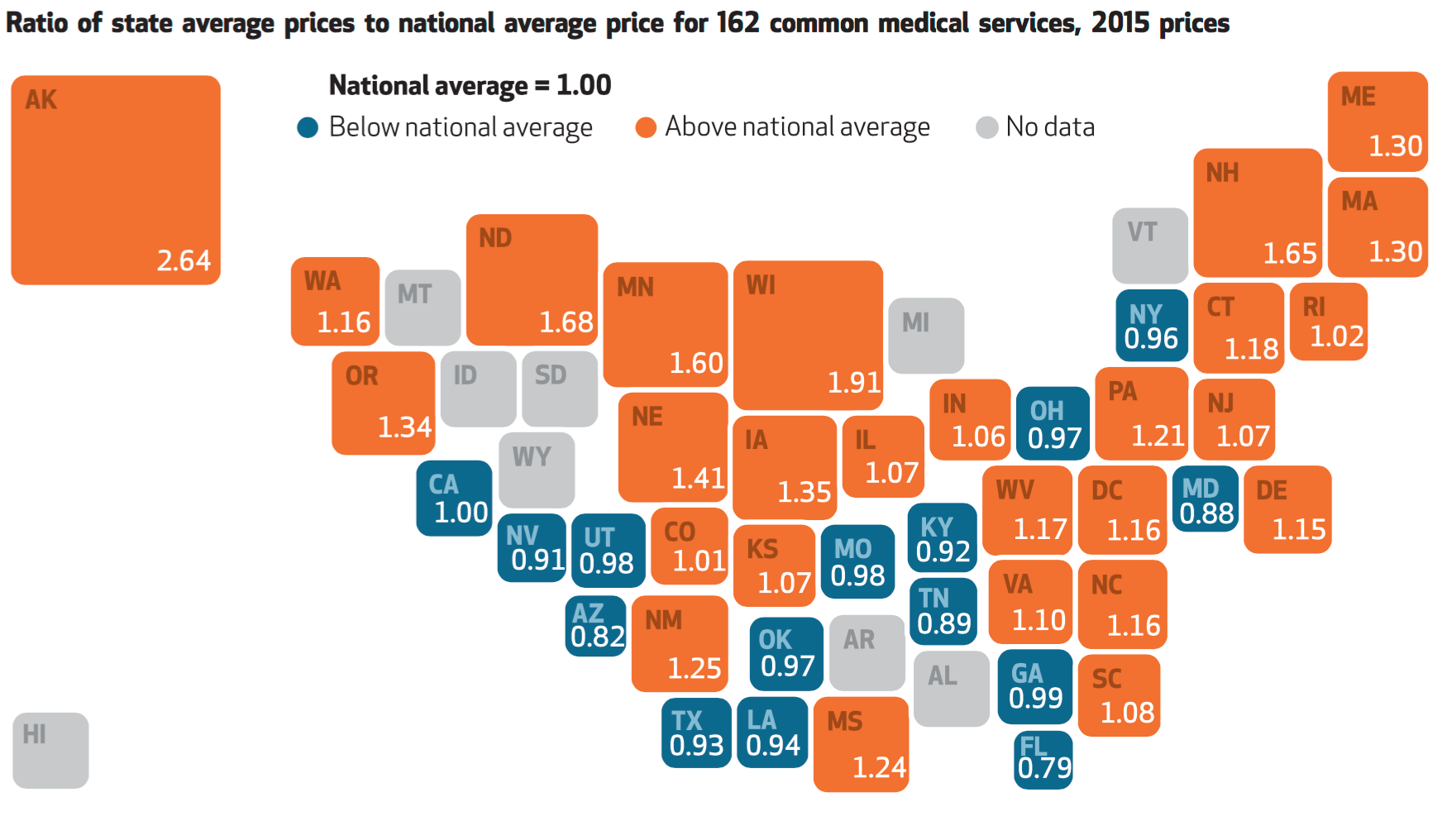

For Healthcare Costs, Geography is Destiny

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice. The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in

