Healthcare Is Local: Channeling Tip O’Neill in the 2018 Midterm Election Results

As Tip O’Neill’s mantra goes, “All politics is local.” In the U.S. 2018 midterm elections, healthcare voting seems to have translated as a local issue, falling into O’Neill’s axiom. In this election, healthcare was the most important voting issue for consumers, PwC found, ranking above the economy, national security, and education. On this morning after 2018 midterm election results are (mostly) out, it looks like healthcare was a local and state issue for U.S. 2018 midterm voters. The Democrats flipped more than 23 seats in the U.S. House of Representatives to gain control of that chamber. The Senate is up

Healthcare and the F-Word: Health Politics Rank High on November 6, 2018

“Let’s get this thing f-ing done,” Martha McSally passionately asserted on May 4, 2017. Paul Ryan said, on the floor of the U.S. House of Representatives without cursing, “A lot of us have waited seven years to cast this vote.” McSally, who represents Tucson, Arizona, in the U.S. Congress, is running to replace retiring Senator Jeff Flake. McSally was one of the 217 Republicans in the House who voted to repeal the Affordable Care Act, subsequently celebrating a victory in the Rose Garden of the White House with jubilant peers. The final vote was 217-213. Here’s the final roll call

Technology, Aging and Obesity Drive Healthcare Spending, BEA Finds

The U.S. Department of Commerce Bureau of Economic Analysis (BEA) released, for the first time, data that quantifies Americans’ spending to treat 261 medical conditions, from “A” diseases like acute myocardial infarction, acute renal failure, ADHD, allergic reactions, anxiety disorders, appendicitis and asthma, to dozens of other conditions from the rest of the alphabet. High Spending Growth Rates For Key Diseases In 2000-14 Were Driven By Technology And Demographic Factors, a June 2018 Health Affairs article, analyzed this data. This granular information comes from the BEA’s satellite account, using data from the Medical Expenditure Panel Survey which nationally examines expenditures by disease;

How Walmart Could Bolster Healthcare in the Community

Walmart has been a health/care destination for many years. The company that defined Big Box stores in their infancy grew in healthcare, health and wellness over the past two decades, pioneering the $4 generic prescription back in 2006. Today, that low-cost generic Rx is ubiquitous in the retail pharmacy. A decade later, can Walmart re-imagine primary care the way the company did low-cost medicines? Walmart is enhancing about 500 of 3500 stores, and health will be part of the interior redecorating. Walmart has had ambitious plans in healthcare since those $4 Rx’s were introduced. Here’s a New York Times article from

The Patient As Payor: From Rationing Visits Due to Co-Pays to Facing $370K for Healthcare in Retirement

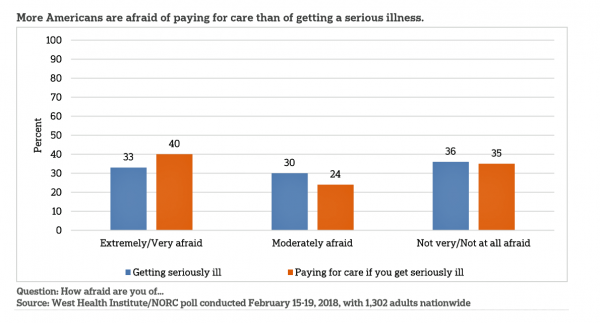

Health care in America is such a scary experience that more people are afraid of paying for care than the actually getting sick part of the scenario. The patient is the payor, and she is afraid…more afraid of the paying than of the illness, according to a survey conducted among U.S. health consumers from WestHealth Institute and NORC, Americans’ Views of Healthcare Costs, Coverage, and Policy from WestHealth and NORC. See the orange bar on the left: 40% of Americans are “extremely or very afraid” about paying for care if they get seriously ill, and 33% are that afraid

Heart-Love – Omron’s Holy Grail of Blood Pressure Tracking on the Wrist

It’s February 1st, which marks the first of 28 days of American Heart Month – a time to get real, embrace, learn about, and engage with heart health. Heart disease kills 610,000 people in the U.S. every year, equal to 1 in 4 deaths in America. It’s the leading cause of death for both men and women in the U.S. Knowing your blood pressure is an important step for managing the risks of heart disease. That hasn’t yet been available to those of us who quantify our steps, weight, sleep, food intake, and other health metrics. In 2017, Hugh Langley

