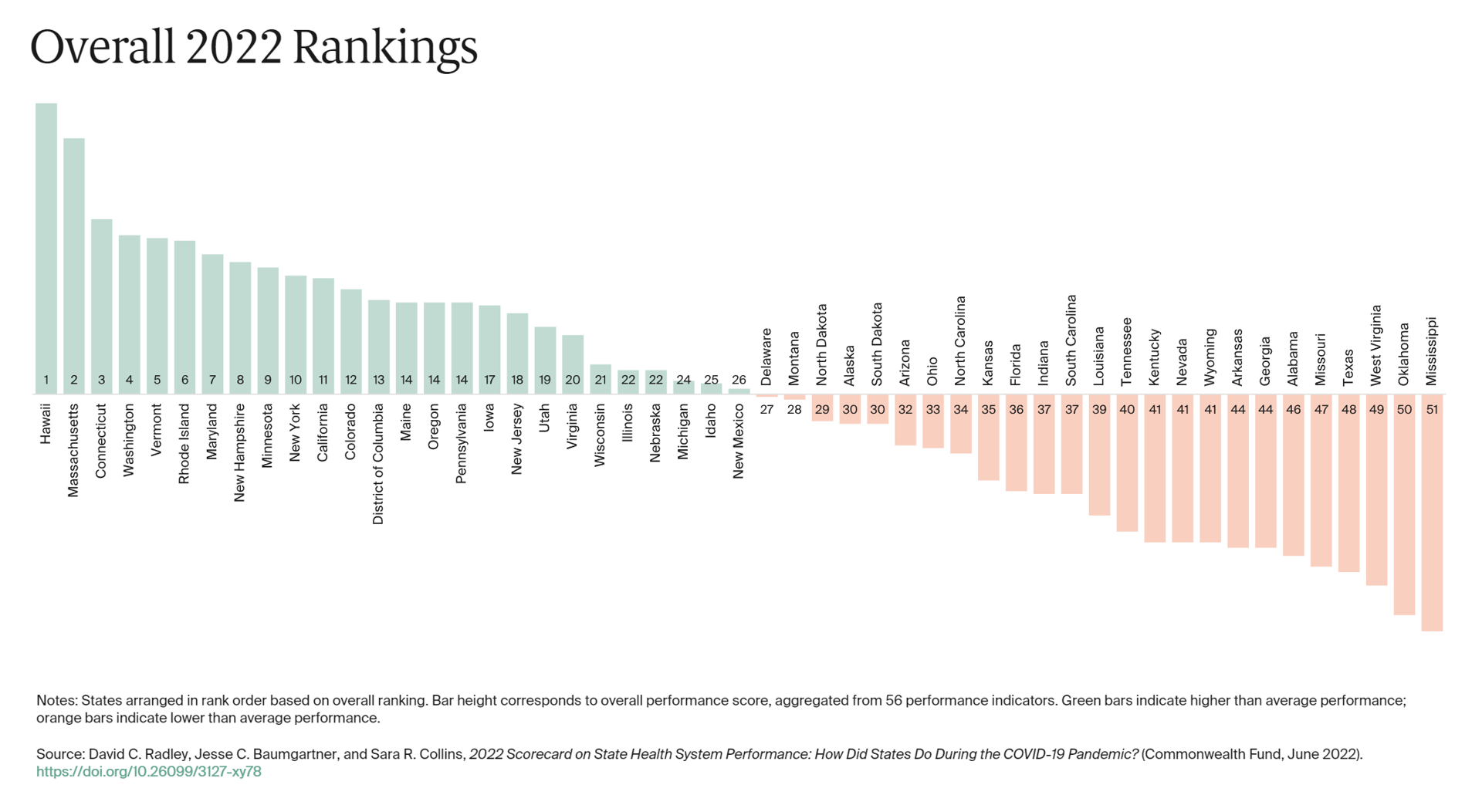

The 2022 US Health System Report Card: Pretty Terrific If You Live in Hawaii or Massachusetts

The best U.S. states to live in for health and health care are Hawaii, Massachusetts, Connecticut, Washington, Vermont, Rhode Island, and Maryland… Those are the top health system rankings in the new 2022 Scorecard on State Health System Performance annual report from the Commonwealth Fund. If you live in Mississippi, Oklahoma, West Virginia, Texas, Missouri, Alabama, Georgia, or Arkansas, your health care and outcomes are less likely to be top-notch, the Fund’s research concluded. The Commonwealth Fund has conducted this study since 2006, assessing a range

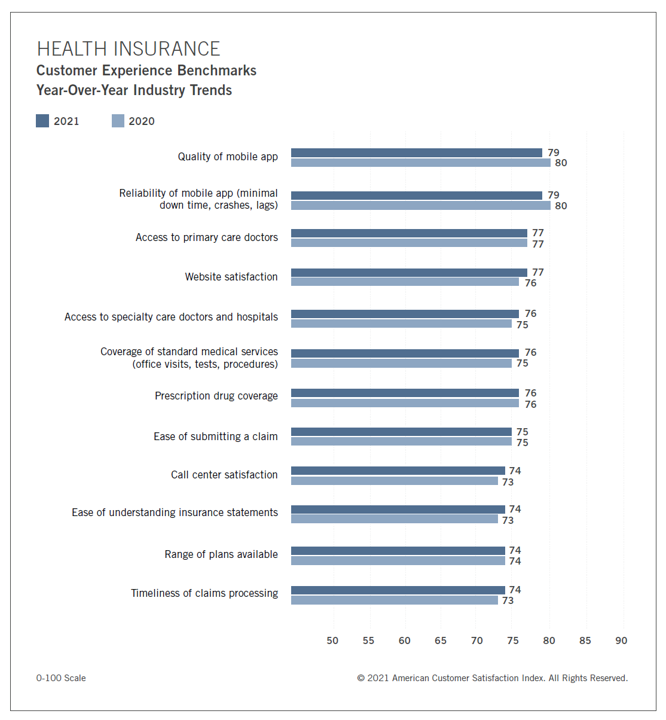

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

How Nurx Is Empowering Women’s Health and Self-Care in the Pandemic Era

In the wake of the coronavirus pandemic, women have experienced more than the direct physical, clinical impact of COVID-19: beyond “lives,” women’s livelihoods, financial health and emotional well-being have been hard-hit. This is true on both a global basis as well as in the United States. In that context, last week I engaged in a fascinating conversation with Varsha Rao, CEO of Nurx, to discuss the current state of women and health/care in America, and some thoughts about the future. If you’ve had the TV on sometime since March 2020, one of many millions of people in the U.S. spending

