Health @ Retail – Prelude to GMDC SelfCare Summit with Updates from Hims & Hers, GoodRx, Sam’s Club and Amazon Care

“We knew millions of people weren’t getting the care they needed — they were either too embarrassed to seek help or felt stuck in a system that was confusing and intimidating. Digital health has the potential to radically change the way people approach their wellness and, since launching in 2017, we’ve outpaced even our own expectations, delivering more than 1 million Hims & Hers products to our customers. In collaboration with highly-qualified doctors and healthcare providers, we’ve built a digital health platform that is changing the way people talk about and receive the care they need.” That’s a verbatim paragraph

Why Humana Joined CTA – The Pivot from “Health Insurance” to Behaving as a Health-Tech Start-Up

“Every company is a tech company,” Christopher Mimms asserted in the Wall Street Journal in December 2018. Connectivity, artificial intelligence, and automation are now competencies every company must master, Mimms explains. This ethos underpins Humana’s decision to join CTA, the Consumer Technology Association which hosts CES every January in Las Vegas. If you read this blog, you know one of the fastest-growing “aisles” at the annual conference is digital health. Humana joined up with CTA’s Health and Fitness Technology Division this month. Last year, Humana hired Heather Cox in the new post of Chief Digital Health and Analytics Officer, reporting directly

The Pharma Industry Hits Bottom of Consumers’ Industry Rankings, and Healthcare Is Only Marginally Higher on the List

from Gallup’s 2019 survey into Americans’ Views of U.S. Business Industry Sectors. Since reaching a relative high regard in 2015, the pharma industry reputation among consumers has declined each year since to the low this year with 58% of Americans having a negative view. This was a 31 percentage point drop in reputation in one year. This is one negativity point above peoples’ low regard for the Federal government. Gallup notes that Americans are over two times more likely to rank the pharmaceutical industry negatively (58%) as positively (27%). The healthcare industry, apart from pharma, didn’t fare well this year in

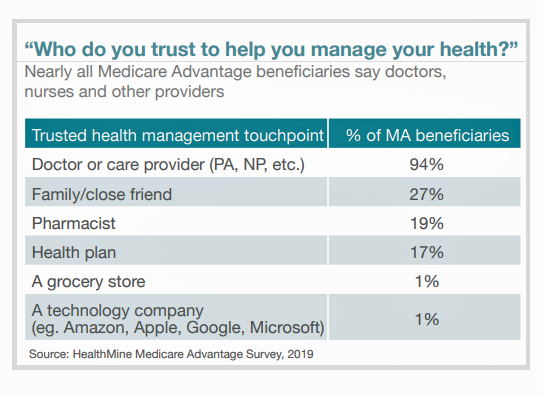

A Profile of People in Medicare Advantage Plans – HealthMine’s Survey of “Digital Immigrants”

There are over 60 million enrollees in Medicare in 2019, and fully one-third are in Medicare Advantage plans. Medicare is adding 10,000 new beneficiaries every day in the U.S. Medicare Advantage enrollment is fast-growing, shown in the first chart where over 22 million people were in MA plans in January 2019. Better understanding this group of people will be critical to helping manage a fast-growing health care bill, and growing burden of chronic disease, for America. To that end, HealthMine conducted a survey among 800 people enrolled in Medicare Advantage plans ag 65 and over with at least one diagnosed

Love ACA Provisions, Not the ACA – KFF Poll Reveals American Voters’ Views on Health Care Reform

Today is the bridge day between The Battle of the Democratic Primary Candidates Debate #2 Part 1 and tonight, Part 2. So it’s a good time to take stock of U.S. voters’ views on health care, through the lens of the Kaiser Family Foundation’s Health Tracking Poll for July 2019 published yesterday. Health care is the top issue Democrats want to hear about in the debates, well ahead of climate change, women’s issues, immigration and gun policy. Let’s start with an overall context statistic from this poll: that is that 86% of insured U.S. adults like their health insurance plan

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

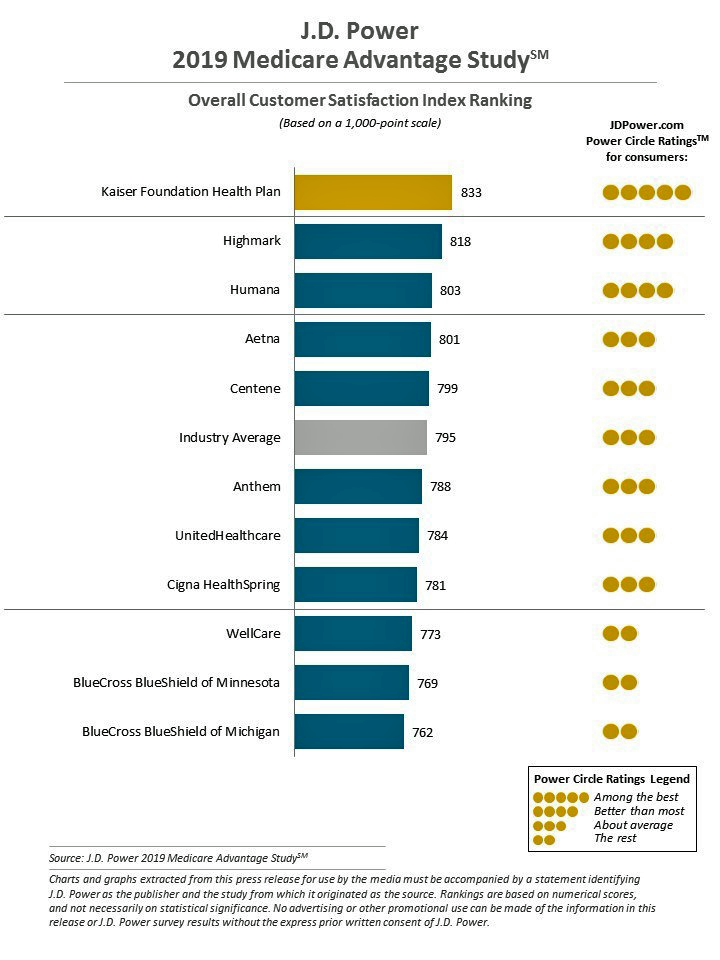

Talk to Me About My Health, Medicare Advantage Beneficiaries Tell J.D. Power

Cost is the major reason why Medicare Advantage plan beneficiaries switch plans, but people who switch also tend to have lower satisfaction scores based on non-cost factors. Those ratings have a lot to do with information and communication, according to J.D. Power’s 2019 Medicare Advantage Plan Study. The Study explores MA beneficiaries’ views on six factors: Coverage and benefits Provider choice Cost Customer service Information and communication, and Billing and payment. Kaiser Foundation Health Plan garnered the top spot for the fifth year in-a-row. By feature, Kaiser achieved 5 “Power Circles” for all factors except for cost and provider choice,

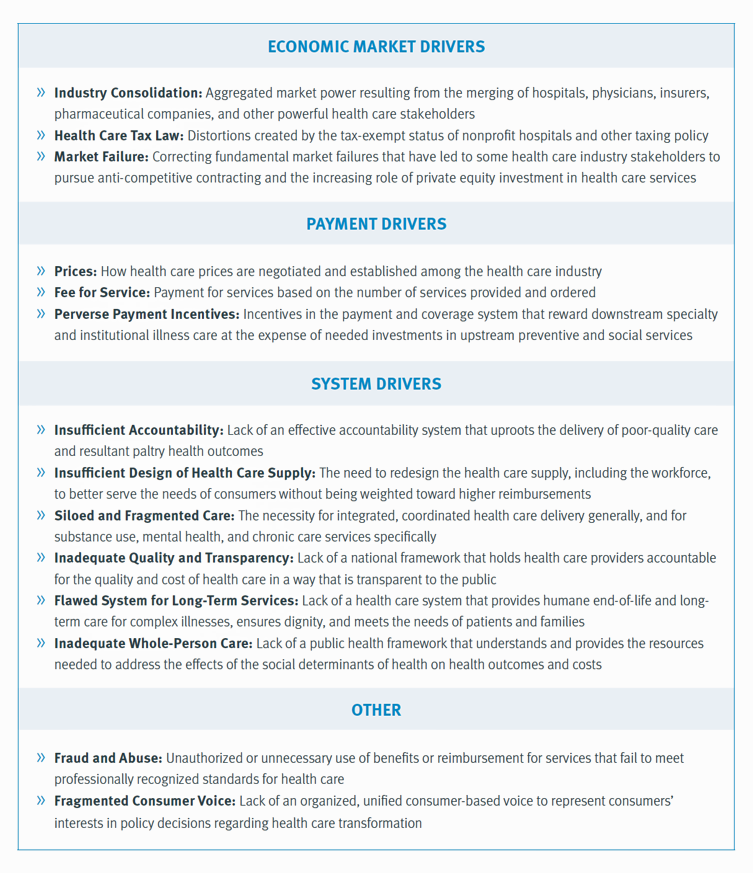

Americans Could Foster a Health Consumer Movement, Families USA Envisions

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

How Consumers Look At Social Determinants of Health for Cancer, Diabetes and Mental Health

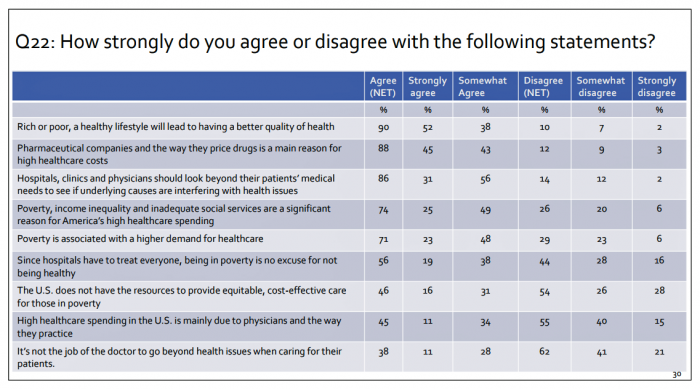

Enlightened health/care industry and public policy stakeholders have begun to embrace and address social determinants of health. These are the inputs that bolster health beyond health care services: they include economic stability like job security and income level (and equity), education, and access to healthy food, food security, safe neighborhoods, social support, clean environments (water and air), and in my own update on SDoH factors, access to broadband connectivity. As physician leaders in the AMA, technology advocates from AMIA, and numerous health plans focus efforts on strengthening social determinants, what do people – consumers, patients, caregivers — think about these

Two-Thirds of Americans Say Healthcare Doesn’t Work Well, in RealClear Politics Poll

Health care is the top issue facing the U.S. today, one in three Americans says, with another one-fourth pointing to the economy. Together, health care + the economy rank the top issues for 62% of Americans. Health care and the economy are, in fact, intimately tied in every American’s personal household economy I assert in my book, HealthConsuming: From Health Consumer to Health Citizen. This poll from RealClear Politics, conducted in late April/early May 2019, makes my point that the patient is the consumer and, facing deductibles and more financial exposure to footing the medical bill, the payor. Fully

Scaling the Social Determinants of Health – McKinsey and Kaiser’s Bold Move

People who are in poor health or use more health care services are more likely to report multiple unmet social needs, such as food insecurity, unsafe neighborhoods, lack of good housing, social isolation, and poor transportation access, found through a survey conducted by McKinsey. The results are summarized in Addressing the Social Determinants of Health. The growing recognition of the influence of social determinants reached a tipping point last week with the news that Kaiser-Permanente would work with Unite US to scale services to people who need them. The mainstreaming of SDoH speaks to the awareness that health is made

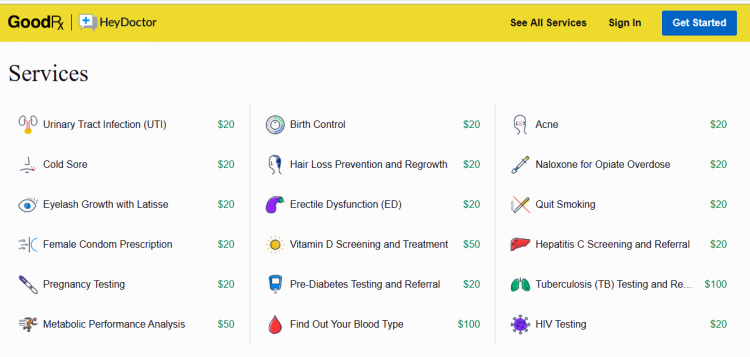

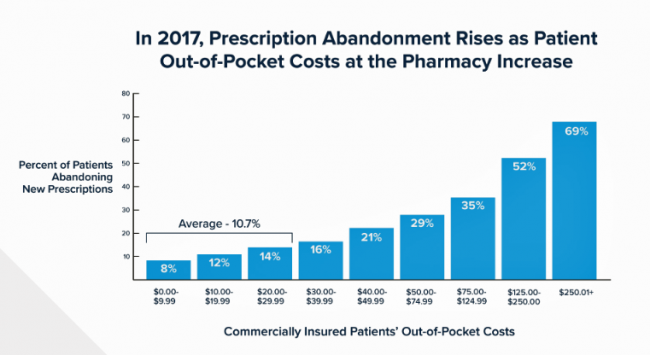

Prescription Drug Costs In America Through the Patient Lens, via IQVIA, GoodRx and a New $2 Million Therapy