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

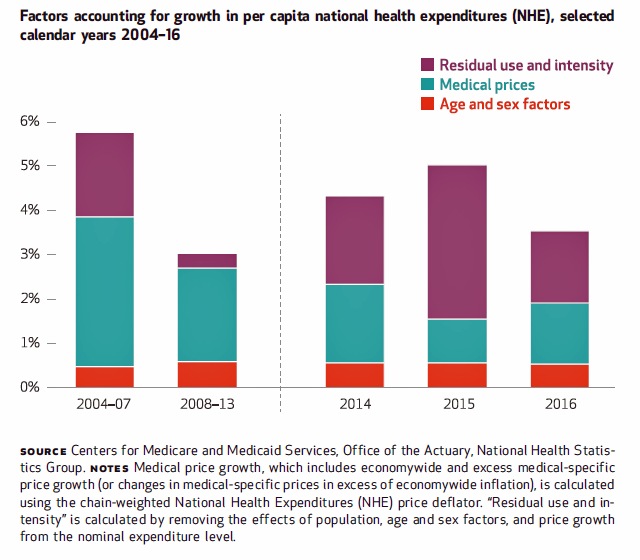

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

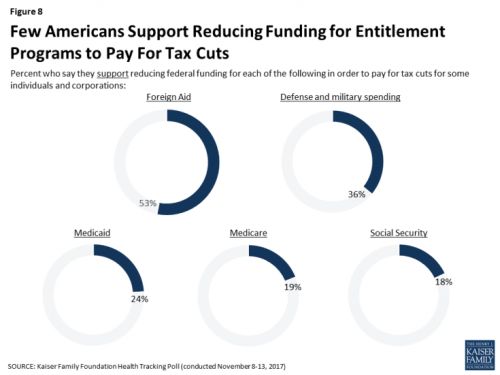

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

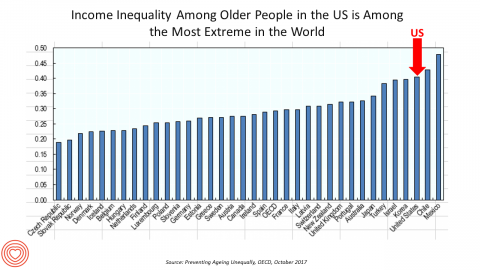

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

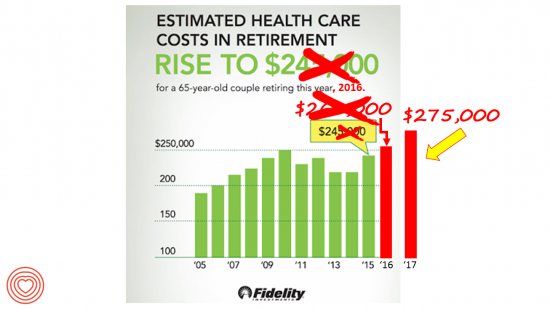

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

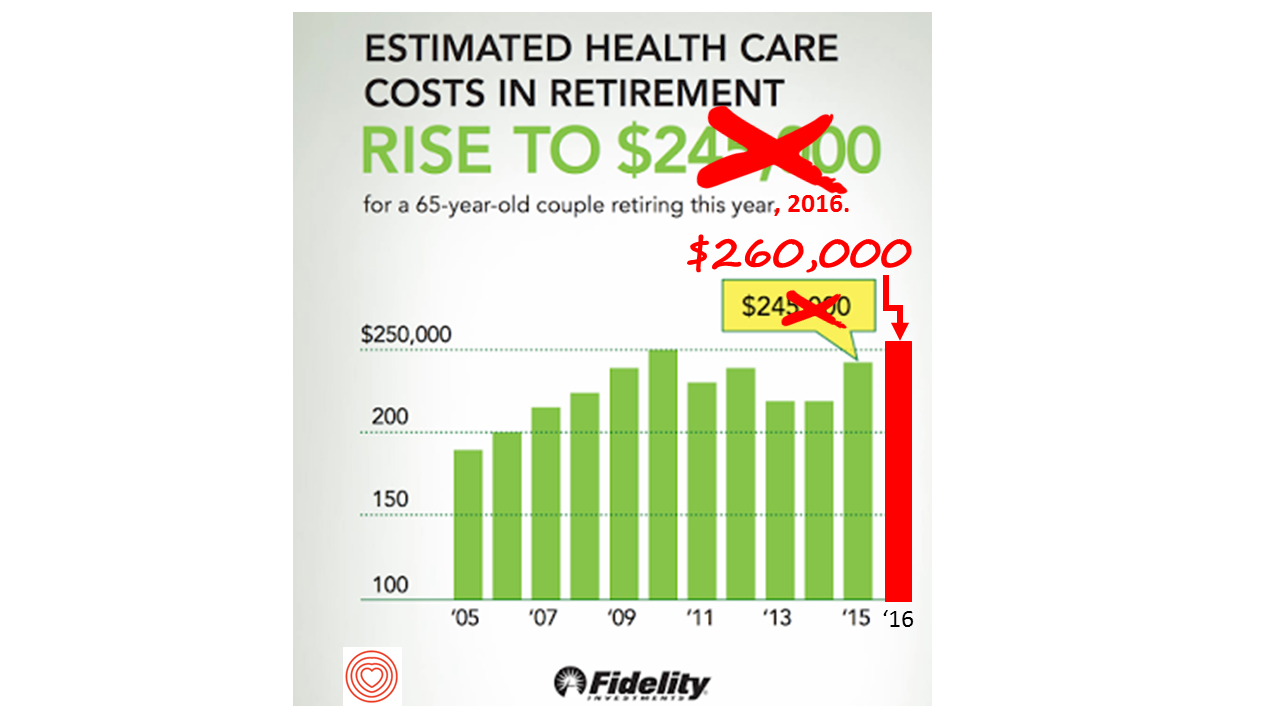

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

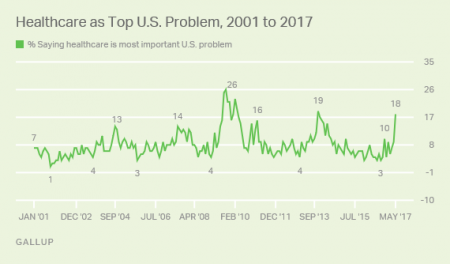

Americans Say Healthcare is the Nation’s #1 Problem – Tied with Dissatisfaction with Government