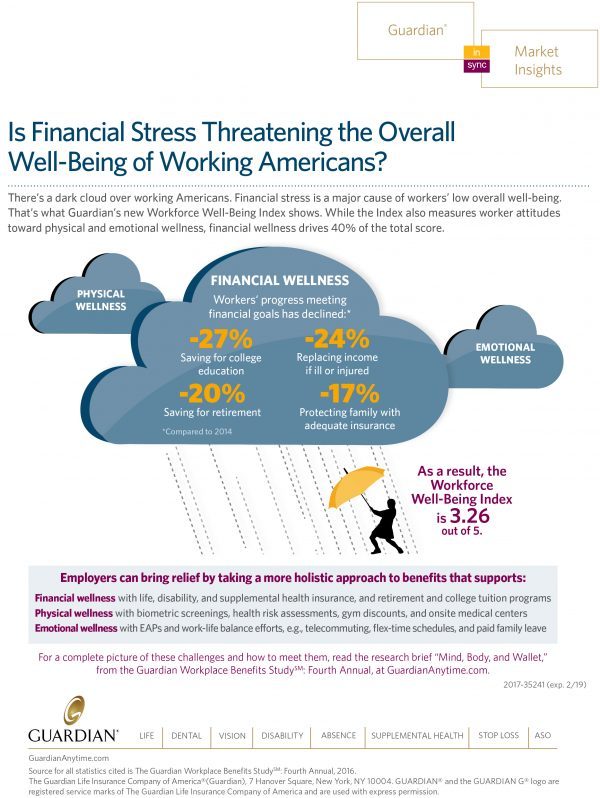

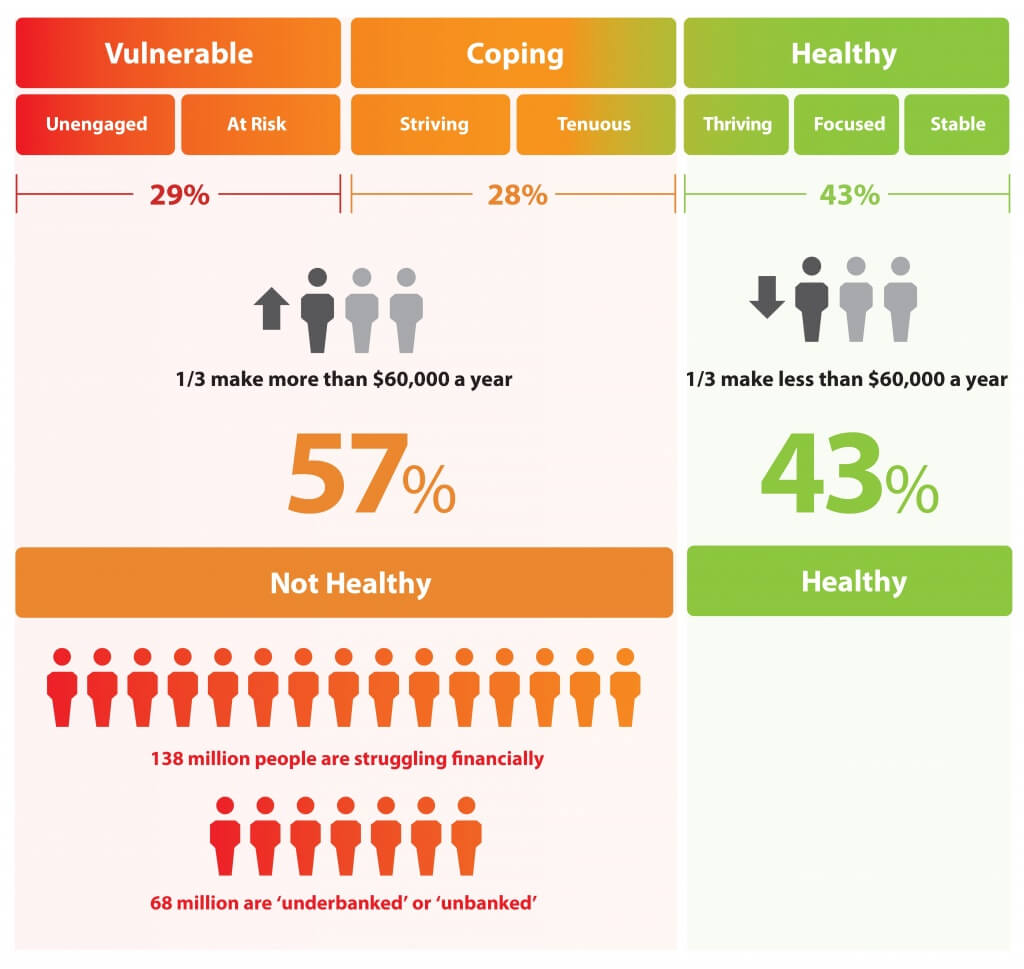

Money, Stress and Health: The American Worker’s Trifecta

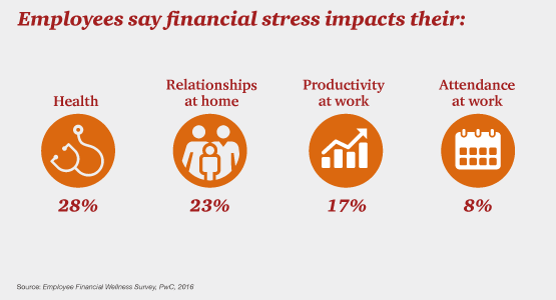

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic. Some of the signs of the financial un-wellness malaise are that, in 2016: 40% of employees find it difficult to meet their household expenses on time each month 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers

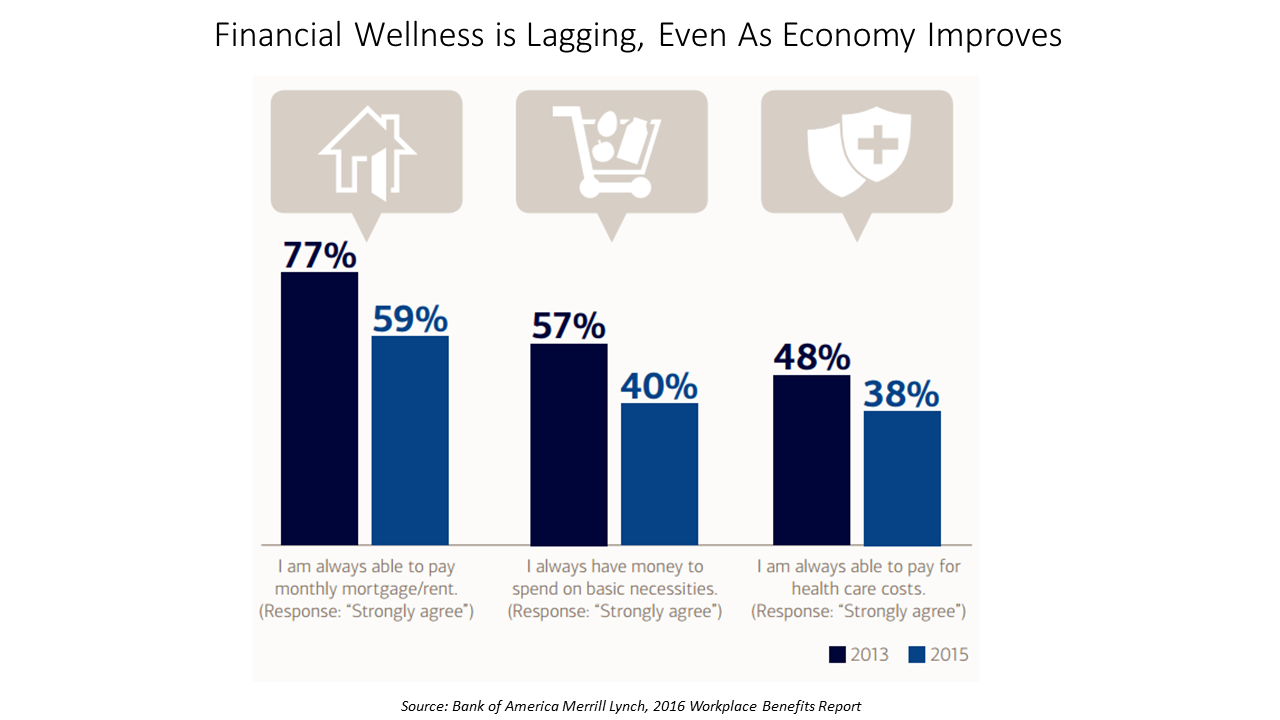

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

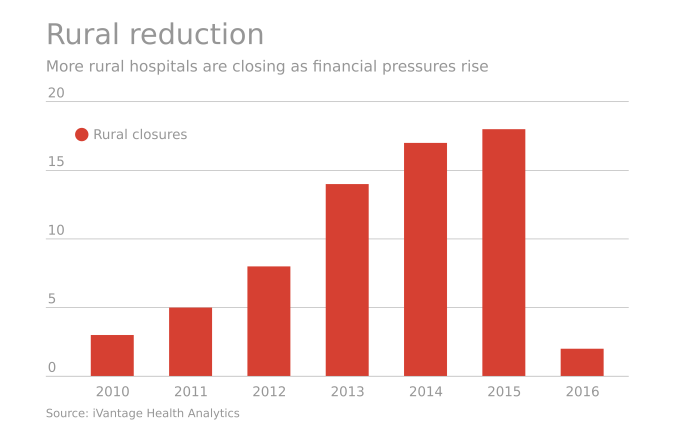

Rural Hospitals in America – Health Disparities, Hospital Disparities

Rural hospitals operating in the U.S. have a higher risk of mortality — closure — than other hospitals in America. The U.S. health care landscape is littered with examples of health disparities among the nation’s health citizens – for example, women’s lower access to heart-health care, Latinos’ higher rates of Type 2 Diabetes, and African-Americans’ greater risks of stroke, many cancers, maternal mortality, and many other causes of mortality and diminished health. A report from iVantage, Rural Relevance – Vulnerability to Value, documents the fiscally challenging environment for rural hospitals in America. There are at least 673 facilities at-risk of closure

Getting Beyond Consumer Self-Rationing in High-Deductible Health Plans

The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute. “What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will

The Average Price of a New Specialty Drug Exceeds Median U.S. Annual Income; and a Tweet from Pam Anderson