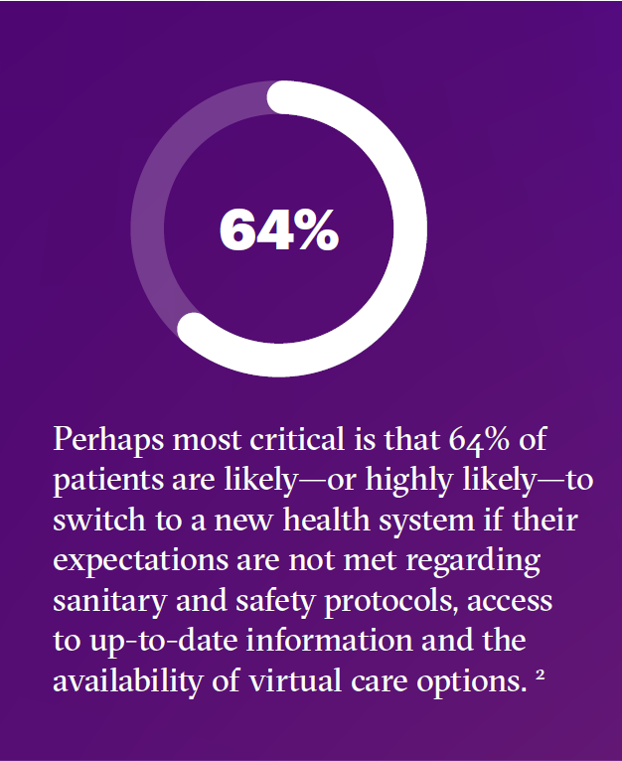

The Coronavirus Pandemic Has Made Patients Less Patient – Insights from Accenture

When it comes to patients, health care providers have been hit hard in two ways in the wake of the COVID-19 pandemic. Hit #1 has been the direct negative impact of the coronavirus on health care volumes and patients not utilizing hospitals and doctors’ services, avoiding physical encounters in health care sites Hit #2 has been the negative impact of patient experience for those health consumers who sought health care services during the pandemic — and had a negative response to the encounter. Accenture explored this phenomenon in their latest report, Elevating the Patient Experience to Fuel Growth. In the

Despite Greater Digital Health Engagement, Americans Have Worse Health and Financial Outcomes Than Other Nations’ Health Citizens

The idea of health care consumerism isn’t just an American discussion, Deloitte points out in its 2019 global survey of healthcare consumers report, A consumer-centered future of health. The driving forces shaping health and health care around the world are re-shaping health care financing and delivery around the world, and especially considering the growing role of patients in self-care — in terms of financing, clinical decision making and care-flows. With that said, Americans tend to be more healthcare-engaged than peer patients in Australia, Canada, Denmark, Germany, the Netherlands, Singapore, and the United Kingdom, Deloitte’s poll found. Some of the key behaviors

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

A Portrait of the Health Consumer as Confused, Cost-Challenged, and Out of Control

Patients in the U.S. are confused, cost-challenged and lacking control, according to The Consumer Healthcare Paradox from Maestro Health, an employee health and benefits company. Data illustrating that “paradox” is shown in the second chart: while 78% percent of patients told Maestro Health their health care experience is positive, 69% feel they lack control over their patient journey. Quality health care in America is too expensive, 79% of consumers said. Furthermore, one in two U.S. patients had received a medical bill that was higher than they anticipated it would be. Finally, one in two U.S. patients said the quality of