Healthcare tops the list of Americans’ concerns, tied with a dissatisfaction for government, this month (May 2017). According to a Gallup poll published 12 May, poor government leadership and healthcare are together the most important problem currently facing the U.S. Immigration, the economy, jobs, and race relations are distance 3rd places in this survey, which was conducted during the first week of May 2017 among 1,011 U.S. adults 18 years and older. The highest percent of Americans citing healthcare as America’s most important problem was 26%, found in August/September 2008 when town hall meetings round the country were protesting healthcare

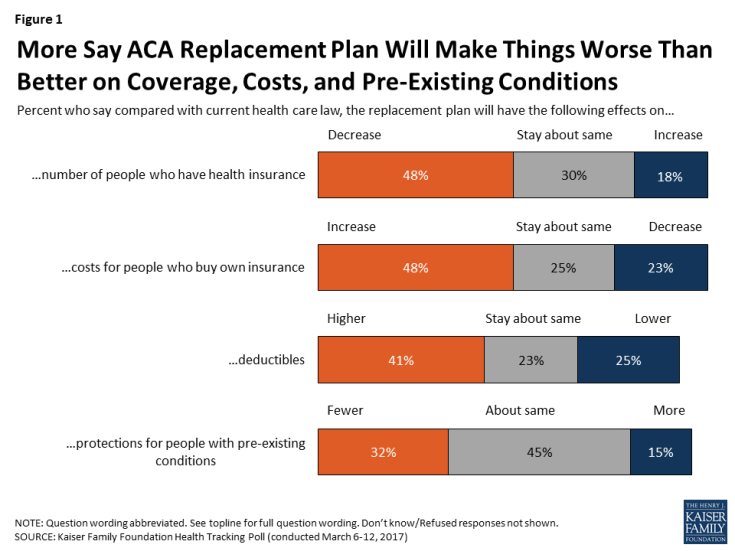

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

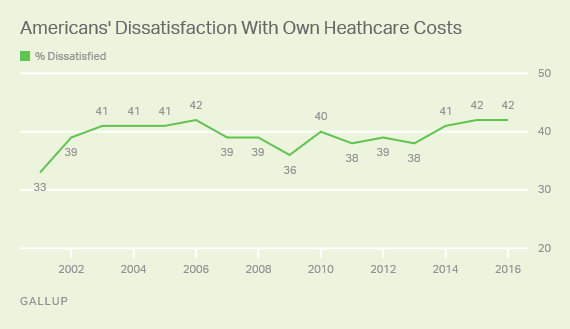

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

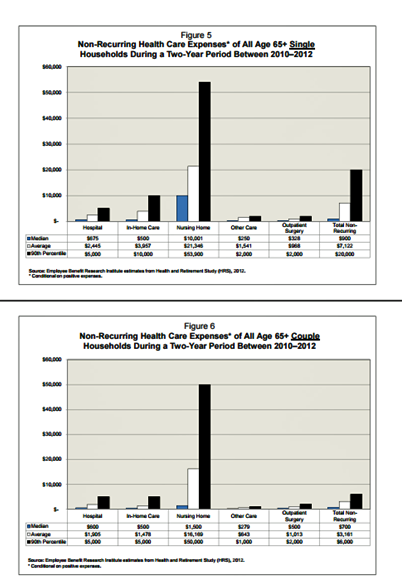

Older Couples Have Lower Out-of-Pocket Healthcare Costs Than Older Singles

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households. In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse. But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found. The average per-person out-of-pocket spending for

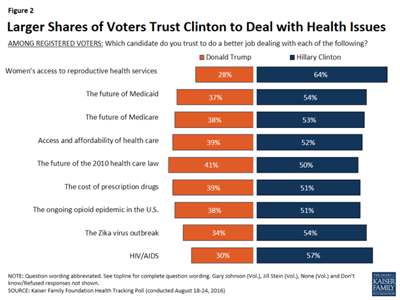

More Americans See Hillary Clinton As the 2016 Presidential Health Care Candidate

When it comes to health care, more American voters trust Hillary Clinton to deal with health issues than Donald Trump, according to the Kaiser Health Tracking Poll: August 2016 from the Kaiser Family Foundation (KFF). The poll covered the Presidential election, the Zika virus, and consumers’ views on the value of and access to personal health information via electronic health records. Today’s Health Populi post will cover the political dimensions of the August 2016 KFF poll; in tomorrow’s post, I will address the health information issues. First, let’s address the political lens of the poll. More voters trust Hillary Clinton to do

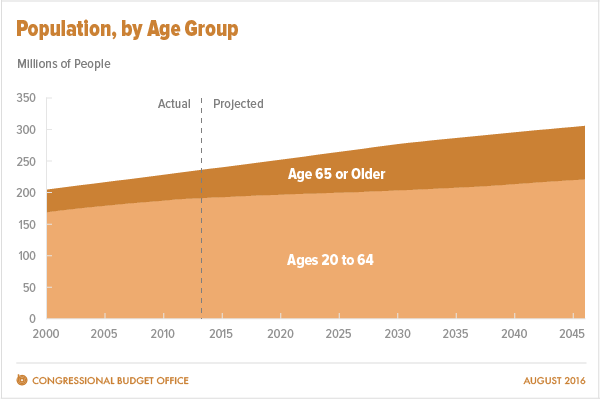

Aging America Is Driving Growth in Federal Healthcare Spending

Federal healthcare program costs are the largest component of mandatory spending in the U.S. budget, according to An Update to the Budget and Economic Outlook: 2016 to 2026 from the U.S. Congressional Budget Office (CBO). Federal spending for healthcare will increase $77 billion in 2016, about 8% over 2015, for a total of $1.1 trillion. The CBO believes that number overstates the growth in Medicare and Medicaid because of a one-time payment shift of $22 bn to Medicare (from 2017 back into 2016); adjusting for this, CBO sees Federal healthcare spending growing 6% (about $55 bn) this year. The driver

Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator. The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi. The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty

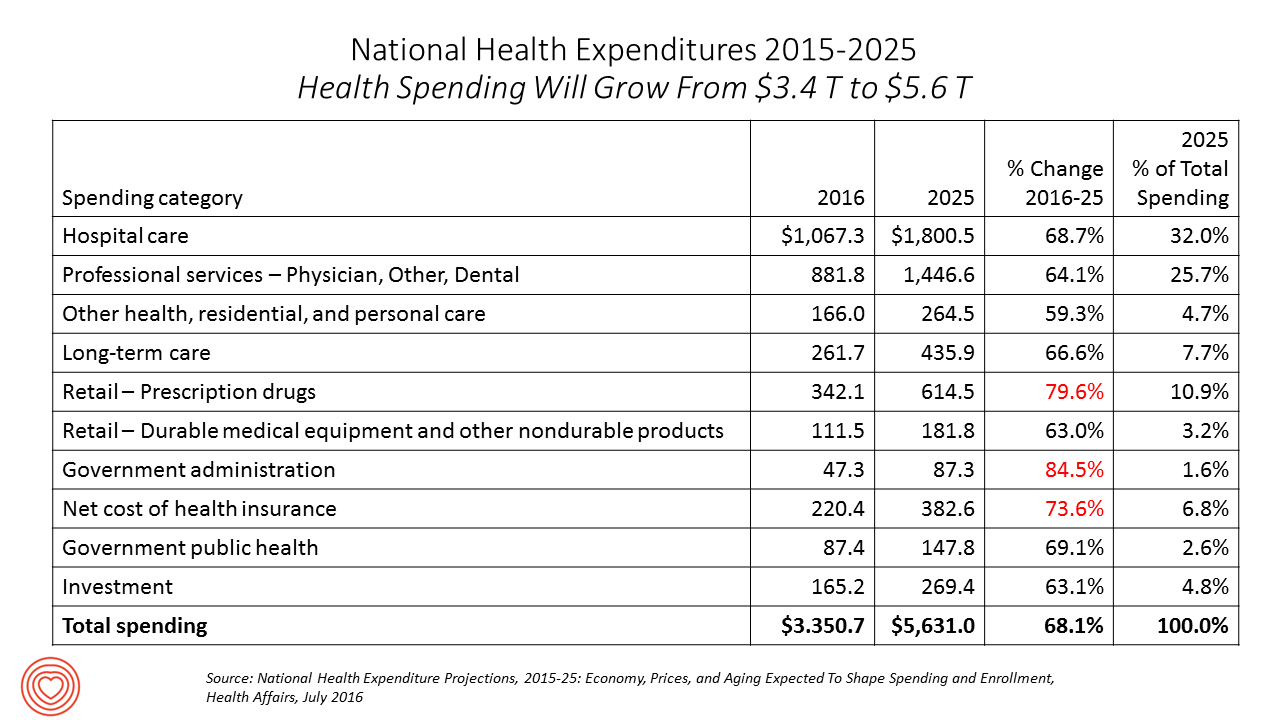

U.S. Health Spending Will Comprise 20% of GDP in 2025

Spending on health care in America will comprise $1 in every $5 of gross domestic product in 2025, according to National Health Expenditure Projections, 2015-25: Economy, Prices, And Aging Expected to Shape Spending and Enrollment, featured in the Health Affairs July 2016 issue. Details on national health spending are shown by line item in the table, excerpted from the article. Health spending will grow by 5.8% per year, on average, between 2015 and 2025, based on the calculations by the actuarial team from the Centers for Medicare and Medicaid Services (CMS), authors of the study. The team noted that the Affordable Care