Americans consumed 17.6 prescriptions per person in 2018, two in three of which treated chronic conditions. Welcome to Medicine Use and Spending in the U.S. , the annual review of prescription drug supply, demand and Rx pricing dynamics from the IQVIA Institute for Human Data Science. In a call with analysts this week in which I participated, the Institute’s Executive Director Murray Aitken discussed the report which looks back at 2018 and forward to 2023 with scenarios about what the U.S. prescription drug market might look like five years from now. The report is organized into four sections: medical use

Assessing the GAO’s Report on Single-Payer Healthcare in America: Let’s Re-Imagine Workflow

Calls for universal health care, some under the banner of Medicare for All,” are growing among some policy makers and presidential candidates looking to run in 2020. As a response, the Chairman of the House Budget Committee in the U.S. Congress, Rep. John Yarmuth (D-Ky.), asked the Congressional Budget Office (CBO) to develop a report outlining definitions and concepts for a single-payer health care system in the U.S. The result of this ask is the report, Key Design Components and Considerations for Establishing a Single-Payer Health Care System, published on 1st May by the CBO. The report provides

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

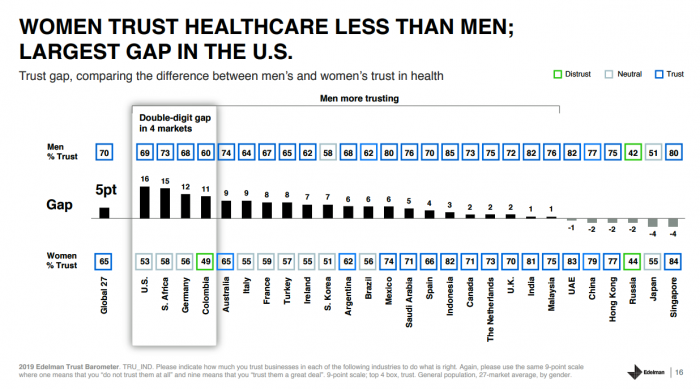

Americans’ Trust in U.S. Healthcare Lags Tech — and Women Are Particularly Cynical

The 2019 Edelman Trust Barometer measured the biggest gap in trust for the healthcare industry between the U.S. “informed public” and the mass population. Fewer American women, too, trust the healthcare industry than men do. “This inequality of trust may be reflective of the mass population continuing to feel left behind as compared to others, even as they recognize the advances that are being made that could benefit them. Given tone and tenor of the day, and particularly among mass population, healthcare may continue to see increasing demands for change and regulation,” Susan Isenberg, Edelman’s head of healthcare, notes in

Most Americans Blame Drug Companies, Insurers, and Hospitals for High Health Care Costs

There’s little agreement between Democrats and Republicans on a plethora of issues in American public life. But one issue that brings U.S. citizens together is agreement that the cost of health care is too high in the country, and that pharma, health plans, and providers are to blame. Welcome to health politics in America as of March 2019, according to The Public and High U.S. Health Care Costs, a poll conducted by POLITICO and the Harvard T.H. Chan School of Public Health. The first chart illustrates the common ground shared by Americans by party affiliation, with vast majorities across parties playing

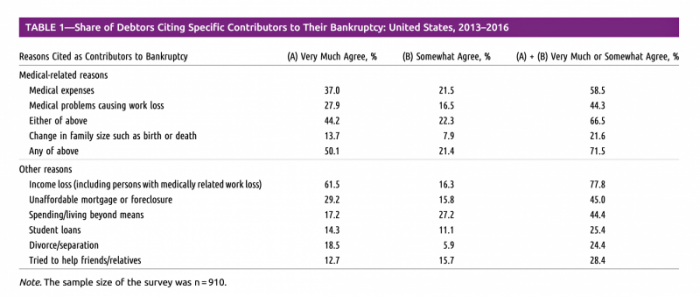

Medical Issues Are Still The #1 Contributor to Bankruptcy in the U.S., An AJPH Study Asserts

Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA). Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

“Telehealth is a digital distribution channel for health care” – catching up with Roy Schoenberg, President and CEO of American Well

Ten years ago, two brothers, physicians both, started up a telemedicine company called American Well. They launched their service first in Hawaii, where long distances and remote island living challenged the supply and demand sides of health care providers and patients alike. A decade later, I sat down for a “what’s new?” chat with Roy Schoenberg, American Well President and CEO. In full transparency, I enjoy and appreciate the opportunity to meet with Roy (or very occasionally Ido, the co-founding brother-other-half) every year at HIMSS and sometimes at CES. In our face-to-face brainstorm this week, we covered a wide range

Telehealth and Virtual Care Are Melting Into “Just” Health Care at HIMSS19

Just as we experienced “e-business” departments blurring into ecommerce and everyday business processes, so is “telehealth” morphing into, simply, health care delivery as one of many channels and platforms. Telehealth and virtual care are key education topics and exhibitor presences at HIMSS19. Several factors underpin the adoption of telehealth in 2019: Consumers’ demand for accessible, lower-cost health care services as people face greater financial responsibility for paying the medical bill (via high-deductible health plans and greater out-of-pocket costs for co-payments) Some consumers’ lacking or losing health insurance as ACA coverage eroded in the past two years, resulting in these patients

The Cost of Prescription Drugs, Doctors and Patient Access – A View from HIMSS19

Most patient visits to doctors result in a prescription written for a medicine that people retrieve from a pharmacy, whether retail in the local community or via mail order for a maintenance drug. This one transaction generates a lot of data points, which individually have a lot of importance for the individual patient. Mashed with other patients’, prescription drug utilization data can combine with more data to be used for population health, cost-effectiveness, and other constructive research pursuits. At HIMSS19, there’s an entire day devoted to a Pharma Forum on Tuesday 12 February, focusing on pharma-provider-payor collaborations. Allocating a full

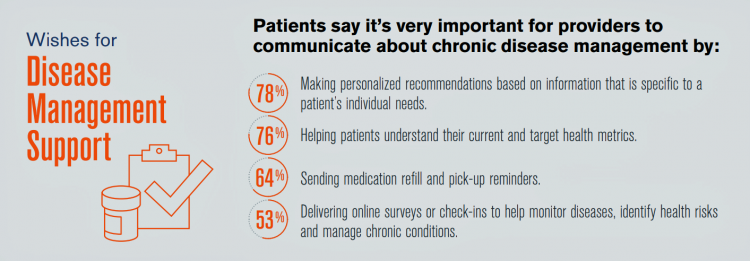

The Expectation Gap Between What Patients Want Vs What They Get

Talk to me, patients are demanding in unison. Most health consumers expect providers to communicate about routine health care and prevention; this is especially true among those patients trying to manage chronic conditions we learn from 10 Ways to Fulfill Patients’ Communication Wish List, a report based on a consumer survey from West, the communications and network infrastructure company. Four in five patients say that talking to “me” means they want personalized recommendations to their unique needs – but only one-third of patients say they’re getting that level of service from their healthcare providers. Most health consumers expect providers to communicate about

The Consumer and the Payor, Bingo and Trust: My Day At Medecision Liberator Bootcamp

To succeed in the business of health information technology (HIT), a company has to be very clear on the problems it’s trying to address. Now that EHRs are well-adopted in physicians’ practices and hospitals, patient data have gone digital, and can be aggregated and mined for better diagnosis, treatment, and intelligent decision making. There’s surely lots of data to mine. And there are also lots of opportunities to design tools that aren’t very useful for the core problems we need to solve, for the clinicians on the front-lines trying to solve them, and for the patients and people whom we

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

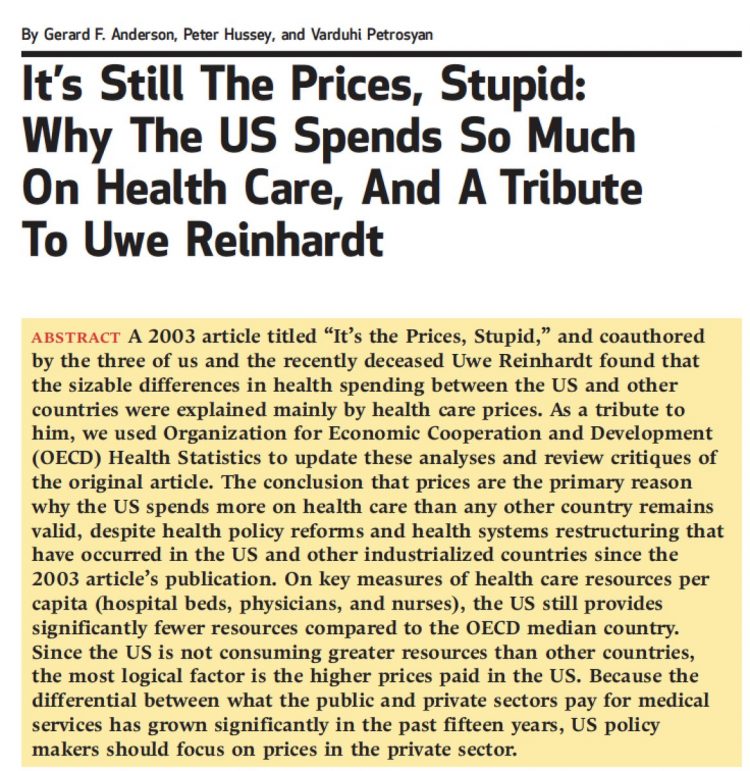

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

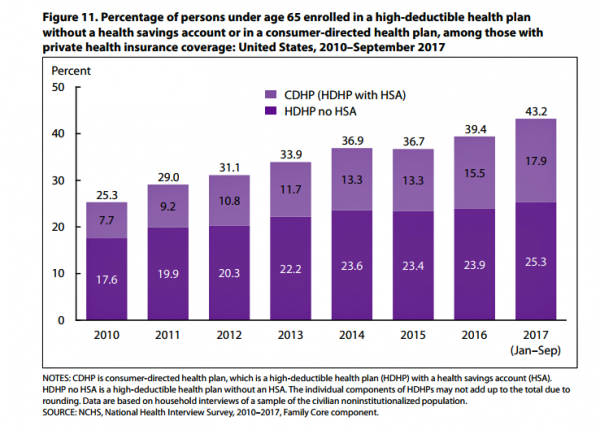

The Consumer as Payor – Retail Health at CES 2019

All health/care is retail now in America. I say this as most people in the U.S. who have health insurance must take on a deductible of some amount, which compels that insured individual to spend the first dollar on medical services up until they meet their financial commitment. At that point, health insurance kicks in, and then the insured may have to spend additional funds on co-payments for general medicines and services, and coinsurance for specialty drugs like injectables and high-cost new therapies. The patient is a consumer is a payor, I asserted today during my talk on the expanding

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

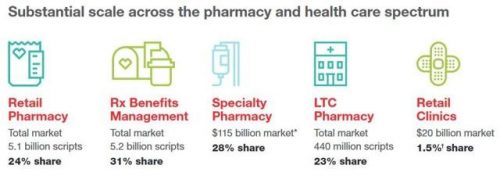

CVS + Aetna: Inflection Point in US Healthcare, Merger Approved Update

CVS Health’s acquisition of Aetna was approved this week by U.S. Federal regulators after months of scrutinizing the antitrust-size-market control implications of the deal. I wrote this post on the deal as an inflection point in American healthcare on 3rd December 2017 when CVS and Aetna announced their marriage intentions. This post updates my initial thoughts on the deal, given the morphing US healthcare market on both the traditional health services front and fast-evolving retail health environment. The nation’s largest retail pharmacy chain signed a deal to combine with one of the top three health insurance companies. The deal