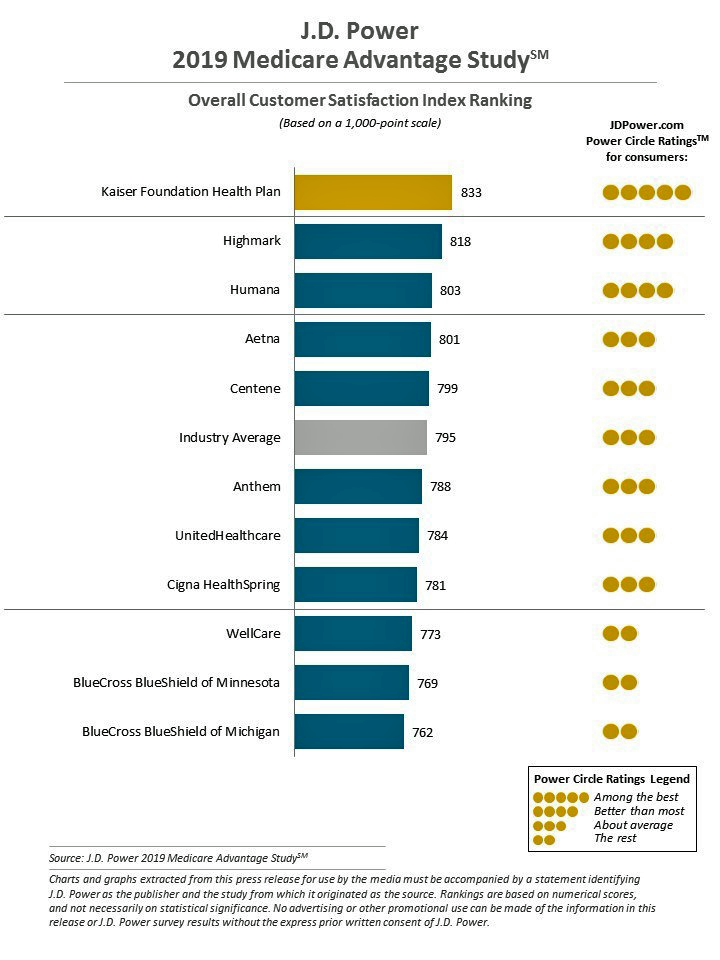

Talk to Me About My Health, Medicare Advantage Beneficiaries Tell J.D. Power

Cost is the major reason why Medicare Advantage plan beneficiaries switch plans, but people who switch also tend to have lower satisfaction scores based on non-cost factors. Those ratings have a lot to do with information and communication, according to J.D. Power’s 2019 Medicare Advantage Plan Study. The Study explores MA beneficiaries’ views on six factors: Coverage and benefits Provider choice Cost Customer service Information and communication, and Billing and payment. Kaiser Foundation Health Plan garnered the top spot for the fifth year in-a-row. By feature, Kaiser achieved 5 “Power Circles” for all factors except for cost and provider choice,

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

Nurses are the most trusted profession in America, followed by doctors and pharmacists

Nurses rank top in Americans’ minds for the seventeenth year-in-a-row, Gallup found in its annual survey of honesty and ethics in professions. At the bottom of the list for honesty and ethics in 2018, Gallup points to U.S. Congressional representatives, “Mad Men” and Women of advertising, telemarketers, and folks who sell autos. Congress-folk and car salespeople have ranked at the low-trust bottom for many years in this Gallup poll. While the 3 health care professions rose once again to the top of the job-trust roster, nurses rank far greater than doctors and pharmacists by a 17-point margin of consumers rating the

Sicker Consumers Are More Willing to Share Health Data

People dealing with chronic conditions are keener to share personally-generated data than people that don’t have a chronic disease, Deloitte’s 2018 Survey of U.S> Health Care Consumers learned. This and other insights about the patient journey are published in Inside the patient journey, a report from Deloitte that assesses three key touch points for consumer health engagement. These three patient journey milestones are searching for care, using new channels of care, and tracking and sharing health data, Deloitte maps. What drives people to engage on their patient journeys has a lot more to do with practical matters of care like convenience,

Value Comes to Healthcare: But Whose Value Is It?

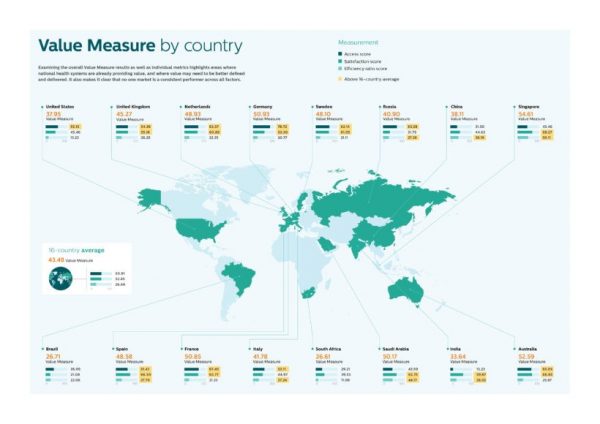

The Search for Value is the prevailing journey to a Holy Grail in healthcare these days. On that, most stakeholders working on the ground, globally. can agree. But whose value is it, anyway? Three reports published in the past few weeks give us some useful perspective on that question, woven together in today’s Health Populi blog. Let’s start with the Philips Future Health Index, which assesses value to 16 national health systems through three lenses: access, satisfaction, and efficiency. The results are shown in the map. “Value-based healthcare is contextual, geared towards providing the right care in the right place, at

What Would Healthcare Feel Like If It Acted Like Supermarkets – the 2018 Temkin Experience Ratings

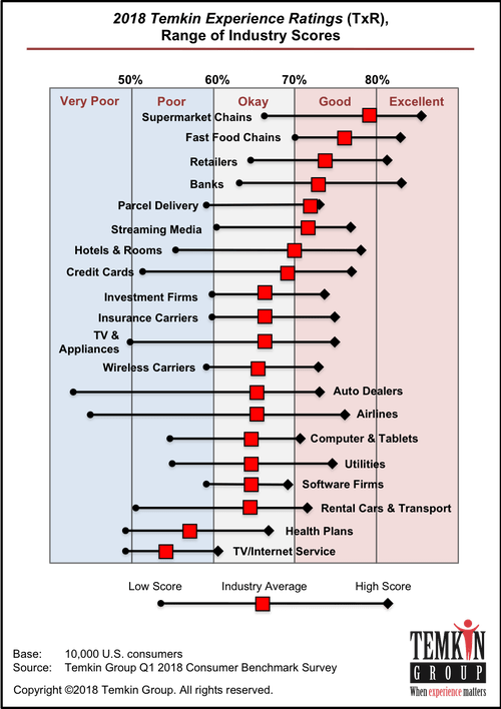

U.S. consumers rank supermarkets, fast food chains, retailers, and banks as their top performing industries for experience according to the 2018 Temkin Experience Ratings. Peoples’ experience with health plans rank at the bottom of the roster, on par with rental cars and TV/Internet service providers. If there is any good news for health plans in this year’s Temkin Experience Ratings compared to the 2017 results, it’s at the margin of “very poor” performance: last year, health plans has the worst performance of any industry (with the bar to the furthest point on the left as “low scoring”). This year, it