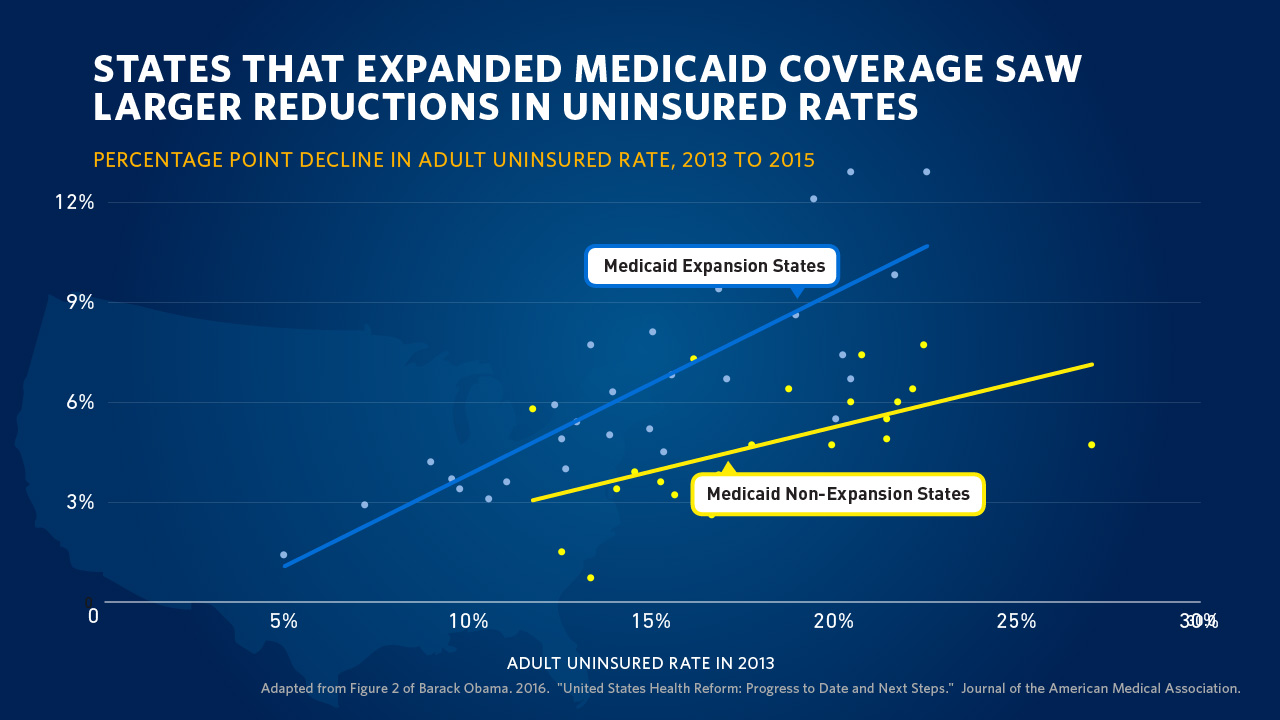

Health Care Reform: President Obama Pens Progress in JAMA

“Take Governor John Kasich’s explanation for expanding Medicaid: ‘For those that live in the shadows of life, those who are the least among us, I will not accept the fact that the most vulnerable in our state should be ignored. We can help them.’” So quotes President Barack Obama in the Journal of the American Medical Association, JAMA, in today’s online issue. #POTUS penned, United States Health Care Reform: Progress to Date and Next Steps. The author is named as “Barack Obama, JD,” a nod to the President’s legal credentials. Governor Kasich, a Republican, was one of 31 Governors who

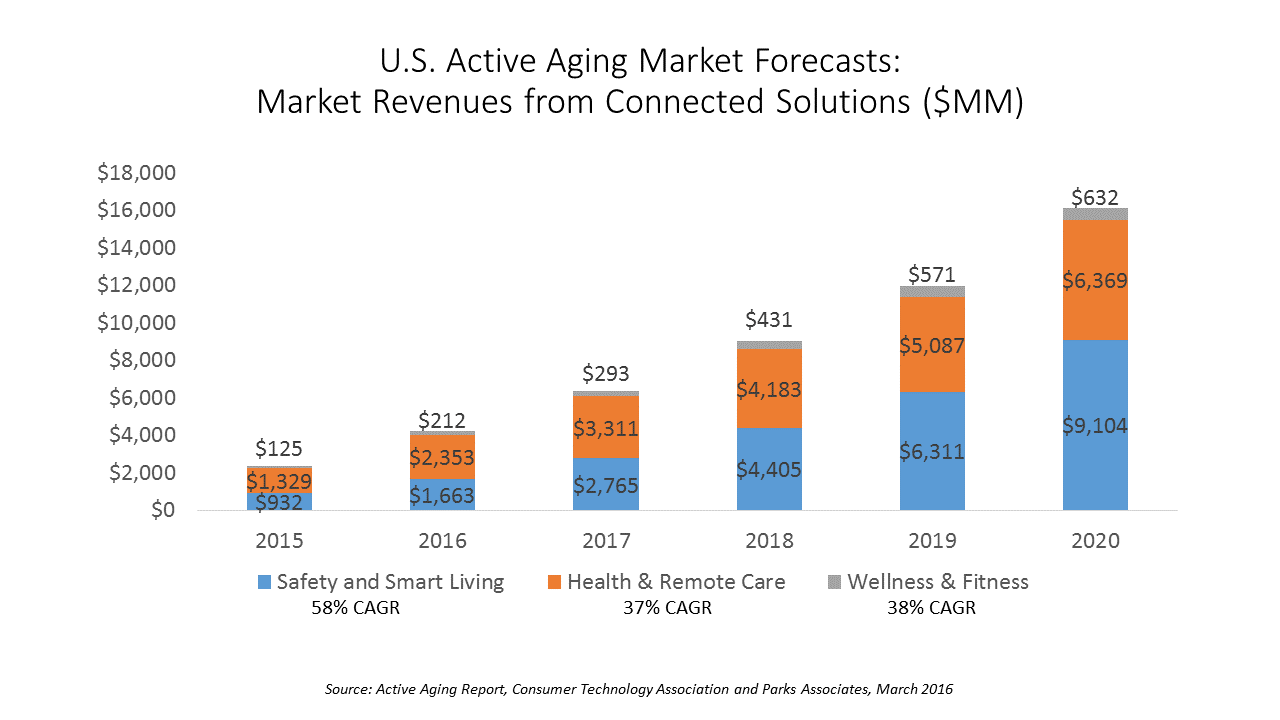

Better Aging Through Technology

There are 85 million people getting older in America, all mindfully working to not go gentle into their good nights — that is, working hard to stay young and well for as long as they can. This is the market for “active aging” technology products, which will be worth nearly $43 billion in 2020, according to a report from the Consumer Technology Association (CTA), the Active Aging Study. CTA and Parks Associates define the active aging technology market in three segments with several categories under each: Safety and smart living, which includes safety monitoring, emergency response (PERS), smart living, and home