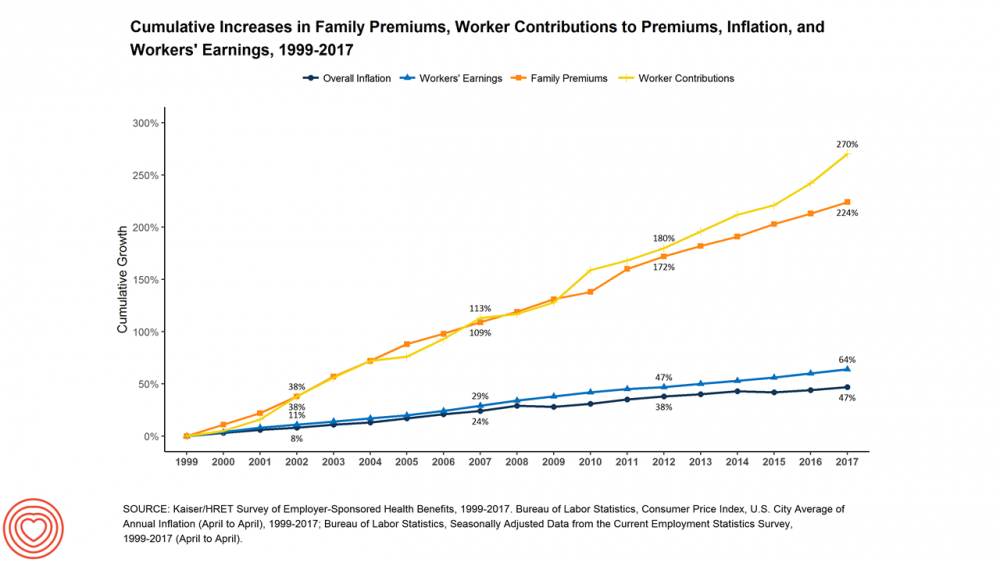

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

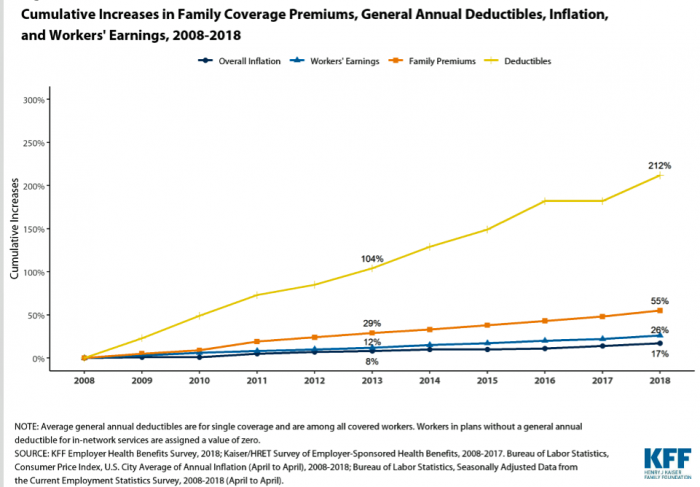

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

The Importance of Broadband and Net Neutrality for Health, to the Last Person and the Last Mile

California’s Governor Jerry Brown signed into law a net neutrality bill this weekend. Gov. Brown’s proverbial swipe of the pen accomplished two things: he went back to the Obama-era approach to ensure that internet service providers treat all users of the internet equally; and, he prompted the Department of Justice, representing the Trump Administration’s Federal Communications Commission (FCC), to launch a lawsuit. California, home to start-ups, mature tech platform companies (like Apple, Facebook and Google), and countless digital health developers, is in a particularly strategic place to fight the FCC and, now, the Department of Justice. Nearly two dozen other states

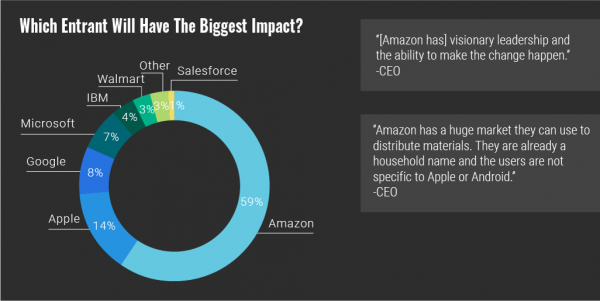

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

Health Il-Literacy Costs

The complexity of the U.S. healthcare system erodes Americans’ health literacy, Accenture asserts in their report, The Hidden Cost of Healthcare System Complexity. And that complexity costs, Accenture calculated, to the tune of nearly $5 billion in administrative cost burden to payors. Accenture developed a healthcare system literacy index to quantify the relationship between peoples’ understanding of how health insurance works and what a lack of understanding can cost the system. The index looks at consumer comprehension of health insurance terms like premium, deductible, copayment, coinsurance, out-of-pocket

The Top Pain Point in the Healthcare Consumer Experience is Money

Beyond the physical and emotional pain that people experience when they become a patient, in the U.S. that person becomes a consumer bearing expenses and financial pain, as well. 98% of Americans rank paying their medical bills is an important pain point in their patient journey, according to Embracing consumerism: Driving customer engagement in the healthcare financial journey, from Experian Health. Experian is best known as the consumer credit reporting agency; Experian Health works with healthcare providers on revenue cycle management, patient identity, and care management, so the company has experience with patient finance and medical expense sticker shock. In the

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

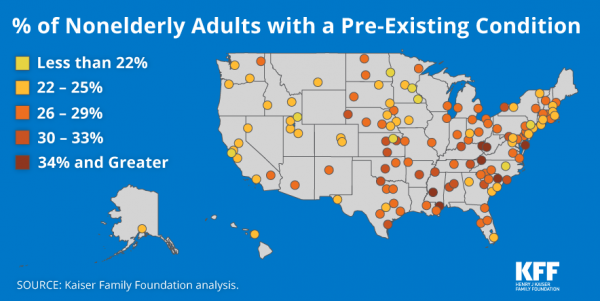

Pre-Existing Conditions: A Trans-Party, National Health Priority

Pre-existing conditions impact Americans north, south, east and west, the Kaiser Family Foundation maps. But those maladies aren’t evenly distributed across the U.S.: the highest incidences of people with pre-existing conditions are generally dotted in the eastern half of the U.S., in diverse metropolitan areas. This study looks at non-elderly adults, people between 18 and 64 years of age. That is, working-age U.S. adults who would be prospects for private health insurance coverage, whether through employers or on the individual insurance market. A striking aspect of this map is that one metro that has a higher rate of people with

Disruption Is Healthcare’s New Normal

Googling the words “disruption” and “healthcare” today yielded 33.8 million responses, starting with “Riding the Disruption Wave in Healthcare” from Bain in Forbes, Accenture’s essay on “Big Bang Disruption in Healthcare,” and, “A Cry for Encouraging Disruption” in the New England Journal of Medicine Catalyst. This last article responded to the question, “Can we successfully deliver better quality care for patients at a lower cost?” asked by François de Brantes, Executive Director of the Health Care Incentives Improvement Institute. “Disruption” as a noun and an elephant in our room has been with us in healthcare since the September/October 2000 issue of

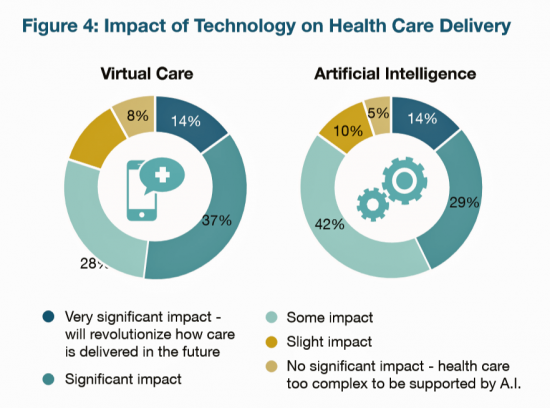

Employers Take on Health Activism, Embracing Behavioral Health, Virtual Care, AI, and Transparency

More U.S. employers are growing activist roles as stakeholders in the healthcare system, according to the 2019 Large Employers Health Care Strategy and Plan Design Survey from the National Business Group on Health (NBGH). Consider the Amazon-Berkshire Hathaway-JPMorgan Chase link up between Jeff Bezos, Warren Buffet, and Jamie Dimon, as the symbol of such employer-health activism. The NBGH report is based on survey results collected from 170 large employers representing 13 million workers and 19 million covered lives (families/dependents). This annual survey is one of the most influential such reports released each year, providing a current snapshot of large employers’ views

The True Costs of Diabetes Go Well Beyond the Wallet

The daily life of a person managing diabetes feels many costs: at work, on relationships, at play, during sleep, on time, on mental health, and to be sure, on personal finances. The True Cost of Diabetes report from Upwell details the many tolls on the person with diabetes. The first-order impact for a patient engaging in self-care to manage diabetes is time that the many tasks in a day borrow from work, sleep, home-keeping, and relationships. Seventy percent of PwD (people with diabetes) checks blood sugar at least once a day (41% one to two times, 29% three to five

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

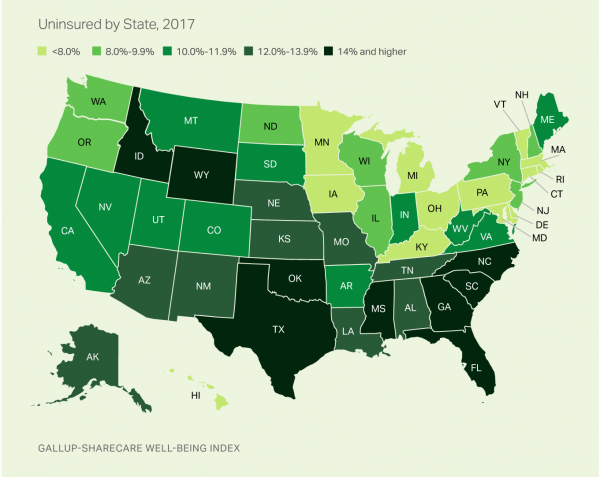

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

Universal Health Care and Financial Inclusion – Two Sides of the Wellness Coin

Two weeks in a row, The Economist, the news magazine headquartered in London, included two special reports stapled into the middle of the magazines. Universal health care was covered in a section on 28 April 2018, and coverage on financial inclusion was bundled into the 5th May edition. While The Economist’s editors may not have intended for these two reports to reinforce each other, my lens on health and healthcare immediately, and appreciatively, connected the dots between healthcare coverage and financial wellness. The Economist, not known for left-leaning political tendencies whatsoever, lays its bias down on the cover of the section here: universal healthcare

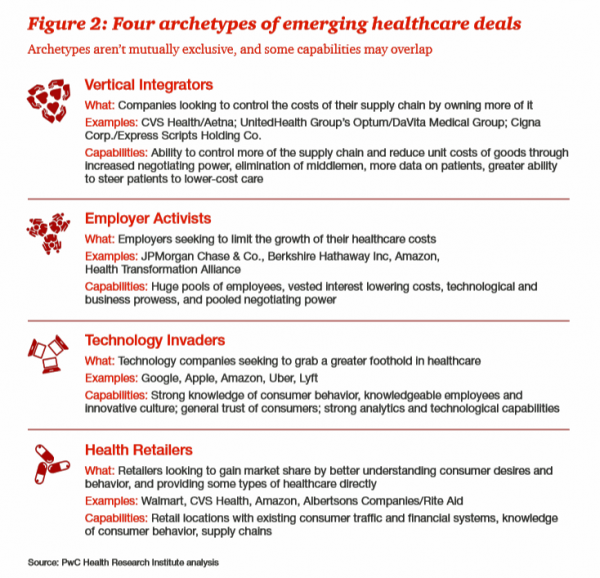

Think Like a LEGO Builder in Healthcare – Considering PwC’s New Health Economy Vision

Expect “new combinations” of industry actors and technologies to reorganize and re-imagine healthcare, with an eye on both price and investments in customer experience (CX), PwC envisions in their latest report on The New Health Economy in the Age of Disruption. In this vision, healthcare will be a more flexible marketplace underpinned by data, platforms, and workers. Yes, it’s challenging to get from here-to-there, but PwC explains just how this can happen. Four archetypes, models, of healthcare deals have begun to emerge in the marketplace, illustrated by the Big Deals and announcements reshaping the industry in the past couple of years:

