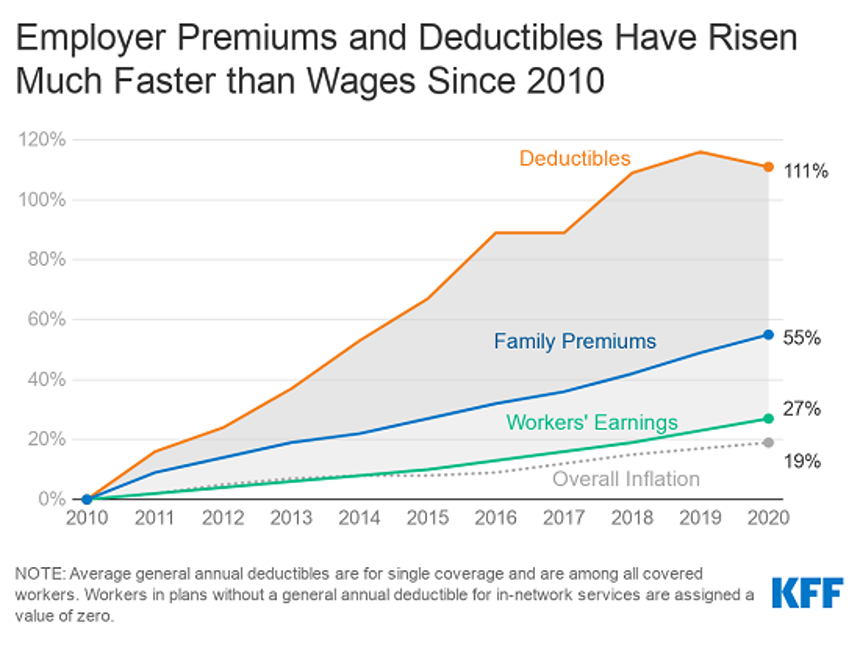

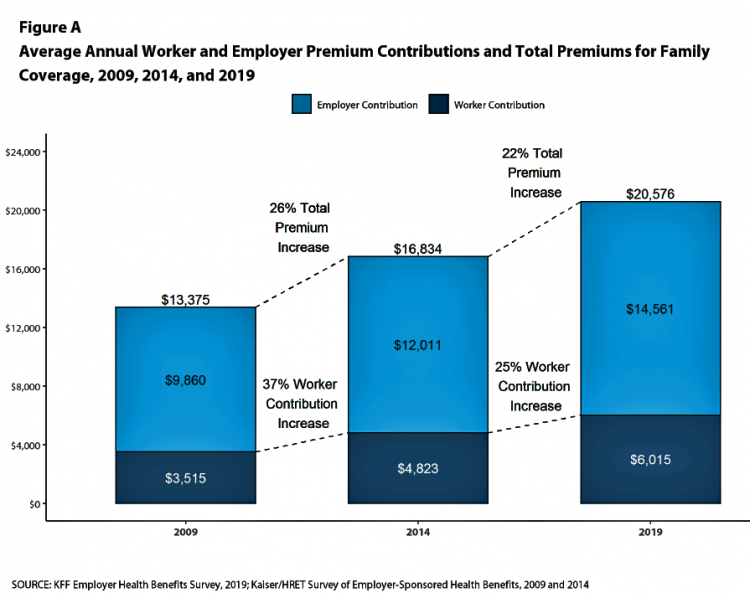

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

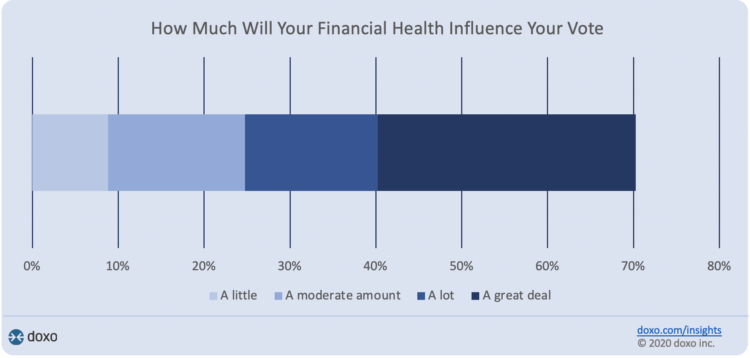

Financial Health Is On Americans’ Minds Just Weeks Before the 2020 Elections

Financial health is part of peoples’ overall health. As Americans approach November 3, 2020, the day of the real-time U.S. Presidential and down-ballot elections, personal home economics are front-of-mind. Twenty-seven days before the 2020 elections, 7 in 10 Americans say their financial health will influence their votes this year, according to the doxoINSIGHTS survey which shows personal financial health as a key voter consideration in the Presidential election. Doxo, a consumer payments company, conducted a survey among 1,568 U.S. bill-paying households in late September 2020. The study has a 2% margin of error. U.S. voters facing this year’s election are

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

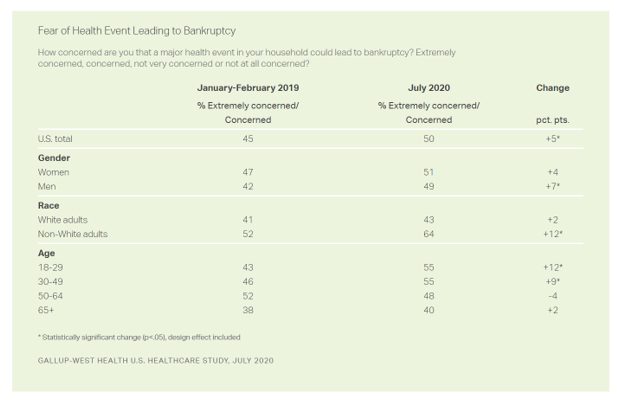

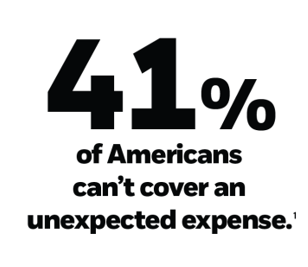

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

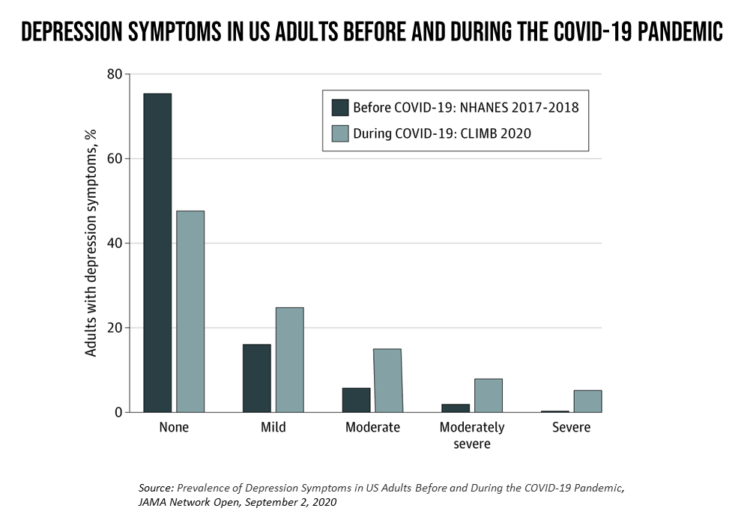

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

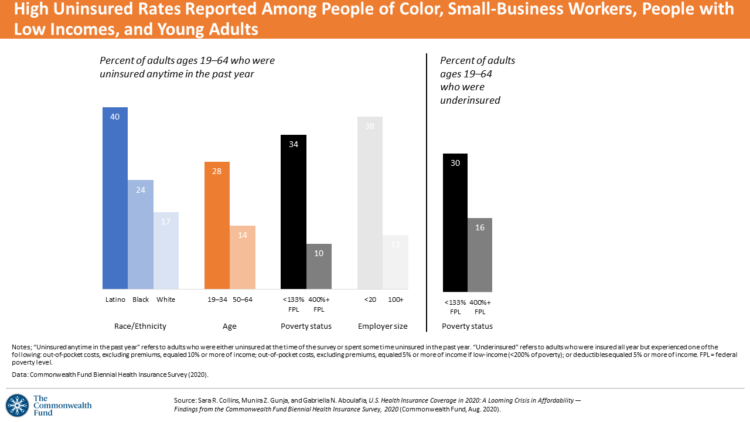

Health Insurance Affordability in the Time of the Coronavirus Pandemic

The coronavirus pandemic has revealed many flaws in the U.S. healthcare system, first and foremost the nation’s patchwork public health infrastructure and health inequities in mortality rates due to COVID-19. The Commonwealth Fund‘s biennial report, published as the pandemic continues into and beyond the third quarter of 2020, sheds light on another weakness in U.S. healthcare: the cost of health insurance relative to working Americans’ relatively flat incomes. I explored the details of this study in a post titled Health Insurance Affordability: A Call-to-Action for Healthcare Industry Stakeholders in the Pandemic, published on the Medecision Liberation blog site. The survey

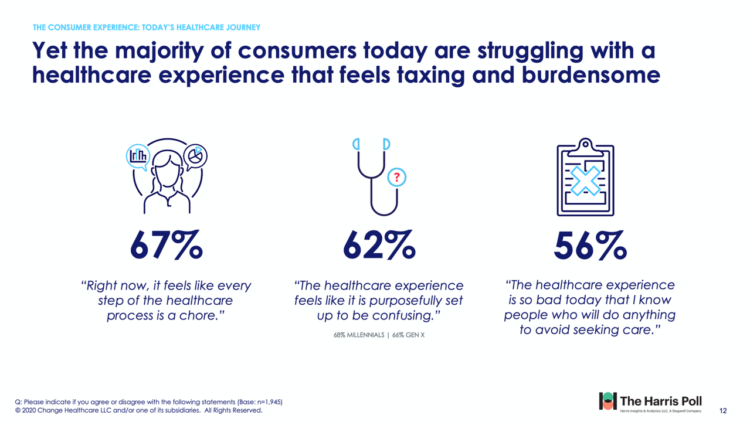

The Unbearable Heaviness of Healthcare in America – the Change Healthcare/Harris Poll

The phrase, “burden of health care,” has two usual meanings: one, to do with the massive chronic care burden, and the other, involving costs. There’s a third area of burden in U.S. health care — the onerous patient experience in finding and accessing care, assessed in the 2020 Change Healthcare – Harris Poll Consumer Experience Index. Two in three U.S. consumers feel like “every step of the healthcare process is a chore.” That burdensome patient experience leads to one in two people in America avoiding seeking care, the poll found. That’s not just self-rationing health care due to costs, but due

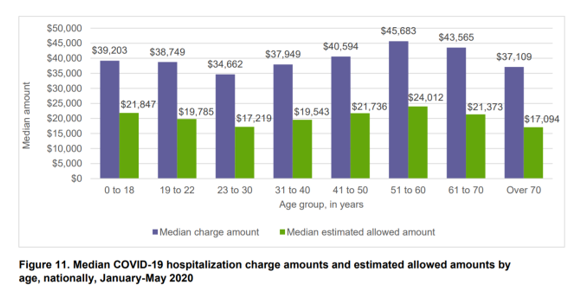

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

How Covid-19 Can Inspire Tech-Enabled Value-Based Health Care in a Cash-Constrained America

“The COVID-19 pandemic…has highlighted like never before the pitfalls of paying for healthcare based on the number of patients seen and services rendered,” a Modern Healthcare article asserted in mid-June 2020. In other words, the U.S. health care financing regime of volume-based payment didn’t fare well as millions of patients postponed or cancelled procedures and visits for fear of contracting the virus in the halls, offices and clinics of hospitals and doctor’s offices. “Just imagine if you were 100% fee-for-service,” commented Dr. Fuad Sheriff, a primary care physician whose practice is based on capitated payments. “You would have been dead

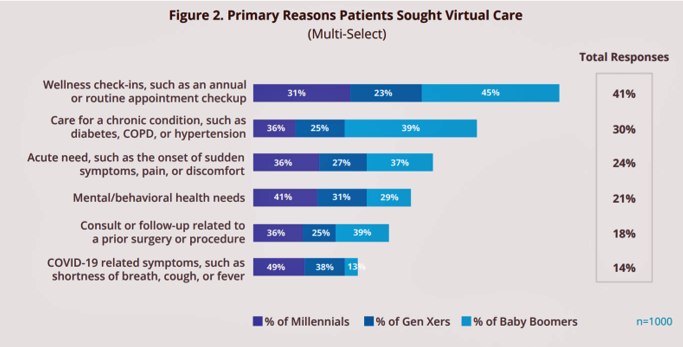

Most Virtual Care Consumers, Satisfied With Visits in the COVID Era, Expect It for Future Care

Within days of the coronavirus pandemic emerging in the U.S., health care providers set up virtual care arrangements to convene with patients. Three months into the COVID-19 crisis, how have patients felt about these telehealth visits? In Patient Perspectives on Virtual Care, Kyruus answers this question based on an online survey of 1,000 patients 18 years of age and older, conducted in May 2020. Each of these health consumers had at least one virtual care visit between February and May 2020. The key findings were that: Engaging in a virtual visit was a new-new thing for 72% of people Patients’