Medicare Makes the Case for Outcomes, As Increasing Costs Loom

Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential. Health Affairs provides the big economic story played out by the forecasts of the Centers for Medicare and Medicaid Services (CMS) in National Health Expenditure Projections, 2014-24: Spending Growth Faster Than Recent Trends. The topline of the forecast is that health spending growth in the U.S. will annually average

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Delaying aging to bend the cost-curve: balancing individual life with societal costs

Can we age more slowly? And if so, what impact would senescence — delaying aging — have on health care costs on the U.S. economy? In addition to reclaiming $7.1 trillion over 50 years, we’d add an additional 2.2 years to life expectancy (with good quality of life). This is the calculation derived in Substantial Health And Economic Returns From Delayed Aging May Warrant A New Focus For Medical Research, published in the October 2013 issue of Health Affairs. The chart graphs changes in Medicare and Medicaid spending in 3 scenarios modeled in the study: when aging is delayed, more people qualify

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

10 Reasons Why ObamaCare is Good for US

When Secretary Sebelius calls, I listen. It’s a sort of “Help Wanted” ad from the Secretary of Health and Human Services Kathleen Sebelius that prompted me to write this post. The Secretary called for female bloggers to talk about the benefits of The Affordable Care Act last week when she spoke in Chicago at the BlogHer conference. Secretary Sebelius’s request was discussed in this story from the Associated Press published July 25, 2013. “I bet you more people could tell you the name of the new prince of England than could tell you that the health market opens October 1st,” the

Healthways buys into Dr. Ornish’s approach: will “Ornish-inside” scale wellness in America?

People who live in U.S. cities with low levels of well-being have twice the rate of heart attacks as people who live in healthier America. That’s 5.5% of the population in sicker America versus 2.8% of the population living in healthy America. The first chart illustrates this disparity, taken from the Gallup-Healthways index that examined 190 metropolitan areas in 2012. Based on this study, it’s good to live in parts of Utah, Nebraska and Colorado, but not so healthy to be a resident in West Virginia, Alabama, and parts of Kentucky and Ohio. Heart disease and diabetes are killing a plurality

Bending the cost-curve: a proposal from some Old School bipartisans

Strange political bedfellows have come together to draft a formula for dealing with spiraling health care costs in the U.S. iin A Bipartisan Rx for Patient-Centered Care and System-Wide Cost Containment from the Bipartisan Policy Center (BPC). The BPC was founded by Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole, and George Mitchell. This report also involved Bill Frist, Pete Domenici, and former White House and Congressional Budget Office Director Dr. Alice Rivlin who together work with the Health Care Cost Containment Initiative at the BPC. The essence of the 132-page report is that the U.S. health system is

1 in 5 US consumers asks a doctor for a lower-cost Rx

With U.S. health consumers spending $45 billion out-of-pocket for prescription drugs in 2011, pharmaceutical products are morphing into retail health products. As such, as they do with any other consumer good, consumers can vote with their feet by walking away from a product purchase or making the spend based on the price of the product and its attributes, along with whether there are substitutes available in the marketplace. When it comes to prescription drugs, it’s not as clear-cut, according to the Centers for Disease Control‘s analysis of data from the 2011 National Health Interview Survey titled Strategies Used by

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

Required reading: TIME Magazine’s Bitter Pill Cover Story

Today’s Health Populi is devoted to Steven Brill and his colleagues at TIME magazine whose special report, Bitter Pill: Why Medical Bills Are Killing Us, is required reading for every health citizen in the United States. Among many lightbulb moments for readers, key findings from the piece are: Local hospitals are beloved charities to people who live in their market – Brill calls these institutions “Non-Profit Profitmakers). They’re the single most politically powerful player in most Congressional districts The poor and less affluent more often pay the high chargemaster (“retail list”) price for health products and services vs. the wealthy

Wealthy Americans’ top financial concern is affording health care in retirement

The wealthiest Americans’ top financial concern is being able to afford healthcare and support they’ll need in old age. The #2 financial concern among wealthy investors is worrying about the financial situation of their children and grandchildren, closely followed by a major family health problem occurring and someone to care for them in their old age. These health-financial worries come out of a survey among 2,056 U.S. investors age 25 and over who have at least $250,000 in investable assets conducted by UBS in January 2013. UBS found that staying health and fit is investors’ top objective, with 73% of wealthy

Health care cost illiteracy: consumers feel the pinch of growing costs, but don’t understand the “why?”

Health care costs for workers lucky enough to receive health insurance at work nearly doubled since 2002. Wages in that decade grew by 33%. This growing affordability gap between health costs vs. wages is shown in the chart. Health consumers in America sharply perceive this gap, according to an analysis of eight focus groups, Consumer Attitudes on Health Care Costs: Insights from Focus Groups in Four U.S. Cities from the Robert Wood Johnson Foundation. To health-covered workers, though, health care “costs” are defined as out-of-pocket health spending for insurance premiums, co-payments and deductibles that come out of paychecks and pocketbooks — not

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Health and consumer spending may be flat, but consumers hard hit due to wage stagnation & self-rationing