Livongo and Cambia Allying to Address Chronic Disease Burden and Scale Solutions to Consumers

Chronic diseases are what kill most people in the world. In the U.S., the chronic disease burden takes a massive toll on both public health and mortality, accounting for 7 in 10 deaths in America each year. That personal health toll comes at a high price and proportion of national health expenditures. A new alliance between Livongo and Cambia Health seeks to address that challenge, beginning with diabetes and scaling to other chronic conditions. Livongo has proven out the Livongo for Diabetes program, which has demonstrated positive outcomes in terms of patient satisfaction and cost-savings. The plan with Cambia is

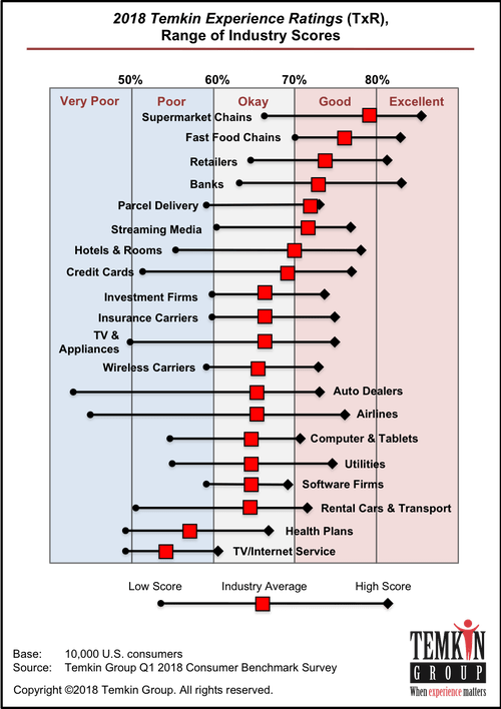

What Would Healthcare Feel Like If It Acted Like Supermarkets – the 2018 Temkin Experience Ratings

U.S. consumers rank supermarkets, fast food chains, retailers, and banks as their top performing industries for experience according to the 2018 Temkin Experience Ratings. Peoples’ experience with health plans rank at the bottom of the roster, on par with rental cars and TV/Internet service providers. If there is any good news for health plans in this year’s Temkin Experience Ratings compared to the 2017 results, it’s at the margin of “very poor” performance: last year, health plans has the worst performance of any industry (with the bar to the furthest point on the left as “low scoring”). This year, it

Tweets at Lunch with Paul Krugman – Health IT Meets Economics

I greatly appreciated the opportunity today to attend a luncheon at the HX360 meeting which convened as part of the 2018 HIMSS Conference. The speaker at this event was Paul Krugman, who won the Nobel Prize for Economics 10 years ago and today is an iconic op-ed columnist at the New York Times And Distinguished Professor of Economics at the City University of New York (CUNY). I admit to being a bit of a groupie for Paul Krugman’s work. It tickles me to look at Rise Global’s list of the Top 100 Influential Economists:

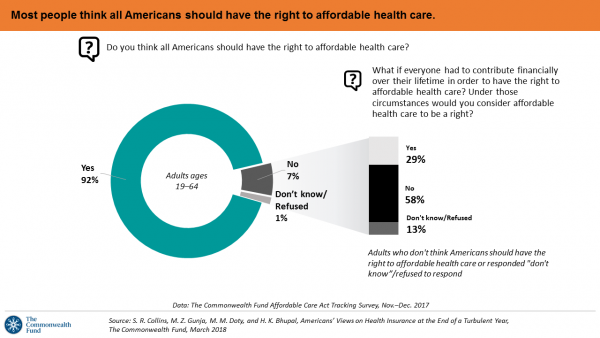

Majority Rules? The Right to Affordable Health Care is A Right for All Americans

If we’re playing a game of “majority rules,” then everyone in America would have the right to affordable health care, according to a new poll from The Commonwealth Fund. The report is aptly titled, Americans’ Views on Health Insurance at the End of a Turbulent Year. The Fund surveyed 2,410 U.S. adults, age 19 to 64, by phone in November and December 2017. This is the sixth survey conducted by the Fund to track Americans’ views of the Affordable Care Act; the first survey was fielded in mid-to-fall 2013. 9 in 10 working-age adults say “yes” indeed, my fellow Americans

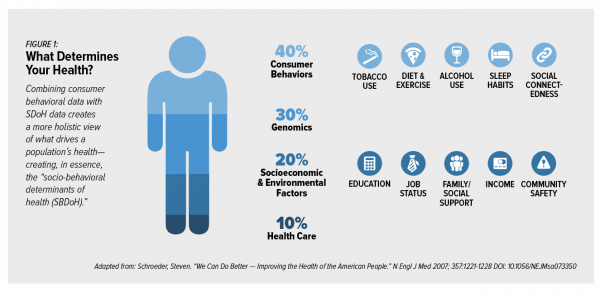

Add Behavioral Data to Social Determinants For Better Patient Understanding

“Health agencies will have to become at least as sophisticated as other consumer/retail industries in analyzing a variety of data that helps uncover root causes of human behavior,” Gartner recommended in 2017. That’s because “health” is not all pre-determined by our parent-given genetics. Health is determined by many factors in our own hands, and in forces around us: physical environment, built environment, and public policy. These are the social determinants of health, but knowing them even for the N of 1 patient isn’t quite enough to help the healthcare industry move the needle on outcomes and costs. We need to

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

The United States of Care Launches to Promote Healthcare for All of US

Let’s change the conversation and put healthcare over politics. Sounds just right, doesn’t it? If you’re reading Health Populi, then you’re keen on health policy, health economics, most of all, patients: now playing starring roles as consumers, caregivers, and payors in their own care. Andy Slavitt, former Acting Administrator of the Centers for Medicare and Medicaid Services (CMS), has assembled a diverse group of health care leaders who care about those patients/people, too, appropriately named the United States of Care. Founders include Dr. Bill Frist, former Republican U.S. Senator from Tennessee, Dave Durenberger, former Republican U.S. Senator from Minnesota, and

The 2018 Edelman Trust Barometer – What It Means for Health/Care in America

Trust in the United States has declined to its lowest level since the Edelman Trust Barometer has conducted its annual survey among U.S. adults. Welcome to America in Crisis, as Edelman brands Brand USA in 2018. In the 2018 Edelman Trust Barometer, across the 28 nations polled, trust among the “informed public” in the U.S. “plunged,” as Edelman describes it, by 23 points to 45. The Trust Index in America is now #28 of 28 countries surveyed (that is, rock bottom), dropping below Russia and South Africa. “The public’s confidence in the traditional structures of American leadership is now fully

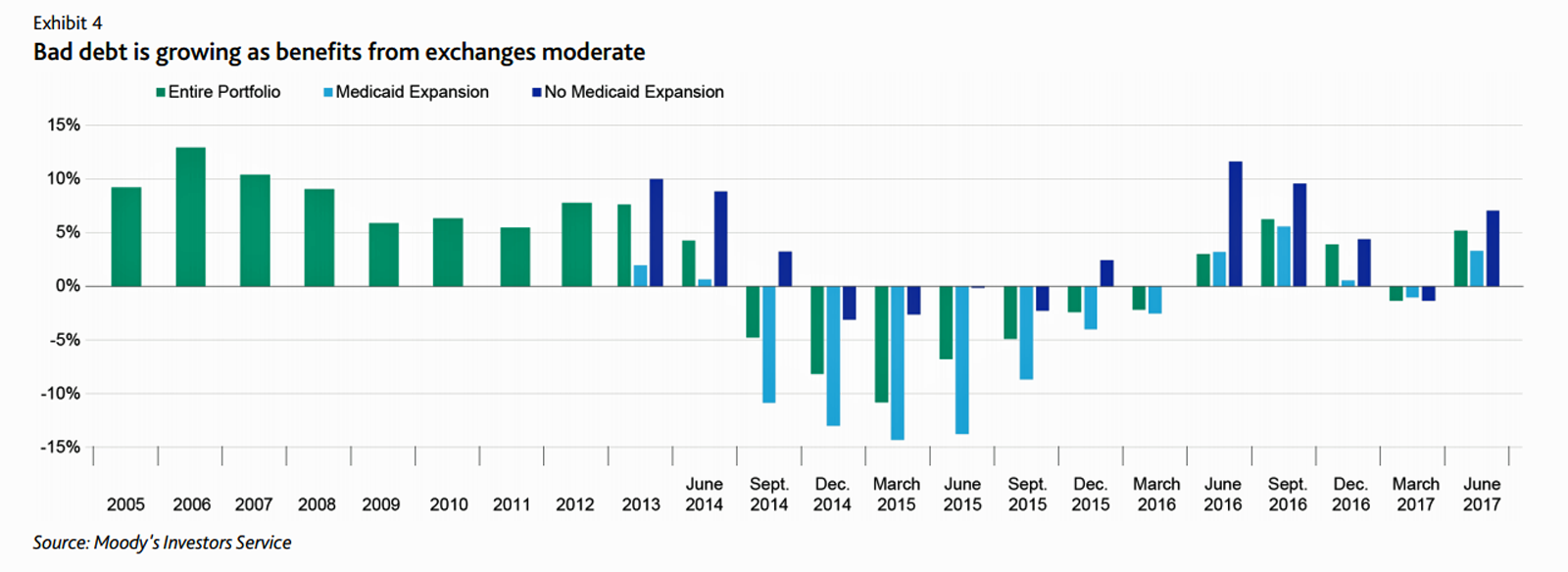

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

CVS + Aetna: An Inflection Point for American Healthcare

The nation’s largest retail pharmacy chain signed a deal to combine with one of the top three health insurance companies. The deal is valued at $69 billion. I wrote about this inflection point for U.S. healthcare four weeks ago here in Health Populi. CVS is both the biggest pharmacy and pharmacy benefit manager in the U.S., as the first chart shows. In my previous post, I talked about the value of vertical integration bringing together the building blocks of retail pharmacy and pharmacist care, retail clinics, the PBM (Caremark), along with Aetna’s health plan member base and business. As Amazon and other

A Health Consumer Perspective on CVS+Aetna

A response to Amazon’s potential moves in healthcare and pharmacy…strategic positioning for the post-Trump healthcare landscape…vertical integration to better manage healthcare utilization and costs…these, and other rationale have been offered by industry analysts and observers of the discussions between CVS and Aetna, for the former to acquire the latter. “A pharmacy chain buying a health insurance company?” many have asked me over the past few days. These inquiring minds include people who work both inside and outside of health/care. I ask back: in 2017 and in the future, “What is a pharmacy? What is a health plan?” See the

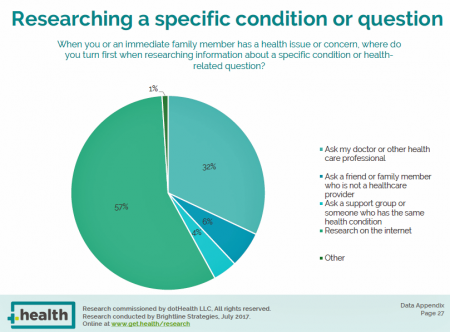

Most Consumers Would Trust a Health Info Site “Prescribed” by Their Doctor

Most consumers access the Internet for health information before they ask their doctor for the same information. But virtually everyone who goes online for health information would trust a website recommended to them by their doctor, according to the dotHealth Consumer Health Online – 2017 Research Report. This survey was conducted on behalf of dotHealth, an internet registry company channeling “.health” domains to organizations in the broad health and healthcare landscape. [FYI, both Health Populi and JaneSarasohnKahn are also registered with .health domains, having availed ourselves of this service at launch]. Six in 10 consumers who have used the internet in the

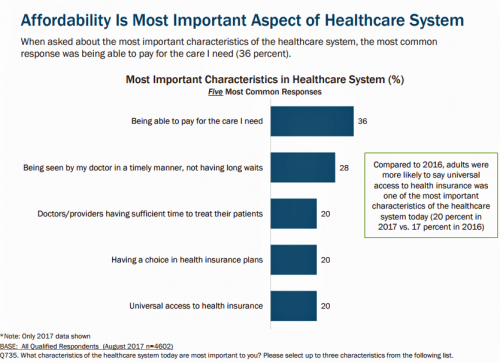

Most Americans Are Concerned About Healthcare Policy, and Costs Top the List of Concerns