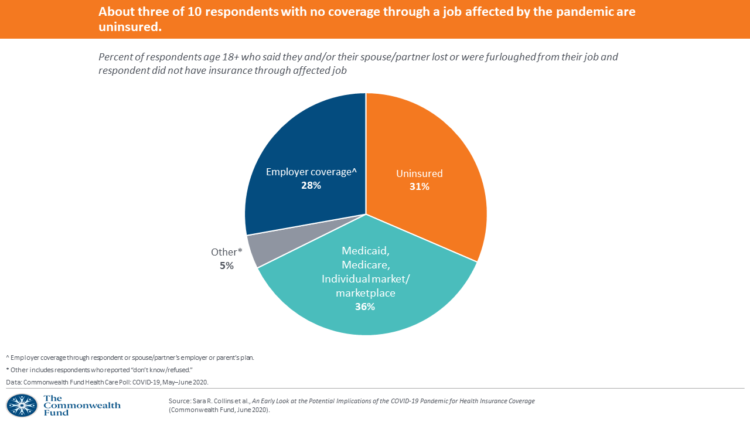

Health Insurance and Demand for Masking, Testing and Contact Tracing – New Data from The Commonwealth Fund

The coronavirus pandemic occasioned the Great Lockdown for people to shelter-at-home, tele-work if possible, and shut down large parts of the U.S. economy considered “non-essential.” As health insurance for working-age people is tied to employment, COVID-19 led to disproportionate loss of health plan coverage especially among people earning lower incomes, as well as non-white workers, explained in the Commonwealth Fund Health Care Poll: COVID-19, May-June 2020. The Commonwealth Fund commissioned interviews with 2,271 U.S. adults 18 and over between 13 May and 2nd June 2020 for this study. The survey has two lenses: first, on health insurance coverage among working

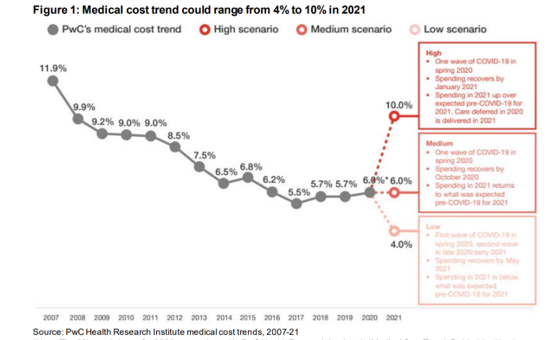

What Will Healthcare Costs Be After COVID? PwC Looks Behind the 2021 Numbers

Whether healthcare spending in 2021 increases by double-digits or falls by one-third directly depends on how the coronavirus pandemic will play out over the rest of 2020, based on PwC’s annual report on medical cost trends for 2021. The three cost scenarios are based on assumptions shown in the fine print on the first chart: The medium scenario, a sort of “return to normal” where medical trend could stay even at 6.0%, equal to the 2020 trend. This assumes that healthcare spending recovers by October 2020 as patients return to hospitals and doctors’ offices for regular care patterns. In 2021,

How Can Healthcare Bring Patients Back? A Preview of Our ATA Session, “Onward Together” in the COVID Era

Today kicks off the first all-virtual conference of the ATA, the American Telemedicine Association. ATA’s CEO Ann Mond Johnson and team turned on a dime over the past few months, migrating the already-planned live conference scheduled in early May to this week, all online. I’ll be midwifing a panel this afternoon at 440 pm Eastern time, initially focused on how health care can garner patient loyalty. That theme was given to us in the fourth quarter of 2019, when initial planning for ATA 2020 had begun. What a difference a few months make. Not only has ATA pivoted to an

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

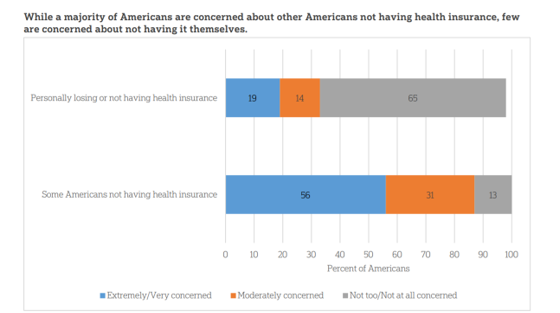

Americans’ Concerns About the US Healthcare System Loom Larger Than Worries About Their Own Care

The coronavirus pandemic has further opened the kimono of the U.S. healthcare system to Americans: four months into the COVID-19 outbreak, most consumers (62%) of people in the U.S. are more concerned about other people not having access to high quality health care versus themselves. This is a 16 point increase in concern in May 2020 compared with the response to the same question asked in February in a poll conducted by the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research (the AP-NORC Center). The AP-NORC Poll found more of this

Trust My Doctor and Fear the Office: The Telehealth Opportunity in and Beyond the COVID-19 Pandemic

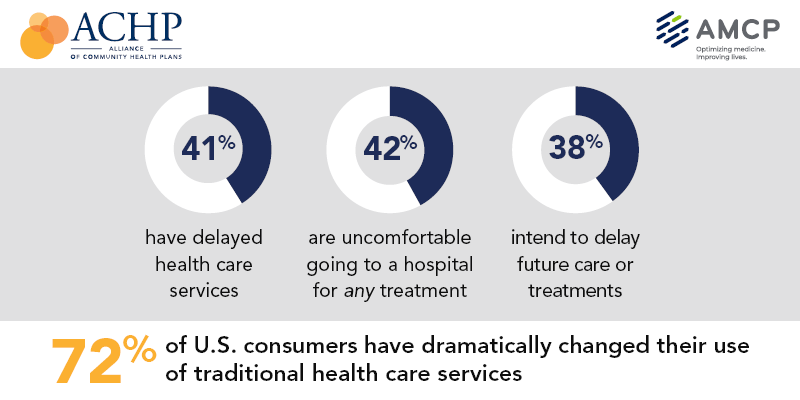

Doctors maintain their top status as U.S. patients’ most-trusted source of coronavirus information. However, as patients continue to be concerned about exposure to COVID-19, 3 in 5 are concerned about being at-risk to the virus in their doctor’s office, according to research from the Alliance of Community Health Plans (ACHP) and AMCP, the Academy of Managed Care Pharmacy. Patients’ concerns of COVID-19 risks have led them to self-ration care in the following ways: 41% have delayed health care services 42% felt uncomfortable going to a hospital for any medical treatment 45% felt uncomfortable using an urgent care or walk-in clinic,

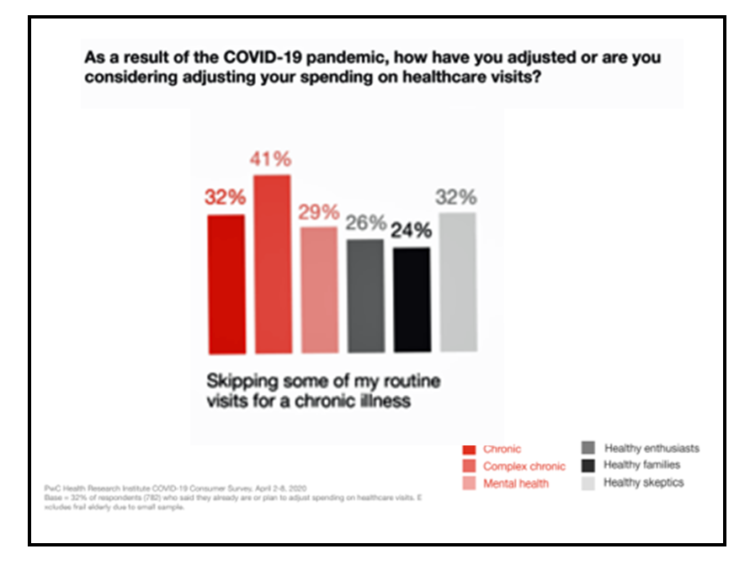

Health Care In the COVID-19 Era – PwC Finds Self-Rationing of Care and Meds Especially for Chronic Care

Patients in the U.S. are self-rationing care in the era of COVID-19 by cutting spending on health care visits and prescription drugs. The coronavirus pandemic’s impact on health consumers’ spending varies depending on whether the household is generally a healthy family unit, healthy “enthusiasts,” dealing with a simple or more complex chronic conditions, or managing mental health issues. PwC explored how COVID-19 is influencing consumers’ health care behaviors in survey research conducted in early April by the Health Research Institute. The findings were published in a May 2020 report, detailing study findings among 2,533 U.S. adults polled in early April

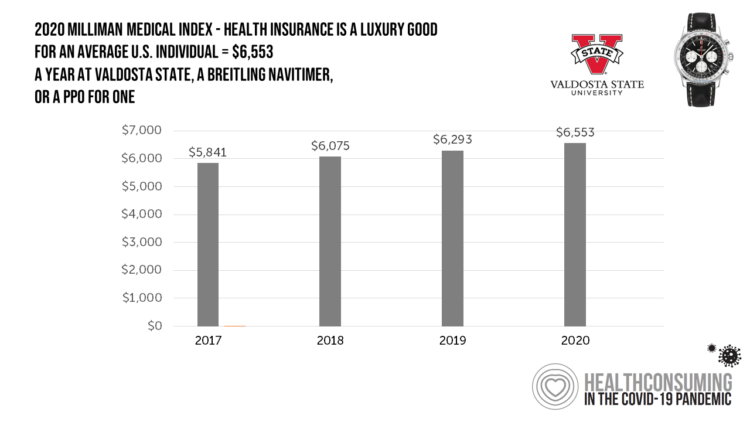

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

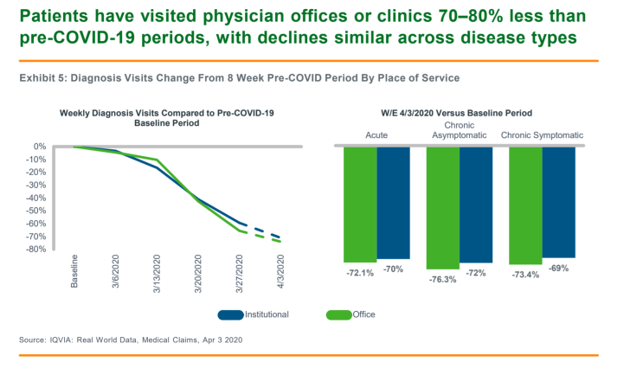

How COVID-19 Has Re-Shaped Health Care Delivery So Far

COVID-19 is re-shaping health care in America across many dimensions. In Shifts in Healthcare Demand, Delivery and Care During the COVID-19 Era, IQVIA presents a multi-faceted profile of the early impacts of the pandemic on U.S. health care. In the report, published in April 2020, IQVIA mined the company’s many data bases that track real-time data, including medical claims, flu data, sales data, oncology medical and pharmacy claims, formularies, among other sources. Top-line, IQVIA spotted the following key shifts in U.S. health care since the start of the coronavirus pandemic: Patients’ use of health services Impacts on medicine use, influenced

