We love new food products, as evidenced by the ever-growing array and permutation of new goodies at our grocery stores. Among those who say new food products are important to them, the top reason why they buy new food products is health.

Open your eyes when you’re next grocery shopping and look around you — your favorite grocer is morhping into a health destination. Whole Foods has launched its Whole Body store-within-a-store concept. Wegmans offers their Eat Well Live Well program. Even Wal-Mart, home of the $4 generic drug price-point, has begun to offer organic food based on demand according to location.

But health isn’t marketed only in the health-and-beauty aisles.

Consumer Interest in New Products in Supermarkets survey was just released, and it’s chock full of insights into consumers’ relationships with food shopping. Three-quarters of people who try new food products tend to try new food and beverage products due to health concerns.

Consumer Interest in New Products in Supermarkets survey was just released, and it’s chock full of insights into consumers’ relationships with food shopping. Three-quarters of people who try new food products tend to try new food and beverage products due to health concerns.

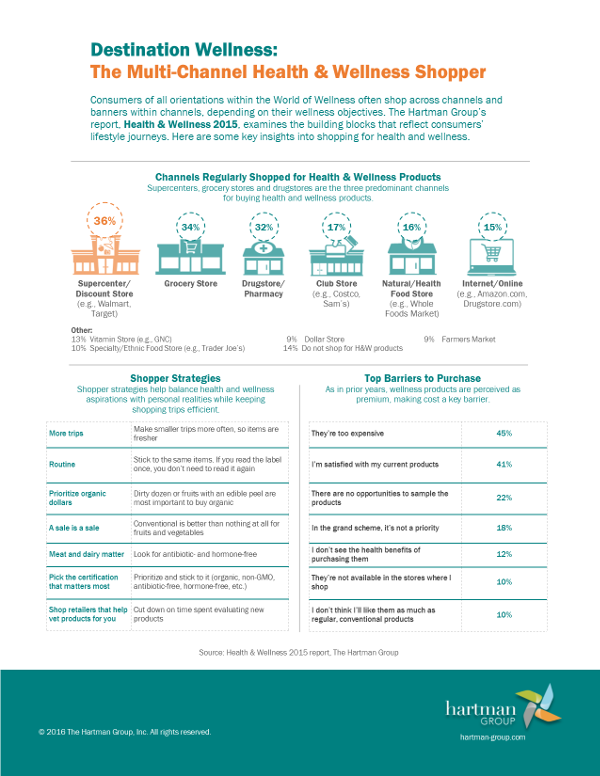

In fact, according to Hartman, health has become a very strong driver that is influencing consumers more than brand — although saving money through coupons trumps even health by a factor of 2:1!

To capitalize on the expanding intersection of health and food, IMS Health, the leader in providing prescription medicine data to the industry, has allied with IRI, a major provider of similar data for the consumer packaged goods and retail sectors.

IRI reports this week that grocery stores’ “center of the store” numbers are growing as spending on fresh foods (the outer ring of the stores) continues to be strong. They say that, “…consumers are really responding to the emphasis on healthy new products in the center aisle, whether it’s lighter and lower-calorie versions or enhanced nutritional benefits.” Younger shoppers are also drawn to exploding categories like energy drinks, trail mixes, and ready-to-drink teas.

The IMS/IRI alliance is so important for health because typical data repositories in health care are populated by health claims data — from reference laboratories, imaging centers, hospitals, physicians offices and, yes, pharmacies. But those are only health care sources and don’t count the substantial consumer out-of-pocket spending that’s, well, totally consumer-driven. By integrating retail data which details a consumer’s use of over-the-counter medicines, vitamins/minerals/supplements, food (healthy and otherwise, organic and non-), and other consumer products, the IMS/IRI analysts could eventually create a 360=degree view into a consumer’s health-style. These would be used for marketers in developing and targeting advertising as well as for new product development.

Health Populi’s Hot Points: The fastest-growing segment of pharmacies are those located within grocery and chain stores. Those pharmacies drive very profitable consumer traffic to the rest of the store, creating very profitable customers. At the same time, grocery chains are recognizing the opportunity that health in the food aisle represents. Organics, healthy snacks, teas, whole grains and “good fats” are seen by a growing proportion of consumers as health-ful purchases. My hope is that it won’t only be only the advertisers, marketers, and retailers who have access to the kind of data that IMS/IRI are developing. If consumers can gain access to the information that can help them view themselves full-on in front of the 360-degree mirror — now, there would be some powerful health information on which to act.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.