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

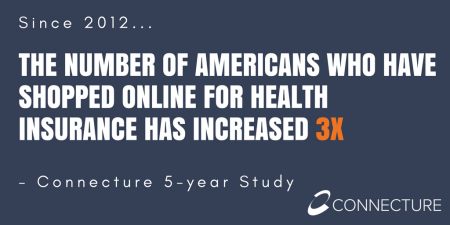

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

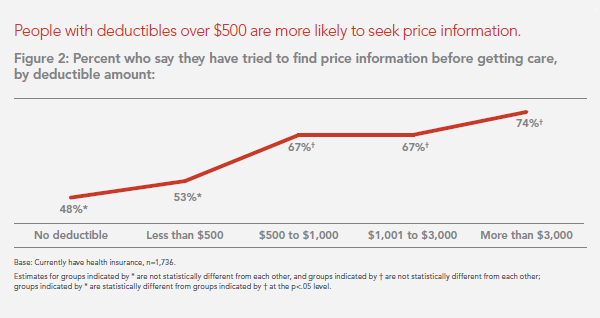

Price-Shopping for Healthcare Still A Heavy Lift for Consumers

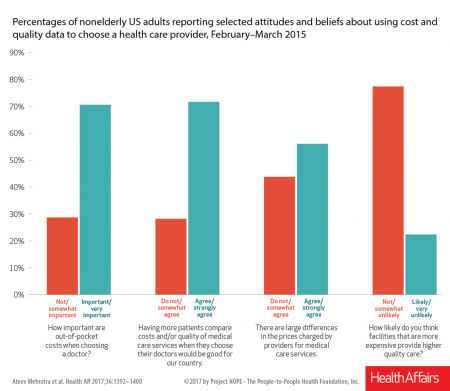

Most U.S. consumers support the idea of price-shopping for healthcare, but don’t practice it. While patients “should” shop for health care and perceive differences in costs across providers, few seek information about their personal out-of-pocket costs before getting treatment. Few Americans shop around for health care, even when insured under a high-deductible health plan, conclude Ateev Mehrotra and colleagues in their research paper, Americans Support Price Shopping For Health Care, But Few Actually Seek Out Price Information. The article is published in Health Affairs‘ August 2017 issue. The bar chart shows some of the survey results, with the top-line finding

The Pursuit of Health Equity and the State of U.S. Health Care

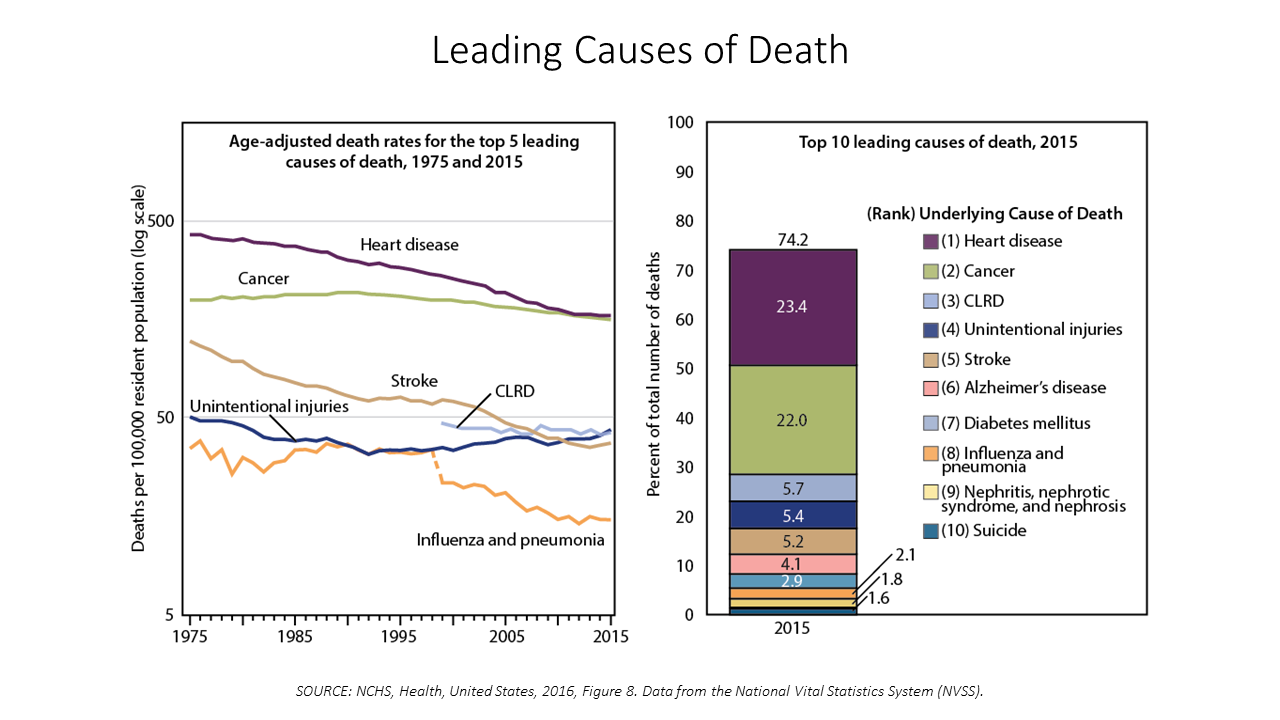

Between 2014 and 2015, death rates increased for eight of the ten leading causes; only death rates caused by cancer fell, and mortality rates for influenza and pneumonia stayed flat. The first chart paints this sobering portrait of Americans’ health outcomes, presented in the CDC’s data-rich 488-page primer, Health, United States, 2016. Think of this publication as America’s annual report on health. Every year, it is prepared and submitted to the President and Congress by the Secretary of the Department of Health and Human Services. This year’s report was delivered by DHHS Secretary Tom Price to President Trump and the

Patients Switch Doctors Based on Service, Not Just Care or Costs – Think “Text”