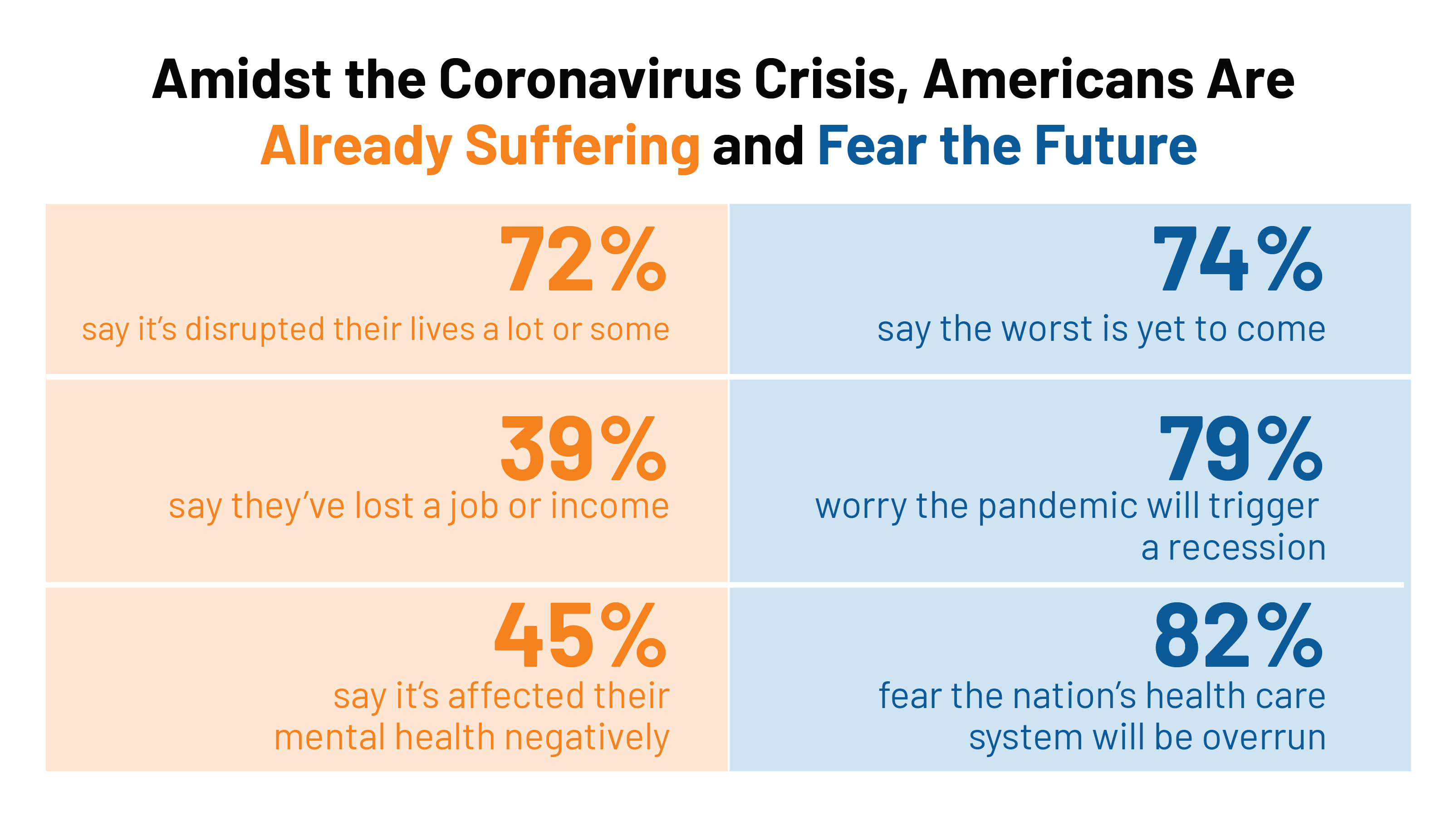

COVID-19 Reveals Urgent Need for Universal Mental Health Care

The coronavirus pandemic has dramatically disrupted every aspect of life for everyday people, ratcheting up stress across all families: The mandate to #StayHome, being physically distanced from work colleagues, beloved family and friends, and our community touchpoints The fear and risk-management of contracting the COVID-19 virus, for ourselves and our families The economic shock or either losing our jobs, seeing our savings eroding from 401(k) plans, losing our health insurance, or all of the above If we’ve kept our jobs in the pandemic, the novel work environment at-home — with children afoot, some of whom are now forced to be

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

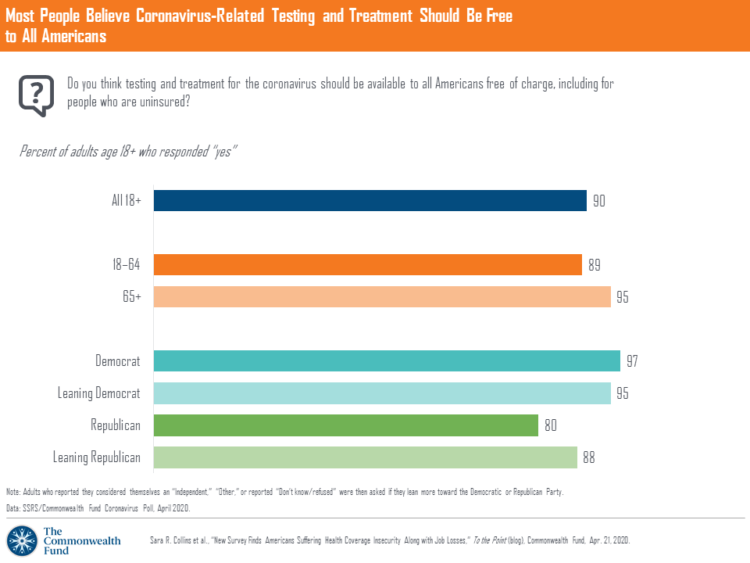

The Patient-as-Payor in the Coronavirus Pandemic

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

Wistful Thinking: The National Health Spending Forecast In a Land Without COVID-19

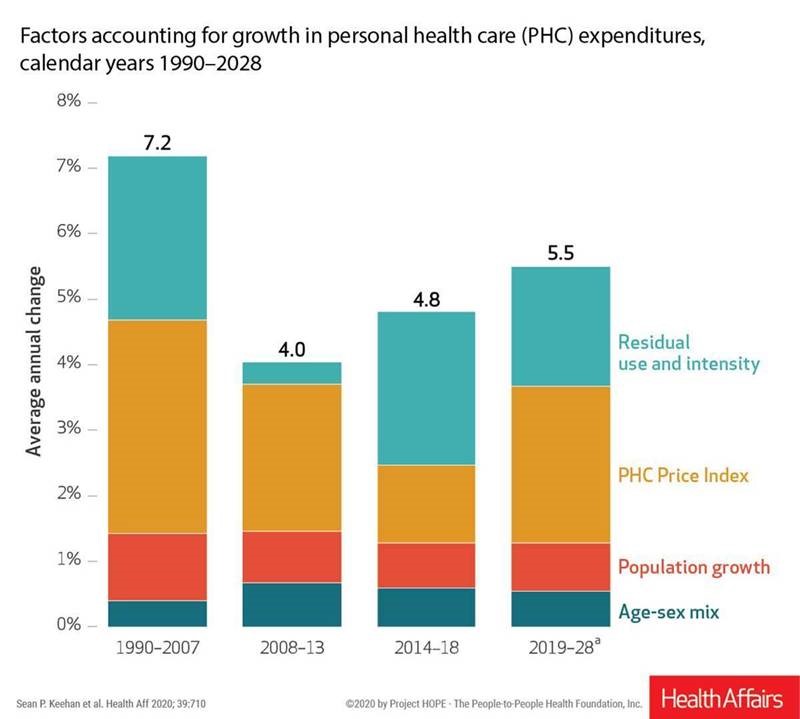

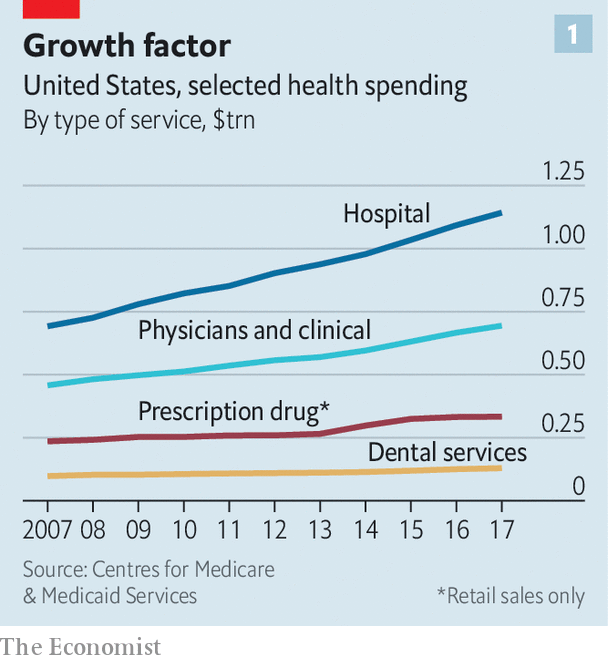

U.S. health care spending will grow to 20% of the national economy by 2028, forecasted in projections pre-published in the April 2020 issue of Health Affairs, National Health Expenditure (NHE) Projections. 2019-28: Expected Rebound in Prices Drives Rising Spending Growth. NHE will grow 5.4% in the decade, the model expects. But…what a difference a pandemic could make on this forecast. This year, NHE will be $3.8 trillion, growing to $6.2 trillion in 2028. Hospital care spending, the largest single component in national health spending, is estimated at $1.3 trillion in 2020. These projections are based on “current law,” the team

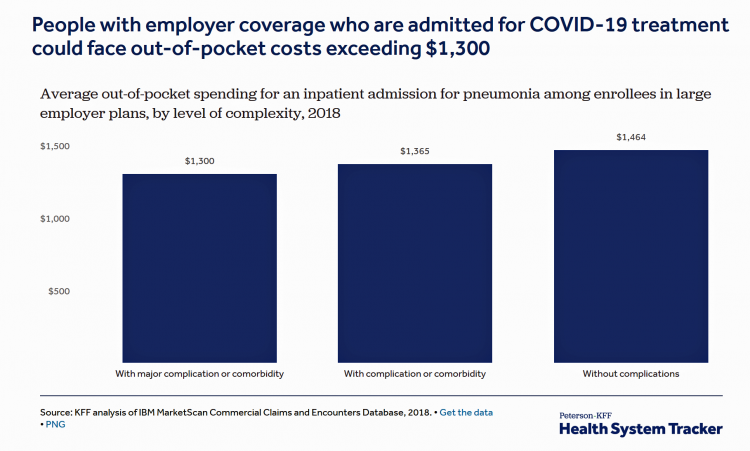

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

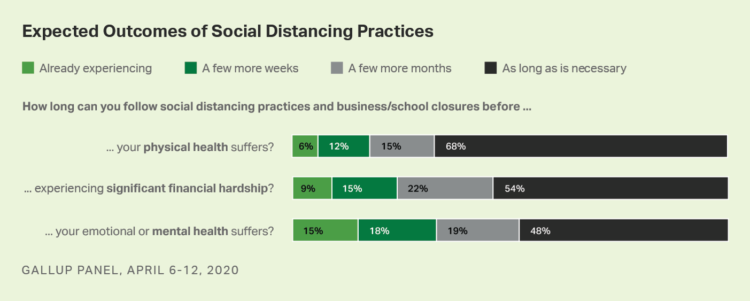

Lockdown Economics for U.S. Health Consumers

The hashtag #StayHome was ushered onto Twitter by 15 U.S. national healthcare leaders in a USA Today editorial yesterday. The op-ed co-authors included Dr. Eric Topol, Dr. Leana Wen, Dr. Zeke Emanuel, Dr. Jordan Shlain, Dr. Vivek Murthy, Andy Slavitt, and other key healthcare opinion leaders. Some states and regions have already mandated that people stay home; at midnight last night, counties in the Bay Area in California instituted this, and there are tightening rules in my area of greater Philadelphia. UBS economist Paul Donovan talked about “Lockdown Economics” in his audio commentary today. Paul’s observations resonated with me as

Telehealth and COVID-19 in the U.S.: A Conversation with Ann Mond Johnson, ATA CEO

Will the coronavirus inspire greater adoption of telehealth in the U.S.? Let’s travel to Shanghai, China where, “the covid-19 epidemic has brought millions of new patients online. They are likely to stay there,” asserts “The smartphone will see you now,” an article in the March 7th 2020 issue of The Economist. The article returns to the advent of the SARS epidemic in China in 2003, which ushered in a series of events: people stayed home, and Chinese social media and e-commerce proliferated. The coronavirus spawned another kind of gift to China and the nation’s health citizens: telemedicine, the essay explains. A

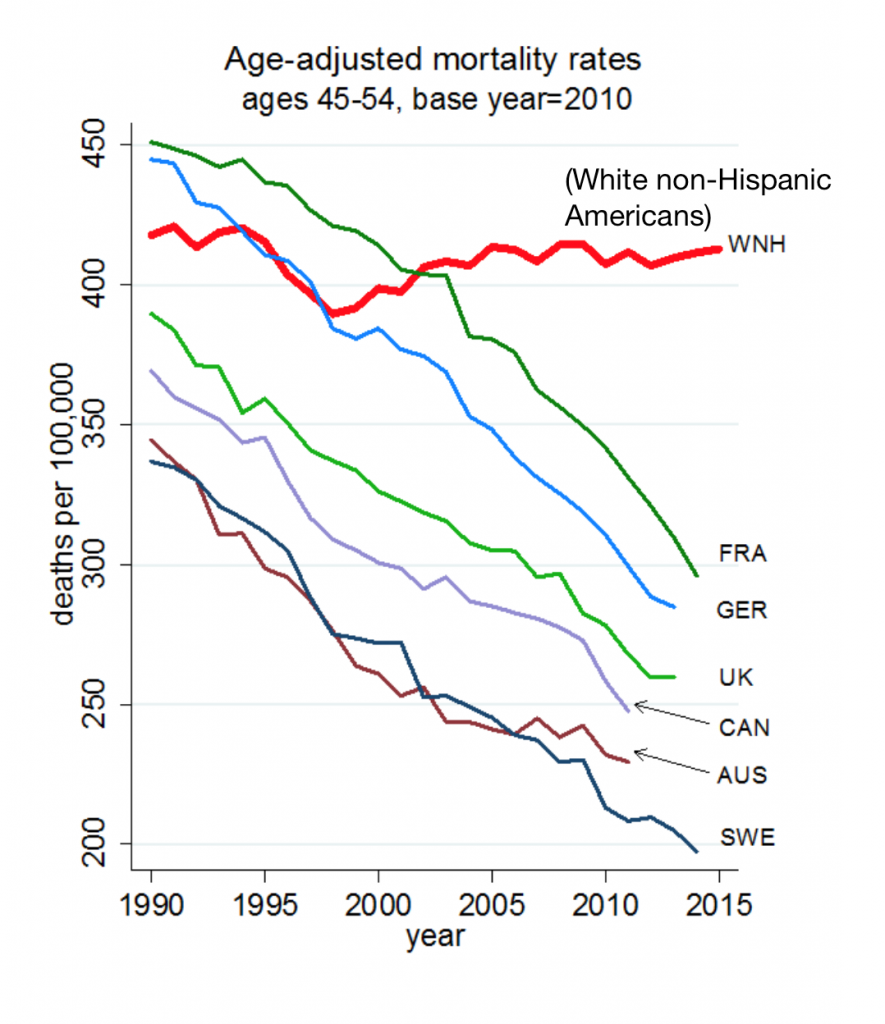

The Book on Deaths of Despair – Deaton & Case On Education, Pain, Work and the Future of Capitalism