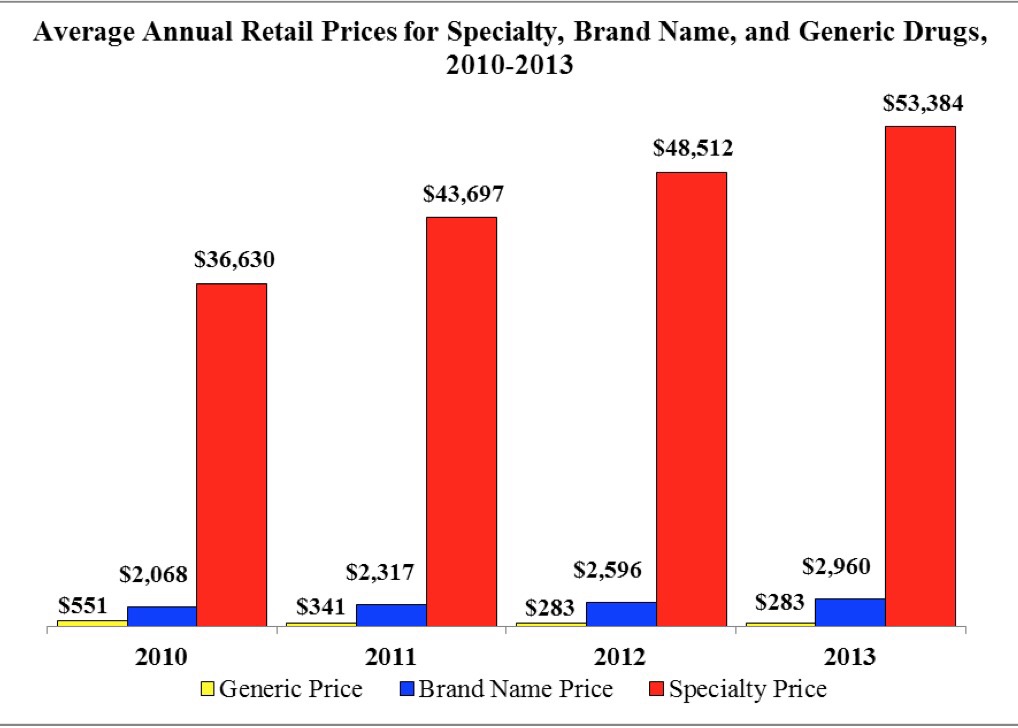

The average price for a specialty drug was $53,384 in 2013; the average household income was $52,250. Thus, even allocating 100% of a family’s annual earnings to pay for a drug wouldn’t stretch far enough to cover it in 2013, nor would it do so today in 2015. This sober health economic artifact comes from the latest Rx Price Watch Report from the AARP, detailing cost trends for prescription drugs across all segments — generics, brands and specialty drugs. Contrast, as well, the $53K for the average specialty drug with the median 2013 Social Security benefit payout of $15,526 and median Medicare

In 2016 Prescription Drugs Will Be The Fastest-Growing Component of Healthcare Costs