4 in 5 Americans are aware of potential changes to healthcare policy brewing in Washington, DC. 92% of them are concerned about those changes, according to Healthcare Consumers in a Time of Uncertainty, the fifth annual survey from Transamerica Center for Health Studies. Peoples’ most-shared fears are losing their coverage for pre-existing conditions, out-of-pocket spending, and a ban on lifetime limits. That boils down to one thing: cost. That is, cost, for having to spend money on services not-covered by their health insurance plan; cost for out-of-pocket items under-insured, denied, or requiring coinsurance or co-payments; and, catastrophic costs that rise beyond

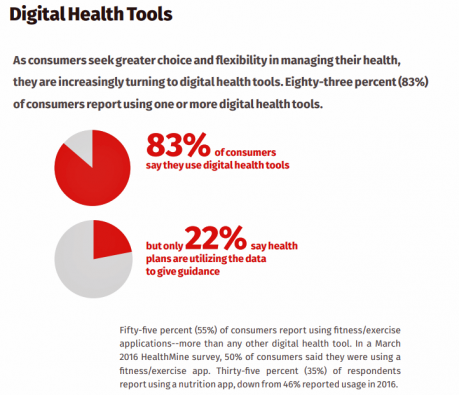

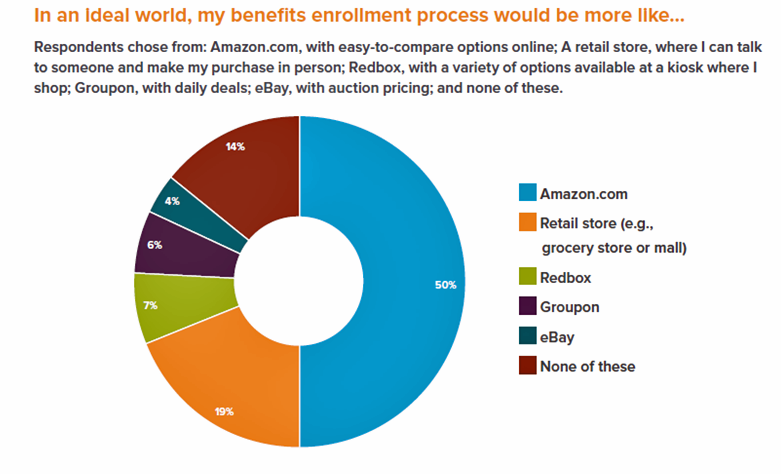

What Health Plans Must Learn from Amazon

One in two U.S. consumers told Aflac that enrolling in health insurance should feel like an experience on Amazon. But health consumers still lack that high benchmark retail experience with health plans, based on new research published in HealthMine’s 2017 Health Intelligence Report focusing on communication and digital healthcare tools. “Most members believe health plan communications are impersonal and centered around bills rather than healthcare guidance,” HealthMine asserts in the introduction to the report. That’s about as un-Amazon as we can imagine. Top findings from HealthMine’s research are that: 3 in 4 consumers don’t think their health insurance plan

What Patients Feel About Technology, Healthcare Costs and Social Determinants

U.S. consumers feel positive about the roles of technology and social determinants in improving healthcare, but are concerned about costs, according to the 2017 Patient Survey Report conducted for The Physicians Foundation. The survey gauged patients’ perspectives across four issues: the physician-patient relationship, the cost of healthcare, social determinants of health, and lifestyle choices. Two key threads in the research explain how Americans feel about healthcare in the U.S. at this moment: the role of technology and the cost of health care. First, the vast majority of consumers view technology, broadly defined, as important for their health care. 85% of people

Consumers Use Digital Health Tools But Still Struggle with Health Literacy

While more U.S. patients are use digital health tools and take on more clinical and financial decision making for their health care, people also have gaps in health engagement and health literacy. Three studies published in early October 2017 provide insights into the state of healthcare consumerism in America. The 2017 UnitedHealthcare Consumer Sentiment Survey found that a plurality of Americans (45%) turn first to primary care providers (doctors or nurses) as their source for the first source of information about specific health symptoms, conditions or diseases. 28% of people also use the internet or mobile health apps as their

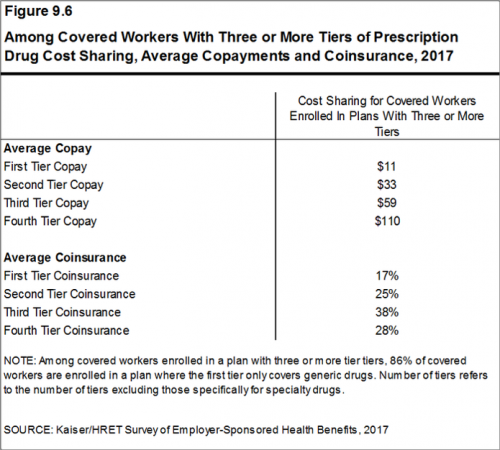

Prescription Drug Coverage at Work: Common, Complex, and Costly

Getting health insurance at work means also having prescription drug coverage; 99% of covered workers’ companies cover drugs, based on the 2017 Employer Health Benefits Survey released by the Kaiser Family Foundation (KFF). I covered the top-line of this important annual report in yesterday’s Health Populi post, which found that the health insurance premium for a family of four covered in the workplace has reached $18,764 — approaching the price of a new 2017 small car according to the Kelley Blue Book. The complexities of prescription drug plans have proliferated, since KFF began monitoring the drug portion of health benefits

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

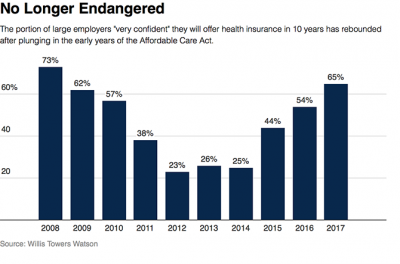

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

Weaving Accenture’s Five Digital Health Technology Trends for 2017

Technology should serve people, and Accenture has identified five major key trends that, together, could forge a person-centered, -friendly, -empowering healthcare system. This is Accenture’s Digital Health Technology Vision for 2017. “Should” and “could” are the important adverbs here, because if tech doesn’t deliver, driving efficiency and effectiveness, personalizing medical treatments, and inspiring people to become more health literate and health-engaging, then tech is just a Field of Dreams being built and available, with no people taking advantage of the potential benefits. The five new-new tech trends are: AI is the new UI, where healthcare experience is everything Ecosystem power

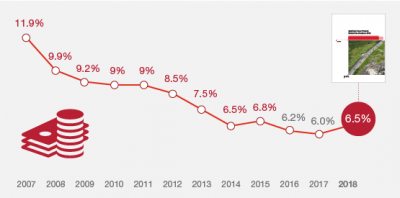

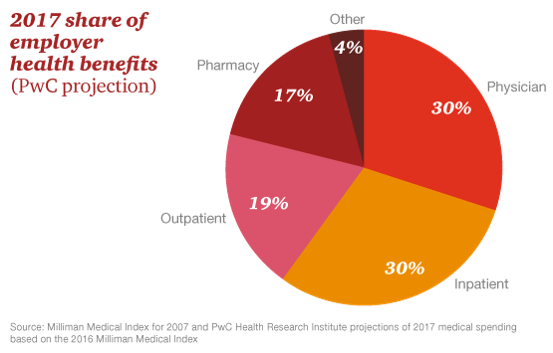

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

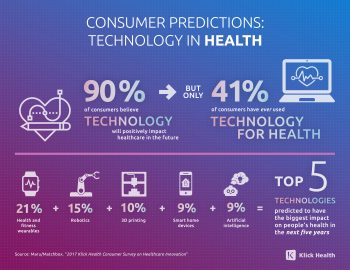

U.S. Consumers Expect, But Don’t See, Innovation From the Health & Wellness Industry

U.S. consumers consider Consumer Electronics to be the most innovative industry they know. But people believe that Health & Wellness should be the most innovative sector in the economy. Welcome to the 2017 Klick Health Consumer Survey, which focuses on health innovation in the context of peoples’ hopes for technology to improve health and healthcare. 1 in 2 people say that technology has had a positive impact on their health and wellness, skewing slightly more toward younger people (although 45% of people 55 years of age and older agree that tech positively contributes to health. 41% of consumers say they’ve

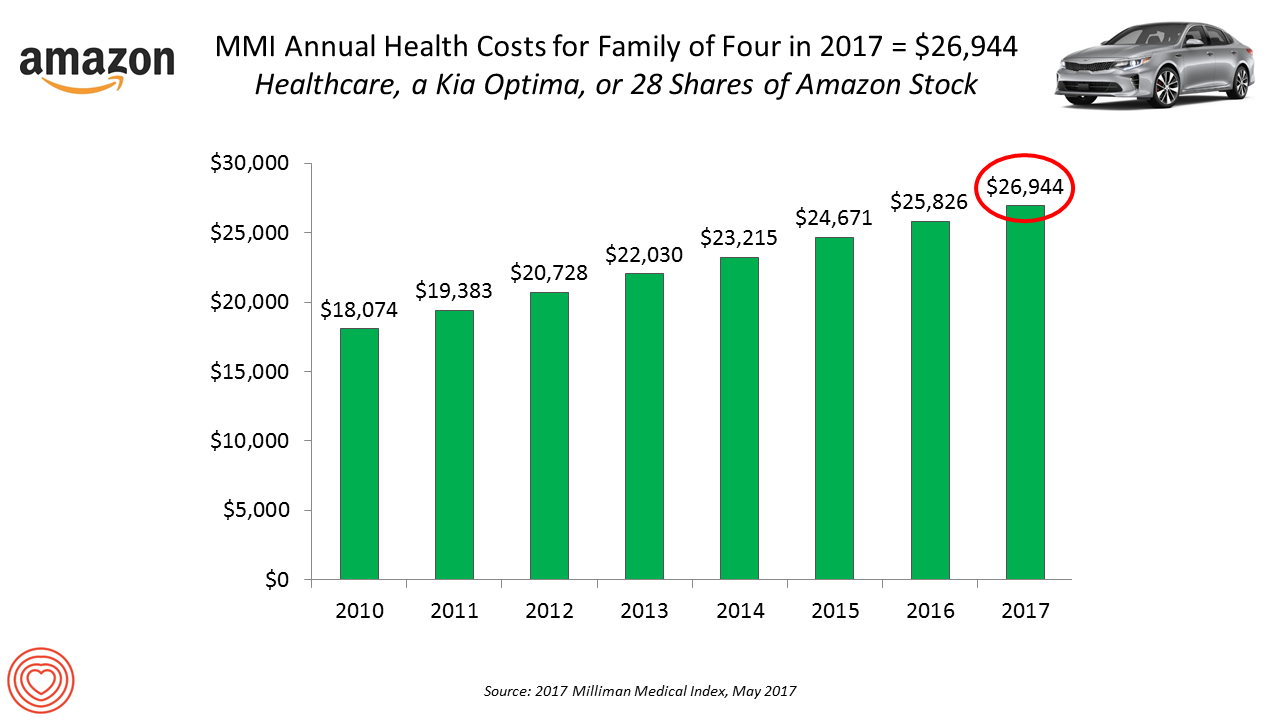

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

Women and Children First? What the AHCA Holds for Vulnerable Populations

In accounting, there’s a rule with acronym “LIFO;” this stands for “last in, first out,” which requires taking account of the most recent cost of products being the first ones to be expensed on the ledger. I’m thinking about LIFO when it comes to the American Health Care Act (AHCA) which narrowly passed through Congress yesterday by 4 votes, with a final tally of 217 to 213. Why “LIFO?” Because long-uninsured folks who just recently received access to health insurance as an on-ramp to health care services could lose this benefit, just months after joining the ranks of the insured. Among