Anne Case and Angus Deaton were working in a cabin in Montana the summer of 2014. Upon analyzing mortality data from the U.S. Centers for Disease Control, they noticed that death rates were rising among middle-aged white people. “We must have hit a wrong key,” they note in the introduction of their book, Deaths of Despair and the Future of Capitalism. This reversal of life span in America ran counter to a decades-long trend of lower mortality in the U.S., a 20th century accomplishment, Case and Deaton recount. In the 300 pages that follow, the researchers deeply dive into and

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

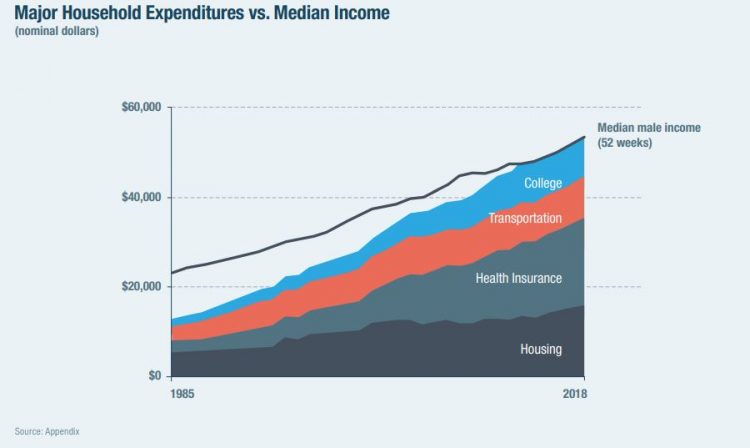

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

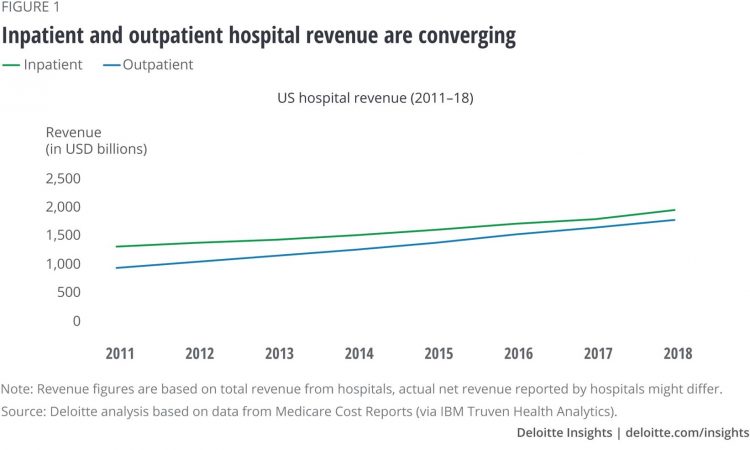

Outpatient is the New Inpatient – The Future of Hospitals in America

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone? The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their

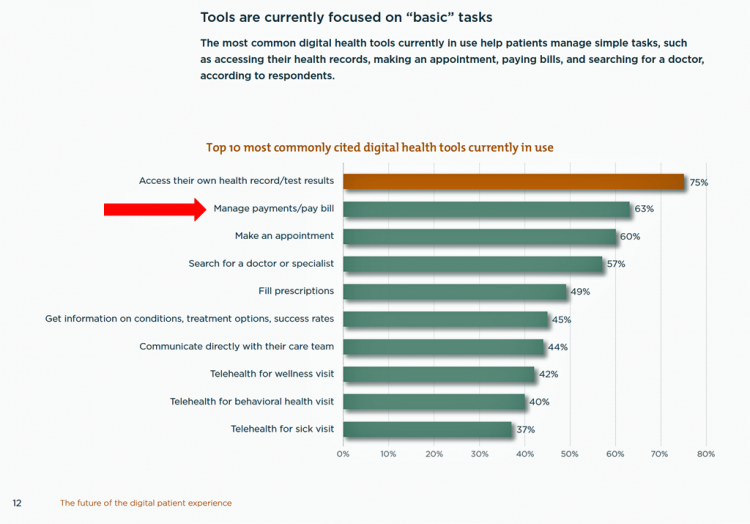

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

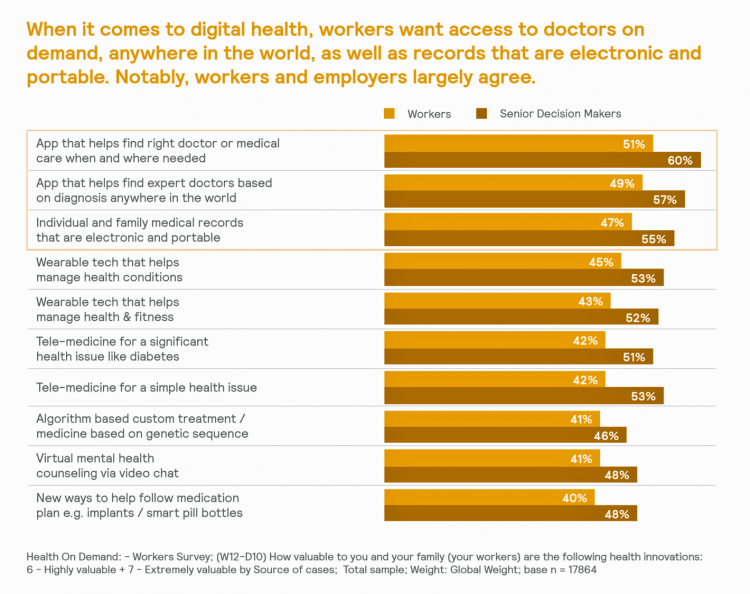

Most Workers and their Employers Want to Receive Digital Healthcare On-Demand

Most employers and their workers see the benefits of digital health in helping make health care more accessible and lower-cost, according to survey research published in Health on Demand from Mercer Marsh Benefits. Interestingly, more workers living in developing countries are keener on going digital for health than people working in wealthier nations. Mercer’s study was global, analyzing companies and their employees in both mature and growth economies around the world. In total, Mercer interviewed 16,564 workers and 1,300 senior decision makers in companies. The U.S. sample size was 2,051 employees and 100 decision makers. There’s a treasure trove of insights

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

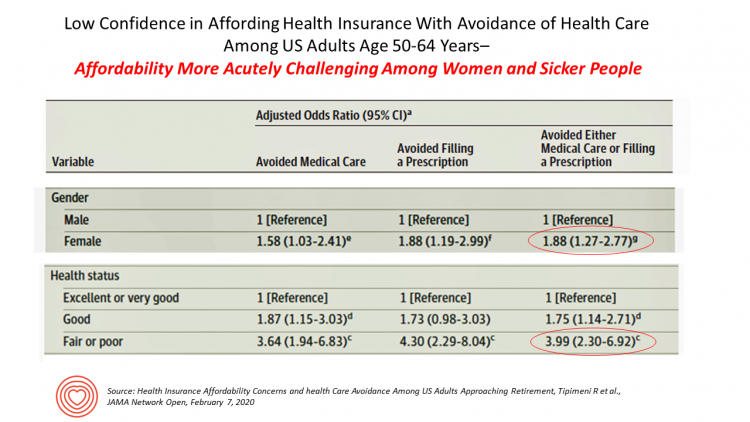

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

Come Together – A Health Policy Prescription from the Bipartisan Policy Center

Among all Americans, the most popular approach for improving the health care in the U.S. isn’t repealing or replacing the Affordable Care Act or moving to a Medicare-for-All government-provided plan. It would be to improve the current health care system, according to the Bipartisan Policy Center’s research reported in a Bipartisan Rx for America’s Health Care. The BPC is a truly bipartisan organization, co-founded by Former Democratic Senate Majority Leaders Tom Daschle and George Mitchell, and Former Republican Senate Majority Leaders Howard Baker and Bob Dole. While this political week in America has revealed deep chasms between the Dems and

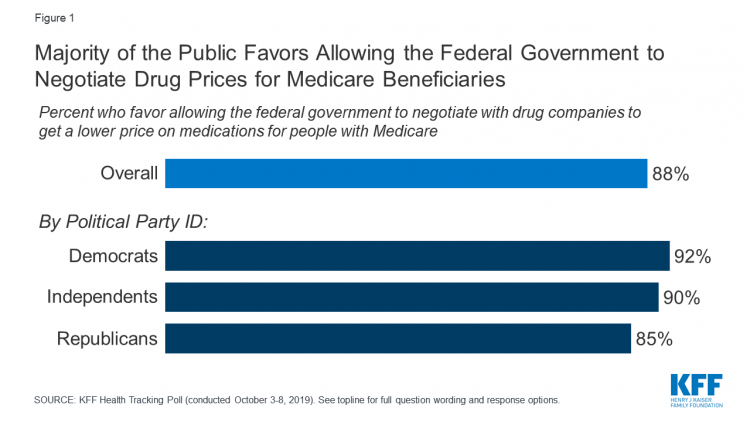

The State of the Union for Prescription Drug Prices

Tonight, President Trump will present his fourth annual State of the Union address. This morning we don’t have a transcript of the speech ahead of the event, but one topic remains high on U.S. voters’ priorities, across political party – prescription drug prices. Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top

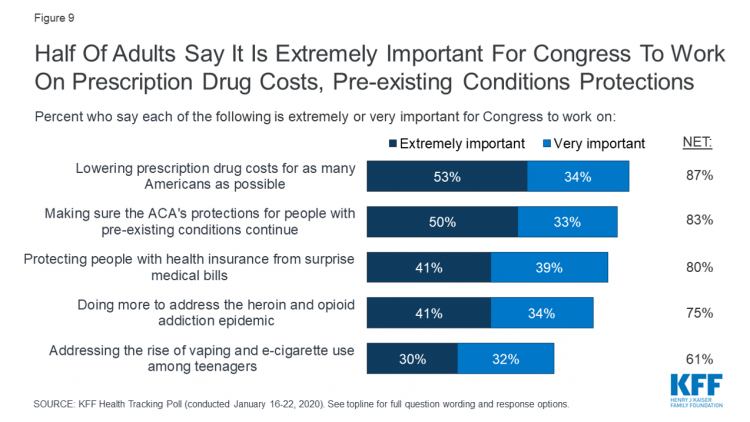

A Uniting Issue in the United States is Lowering Prescription Drug Costs

Health care continues to be the top-ranked voting issue in the U.S. looking to the November 2020 Presidential and Congressional elections. The Kaiser Family Foundation conducts the monthly poll which gauges U.S. adults’ perspectives on health care, and this month’s January 2020 Kaiser Health Tracking Poll explores Americans’ views on broad healthcare reform plans and specific medical policy issues. Overall, Americans point to prescription drug costs and the preservation of the Affordable Care Act’s protections for people with pre-existing conditions, the first chart tells us. Third and fourth on voters’ minds are protecting patients from surprise medical bills and better

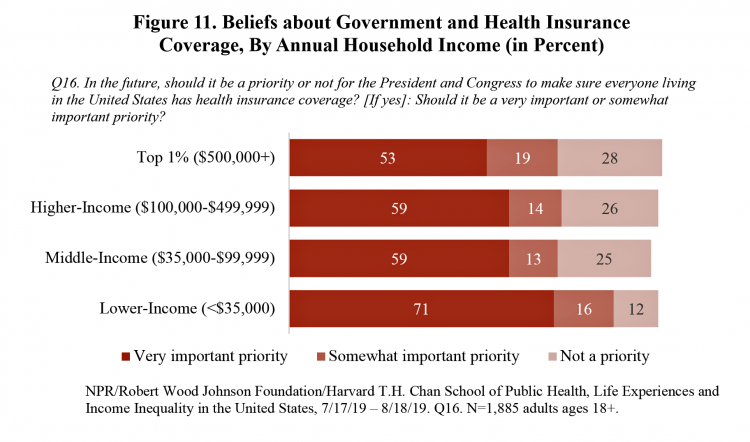

Most Americans Regardless of Income Say It’s Unfair for Wealthier People to Get Better Health Care