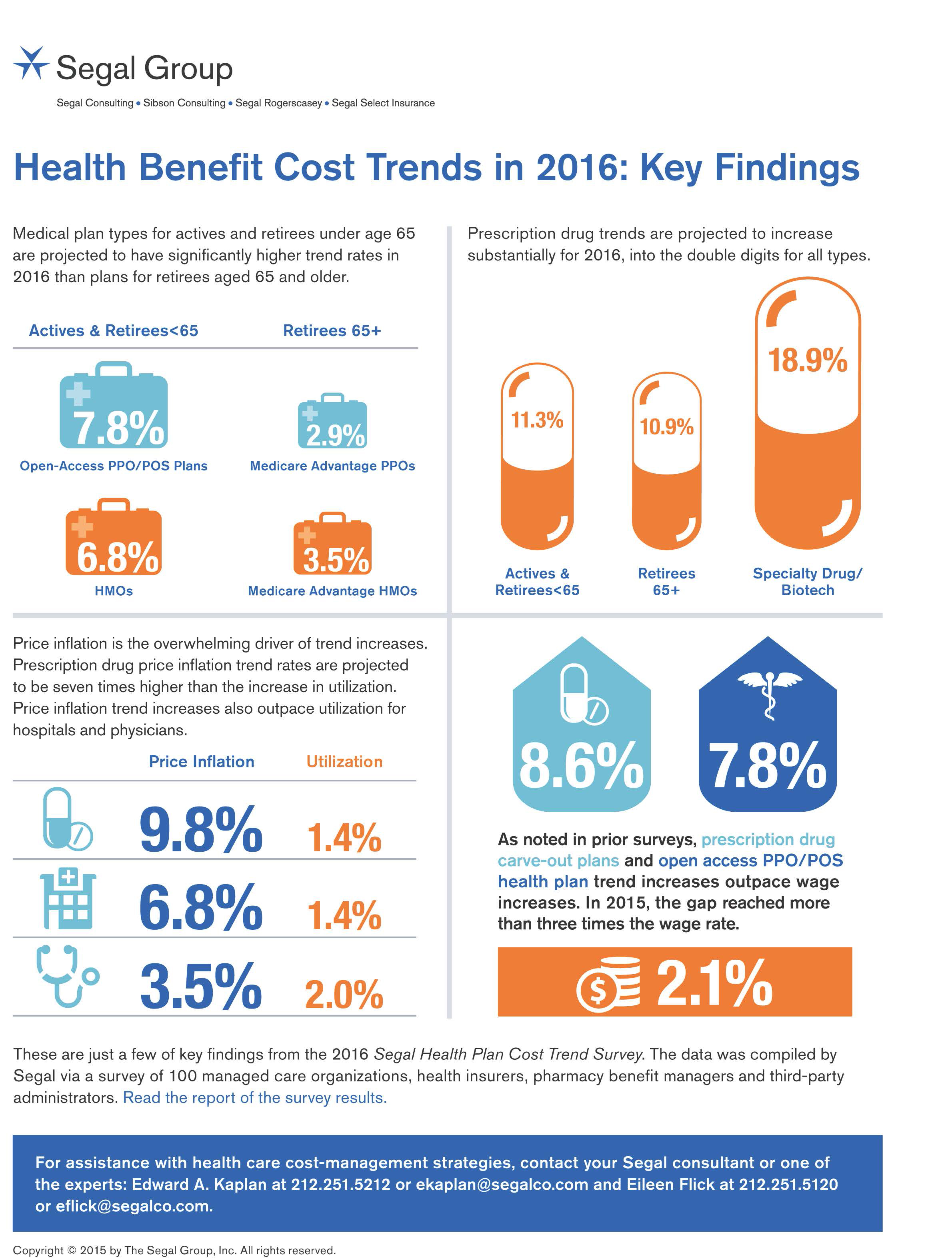

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015. By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies. Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in

A Company’s Healthy Bottom Line Requires Healthy Employees

“What is the meaning of health to our businesses?” asked Dr. Thomas Parry of the Integrated Benefits Institute (IBI) at a dinner last night, convened by the Pittsburgh Business Group on Health on the eve of the organization’s annual meeting being held today in Steel City. I was fortunate to attend the dinner and hear Dr. Parry speak; I will be addressing the meeting today on the topic, “Building a Better Health Consumer.” The IBI is researching the direct link between the top line of a healthy employee base and healthy workers’ impacts on the bottom line. A report will be

How value will impact the business of pharma

The top 25 life science companies grew a paltry 1% in 2014, and 70% of recent brand launches underperformed analysts’ expectations. The introductory page of a new report from KPMG describes, in a single sentence, the very challenging market environment for bio/life sciences: “The pharmaceutical industry is caught between a blockbuster-driven past and a future comprising precision medicine, curative therapies, and payment for outcomes. The years of consistent double-digit growth and unconstrained pricing power are fading into memory.” The assertively titled, “Change in pharma? Not optional,” offers 10 “integrated imperatives” for the pharma industry to follow to best respond to

Medicare Makes the Case for Outcomes, As Increasing Costs Loom

Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential. Health Affairs provides the big economic story played out by the forecasts of the Centers for Medicare and Medicaid Services (CMS) in National Health Expenditure Projections, 2014-24: Spending Growth Faster Than Recent Trends. The topline of the forecast is that health spending growth in the U.S. will annually average

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

Most Americans say drug prices are unreasonable and blame company profits

Three-quarters of U.S. adults say the cost of prescription drugs are unreasonable, and blame high medication prices set by profitable pharmaceutical companies according to the Kaiser Family Foundation Health Tracking Poll for June 2015. Profits made by drug companies are the #1 reason Americans cite among major factors that contribute to the price of prescription drugs (among 77% of people), followed by the cost of medical research (64%), the cost of marketing and advertising (54%), and the cost of lawsuits (49%). Regardless of the cost, 71% of people say that health insurance should “always” pay for high-cost drugs. At the same

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

How Growing Income Inequality Hurts Everyone, and Especially Our Health

Income inequality has increased in most developed countries, and especially in the U.S., according to the OECD’s report, In It Together: Why Less Inequality Benefits All, published in May 2015. The red arrow in the first chart shows where the U.S. ranks versus other developed nations in income inequality, which is defined as the wealth gap between rich and poor people. The U.S. has the greatest income inequality in the developed world. The second chart shows data for the U.S. on benefits provided to low-wage workers (the bottom 25% of wage earners) versus high-wage workers (the top 25% of earners).