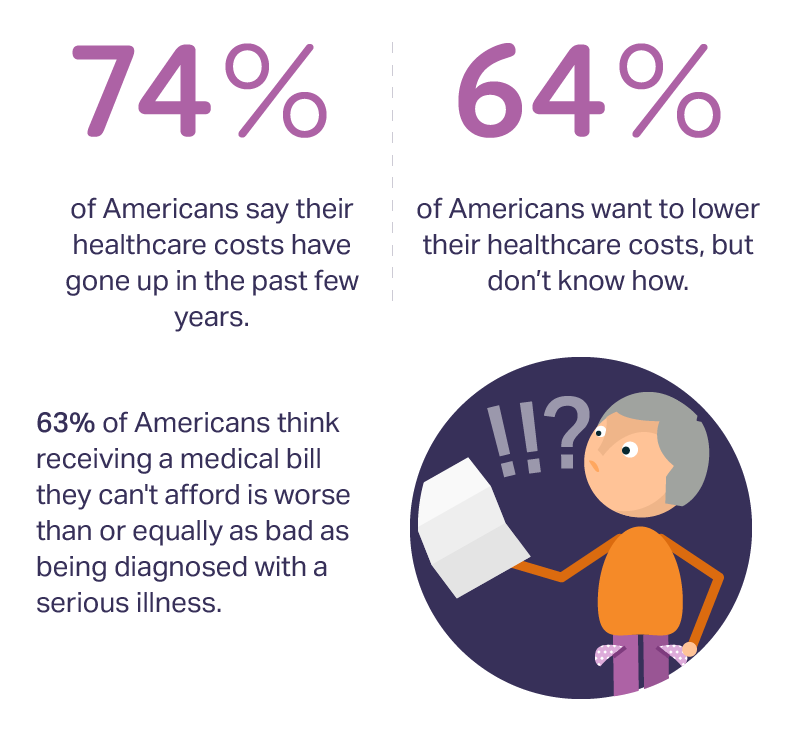

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

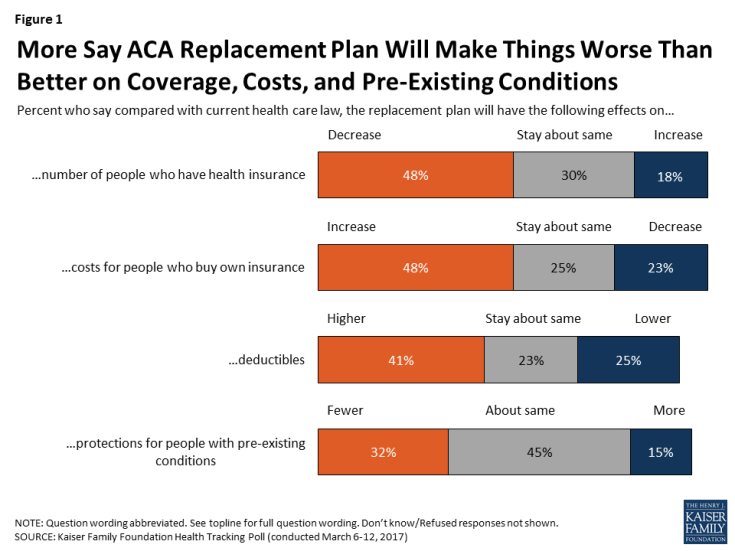

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

Consumers Taking Healthcare Into Own Hands at CES 2017

Consumer electronics (CE) aren’t just big screen TVs, sexy cars, and videogames anymore. Among the fastest-growing segments in CE is digital health, and health-tech will be prominently featured at the 2017 CES in Las Vegas hours after the champagne corks have popped at the start of the new year. On the second day of 2017, I’ll be flying to Las Vegas for several days of consumer technology immersion, learning about connected and smart homes and cars, and shiny new things all devoted to personal health. Welcome to my all-health lens on CES 2017, once referred to as the Consumer Electronics

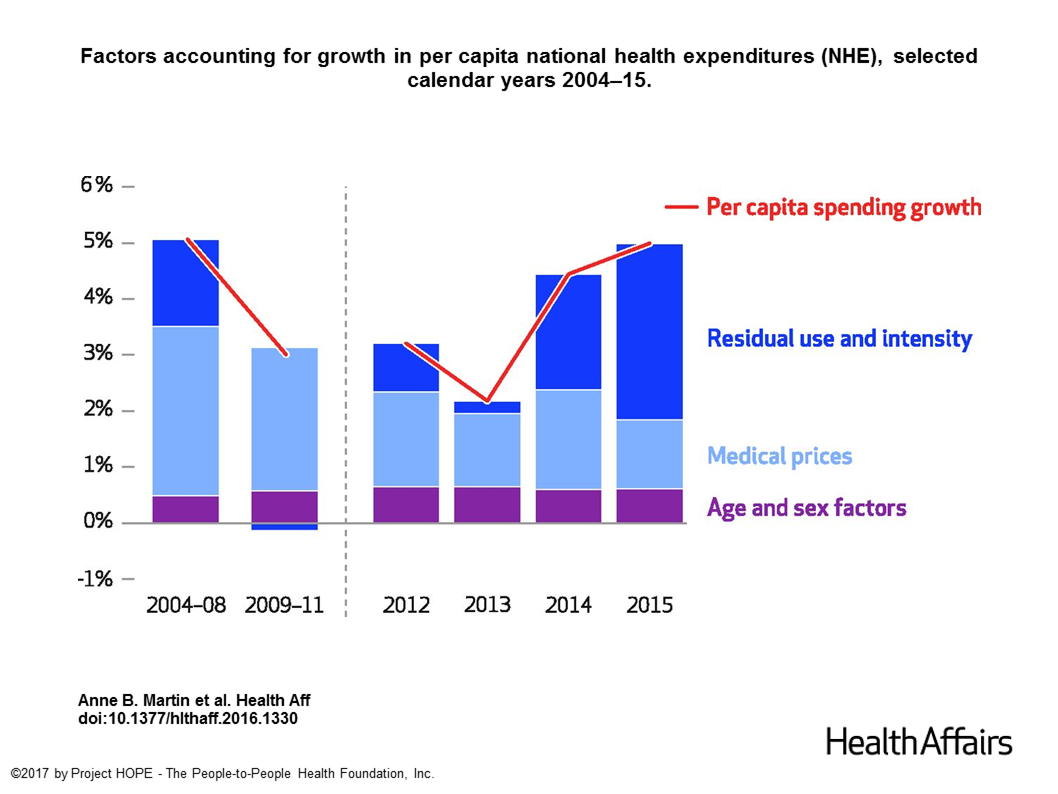

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

Self-Care Is the Best Healthcare Reform

The greater a person’s level of health engagement, the better their health outcome will be. Evidence is growing on the return-on-investment for peoples’ health activation and how healthy they are. That ROI is both in survival (mortality) and quality of life (morbidity), as well as hard-dollar savings — personally bending-the-healthcare-cost-curve. But people are more likely to engage in “health” than “healthcare.” We’d rather ingest food-as-medicine than a prescription drug, use walking in a lovely park for exercise, and laugh while we’re learning about how to manage our health insurance benefits. Thus, Campbell’s Soup Company and Hormel are expanding healthy offerings,

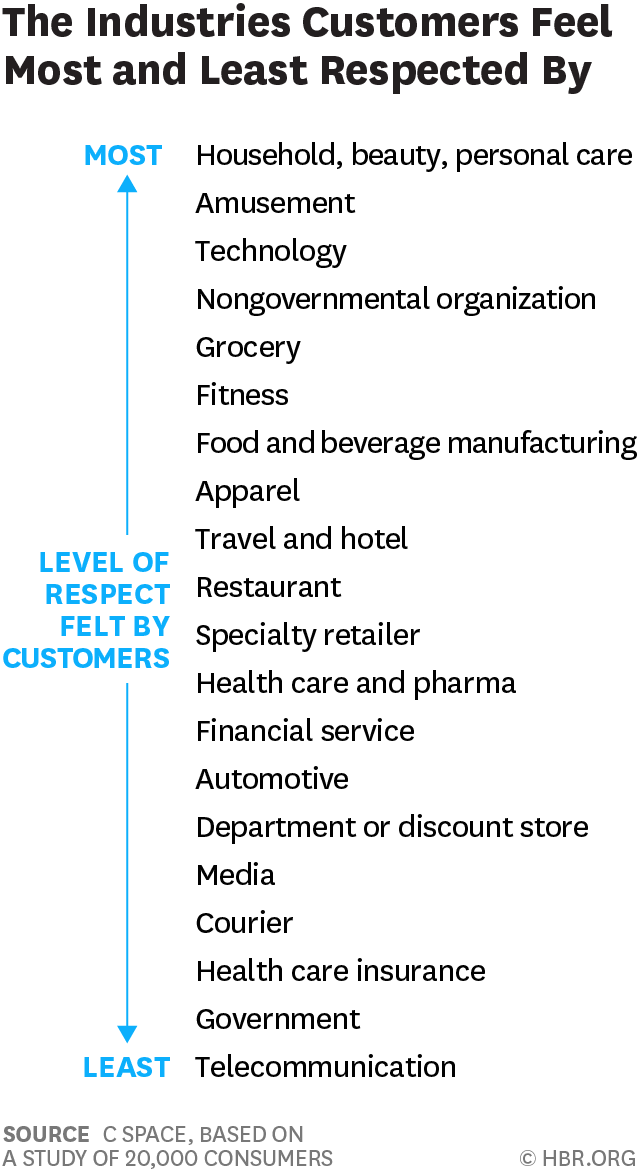

Consumers Feel More Respect from Personal Care and Grocery Brands Than Pharma or Insurance

People feel like get-no-respect Rodney Dangerfield when they deal with health insurance, government agencies, or pharma companies. Consumers feel much more love from personal care and beauty companies, grocery and fitness, according to a brand equity study by a team from C Space, published in Harvard Businss Review. As consumer-directed health care (high deductibles, first-dollar payments out-of-pocket) continues to grow, bridging consumer trust and values will be a critical factor for building consumer market share in the expanding retail health landscape. Nine of the top 10 companies C Space identified with the greatest “customer quotient” are adjacent in some way to health:

Looking for Amazon in Healthcare

Consumers have grown accustomed to Amazon, and increasingly to the just-in-time convenience of Amazon Prime. Today, workers who sign onto employee benefit portals are looking for Amazon-style convenience, access, and streamlined experiences, found in the Aflac Workforces Report 2016. Aflac polled 1,900 U.S. adults employed full or part time in June and July 2016 to gauge consumers’ views on benefit selections through the workplace. Consumers have an overall angst and ennui about health benefits sign-ups: 72% of employees say reading about benefits is long, complicated, or stressful 48% of people would rather do something unpleasant like talking to their ex or