In America, earning lower or middle incomes is a risk factor for having trouble accessing health care and/or paying for it. But most Americans, rich or not, believe that it’s unfair for wealthier people to get better health care, according to a January 2020 poll from NPR, the Robert Wood Johnson Foundation and Harvard Chan School of Public Health, Life Experiences and Income Equality in the United States. The survey was conducted in July and August 2019 among 1,885 U.S. adults 18 or older. Throughout the study, note the four annual household income categories gauged in the research: Top 1%

The Heart of Health at CES 2020 – Evidence & Innovation Bridge Consumers and Doctors

The digital health presence at CES 2020 is the fastest-growing segment of consumer technologies at the Show this year, increasing by 25% over 2019. Heart-focused technologies are a big part of that growth story. In fact, in our search for devices and tools underpinned with clinical proof, evidence is growing for consumer-facing technology for heart-health, demonstrated by this year’s CES. Wrist-worn devices, digital therapeutics, patient engagement platforms, pharma and health plans converged at this year’s CES, with the professional association “blessing” of the American College of Cardiology who granted a continuing medical education credit for physicians attending a one-day “disruptive

“Digital Health Is An Ecosystem of Ecosystems” – CTA’s 2020 Trends to Watch Into the Data Age

In CTA’s 2020 Consumer Tech Forecast launched yesterday at Media Day 1 at CES, Steve Koenig VP of Research, said that, “digital health is an ecosystem of ecosystems.” Health, medical and wellness trends featured large in the forecast, which brought together key trends for 5G, robotics, voice tech, AR/VR/XR, and the next iteration of IoT — which Steve said will still be called “IoT,” but in this phase will morph into the “Intelligence of Things.” That speaks to Steve’s phrase, “ecosystem of ecosystems,” because that’s not just “digital” health — that’s now the true nature of health/care, and what is

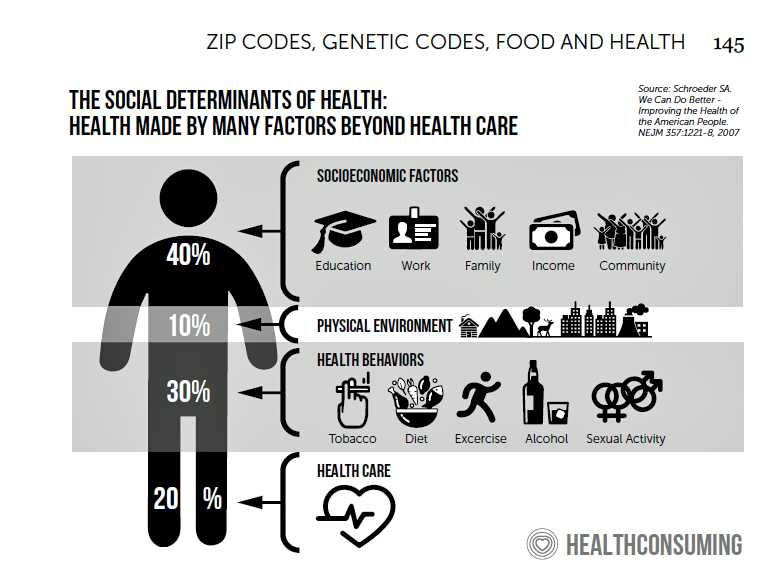

The 2020 Social Determinants of Health: Connectivity, Art, Air and Love

Across the U.S., the health/care ecosystem warmly embraced social determinants of health as a concept in 2019. A few of the mainstreaming-of-SDoH signposts in 2019 were: Cigna studying and focusing in on loneliness as a health and wellness risk factor Humana’s Bold Goal initiative targeting Medicare Advantage enrollees CVS building out an SDOH platform, collaborating with Unite US for the effort UPMC launching a social impact program focusing on SDoH, among other projects investing in social factors that bolster public health. As I pointed out in my 2020 Health Populi trendcast, the private sector is taking on more public health

Medicare Members Are Health Consumers, Too – Our AHIP Talk About Aging, Digital Immigrants, and Personalizing Health/Care

As Boomers age, they’re adopting mobile and smart technology platforms that enable people to communicate with loved ones, manage retirement investment portfolios, ask Alexa to play Frank Sinatra’s greatest hits, and manage prescription refills from the local grocery store pharmacy. Last week, the Giant Eagle grocery chain was the first pharmacy retailer to offer a new medication management skill via Alexa. That program has the potential to change our Medicare members manage meds at home to ensure better adherence, supporting better health outcomes and personal feelings of efficacy and control. [As an aside, consumers really value pharmacies embedded in grocery

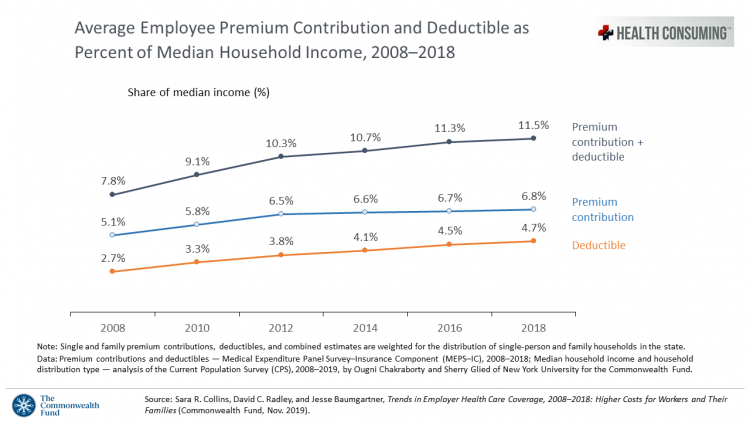

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Being Transparent About Healthcare Transparency – My Post on the Medecision Blog

With new rules emanating from the White House this month focusing on health care price transparency, health care costs are in the spotlight at the Centers for Medicare and Medicaid Services. A hospital transparency mandate will go into effect in January 2021 as a final rule, and a second rule with a focus on health plans and friendly explanations-of-benefits will receive comments in the Federal Register until January 14, 2020. As patients continue to grow muscles as payors and health consumers, transparency is one key to enabling people to “shop” for those health care and medical products and services that

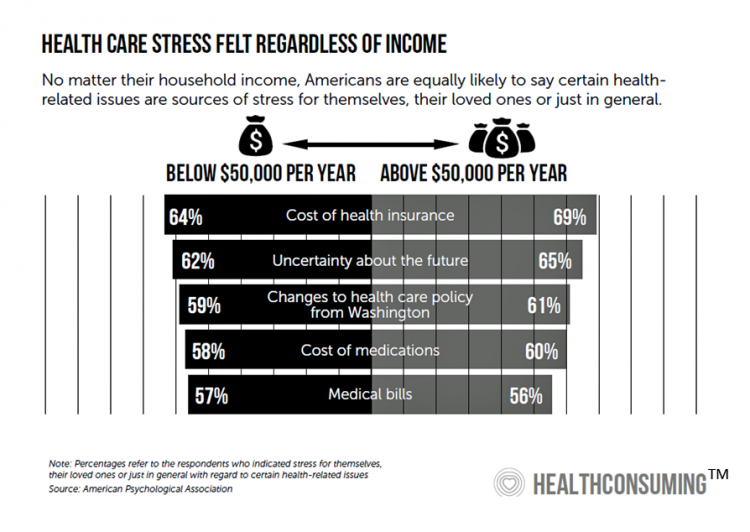

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

The Link Between Wellness & Wealth Is Powerful for Everyone – and Especially Women

In the U.S., the link between wellness and wealth, money and health, is strong and common across people, young and old. But the impacts of money on health, well-being, and life choices varies across the ages, based on a study from Lively, a company that builds platforms for health savings accounts. The first chart illustrates that health care costs challenge people in many ways: the most obvious health care cost problems prevent people from saving more for retirement or paying down debt. Eight in 10 Americans concur that rising health care costs challenge their ability to save for retirement. Beyond the

Thinking About Health Care One Year From the 2020 Presidential Election

Today is 4th November 2019, exactly one year to the day that Americans can express their political will and cast their vote for President of the United States. Health care will be a key issue driving people to their local polling places, so it’s an opportune moment to take the temperature on U.S. voters’ perspectives on healthcare reform. This post looks at three current polls to gauge how Americans are feeling about health care reform 365 days before the 2020 election, and one day before tomorrow’s 2019 municipal and state elections. Today’s Financial Times features a poll that found two-thirds

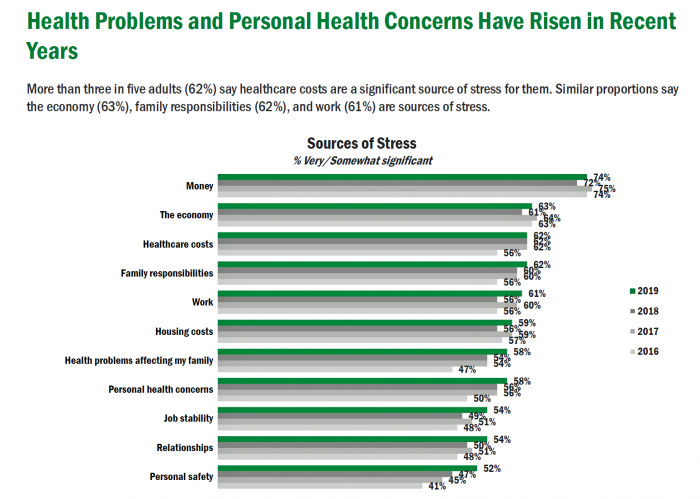

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

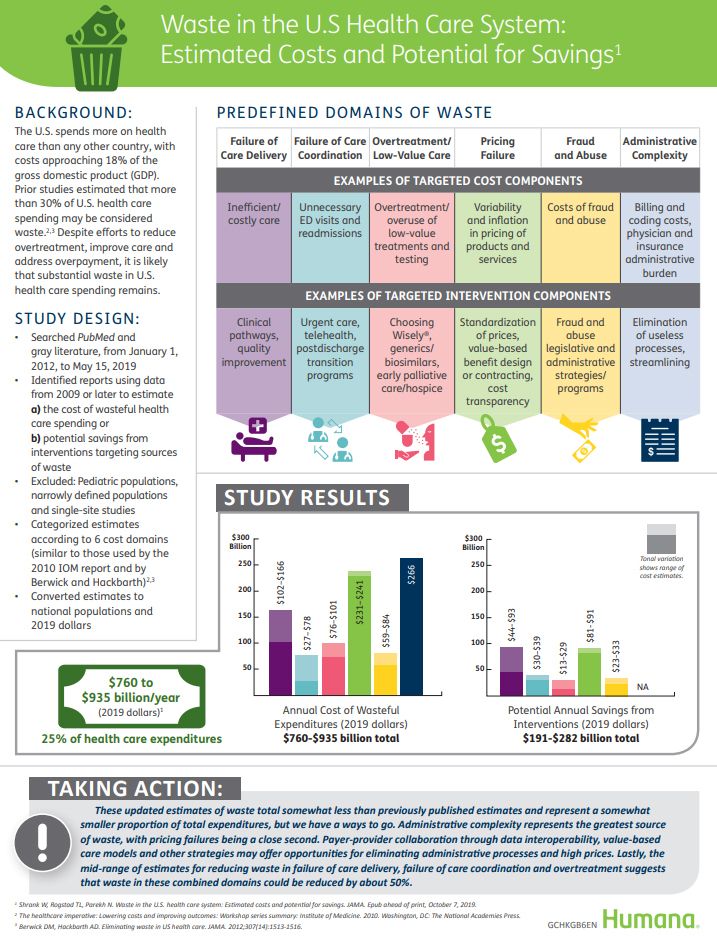

Wasted: $1 of Every $4 Spent on Health Care In America

A study in JAMA published this week analyzed research reports that have measured waste in the U.S. health care system, calculating that 25% of medical spending in America is wasted. If spending is gauged at $3.8 trillion, waste amounts to nearly $1 trillion. If spending is 18% of the American gross domestic product (GDP), then some 4.5% of the U.S. economy is wasted spending by the health care system and its stakeholders. In “Waste in the US Health Care System,” a team from Humana and the Univrsity of Pittsburgh recalibrated the previous finding of 30% of wasted spending to the 25%,

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

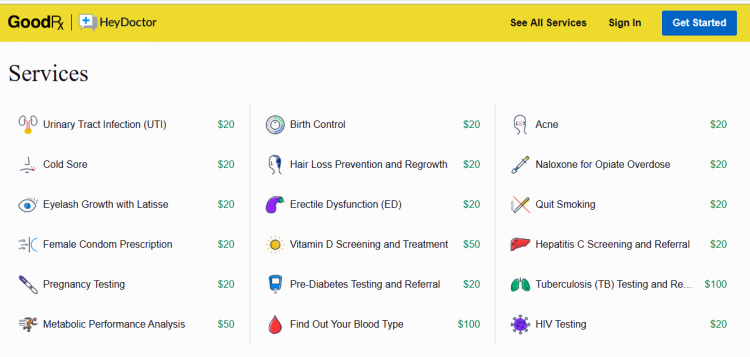

Health @ Retail – Prelude to GMDC SelfCare Summit with Updates from Hims & Hers, GoodRx, Sam’s Club and Amazon Care

“We knew millions of people weren’t getting the care they needed — they were either too embarrassed to seek help or felt stuck in a system that was confusing and intimidating. Digital health has the potential to radically change the way people approach their wellness and, since launching in 2017, we’ve outpaced even our own expectations, delivering more than 1 million Hims & Hers products to our customers. In collaboration with highly-qualified doctors and healthcare providers, we’ve built a digital health platform that is changing the way people talk about and receive the care they need.” That’s a verbatim paragraph

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

“It’s the Deductible, Stupid” – Health Premiums Reach $20,576 in 2019 for a Family

Here’s the latest arithmetic on American workers’ financial trade-off of wages for health care insurance coverage: in the ten years since 2009, family premiums have risen 54% and workers’ contribution to health care spending grew 71%. Wages? They rose 26%, and general price inflation by 20%, according to the Kaiser Family Foundation survey on employer-sponsored benefits for 2019 released yesterday. Survey details for this 21st annual encyclopedia on employer-sponsored health care are published in Health Affairs October 2019 issue in a paper titled, Health Benefits in 2019: Premiums Inch Higher, Employers Respond to Federal Policy. Because this

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

Most U.S. Voters Support Building on the ACA, Not Medicare For All, As Fewer Americans Have Insurance Coverage

The vast majority of Americans favor lowering the cost of prescriptions, keeping the Affordable Care Act’s provisions to cover pre-existing conditions, lower overall medical costs, and protect people from surprise medical bills, according to the KFF Health Tracking Poll – September 2019: Health Care Policy In Congress And On The Campaign Trail. The big headline in this poll following last night’s third Democratic Presidential debate is that 55% of Democrats and Democrat-leaning Independent voters prefer a candidate that will build on the Affordable Care Act (ACA) versus a President that would replace the ACA with a Medicare For All plan (M4A).