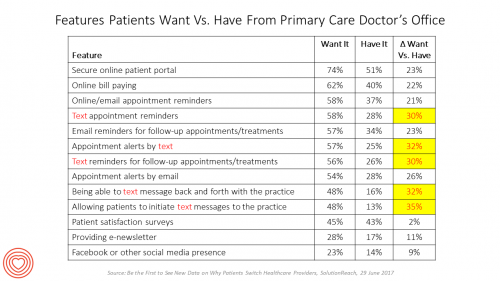

There’s more evidence of shopping behavior among patients: there’s new data showing that patients-as-consumers switch healthcare providers not due to quality of care or costs, but because of lack of service. I discovered one key verb and feature patient-consumers expect from doctors: it’s the ability to text, for appointment reminders, alerts, treatments, and communicating with the practice. SolutionReach, in the business of patient engagement, conducted a survey among 500 consumers asking about primary care providers, communication experience and satisfaction levels. The company presented the research results in a webinar on 29 June 2017. The research was also written up in

Consumer Experience Is An Integral Part of the Healthcare Experience

Patient satisfaction should be baked into healthcare provider service goals, according to Prioritizing the Patient Experience from West Corporation, the communications company. West is in the business of improving communications systems, and has a vested interest in expanding comms in health. This research polled patients and providers to assess how each healthcare stakeholder perceives various patient satisfaction issues, which when done well are grounded in sound communications strategy and technologies. Patient satisfaction is directly linked to the bottom lines of healthcare organizations, West contends, due to two key drivers: Evolving payment models are increasingly tying patient satisfaction to reimbursements; and,

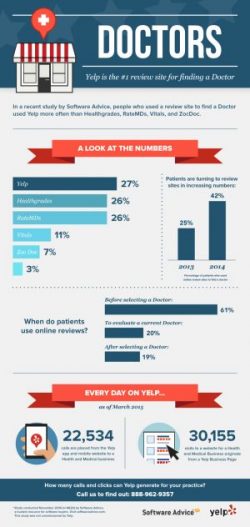

Consumer Healthcare Reviews on Yelp Help

Just as consumers use TripAdvisor, Zagat, OpenTable, and their Facebook pages to review restaurants, hotels, automobiles, and financial services companies, many patients – now health consumers in earnest – have taken to reviewing healthcare services in social networks. Finding reliable, understandable information about healthcare quality and prices is very challenging for most consumers. Are healthcare reviews on social networks statistically valid? An analysis of consumer ratings for New York State hospitals on Yelp, the social network, were positively correlated to objective scores of hospital quality, according to the research published in Yelp for Health: Using the Wisdom of Crowds to

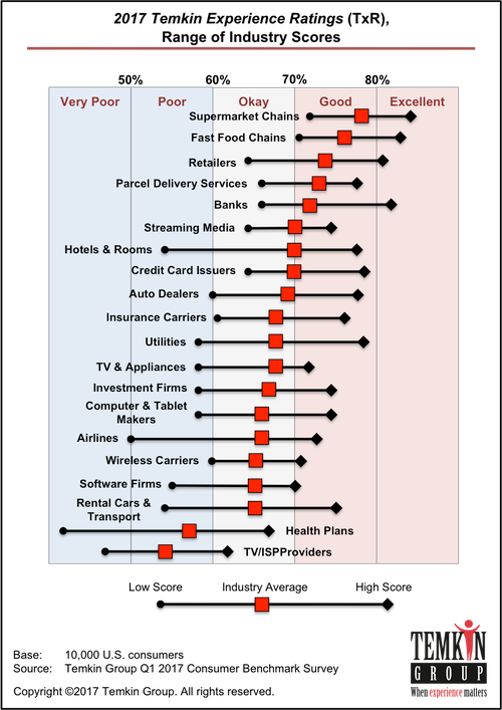

Health Insurance Plans Rank Lowest In Consumer Experience

Consumers love their supermarkets, fast food shops, retailers, delivery services, and banks. These industries rank highest in the 2017 Temkin Experience Ratings, my go-to source for understanding consumer service Nirvana. Health insurance companies and internet service providers (ISPs) are at the bottom of the Temkin Ratings, as shown in the first chart. Note that health plans range from a score approaching 70 to under 50, illustrating the very wide range of consumer experience from okay-to-good, too very poor. The top-ranked health plan was Kaiser Permanente, with a rating of 67%; Health Net was ranked the worst of the health plans