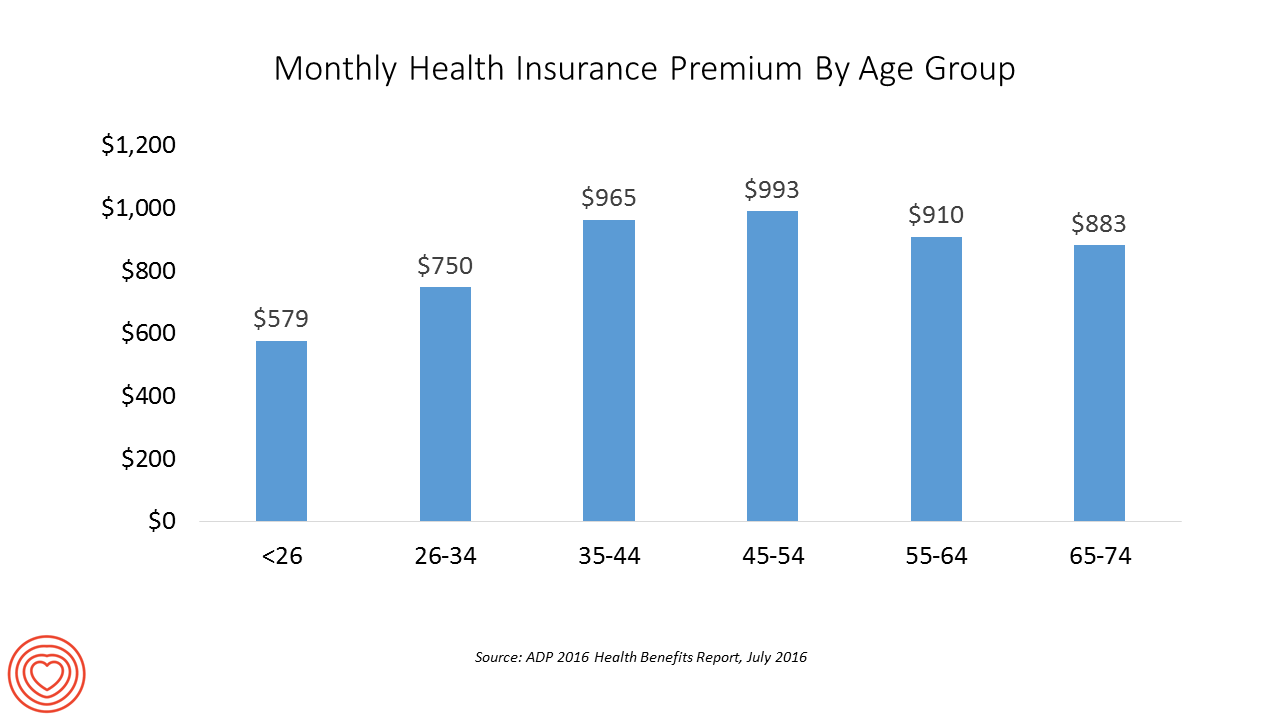

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

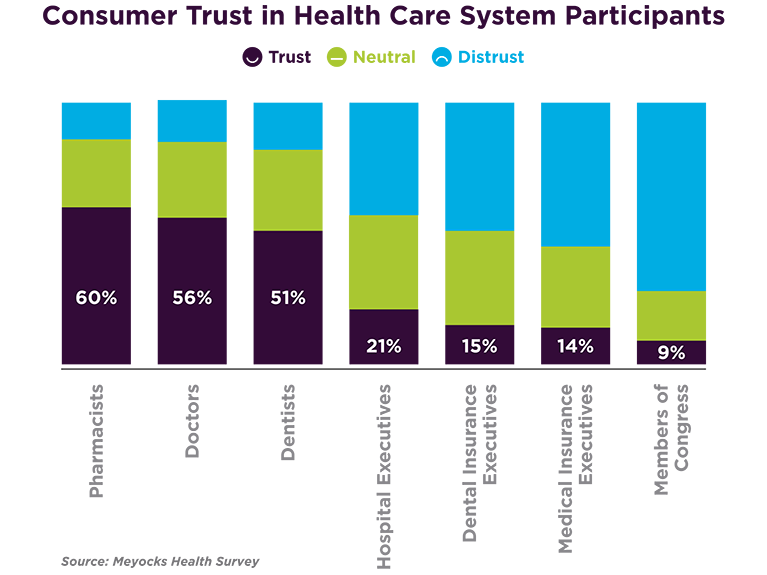

In Healthcare, Pharmacists and Doctors Most Trusted. Insurance Execs and Congress? Not.

When consumers consider the many stakeholder organizations in healthcare, a majority trust pharmacists first, then doctors and dentists. Hospital and health insurance execs, and members of Congress? Hardly, according to a survey from Meyocks, a marketing consultancy. Meyocks conducted the survey via email among 1,170 US adults, 18 years of age and older. This survey correspondends well with the most recent Gallup Poll on most ethical professions, conducted in December 2015. In that study, pharmacists, nurses and doctors come out on top, with advertisers (“Mad Men”), car salespeople, and members of Congress at the bottom, as shown in the second

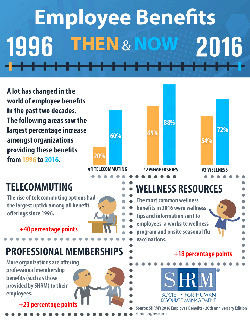

The State of Health Benefits in 2016: Reallocating the Components

Virtually all employers who offer health coverage to workers extend health benefits to all full-time employees. 94% offer health care coverage to opposite-sex spouses, and 83% to same-sex spouses. One-half off health benefits to both opposite-sex and same-sex domestic partners (unmarried). Dental insurance, prescription drug coverage, vision insurance, mail order prescription programs, and mental health coverage are also offered by a vast majority (85% and over) of employers. Welcome to the detailed profile of workplace benefits for the year, published in 2016 Employee Benefits, Looking Back at 20 Years of Employee Benefits Offerings in the U.S., from the Society for Human

PwC’s “Behind the Numbers” – Where the Patient Stands

The growth of health care costs in the U.S. is expected to be a relatively moderate 6.5% in 2017, the same percentage increase as between 2015 and 2016, according to Medical Cost Trend: Behind the Numbers 2017, an annual forecast from PwC. As the line chart illustrates, the rate of increase of health care costs has been declining since 2007, when costs were in double-digit growth mode. Since 2014, health care cost growth has hovered around the mid-six percent’s, considered “low growth” in the PwC report. What’s driving overall cost increases is price, not use of services: in fact, health care

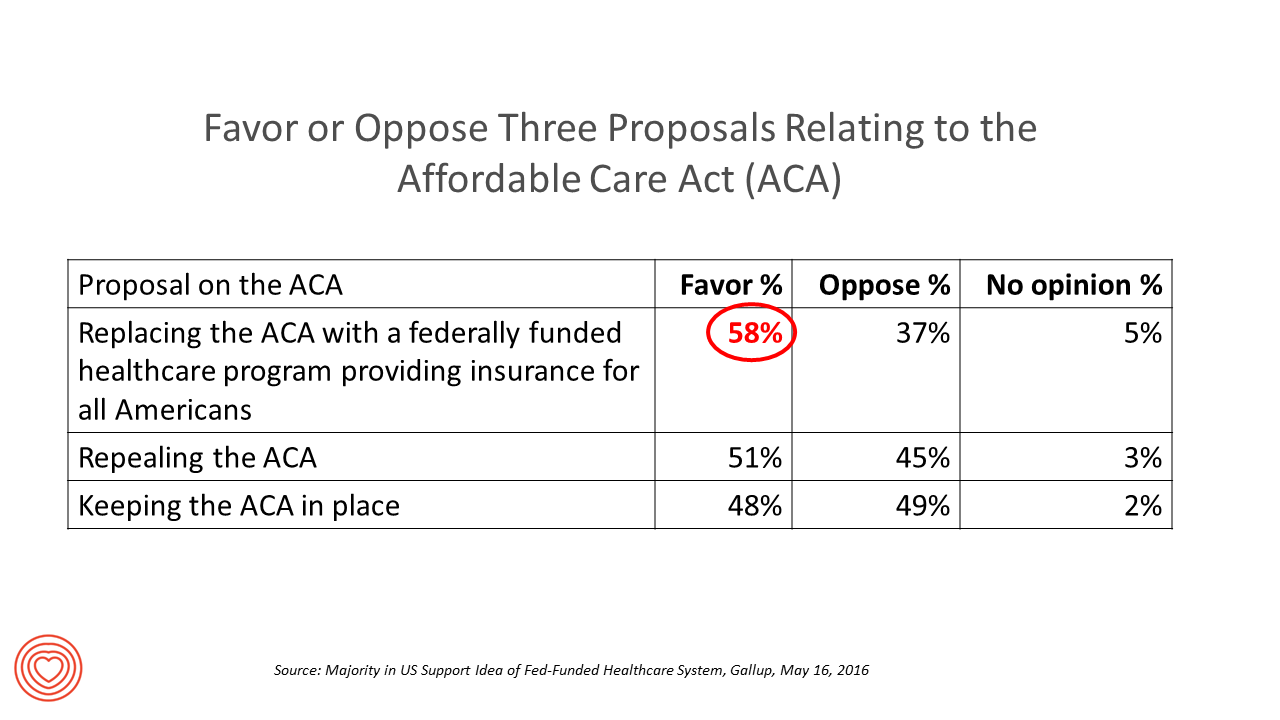

Most Americans Favor A Federally-Funded Health System

6 in 10 people in the US would like to replace the Affordable Care Act with a national health insurance program for all Americans, according to a Gallup Poll conducted on the phone in May 2016 among 1,549 U.S. adults. By political party, RE: Launch a Federal/national health insurance plan (“healthcare a la Bernie Sanders”): Among Democrats, 73% favor the Federal/national health insurance plan, and only 22% oppose it; 41% of Republicans favor it and 55% oppose it. RE: Repeal the ACA (“healthcare a la Donald Trump”): Among Democrats, 25% say scrap the ACA, and 80% of Republicans say to do

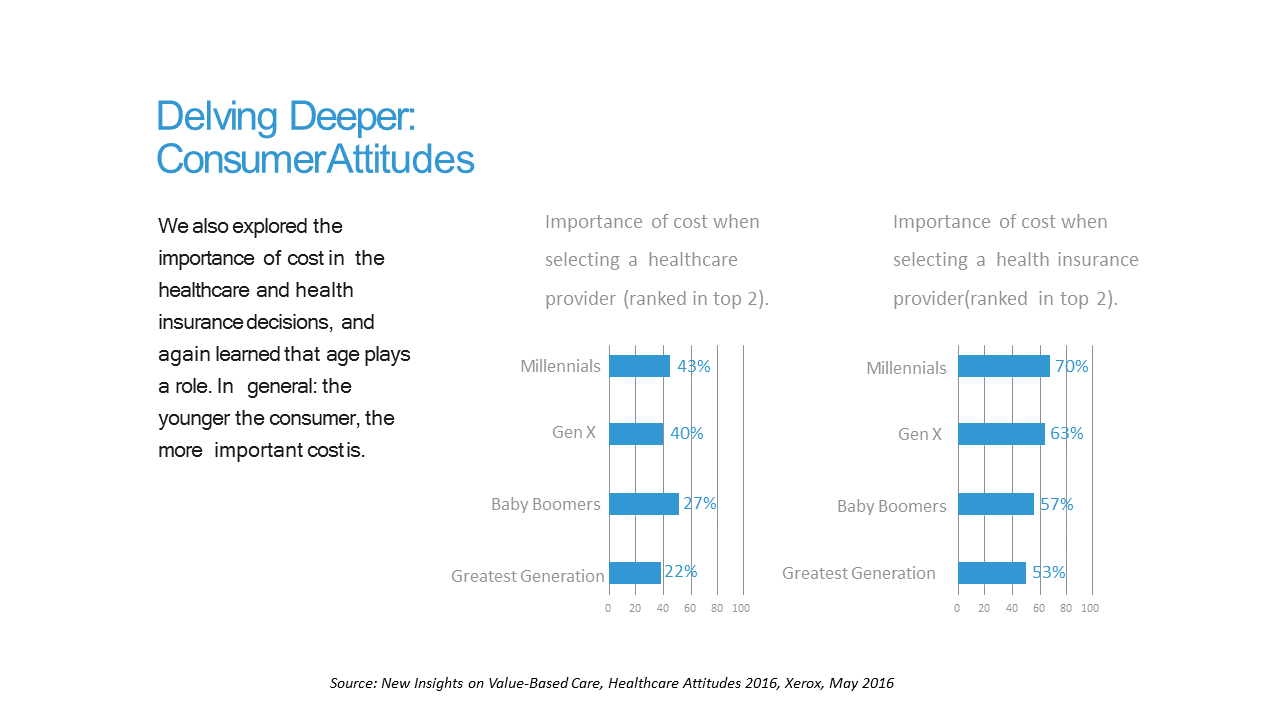

Costs and Connection At the Core of Consumers’ Health-Value Equations

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016. The younger the consumer, the more important costs are, Xerox’s poll found, shown in the first chart. Thus, “shopping around” is more pronounced among younger health consumers — although a majority people who belong to Boomer and Greatest Generation cohorts do shop around for both health providers and health insurance plans —

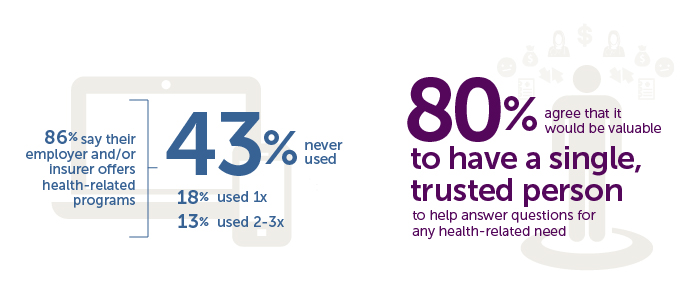

Generation Gaps in Health Benefit Engagement

Older workers and retirees in the U.S. are most pleased with their healthcare experiences and have the fewest problems accessing services and benefits. But, “younger workers [are] least comfortable navigating U.S. healthcare system,” which is the title of a press release summarizing results of a survey conducted among 1,536 U.S. adults by the Harris Poll for Accolade in September 2015. Results of this Accolade Consumer Healthcare Experience Index poll were published on April 12, 2016. Accolade, a healthcare concierge company serving employers, insurers and health systems, studied the experiences of people covered by health insurance to learn about the differences across age