Health care costs for a family of four in the U.S. reach $24,671 in 2015

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%. Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all

Supersize Rx: the impact of specialty drug spending and Hep C in 2014

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab. Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans. The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Capital investments in health IT moving healthcare closer to people

In recent weeks, an enormous amount of money has been raised by organizations using information technology to move health/care to people where they live, work, and play… This prompted one questioner at the recent ANIA annual conference to ask me after my keynote speech on the new health economy, “Is the hospital going the way of the dinosaur?” Before we get to the issue of possible extinction of inpatient care, let’s start with the big picture on digital health investment for the first quarter of 2015. Some $429 mm was raised for digital health in the first quarter of 2015,

No relief for consumers’ healthcare costs

U.S. consumers are spending $1 in every $5 dollars in the household on health care, and personal cost curves aren’t going to bend down anytime soon. Three surveys published in April confirm my financially unwell forecast for American health citizens. Kaiser Family Foundation’s April 2015 Health Tracking Poll finds most people say health care costs or going up or holding flat, shown in the first diagram from the KFF survey. U.S. adults told KFF the top health care priorities for the President and Congress should focus on health costs, such as: Making sure high-cost drugs for chronic conditions, such as HIV,

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Americans are spending $1 in $5 on health care

People in the U.S. are spending over 20.6% of their income on health care, according to data published by the U.S. Department of Commerce on March 2, 2015. This is up from 15% of personal income in 1990. Note the slope of this curve, moving up the X-Y axes from southwest to northwest. Now note the slope of the curves in the second chart, which illustrates consumer spending on other household goods and services: cars, housing, clothing, education, groceries, and eating outside of the home. Spending on these home budget line items remained relatively flat over the 25 year period 1990-2015,

Fiscal and physical fitness: TD Bank makes the link

What does a bank have to do with health? Plenty, if you listen to 70% of consumers who say that financial health has a positive impact on physical health. TD Bank released the Fiscal Fitness survey this week, finding that consumers make a direct connection between fiscal and physical fitness. That’s what we here at THINK-Health refer to as financial wellness. TD learned that 80% of consumers made a health resolution in the New Year and 69% of people made a financial resolution 40% of people want to save more and spend less, and 42% want to get healthy and

Telehealth is in demand, driven by consumer convenience and cost – American Well speaks

Evidence of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home. [For context, this survey defines “telehealth” as a remote consultation between doctor and patient]. Convenience drives most peoples’ interest in telehealth: saving time and money, not leaving home if feeling unwell, and “avoiding germs