Healthcare Consumerism? Not So Fast, Alegeus Finds

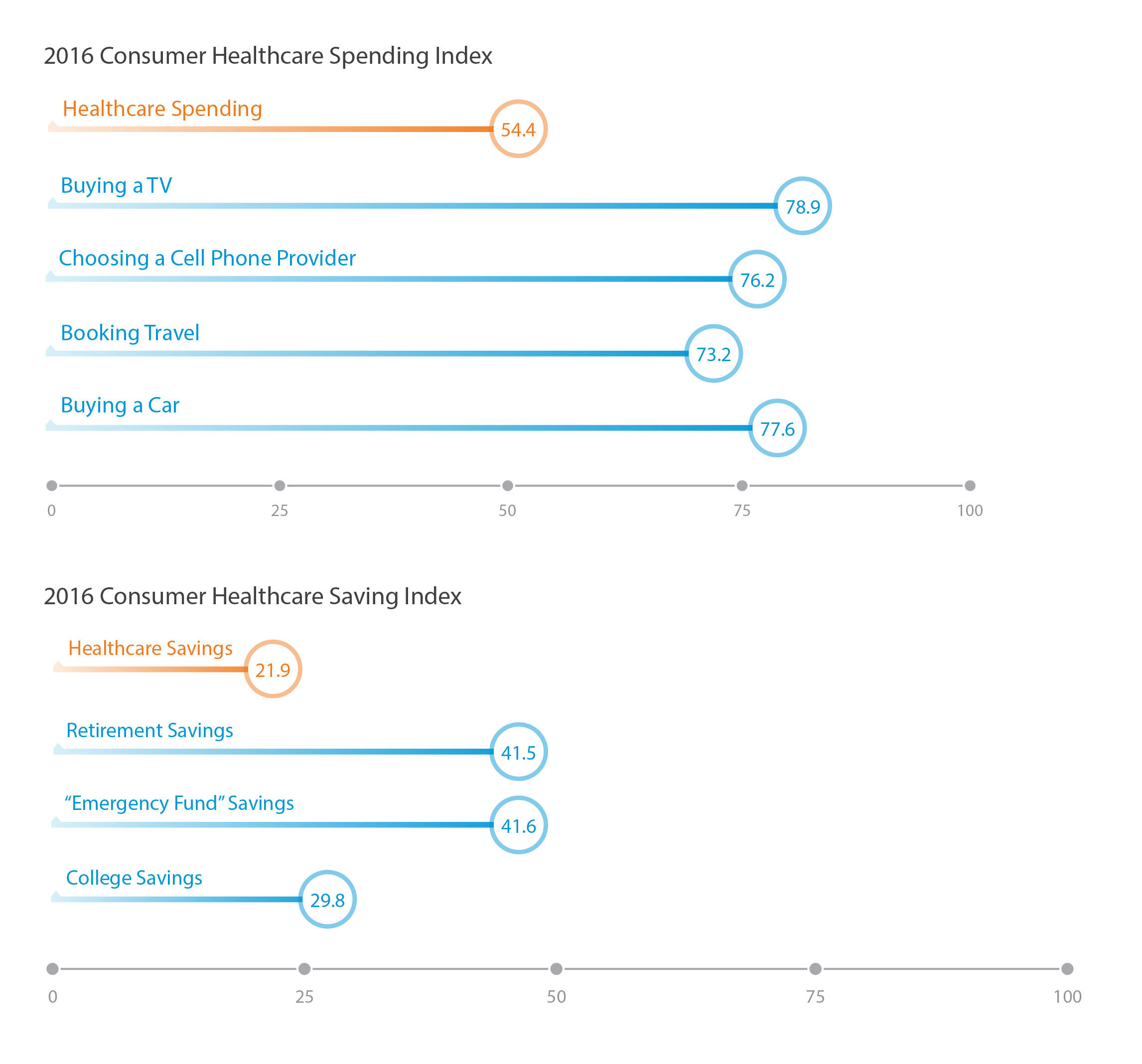

Millions of U.S. patients have more financial skin in the American health care game. But are they behaving like the “consumers” they are assumed to be as members in consumer-directed health plans? Not so much, yet, explained John Park, Chief Strategy Officer at Alegeus, during a discussion of his company’s 2016 Healthcare Consumerism Index. This research is based on an online survey of over 1,000 U.S. healthcare consumers in April 2016. Alegeus looks at healthcare consumerism across two main dimensions: healthcare spending and healthcare saving. As the chart summarizes, consumers show greater engagement and focus on buying a TV or car, choosing