Why Humana Joined CTA – The Pivot from “Health Insurance” to Behaving as a Health-Tech Start-Up

“Every company is a tech company,” Christopher Mimms asserted in the Wall Street Journal in December 2018. Connectivity, artificial intelligence, and automation are now competencies every company must master, Mimms explains. This ethos underpins Humana’s decision to join CTA, the Consumer Technology Association which hosts CES every January in Las Vegas. If you read this blog, you know one of the fastest-growing “aisles” at the annual conference is digital health. Humana joined up with CTA’s Health and Fitness Technology Division this month. Last year, Humana hired Heather Cox in the new post of Chief Digital Health and Analytics Officer, reporting directly

The Pharma Industry Hits Bottom of Consumers’ Industry Rankings, and Healthcare Is Only Marginally Higher on the List

from Gallup’s 2019 survey into Americans’ Views of U.S. Business Industry Sectors. Since reaching a relative high regard in 2015, the pharma industry reputation among consumers has declined each year since to the low this year with 58% of Americans having a negative view. This was a 31 percentage point drop in reputation in one year. This is one negativity point above peoples’ low regard for the Federal government. Gallup notes that Americans are over two times more likely to rank the pharmaceutical industry negatively (58%) as positively (27%). The healthcare industry, apart from pharma, didn’t fare well this year in

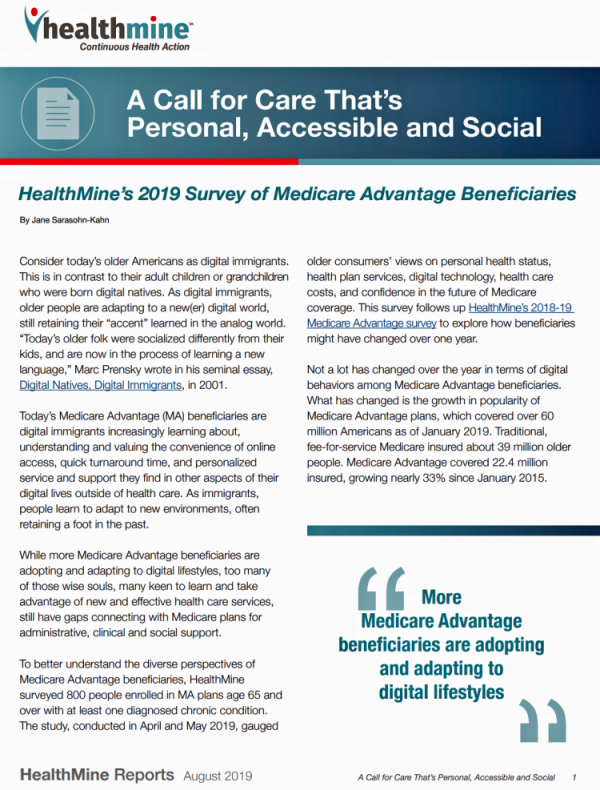

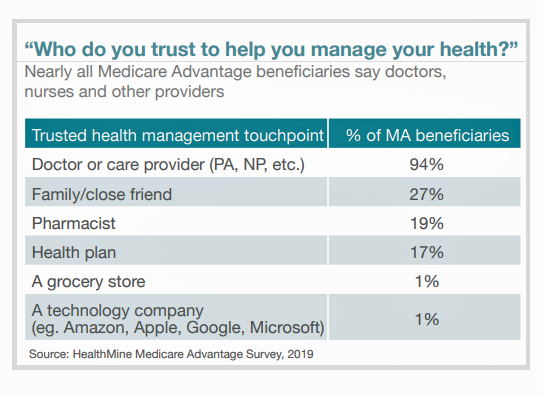

A Profile of People in Medicare Advantage Plans – HealthMine’s Survey of “Digital Immigrants”

There are over 60 million enrollees in Medicare in 2019, and fully one-third are in Medicare Advantage plans. Medicare is adding 10,000 new beneficiaries every day in the U.S. Medicare Advantage enrollment is fast-growing, shown in the first chart where over 22 million people were in MA plans in January 2019. Better understanding this group of people will be critical to helping manage a fast-growing health care bill, and growing burden of chronic disease, for America. To that end, HealthMine conducted a survey among 800 people enrolled in Medicare Advantage plans ag 65 and over with at least one diagnosed

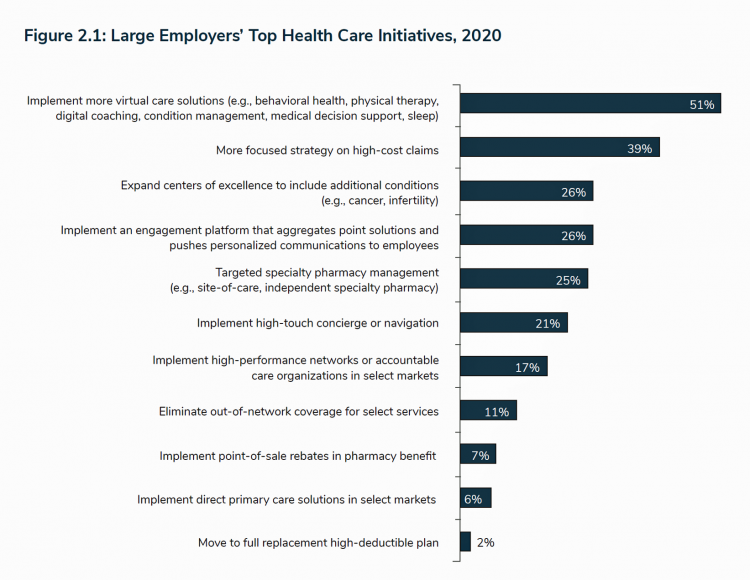

Getting More Personal, Virtual and Excellent – the 2020 NBGH Employer Report

In 2020, large employers will be “doubling down” efforts to control health care costs. Key strategies will include deploying more telehealth and virtual health care services, Centers of Excellence for high-cost conditions, and getting more personal in communicating and engaging through platforms. This is the annual forecast for 2020 brought to us by the National Business Group of Health (NBGH), the Large Employers’ Health Care Strategy and Plan Design Survey. The 42-page report is packed with strategic and tactical data looking at the 2020 tea leaves for large employers, representing over 15 million covered lives. Nearly 150 companies were surveyed

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

Love ACA Provisions, Not the ACA – KFF Poll Reveals American Voters’ Views on Health Care Reform

Today is the bridge day between The Battle of the Democratic Primary Candidates Debate #2 Part 1 and tonight, Part 2. So it’s a good time to take stock of U.S. voters’ views on health care, through the lens of the Kaiser Family Foundation’s Health Tracking Poll for July 2019 published yesterday. Health care is the top issue Democrats want to hear about in the debates, well ahead of climate change, women’s issues, immigration and gun policy. Let’s start with an overall context statistic from this poll: that is that 86% of insured U.S. adults like their health insurance plan

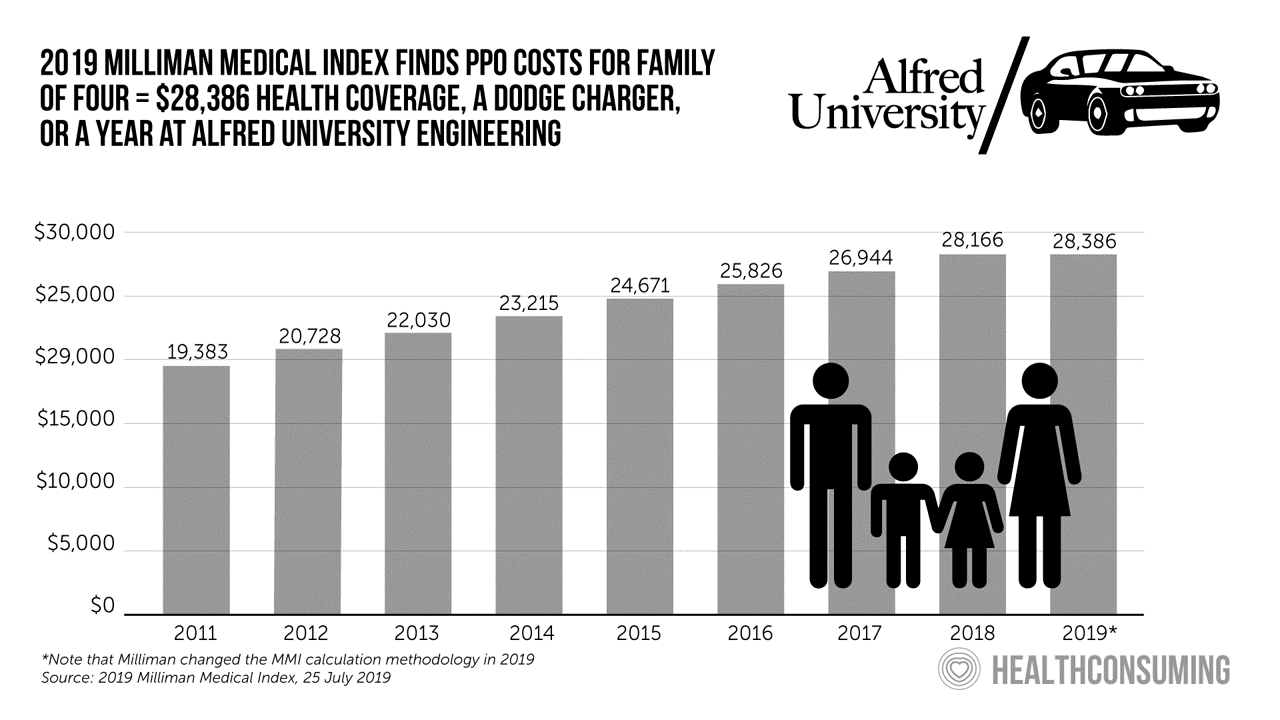

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

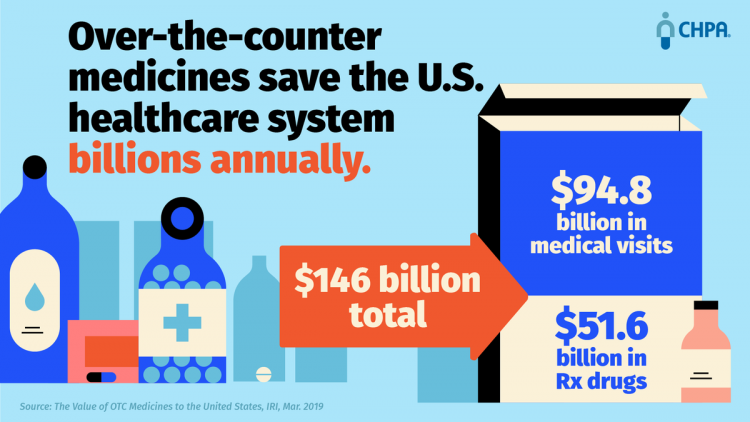

Marketing Health To Consumers in the Age of Retail Disruption

Today, I am speaking with marketing leaders who are members of CHPA, the Consumer Healthcare Products Association on this very topic. This is CHPA’s 2019 Marketing Conference being held at the lovely historic Hotel du Pont in Wilmington, DE. The gist of my remarks will be to focus on the evolving retail health ecosystem, with my HealthConsuming lens on health/care, everywhere. And timing is everything, because today is International Self-Care Day to promote peoples’ health engagement. The plotline begins with a tale of two companies — CVS/health and Best Buy — discussing these two organizations’ approach to acquiring companies to expand