There’s good news on the macro-health economics front: the growth rate in national health spending in the U.S. fell in 2011, according to an analysis published in Health Affairs January 2013 issue. Furthermore, this study found that consumers’ spending on health has fallen to 27.7% of health spending, down from 32% in 2000, based on three spending categories: 1. Insurance premiums through the workplace or self-paid 2. Out-of-pocket deductibles and co-pays 3. Medicare payroll taxes. A key factor driving down health spending is the growth of generic drug substitution for more expensive Rx brands. Generics now comprise 80% of prescribed

Call them hidden, direct or discretionary, health care costs are a growing burden on U.S. consumers

Estimates on health spending in the U.S. are under-valued, according to The hidden costs of U.S. health care: Consumer discretionary health care spending, an analysis by Deloitte’s Center for Health Solutions. Health spending in the U.S. is aggregated in the National Health Expenditure Accounts (NHEA), assembled by the Department of Health and Human Services (DHHS) Centers for Medicare and Medicaid Services (CMS). In 2010, the NHEA calculated that $2.6 trillion were spent on health care based on the categories they “count” for health spending. These line items include: Hospital care Professional services (doctors, ambulatory care, lab services) Dental services Residential

What’s on senior Americans’ minds? Medicare and money

What’s keeping seniors up at night when it comes to retirement? #1, according to 6 in 10 seniors, is the future of Medicare, followed by having enough money to enjoy retirement. In particular, 61% of seniors are concerned about future out-of-pocket health care costs. It’s all about Medicare and money for U.S. seniors, found in the Allsup Medicare Advisor Seniors Survey, Medicare Planning and Trends Among Seniors, published in October 2012. Medicare could be the most beloved government program ever, as 89% of seniors say they’re satisfied with Medicare coverage. Given the program’s shaky financial future, Allsup wanted to get

58% of Americans self-rationing health care due to cost

Since the advent of the Great Recession of 2008, more Americans have been splitting pills, postponing needed visits to doctors, skipping dental care, and avoiding recommended medical tests due to the cost of those health care services. Call it health care self-rationing: the Kaiser Family Foundation (KFF) has been tracking this trend for the past several years, and the proportion of American adults rationing health demand is up to 58%. This KFF Health Tracking Poll interviewed 1,218 U.S. adults age 18 and older via landline and cell phone in May 2012. As the chart illustrates, 38% of people are “DIYing” health care

$12 water and $10 premium increases: how price elasticity is contextual in health and life

A $10 increase in a health plan premium drove up to 3% of retired University of Michigan employees to leave the plan, according to a study from U-M published in Health Economics, The Price Sensitivity of Medicare Beneficiaries. The U-M researchers analyzed the behaviors of 3,182 retirees over four years, to assess the impact of price on beneficiaries’ health plan choices. During the four years, the premium contribution for retirees increased significantly. The researchers conducted this study, in part, to anticipate how Americans will respond to health insurance exchanges in 2014 as they bring health plan information to the market

Rising cost of healthcare a headache among affluent Americans

For the third year in a row, wealthy Americans cite increasing health costs as their top financial concern. Furthermore, 1 in 3 affluent Americans are more concerned about the financial stress that could accompany a health event than they are about how that condition could affect their quality of life. Merrill Lynch Wealth Management, part of Bank of America, conducted the firm’s annual poll among 1,000 Americans with investable assets of at least $250,000, in December 2011. The investment firm has looked at richer Americans’ views on financial concerns since 2009. The chart shows rising health care costs to be

The self-care economy: OTC medicines in the U.S. deliver value to the health system

U.S. health consumers’ purchase and use of over-the-counter medicines (OTCs) generate $102 billion worth of value to the health system every year. Half of this value accrues to employers who sponsor health insurance for their workforce; 25% goes to government payers (e.g., Medicare, Medicaid); and, 25% returns to self-insured and uninsured people. For every $1 spent on OTCs, $6.50 is saved by the U.S. health system, shown by the chart. For millions of health consumers, OTCs substitute for a visit to a doctor’s office: most cost-savings generated by OTC use are in saved costs of not visiting a clinician, as discussed

Addressing chronic illness can help cure the U.S. budget deficit

Chronic illness represents $3 of every $4 of annual health spending in the U.S. That’s about $1.5 trillion. Living Well With Chronic Illness, a report from The Institute of Medicine (IOM), issues a “call for public health action” to address chronic illness through: – Adopting evidence-based interventions for disease prevention – Developing new public policies to promote better living with chronic disease – Building a comprehensive surveillance system that integrates quality of life measures, and – Enhancing collaboration among health ecosystem stakeholders: health care, health, and community non-healthcare services. The IOM recognizes the social determinants that shape peoples’ health status

Hey, Big Spender: 1% of US health citizens consume 20% of costs

Cue up the song “Hey Big Spender” from the Broadway hit, Sweet Charity, when you read the January 2012 AHRQ report with the long-winded title, The Concentration and Persistence in the Level of Health Expenditures over Time: Estimates for the U.S. Population, 2008-2009.” The report’s headline is that 1% of the U.S. population consumed 20% of all health costs spent in the U.S. in 2008 and 2009, illustrated by the chart. These Big Health Spenders tend to be in poor or fair health, older, female, non-Hispanic whites and people with only publicly-provided health insurance. Their mean expenditure was $90,061. The top 10%

Paying medical bills is a chronic problem for 1 in 3 uninsured, and 1 in 5 insured people under 65