For Healthcare Costs, Geography is Destiny

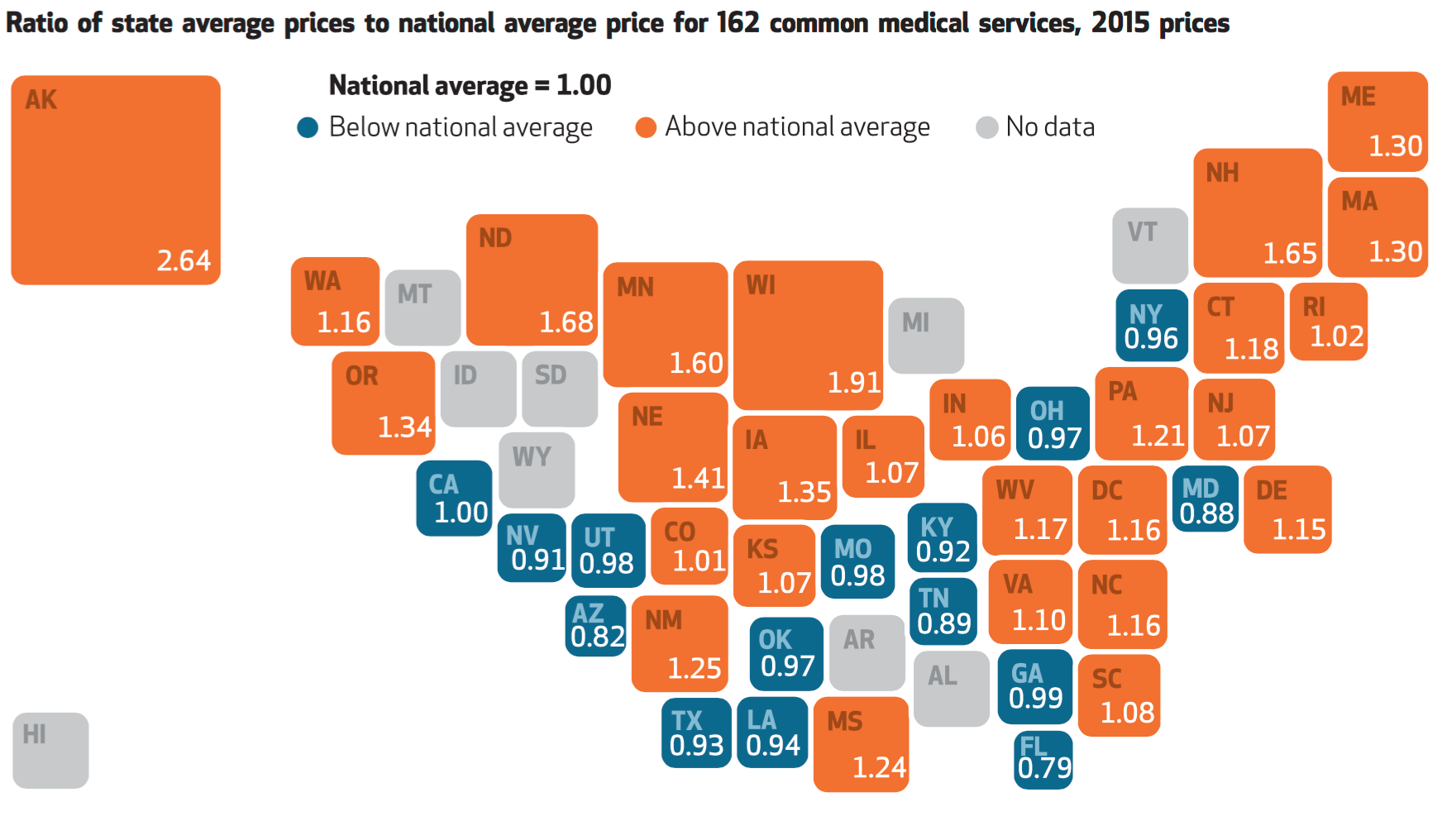

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice. The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in

Welcome to the Era of Personal Health IT – a #HIMSS16 Preview

People – patients, caregivers, health consumers all – have begun to use the digital tools they use in daily life for booking taxis, managing money, seeking information — for their health. This is the growing adoption of Personal Health IT (PHIT), and it’s a growing aspect of the annual HIMSS Conference that the planet’s health IT folk will attend from 29th February until 4th March in Las Vegas. I talk about the phenomenon of PHIT and #HIMSS16 in The State of Health IT to Engage the New Health Consumer, a summary of the driving forces of the trend and opportunities

Health Consumers Grow Clinical and Financial Engagement Chops

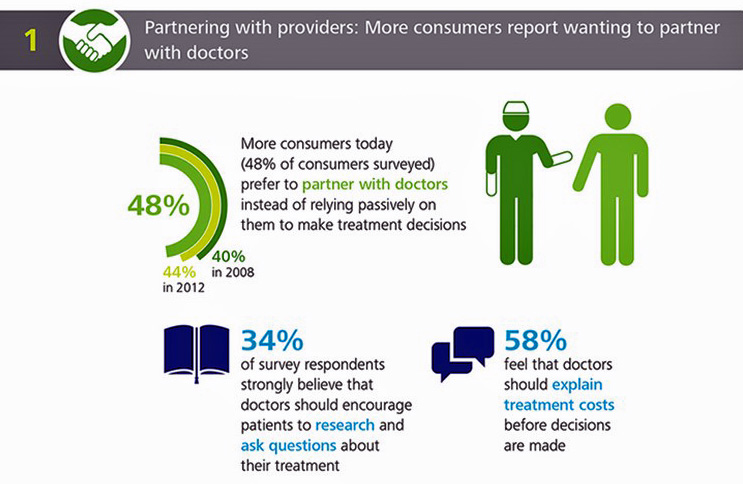

About one-half of consumers want to partner with doctors instead of allowing their physicians to make treatment decisions for them, according to a report from the Deloitte Center for Health Solutions, Health care consumer engagement: No “one-size-fits-all” approach. 1 in 4 people (25%) want to make treatment decisions themselves. Call that clinical health engagement. But even more people, 6 in 10, want to be financially-health engaged: 58% believe doctors should explain treatment costs before decisions are made, shown in the first chart. Most consumers would be comfortable talking about health care costs with doctors, and believe doctors should provide and explain the

Diagnosis: Acute Health Care Angst In America

There’s an overall feeling of angst about healthcare in America among both health care consumers and the people who provide care — physicians and administrators. On one thing most healthcare consumers and providers (can agree: that the U.S. health care system is on the wrong track. Another area of commonality between consumers and providers regards privacy and security of health information: while healthcare providers will continue to increase investments in digital health tools and electronic health records systems, both providers and consumers are concerned about the security of personal health information. In How We View Healthcare in America: Consumer and Provider Perspectives,

Yes, Virginia, There Really Are Healthcare Consumers: McKinsey

“There’s no such thing as a healthcare consumer. No one really wants to consume healthcare,” naysayers tell me, critical of my all health-consmer-all-the-time bully pulpit. But, touché to my health consumer-critics! I’ve more evidence refuting the healthcare consumer detractors from McKinsey in their research report, Debunking common myths about healthcare consumerism, from the team working in McKinsey’s Healthcare Systems and Services Practice. Their survey research among over 11,000 U.S. adults uncovered 8 myths about the emerging American health consumer, including: Healthcare is different from other industries Consumers know what they want from healthcare and what drives their decisions Most consumers

Growing Signs Of Consumer Health Engagement, Via Deloitte

A growing desire for shared decision making with doctors. Increasing trust and consumption of health care information online, in social media, and report cards. Reliance on technology for monitoring health adn wellness, and medical conditions. Together, these three signals converge, illustrating a growing sense of consumer engagement among U.S. patients, found in the 2015 Deloitte Center for Health Solutions Survey of US Health Care Consumers. In Deloitte’s research summary, the title states that “No ‘one-size-fits-all’ approach” will work, given diversity among American health consumers. The sickest health consumers, Deloitte notes, have higher levels of health engagement and index higher on

People-powered health/care – celebrating Patient Independence & Empowerment

In the growing shared economy, one centerpiece is people-powered health – co-creating, shared decision-making, and a greater appreciation for the impact of social on health. As we approach the mid-point of 2015, there are several signposts pointing to people-powered health/care. FasterCures launched the Science of Patient Input Project, with the objective of getting the patient’s voice into clinical discovery and decision-making. This video describes the intent of the program and its potential for people-powered health and user/patient-centered drug design, beyond the pure clinical efficacy of therapies. Another example of people-powered health comes from The Wall Street Journal dated 29 June 2015, which

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The blurring landscape of digital health: the Health 2.0 team puts it in focus