Behavioral Economics in Motion: UnitedHealthcare and Qualcomm

What do you get when one of the largest health insurance companies supports the development of a medical-grade activity tracker, enables data to flow through a HIPAA-compliant cloud, and nudges consumers to use the app by baking behavioral economics into the program? You get Motion from UnitedHealthcare, working with Qualcomm Life’s 2net cloud platform, a program announced today during the 2016 HIMSS conference. What’s most salient about this announcement in the context of HIMSS — a technology convention — is that these partners recognize the critical reality that for consumers and their healthcare, it’s not about the technology. It’s about

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

Telehealth Comes of Age at HIMSS 2016

Telehealth will be in the spotlight at HIMSS 2016, the biggest annual conference on health information technology (HIT) that kicks off on 29th February 2016 in Las Vegas – one of the few convention cities that can handle the anticipated crowd of over 50,000 attendees. Some major pre-HIMSS announcements relate to telehealth: American Well, one of the most mature telehealth vendors, is launching a software development kit (SDK) which will enable The new videoconferencing option can simultaneously connect patients with multiple physicians and specialists, and the SDK is designed to enable users to incorporate telemedicine consults into patient portals and

U.S. National Health Spending Up Due to More People Covered and Higher Drug Costs

National health spending in American grew by 5.3% in 2014, hitting the $3 trillion mark. This represented an up-tick nearly twice the growth rate of 2.9% in 2013, the slowest rate of growth in 55 years, according to the latest analysis of the U.S. health economy published by Health Affairs. The first chart illustrates the factors that contribute to that 5.3% growth in health spending. The two largest factors were medical prices and so-called “residual use and intensity.” The medical price increase portion was 1.8% in 2014, up from 1.3% in 2013. The use and intensity component was attributable to

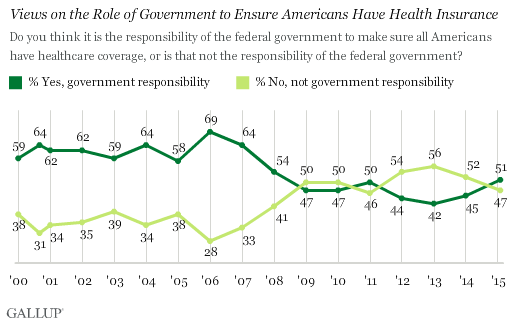

51% of Americans Say It’s Government’s Responsibility To Provide Health Insurance

For the first time since 2008, a majority of Americans say government is responsible for ensuring that people have health insurance. The first chart shows the crossing lines between those who see government-assured health insurance in the rising dark green line in 2015, and people who see it as a private sector responsibility. The demographics and sentiments underneath the 51% are important to parse out: people who approve of the Affordable Care Act are over 3x more likely to believe in government sponsoring health insurance versus those who disapprove, 80% compared with 26%. The demographic differences are also striking, detailed

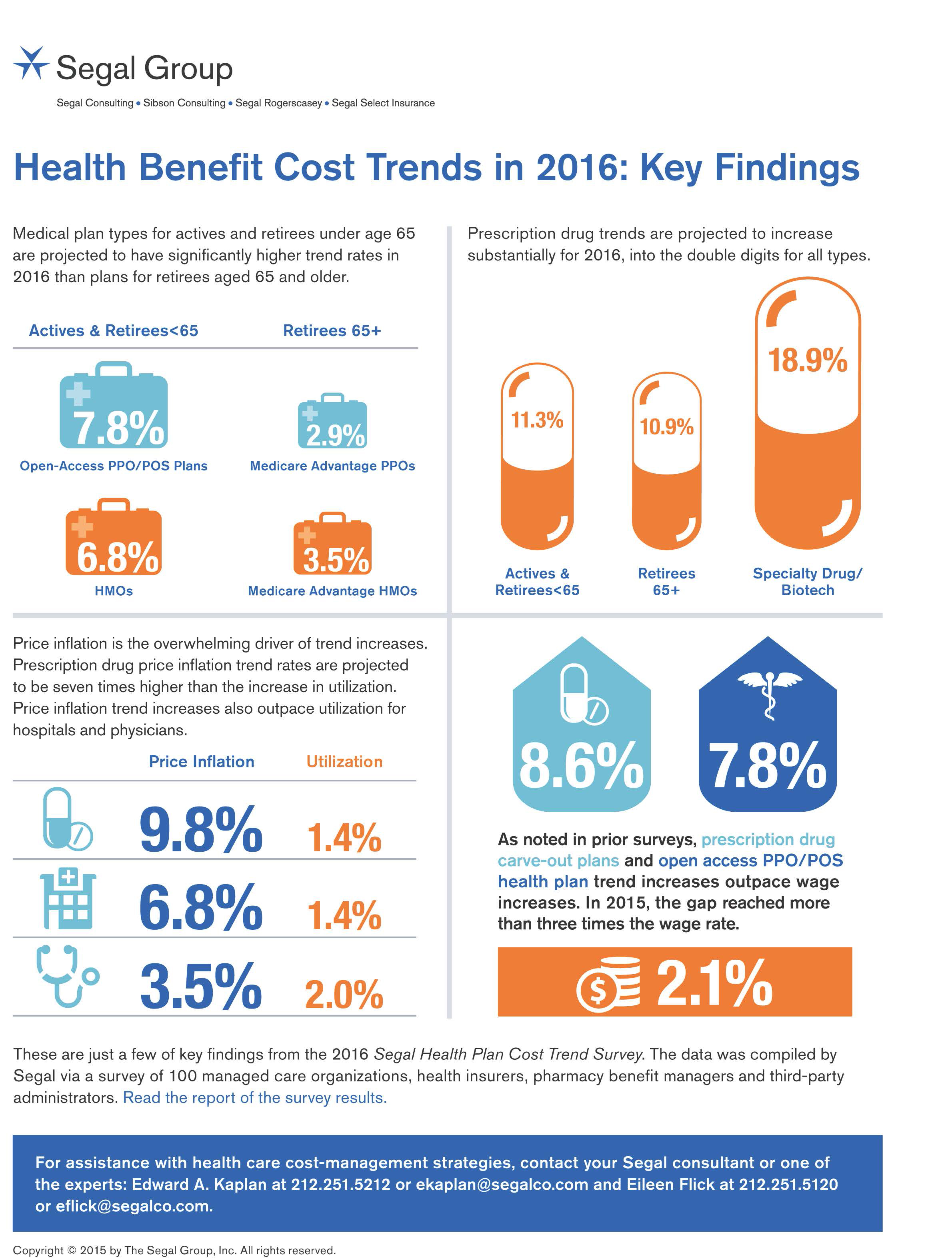

In 2016 Prescription Drugs Will Be The Fastest-Growing Component of Healthcare Costs

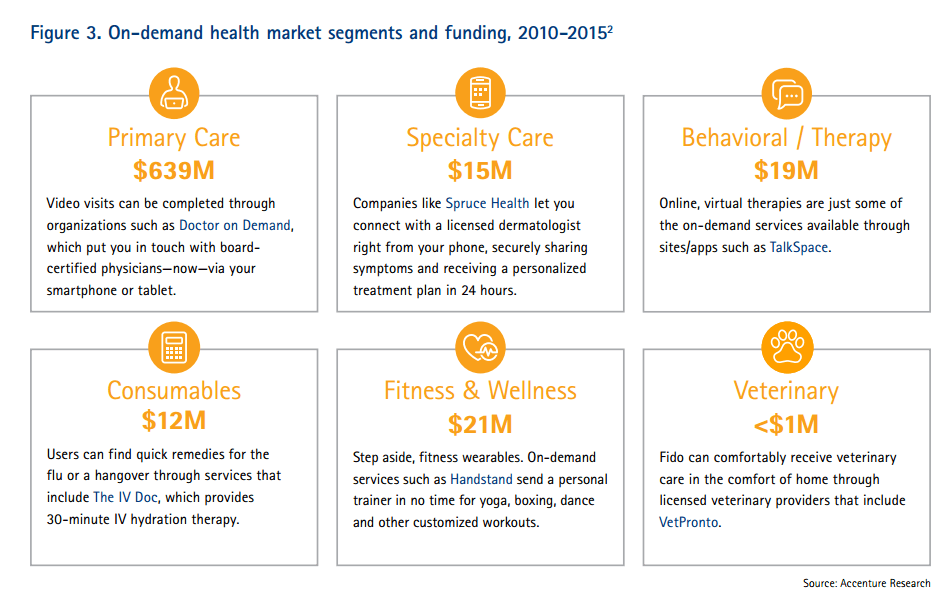

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015. By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies. Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in

From Pedometers to Premiums in Swiss Health Insurance

A Switzerland-based health insurance company is piloting how members’ activity tracking could play a role in setting premiums. The insurer, CSS, is one of the largest health insurance companies in the country and received a “most trusted general health insurance” brand award in 2015 from Reader’s Digest in Switzerland. The company is conducting the pilot, called the MyStep project, with volunteers from the Federal Institute of Technology in Zurich and the Unviersity of St. Gallen. According to an article on the program published in the Swiss newspaper The Local, “the pilot aims to discover to what extend insured people are

A Company’s Healthy Bottom Line Requires Healthy Employees

“What is the meaning of health to our businesses?” asked Dr. Thomas Parry of the Integrated Benefits Institute (IBI) at a dinner last night, convened by the Pittsburgh Business Group on Health on the eve of the organization’s annual meeting being held today in Steel City. I was fortunate to attend the dinner and hear Dr. Parry speak; I will be addressing the meeting today on the topic, “Building a Better Health Consumer.” The IBI is researching the direct link between the top line of a healthy employee base and healthy workers’ impacts on the bottom line. A report will be

Employers pushing consumerism for health benefits in 2016

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers. That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

Coverage and price before brand for health plan shoppers

When Americans shop for health insurance (and they do – more, later in the post), they look most for covering major medical expenses, prescription drugs, preventive care, and price. Less important is the brand of the plan, or its high ratings. Valence Health surveyed 524 U.S. consumers in June 2015 to learn how healthcare shoppers feel about health insurance and health reform. The results are published in the report, U.S. Attitudes Toward Health Insurance and Healthcare Reform in August 2015. Key findings in the study were that: Price and coverage come before all other factors in evaluating health plans 73%

Telehealth goes retail

In the past couple of weeks, a grocery store launched a telemedicine pilot, a pharmacy chain expanded telehealth to patients in 25 states, and several new virtual healthcare entrants received $millions in investments. On a parallel track, the AMA postponed dealing with medical ethics issues regarding telemedicine, the Texas Medical Association got stopped in its tracks in a case versus Teladoc, and the Centers for Medicare and Medicaid Services (CMS) issued a final rule for the Medicare Shared Savings Program that falls short of allowing Accountable Care Organizations (ACOs) to take full advantage of telehealth services. These events beg the

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Purchase of wearable fitness trackers expected to grow in 2015, but one-half of Americans would “never” buy one

Headphones and smartphones are the top two electronics products U.S. consumers intend to purchase in 2015. But the emerging consumer electronics categories of wearable fitness trackers, smart watches, and smarthome devices (especially “smart” thermostats) are positioned to grow, too, in 2015, according to the 17th Annual CE Ownership and Market Potential Study from the Consumer Electronics Association (CEA). Wearable trackers have an installed base of about 17 million devices in the U.S., with 11% of U.S. households intending to purchase a tracker in 2015 — 6 percentage points up from 2014 (about a 50% increase over 2014). There are about 6 million smart

Supersize Rx: the impact of specialty drug spending and Hep C in 2014

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab. Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans. The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

#OwnYourHealth: Health is everywhere, even underground

Living my mantra of Health is Everywhere, where we live, work, play, pray, and shop, I am always on the lookout for signs of health in my daily life. Today I’m in Washington, DC, speaking on a webinar led by the National Council on Patient Information and Education (NCPIE), discussing the findings in a survey of U.S. adults on self-care health care – my shorthand for healthcareDIY. And the hashtag for the webinar also speaks volumes: #OwnYourHealth. Here’s the link to the survey resources. On my walk from Farragut North Metro station to a nearby office where the meeting will take place,

Health = love. Care = love. Healthcare? Meh

Bruce Broussard, CEO of Humana, forgot the charger for his smartwatch on a business trip. Stopping into a consumer electronics store, he was struck by the options he faced of various wearable technologies. He ended up buying a new watch, which he uses for exercise tracking. “Technology is such an important part of the direction of health care,” Broussard told the HIMSS 2015 audience in his keynote address on 14 April 2015. But Broussard was quick to point out to the thousands of technology geeks that comprise HIMSS’s membership that improving the health/care system isn’t just about technology: “we have

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.