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Americans’ Financial Anxiety Ties to Personal Cash Flow and Health Care

“The Dow Jones Industrial Average was on the brink of claiming a thousand-point milestone for the first time since January 2018, ending the longest period without crossing such a psychologically significant level since the blue-chip benchmark crossed the 19,000 threshold three weeks after Donald Trump was elected president in November 2016,” Mark DeCambre of MarketWatch wrote yesterday morning. He noted that President Trump, “tweeted a simple call-out to the intraday record: ‘Dow just hit 27,000 for first time EVER!'” clipped here from Twitter. Indeed, the U.S. macro-economy has nearly full employment and the stock market hit a high mark this

The New Drug Companies Aren’t Drug Companies At All

The health/care ecosystem continues to morph as the stakeholder groups themselves are blurring across and outside of their core businesses. Today’s example of this is Clover Health, which launched Clover Therapeutics this week. This research organization will develop medicines targeting older adults — which makes sense because Clover Health’s target consumer market is Medicare Advantage beneficiaries. “Clover Therapeutics was created to address the significant unmet needs in chronic progressive diseases in the Medicare population,” Cheng Zhang, Head of Clover Therapeutics, is quoted in the press release. The company will first collaborate with Genentech (Roche) to research and develop therapies based

Retail Pricing in U.S. Health Care? Why Transparency Is Hard to Do

“It’s the prices stupid,” Uwe Reinhardt and Gerard Anderson and colleagues asserted in the title their seminal Health Affairs manifesto on U.S. healthcare spending. Sixteen years later, yesterday on 8th July 2019, a Federal U.S. judge blocked, in the literal last-minute, a DHHS order mandating prescription drug companies to publish “retail prices” of medicines in direct-to-consumer TV ads. I was getting this post on transparency together just before that announcement hit the press, so this post would have had a different nuance yesterday compared with today. And that’s how health care politics and economics in America roll these days. Welcome to

Health Care and the Democratic Debates – Round 2 – Battle Royale for M4All vs Medicare for All Who Want It – What It Means for Industry

Looking at this photo of the 2020 Democratic Party Presidential candidate debater line-up might give you a déjà vu feeling, a repeat of the night-before debate. But this was Round 2 of the debate, with ten more White House aspirants sharing views — sometimes sparring — on issues of immigration, economic justice, climate change, and once again health care playing a starring role from the start of the two-hour event. The line-up from left to write included: Marianne Williamson. author and spiritual advisor John Hickenlooper, former Governor of Colorado Andrew Yang. tech company executive Pete Buttigieg, Mayor of South Bend,

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

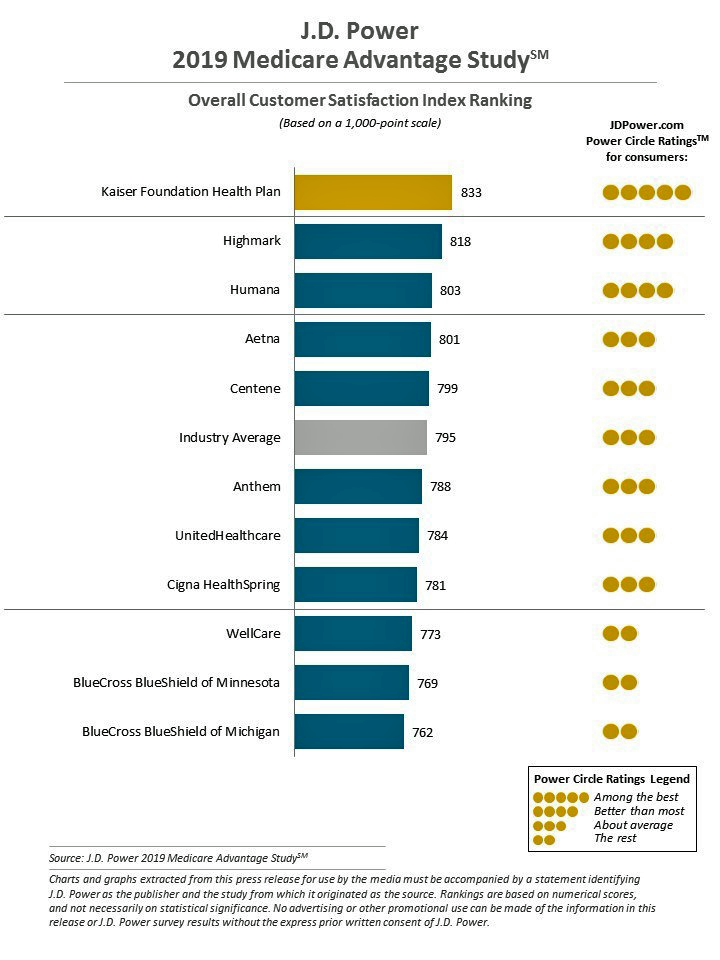

Talk to Me About My Health, Medicare Advantage Beneficiaries Tell J.D. Power

Cost is the major reason why Medicare Advantage plan beneficiaries switch plans, but people who switch also tend to have lower satisfaction scores based on non-cost factors. Those ratings have a lot to do with information and communication, according to J.D. Power’s 2019 Medicare Advantage Plan Study. The Study explores MA beneficiaries’ views on six factors: Coverage and benefits Provider choice Cost Customer service Information and communication, and Billing and payment. Kaiser Foundation Health Plan garnered the top spot for the fifth year in-a-row. By feature, Kaiser achieved 5 “Power Circles” for all factors except for cost and provider choice,

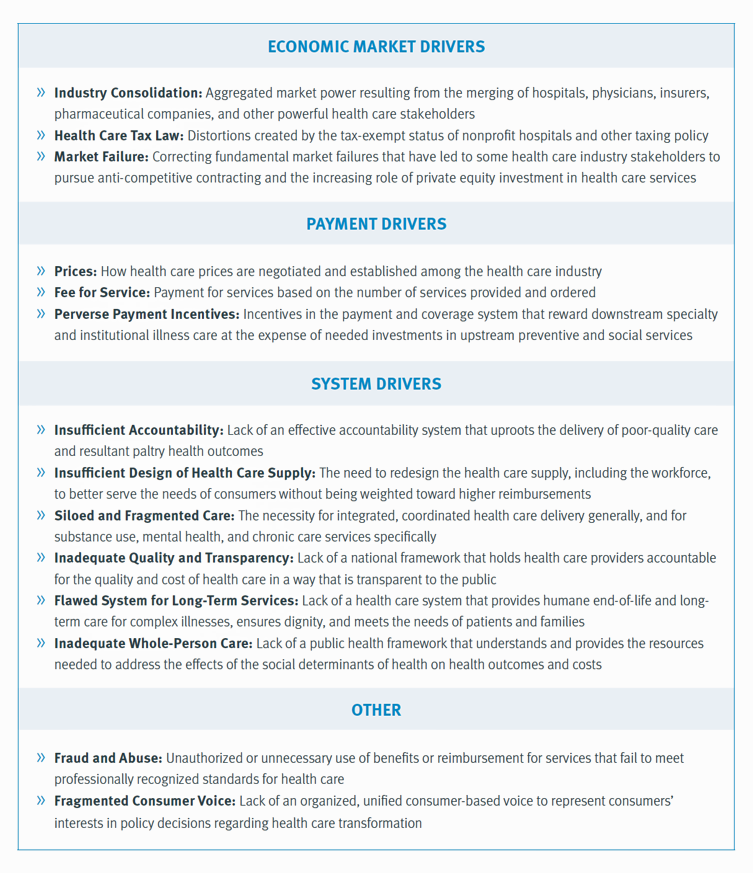

Americans Could Foster a Health Consumer Movement, Families USA Envisions

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

How Consumers’ Belt-Tightening Could Impact Health/Care – Insights from Deloitte’s Retail Team

Over the ten years between 2007 and 2017, U.S. consumer spending for education, food and health care substantially grew, crowding out spending for other categories like transportation and housing. Furthermore, income disparity between wealthy Americans and people earning lower-incomes dramatically widened: between 2007-2017, income for high-income earners grew 1,305 percent more than lower-incomes. These two statistics set the kitchen table for spending in and beyond 2019, particularly for younger people living in America, considered in Deloitte’s report, The consumer is changing, but perhaps not how you think. The authors are part of Deloitte Consulting’s Retail team. The retail spending data

Two-Thirds of Americans Say Healthcare Doesn’t Work Well, in RealClear Politics Poll

Health care is the top issue facing the U.S. today, one in three Americans says, with another one-fourth pointing to the economy. Together, health care + the economy rank the top issues for 62% of Americans. Health care and the economy are, in fact, intimately tied in every American’s personal household economy I assert in my book, HealthConsuming: From Health Consumer to Health Citizen. This poll from RealClear Politics, conducted in late April/early May 2019, makes my point that the patient is the consumer and, facing deductibles and more financial exposure to footing the medical bill, the payor. Fully

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

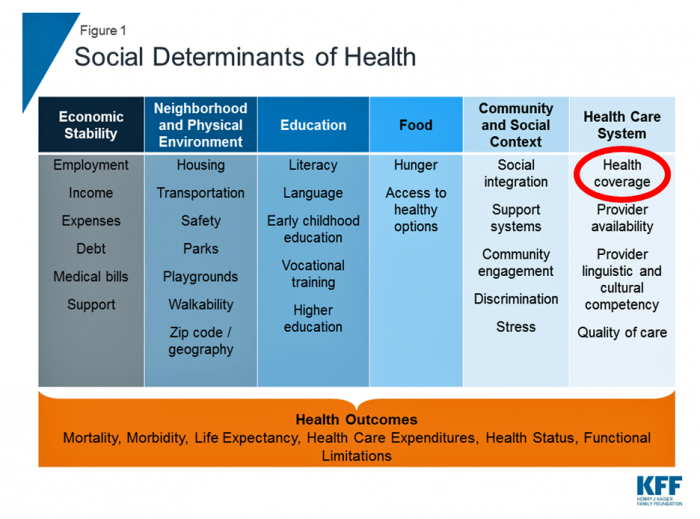

Scaling the Social Determinants of Health – McKinsey and Kaiser’s Bold Move

People who are in poor health or use more health care services are more likely to report multiple unmet social needs, such as food insecurity, unsafe neighborhoods, lack of good housing, social isolation, and poor transportation access, found through a survey conducted by McKinsey. The results are summarized in Addressing the Social Determinants of Health. The growing recognition of the influence of social determinants reached a tipping point last week with the news that Kaiser-Permanente would work with Unite US to scale services to people who need them. The mainstreaming of SDoH speaks to the awareness that health is made

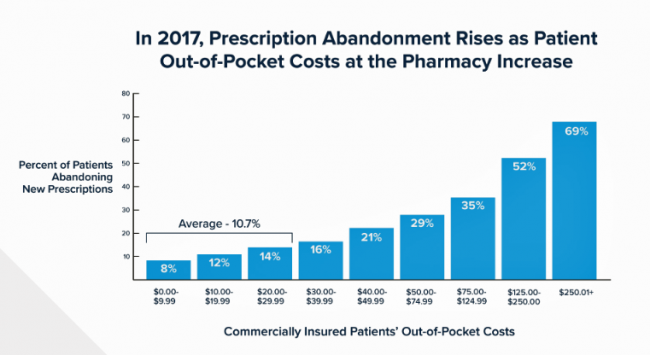

Prescription Drug Costs In America Through the Patient Lens, via IQVIA, GoodRx and a New $2 Million Therapy

Americans consumed 17.6 prescriptions per person in 2018, two in three of which treated chronic conditions. Welcome to Medicine Use and Spending in the U.S. , the annual review of prescription drug supply, demand and Rx pricing dynamics from the IQVIA Institute for Human Data Science. In a call with analysts this week in which I participated, the Institute’s Executive Director Murray Aitken discussed the report which looks back at 2018 and forward to 2023 with scenarios about what the U.S. prescription drug market might look like five years from now. The report is organized into four sections: medical use

Assessing the GAO’s Report on Single-Payer Healthcare in America: Let’s Re-Imagine Workflow

Calls for universal health care, some under the banner of Medicare for All,” are growing among some policy makers and presidential candidates looking to run in 2020. As a response, the Chairman of the House Budget Committee in the U.S. Congress, Rep. John Yarmuth (D-Ky.), asked the Congressional Budget Office (CBO) to develop a report outlining definitions and concepts for a single-payer health care system in the U.S. The result of this ask is the report, Key Design Components and Considerations for Establishing a Single-Payer Health Care System, published on 1st May by the CBO. The report provides

Will Health Consumers Morph Into Health Citizens? HealthConsuming Explains, Part 5