They’re the team that built a brand with the phrase “Health 2.0” before the world barely recognized v 1.0 in healthcare. This week, those folks that brought you the Health 2.0 Conference unveiled the Market Intel database of over 3,000 companies, trying to make sense out of a very blurry and fast-morphing market landscape. I spoke with Matthew Holt and Kim Krueger of Health 2.0 earlier this week to discuss just what’s in this mine of information, and what they intend to do with it. In full disclosure, I have been a colleague and friend of Matthew Holt since his

Americans are spending $1 in $5 on health care

People in the U.S. are spending over 20.6% of their income on health care, according to data published by the U.S. Department of Commerce on March 2, 2015. This is up from 15% of personal income in 1990. Note the slope of this curve, moving up the X-Y axes from southwest to northwest. Now note the slope of the curves in the second chart, which illustrates consumer spending on other household goods and services: cars, housing, clothing, education, groceries, and eating outside of the home. Spending on these home budget line items remained relatively flat over the 25 year period 1990-2015,

Hug your physician – chances are, s/he’s burned out

If you’re meeting with a physician in the next week or two, put on your empathy hat: chances are, they are feeling burned-out. Overall 46% of physicians report they were burned out in 2014, up from just under 40% last year. Medscape’s Physician Lifestyle Report 2015 finds that at least one-half of physicians are burned-out who work in critical care, emergency medicine, family medicine, internal medicine, general surgery, and infectious disease (including HIV). And, at least 37% of physicians are burned-out working in all other specialties, shown in the first chart. Medscape gauges doctors’ self-assessments of burnout with a lens

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Health care as a retail business

The health care industry is undergoing a retail transformation, according to Retail Reigns in Health Care: The rise of consumer power and its organization & workforce implications from Deloitte. Deloitte’s report published in October 2014 focuses on the health insurance business, which is newly-dealing with uninsured people largely unfamiliar with how to evaluate health plan options. This by any definition requires new muscles for both buyers and sellers on a health insurance exchange: new product access + uninformed consumer = retail challenge. Deloitte notes another supply and demand challenge, and that’s with the health insurance company workforce: while 93% of health

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Dr Eric Topol on the digital democratization of health care

Moore’s Law is coming to medicine. And it will look and feel a lot like Uber: with rich technology underpinning, consumer-service oriented and friendly, and shaking up the professionals at the front line of the business (from taxi drivers to physicians). Eric Topol, physician and editor-in-chief at Medscape, told a standing-room-only audience at the kickoff of the 8th annual Health 2.0 Conference that the democratization of health care is coming based on consumers’ use of eight drivers: sensors, labs, imaging, physical exams, access to medical records, transparency of costs, and digital pills. Dr. Topol referred to the cover ot TIME

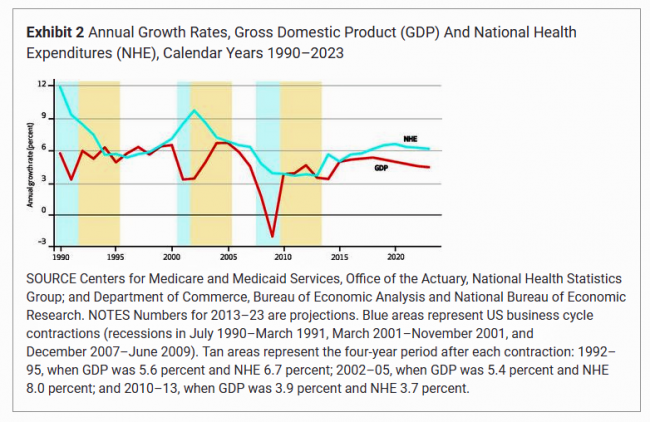

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Best Hospitals, Marketing and Money – more on transparency in health care

As Americans become health care shoppers, learning to spend “their” money to meet high deductibles and manage expenses in health savings accounts, they seek information — made transparent through trusted, sometimes branded, sources. One of these is U.S. News & World Reports, which has published the U.S. News & World Reports Best Hospitals list since 1990, and as such, has become a popular go-to source for engaged patients looking for information on hospitals before receiving surgery, seeking second opinions for a medical condition, or moving to a new town looking to affiliate with a health system. But in February 2014, a

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

Risk-shift: employers continue to push more risk to employees and families for health costs

With health costs increase increasing at 4.4% in 2014, a slightly higher rate of growth than the 4.1% seen in 2013. While this is lower than the double-digit increases U.S. employers faced in 2001-2004, it’s still twice the rate of general consumer price inflation. That’s what the first graph shows, based on the The 19th Annual Towers Watson/National Business Group on Health Employer Survey on Purchasing Value in Health Care. Employers generally want to continue to provide health insurance…for the time being. 92% of companies expect to make changes in health plan provisions in 2014, with 1 in 2 anticipating “significant

HIMSS14 Monday Morning Quarterback – The Key Takeaways

Returning to terra firma following last week’s convening of the 2014 annual HIMSS conference…taking some time off for family, a funeral, the Oscars, and dealing with yet another snowstorm…I now take a fresh look back at #HIMSS14 at key messages. In random order, the syntheses are: Healthcare in America has entered an era of doing more, with less...and health information technology is a strategic investment for doing so. The operational beacon going forward is moving toward The Triple Aim: building population health, enhancing the patient’s experience, and lowering costs per patient. The CEO of Aetna, Mark Bertolini, spoke of the

Where’s TripAdvisor for health care? JAMA on physician ratings sites

As more U.S. health citizens enroll in high-deductible health plans – now representing about 30% of health-insured people in America – health plan members are being called on to play the role of consumer. Among the most important choices the health consumer makes is for a physician. Ratings sites and health care report cards ranking doctors by various characteristics have been in the market for over a decade. However, little has been known on the public’s knowledge about the availability of these information sources, nor of peoples’ use of physician rating sites. This question is addressed in Public Awareness, Perception, and

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.