Over 20% of U.S. families had problems paying medical bills in 2010 — about the same proportion as in 2007. The Center for Studying Health System Change found this datapoint “surprising,” given the Great Recession of 2008 that lingers into 2012. However, HSC points out that the leveling of medical bill problems may be a “byproduct” of reduced medical care utilization; in Health Populi-speak, self-rationing of health care. In the Tracking Report, Medical Bill Problems Steady for U.S. Families, 2007-2010, HSC analyzed data from the 2010 Health Tracking Household Survey and discovered that since 2003, the proportion of families facing problems with medical debt

What’s baked into the Affordable Care Act? Half of Americans still don’t realize there’s no-cost preventive care

The U.S. public’s views on health reform — the Affordable Care Act (ACT) – remain fairly negative, although the percent of people feeling favorably toward it increased from 34% to 37% between October and November. Still, that represents a low from the 50% who favored the law back in July 2010. It’s quite possible that American health citizens’ views on health reform are largely reflective of their more general feelings about the direction of the country and what’s going on in Washington right now, versus what’s specifically embodied in the health care law, according to the November 2011 Kaiser Health

Unretirement: the number of Americans planning to retire at 67 is plummeting

Two publications this week reinforce the new reality of health and financial insecurity: The Vanishing Middle America issue of Advertising Age (October 17, 2011 issue) and the Sun Life Financial U.S. Unretirement Index – Fall 2011 with the subtitle, “Americans’ trust in retirement reaches a tipping point.” The chart shows the retirement coin’s two sides: since 2008, the proportion of people in the U.S. who expect to retire by 67 dropped from 52% down to 35%; and, those who believe they will be working full-time (I emphasize “full,” not “part,” time) grew from 19% to 29%. 61% of working Americans plan to

Working past 70 is the new retirement

American workers are worried about outliving their savings and not being able to meet the financial needs of their families, according to The 12th Annual Retirement Survey from the Transamerica Center for Retirement Studies. The study paints a picture of 4,080 U.S. workers who forecast insecure financial futures. Their personal portraits find them working into older ages than they had previously expected to — before the recession. 54% of workers plan to work in retirement. 39% of workers will retire after age 70, or not at all. It’s not only Baby Boomers who expect to work past 65. Two-thirds of workers in their

The average annual health costs for a U.S. family of four approach $20,000, with employees bearing 40%

Health care costs have doubled in less than nine years for the typical American family of four covered by a preferred provider health plan (PPO). In 2011, that health cost is nearly $20,000; in 2002, it was $9,235, as measured by the 2011 Milliman Medical Index (MMI). To put this in context, The 2011 poverty level for a family of 4 in the 48 contiguous U.S. states is $22,350 The car buyer could purchase a Mini-Cooper with $20,000 The investor could invest $20K to yield $265,353 at a 9% return-on-investment. The MMI increased 7.3% between 2010 and 2011, about the same

Robert Reich connects the dots between the macroeconomy, angst, politics and health care costs

“I’m not a class warrior. I’m a class worrier,” Robert Reich told a standing-room only crowd of thousands of health IT geeks as he delivered the first keynote address of the annual meeting of HIMSS, the Healthcare Information Management and Systems Society. This year’s crowd will have reached about 31,000 people interested in health information technology’s transformative role in health care. The 31K represents an 18% increase in attendance from last year’s crowd. The HIMSS economy is strong. Robert Reich warns, however, that the U.S. macroeconomy is far from healthy…and health care costs will be a long-term threat to the

Affluent boomers worry about health costs in retirement

Affluent Baby Boomers in the U.S. foresee a retirement with a more active lifestyle, with a better standard of living and engagement in work. 1 in 4 see continuing their education or learning a new trade, and 1 in 5 anticipate starting or furthering their business. These aspirations are tempered with many financial concerns — top among them being rising health care costs and expenses (a concern for 2 in 3 affluent Boomers), and ensuring that retirement assets will last throughout their lifetime (a worry among 1 in 2 Boomers). Merrill Lynch surveyed affluent U.S. adults on their retirement concerns

Health care is not a luxury good – it just feels like it is

What is a luxury good? A good working definition is a good for which demand increases as income grows. Contrast this to a “necessity good,” something that people need regardless of level of income. Baby Boomers are morphing their idea of what constitutes a luxury good versus a necessity in light of the recession, according to a new study from New York Life, MainStay Investments Boomer Retirement Lifestyle Study, published August 5, 2010. The chart illustrates that 3 in 4 Boomers put health care costs as a top #1 or #2 retirement concern. Furthermore, 98% of Boomers called health care

Mayberry RFDHHS

Now showing in a 60-second spot during the 6 o’clock news: Andy Griffith’s got the starring role in promoting the peoples’ use of the Patient Protection and Affordable Care Act of 2010 (PPACA). Here is the announcement of the ad in The White House blog of July 30 2010. In the ad, Andy, now 84, recalls the signing of Medicare by President Johnson and moves into some details about the good things PPACA brings to seniors in the U.S. The Christian Science Monitor covers the story and shows the video here. This has caused quite a stir among Republicans who say

Seniors grab brands for Part D, and generics for self-pay

Seniors are acting like true, Adam Smith-style Rational Economic Man and Woman when it comes to their behavior as Medicare Part D enrollees. They go for the more expensive prescription drug brands when covered by the government; once getting to the ‘donut hole,’ though, seniors opt for lower-cost generics. Medco Health discovered this in their latest study into Medicare drug trends. Their conclusion is that Medicare could save more money if seniors went for generics 100% of the time. Rational selection, indeed. In a study from the Kaiser Family Foundation (KFF), Medicare Prescription Drug Plans in 2008 and

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're