The last chapter (8) of HealthConsuming considers whether Americans can become “health citizens.” “Citizens” in this sense goes back to the Ancient Greeks: I return to Hippocrates, whose name is, of course, the root of The Hippocratic Oath that physicians take. Greece was the birthplace of Democracy with a capital “D.” Hippocrates’ book The Corpus is thought to be one of the first medical textbooks. The text covered social, physical, and nutritional influences, and the concept of “place” for health and well-being. Here, the discussion detailed the roles of air and water for health. The Hippocratic texts also coached doctors to

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

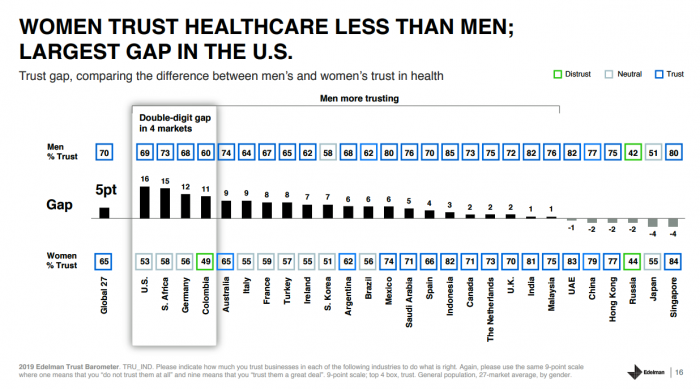

Americans’ Trust in U.S. Healthcare Lags Tech — and Women Are Particularly Cynical

The 2019 Edelman Trust Barometer measured the biggest gap in trust for the healthcare industry between the U.S. “informed public” and the mass population. Fewer American women, too, trust the healthcare industry than men do. “This inequality of trust may be reflective of the mass population continuing to feel left behind as compared to others, even as they recognize the advances that are being made that could benefit them. Given tone and tenor of the day, and particularly among mass population, healthcare may continue to see increasing demands for change and regulation,” Susan Isenberg, Edelman’s head of healthcare, notes in

World Health Day 2019: Let’s Celebrate Food, Climate, Insurance Coverage and Connectivity

Today, 7 April, is World Health Day. With that in mind, I devote this post to three key social determinants of health (SDOH) that are top-of-mind for me these days: food for health, climate change, and universal health coverage. UHC happens to be WHO’s focus for World Health Day 2019. [As a bonus, I’ll add in a fourth SDOH in the Hot Points for good measure and health-making]. Why a World Health Day? you may be asking. WHO says it’s, “a chance to celebrate health and remind world leaders that everyone should be able to access the health care they need,

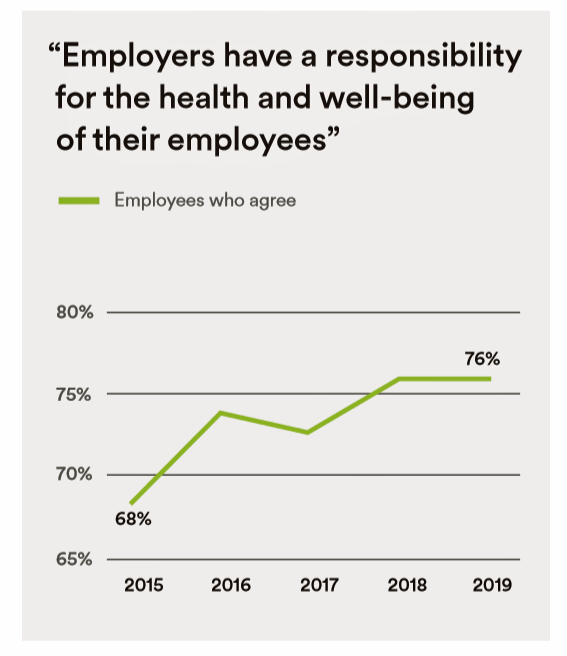

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

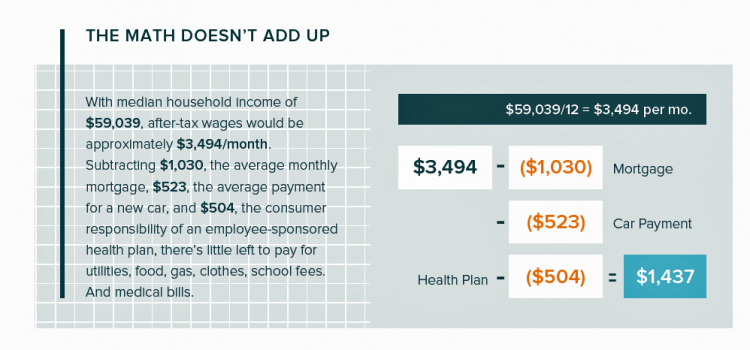

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

Most Americans Blame Drug Companies, Insurers, and Hospitals for High Health Care Costs

There’s little agreement between Democrats and Republicans on a plethora of issues in American public life. But one issue that brings U.S. citizens together is agreement that the cost of health care is too high in the country, and that pharma, health plans, and providers are to blame. Welcome to health politics in America as of March 2019, according to The Public and High U.S. Health Care Costs, a poll conducted by POLITICO and the Harvard T.H. Chan School of Public Health. The first chart illustrates the common ground shared by Americans by party affiliation, with vast majorities across parties playing

Having Health Insurance Is A Social Determinant of Health

Health insurance was on the collective minds of American voters in the 2018 midterm elections. Health care, broadly defined, drove many people to the polls voting with feet and ballots to protect their access to a health plan covering a pre-existing condition or to protest the cost of expensive prescription drugs. These were the two top health care issues among voters in late 2018, a Kaiser Family Foundation poll at the time assessed. Yesterday, President Trump verbally re-branded the Republican Party as “the party of healthcare.” That Presidential pronouncement was tied to a letter written on U.S. Department of Justice

Isn’t It Eyeconic? Vision Care in the Evolving Health Care Ecosystem

The vision/optical industry is one piece of the health/care ecosystem, but the segment has not been as directly impacted by patients’ new consumer muscles until just about now. It feels like the vision industry is at an inflection point at this moment, I intuited during yesterday’s convening of Decoding the Consumer: The new science of customer behavior, the theme of the 13th annual global leadership summit hosted by Vision Monday, a program of Jobson Medical Information which is part of the WebMD family. I was grateful to have an opportunity to share my views with attendees on the vision patient as

The Evolution of Self-Care for Consumers – Learning and Sharing at CHPA

Self-care in health goes back thousands of years. Reading from Hippocrates’ Corpus about food and clean air’s role in health sounds contemporary today. And even in our most cynical moments, we can all hearken back to our grandmothers’ kitchen table wisdom for dealing with skin issues, the flu, and broken hearts. The annual conference of the Consumer Healthcare Products Association (CHPA) convened this week, and I was grateful to attend and speak on the evolving retail health landscape yesterday. Gary Downing, CEO of Clarion Brands and Chairman of the CHPA Board, kicked off the first day with a nostalgic look

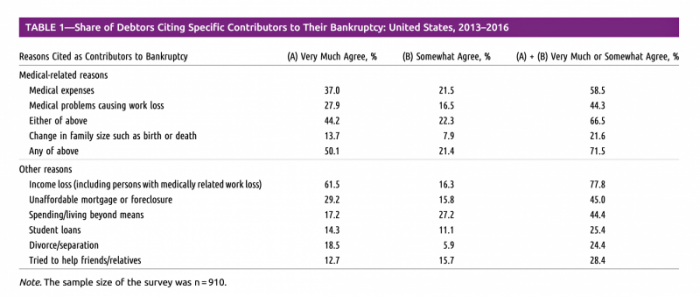

Medical Issues Are Still The #1 Contributor to Bankruptcy in the U.S., An AJPH Study Asserts

Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA). Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

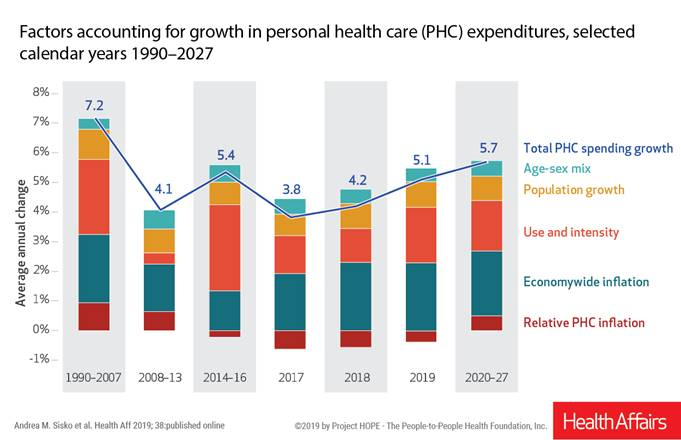

National Health Spending Will Reach Nearly 20% of U.S. GDP By 2027

National health spending in the U.S. is expected to grow by 5.7% every year from 2020 to 2027, the actuaries at the Centers for Medicare and Medicaid Services forecast in their report, National Health Expenditure Projections, 2018-2927: Economic And Demographic Trends Drive Spending And Enrollment Growth, published yesterday by Health Affairs. For context, note that general price inflation in the U.S. was 1.6% for the 12 months ending January 2019 according to the U.S. Bureau of Labor Statistics. This growth rate for health care costs exceeds every period measured since the high of 7.2% recorded in 1990-2007. The bar chart illustrates the

Telehealth and Virtual Care Are Melting Into “Just” Health Care at HIMSS19

Just as we experienced “e-business” departments blurring into ecommerce and everyday business processes, so is “telehealth” morphing into, simply, health care delivery as one of many channels and platforms. Telehealth and virtual care are key education topics and exhibitor presences at HIMSS19. Several factors underpin the adoption of telehealth in 2019: Consumers’ demand for accessible, lower-cost health care services as people face greater financial responsibility for paying the medical bill (via high-deductible health plans and greater out-of-pocket costs for co-payments) Some consumers’ lacking or losing health insurance as ACA coverage eroded in the past two years, resulting in these patients

The Cost of Prescription Drugs, Doctors and Patient Access – A View from HIMSS19

Most patient visits to doctors result in a prescription written for a medicine that people retrieve from a pharmacy, whether retail in the local community or via mail order for a maintenance drug. This one transaction generates a lot of data points, which individually have a lot of importance for the individual patient. Mashed with other patients’, prescription drug utilization data can combine with more data to be used for population health, cost-effectiveness, and other constructive research pursuits. At HIMSS19, there’s an entire day devoted to a Pharma Forum on Tuesday 12 February, focusing on pharma-provider-payor collaborations. Allocating a full

The Consumer and the Payor, Bingo and Trust: My Day At Medecision Liberator Bootcamp

To succeed in the business of health information technology (HIT), a company has to be very clear on the problems it’s trying to address. Now that EHRs are well-adopted in physicians’ practices and hospitals, patient data have gone digital, and can be aggregated and mined for better diagnosis, treatment, and intelligent decision making. There’s surely lots of data to mine. And there are also lots of opportunities to design tools that aren’t very useful for the core problems we need to solve, for the clinicians on the front-lines trying to solve them, and for the patients and people whom we

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

The Caveats for Health/Care at CES 2019

According to the Cambridge Dictionary, a “caveat” is, “a warning to consider something before doing anything more.” It is fitting that CES is held in Las Vegas, land of high risk and, with a lot of luck, reward. With that theme in mind, I depart LAS airport tonight on an aptly-named red-eye flight back home after spending an entire week here. I’m pondering not what I saw — some of which I covered daily over the past week — but what I didn’t see. Consider these the caveats for health/care at #CES2019. In no particular order… Where was the Chairman of

The Consumer as Payor – Retail Health at CES 2019

All health/care is retail now in America. I say this as most people in the U.S. who have health insurance must take on a deductible of some amount, which compels that insured individual to spend the first dollar on medical services up until they meet their financial commitment. At that point, health insurance kicks in, and then the insured may have to spend additional funds on co-payments for general medicines and services, and coinsurance for specialty drugs like injectables and high-cost new therapies. The patient is a consumer is a payor, I asserted today during my talk on the expanding

Heart Health at #CES2019 – Food and Tech as Medicine

Self-care is the new health care as patients, now consumers at greater financial risk for medical spending, are learning. At #CES2019, I’m on the lookout for digital technologies that can help people adopt and sustain healthy behaviors that can help consumers save money on medical care and enhance quality of life-years. This week’s heart-and-food tech announcements at #CES2019 coincide with an FDA recall on a popular drug prescribed to treat hypertension (high blood pressure). Using food and tech as medicine can help people avoid going on medications like statins and others for heart health. An important example of this self-care

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

While National Health Care Spending Growth Slowed in 2017, One Stakeholder’s Financial Burden Grew: The Consumer’s

National health care spending growth slowed in 2017 to the post-recession rate of 3.9%, down from 4.8% in 2016. Per person, spending on health care grew 3.2% to $10,739 in 2017, and the share of GDP spent on medical care held steady at 17.9%. Healthcare spending in America is a $3.5 trillion micro-economy…roughly the size of the entire GDP of Germany, and about $1 trillion greater than the entire economy of France. These annual numbers come out of the annual report from the Centers for Medicare and Medicaid Services, published yesterday in Health Affairs. Underneath these macro-health economic numbers is

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.