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

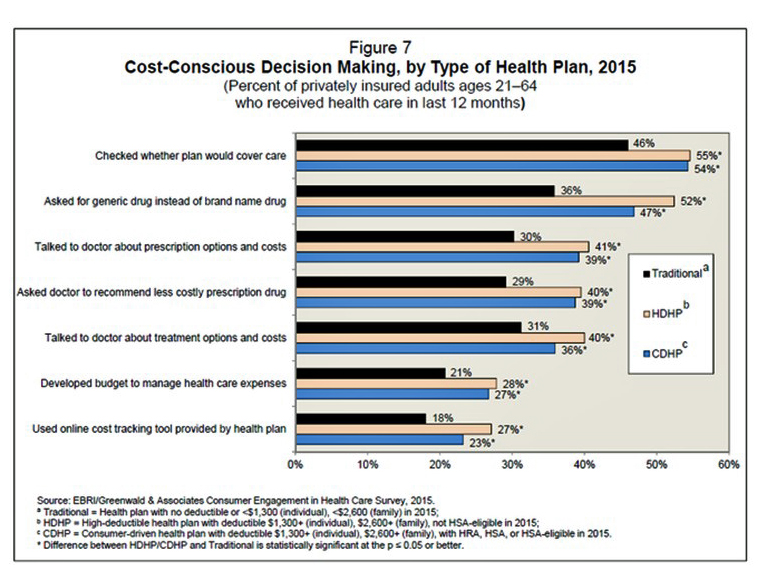

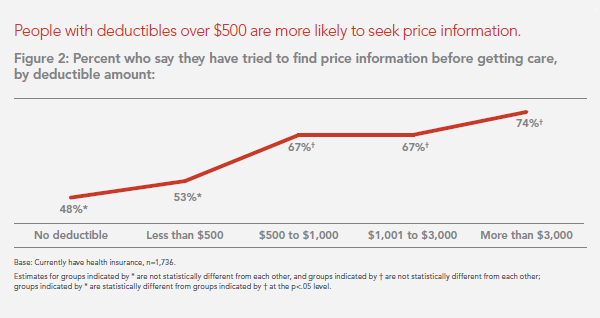

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

Trend-weaving the 2015 health care trends

‘Tis the season for annual health trendcasting, which is part of my own business model. Here’s a curated list of some of my favorite trend reports for health care in the new year, with my Hot Points in the conclusion, below, summarizing the most salient trends among them. TechCrunch’s Top 5 Healthcare Predictions for 2015: In this succinct forecast, Walmart grows its presence as a health plan, startups get more pharm-funding, hospitals channel peer-to-peer lending, Latinos emerge as a “most-desired” health care segment, and Amazon disrupts the medical supply chain. Experian 2015 Data Breach Forecast: Healthcare security breaches will be

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Live from the 11th annual Connected Health Symposium – Keeping Telehealth Real

Dr. Joseph Kvedar has led the Center for Connected Health for as long as I’ve used the word “telehealth” in my work – over 20 years. After two decades, the Center and other pioneers in connected health have evidence proving the benefits, ROI (“hard” in terms of dollars, and “soft” in terms of patient and physician satisfaction), and technology efficacy for connecting health. The 11th Annual Connected Health Symposium is taking place as I write this post at the Seaport Hotel in Boston, bringing health providers, payers, plans and researchers together to share best practices, learnings and evidence supporting the

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health care as a retail business

The health care industry is undergoing a retail transformation, according to Retail Reigns in Health Care: The rise of consumer power and its organization & workforce implications from Deloitte. Deloitte’s report published in October 2014 focuses on the health insurance business, which is newly-dealing with uninsured people largely unfamiliar with how to evaluate health plan options. This by any definition requires new muscles for both buyers and sellers on a health insurance exchange: new product access + uninformed consumer = retail challenge. Deloitte notes another supply and demand challenge, and that’s with the health insurance company workforce: while 93% of health

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

NephCure – a rare disease community that’s patient-powered

The burden of chronic kidney disease (CKD) is growing, with one in 10 U.S. adults having some level of CKD. End-stage renal disease (ESRD) is the last phase of CKD, when dialysis or an organ transplant are required. Nephrotic syndrome is one of the most common forms of CKD, and focal segmental glomerulosclerosis — FSGS — is the fastest-growing cause of nephrotic syndrome in children, and the second-leading cause of kidney failure in children. I spoke with Gigi Peterkin, a longtime colleague of mine who has helped guide my own digital footprint in health. Gigi is Global Director of Marketing at

Understanding the patient journey – using real-world data

It’s de rigueur for any organization marketing a product or service in health care to be “patient-centered” these days. “Patient engagement” and “health engagement” are phrases found on health conference agendas, whether pitching to attendees in pharma and life sciences, health IT, health insurance, or healthcare (to hospitals and physicians, alike). One paradigm for patient-centricity that’s more mature than most is IMS Health’s Patient Journey construct, which the data-driven company has been talking about since 2012. While the concept focused mainly on pharmaceutical marketing and medication adherence, it’s useful for all industry segments looking to motivate behavior change in health

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Blurred lines: health, pharmacy, food and care

In the past few weeks, several events bolster the reality that health and health care are in Blurred Lines mode. Not Robin Thicke Blurred Lines, mind you, but the Venn Diagram overlapping kind. Walmart launched real primary care clinics in South Carolina and Texas. These will provide services beyond urgent care, charging $4 a visit for company employees and $40 a visit for other people The U.S. Department of Agriculture issued a report promoting “nudges” to grocery shoppers enrolled in the Supplemental Nutrition Access Program (SNAP) to buy healthy foods Apple is talking with Cleveland Clinic, Johnson Hopkins, and Mount Sinai Medical

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Consumer healthcare spending is up, and “fun spending” is down

This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending. The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a